Last updated: 6/15/2006

Pennsylvania Public Disclosure Form {BCO-23}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

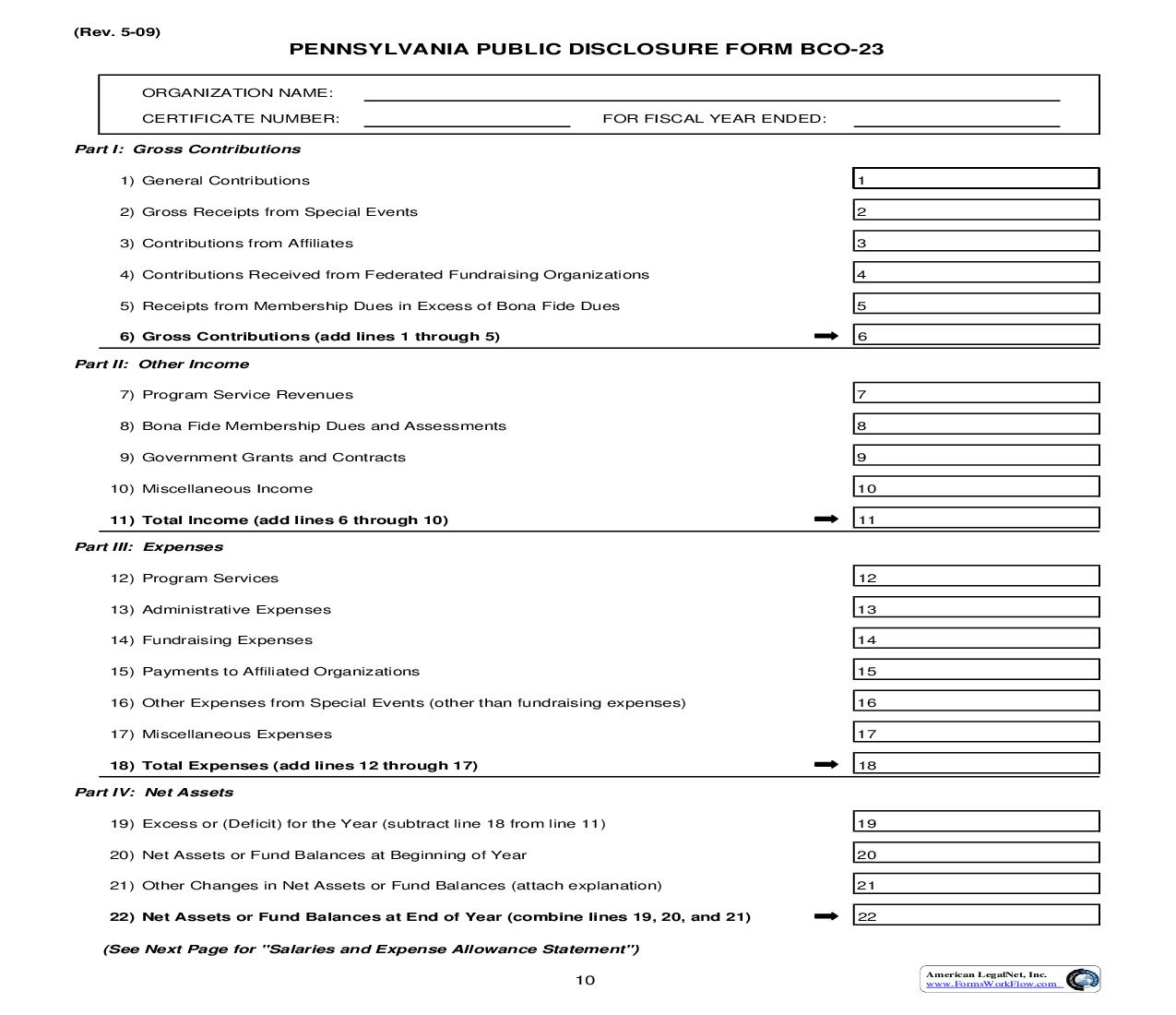

PENNSYLVANIA PUBLIC DISCLOSURE FORM BCO-23 ORGANIZATION NAME: CERTIFICATE NUMBER: Part I: Gross Contributions 1) General Contributions 2) Gross Receipts from Special Events 3) Contributions from Affiliates 4) Contributions Received from Federated Fundraising Organizations 5) Receipts from Membership Dues in Excess of Bona Fide Dues 6) Gross Contributions (add lines 1 through 5) Part II: Other Income 7) Program Service Revenues 8) Bona Fide Membership Dues and Assessments 9) Government Grants and Contracts 10) Miscellaneous Income 11) Total Income (add lines 6 through 10) Part III: Expenses 12) Program Services 13) Administrative Expenses 14) Fundraising Expenses 15) Payments to Affiliated Organizations 16) Other Expenses from Special Events (other than fundraising expenses) 17) Miscellaneous Expenses 18) Total Expenses (add lines 12 through 17) Part IV: Net Assets 19) Excess or (Deficit) for the Year (subtract line 18 from line 11) 20) Net Assets or Fund Balances at Beginning of Year 21) Other Changes in Net Assets or Fund Balances (attach explanation) 22) Net Assets or Fund Balances at End of Year (combine lines 19, 20, and 21) (See Next Page for "Salaries and Expense Allowance Statement") 19 20 21 22 (Rev. 8-99) FOR FISCAL YEAR ENDED: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 American LegalNet, Inc. www.USCourtForms.com 23) Salaries and Expense Allowance Statement Name of Individual Title and Average Hours Per Week Devoted to Position Salary Expense Account and Other Allowances Five Highest Paid Employees: 1. 2. 3. 4. 5. Officers: (Rev. 8-99) American LegalNet, Inc. www.USCourtForms.com INSTRUCTIONS FOR COMPLETING BCO-23 FORM 1) General Contributions: Enter the total gross contributions, gifts, grants and similar amounts received, including contributions from individuals, commercial co-ventures, corporations and other businesses, foundations, public charities, exempt organizations (do not include amounts received from fundraising organizations or affiliates), trusts, and estates. Also include noncash contributions such as donated land, buildings, property, equipment, and materials (exclude the value of services donated to the organization and the free use of materials, equipment or facilities). Noncash items should be valued at their fair market value on the date of the contribution to the organization. Exclude government grants and contracts. 2) Gross Receipts from Special Events: Enter the total gross amounts received from all special events and activities conducted by the organization, or on its behalf. Include amounts received from events that were conducted primarily to raise funds to finance the organization's exempt activities. Events and activities include, but are not limited to, carnivals, dinners, dances, raffles, shows, sales to the public, bingo games, and other gambling activities. Do not reduce the total gross amounts received by any expenses related to the events or activities. These expenses should be included on lines 14 or 16. 3) Contributions from Affiliates: Enter the total contributions received from associated organizations such as affiliates, national organizations, or parent organizations. 