Last updated: 9/14/2011