4) Contributions Received from Federated Fundraising Organizations: Enter the total contributions received from fundraising organizations such as United Way, United Fund, and Community Chests. 5) Receipts from Membership Dues in Excess of Bona Fide Dues: Include only those dues that represent contributions from the public. Dues are considered to be contributions to the extent that they exceed the monetary value of the benefits available to the member. Do not include the amounts received up to the value of the benefits available to the member. These amounts are bona fide membership dues and should be included on line 8. 6) Gross Contributions: Add lines 1 through 5. 7) Program Service Revenues: Enter the gross amount of fees and revenues earned by the organization for providing services or performing activities that fulfill the organization's stated mission or purpose. Include income earned for providing a government agency with a service, product, or facility that directly benefited only the government agency. Do not include any amounts received from a government agency that are used to serve the needs of the general public. These amounts should be included on line 9. 8) Bona Fide Membership Dues and Assessments: Include only those dues and assessments received that do not exceed the monetary value of the benefits available to the member. Do not include dues received by the organization to the extent that they exceed the monetary value of the benefits available to the member. These amounts should be included on line 5. If a member pays dues mainly to support the organization (not to obtain benefits) include this amount on line 5. 9) Government Grants and Contracts: Include total grants or other payments received from a federal, state, or local governmental unit if its primary purpose is to enable the organization to provide a service, product, or maintain a facility for the primary benefit of the general public. Do not include any amounts received that are used to serve the needs of the governmental agency. These amounts should be included on line 7. 10) Miscellaneous Income: This figure represents the total income from all sources not covered by lines 1 through 5 and lines 7 through 9, including, but not limited to, interest, dividends and interest from securities, gross rental income, gross amounts from the sale of assets other than inventory, and gross sales of inventory (this does not include items that were sold through a special event or activity). 11) Total Income: Add lines 6 through 10. 12) Program Services: Include total costs of services or activities performed by the organization which fulfill its charitable purposes. Include any donations, grants, scholarships, or similar amounts given out in fulfillment of the organization's stated purposes. United Way and similar fundraising organizations should include allocations to participating agencies on this line. Include allocated administrative expenses, if any. See instructions to line 13. (Rev. 8-99) American LegalNet, Inc. www.USCourtForms.com 13) Administrative Expenses: Include costs related to the overall administration and management of the organization. If a portion of these costs relate to program services or fundraising, a reasonable allocation should be made among the applicable functions. 14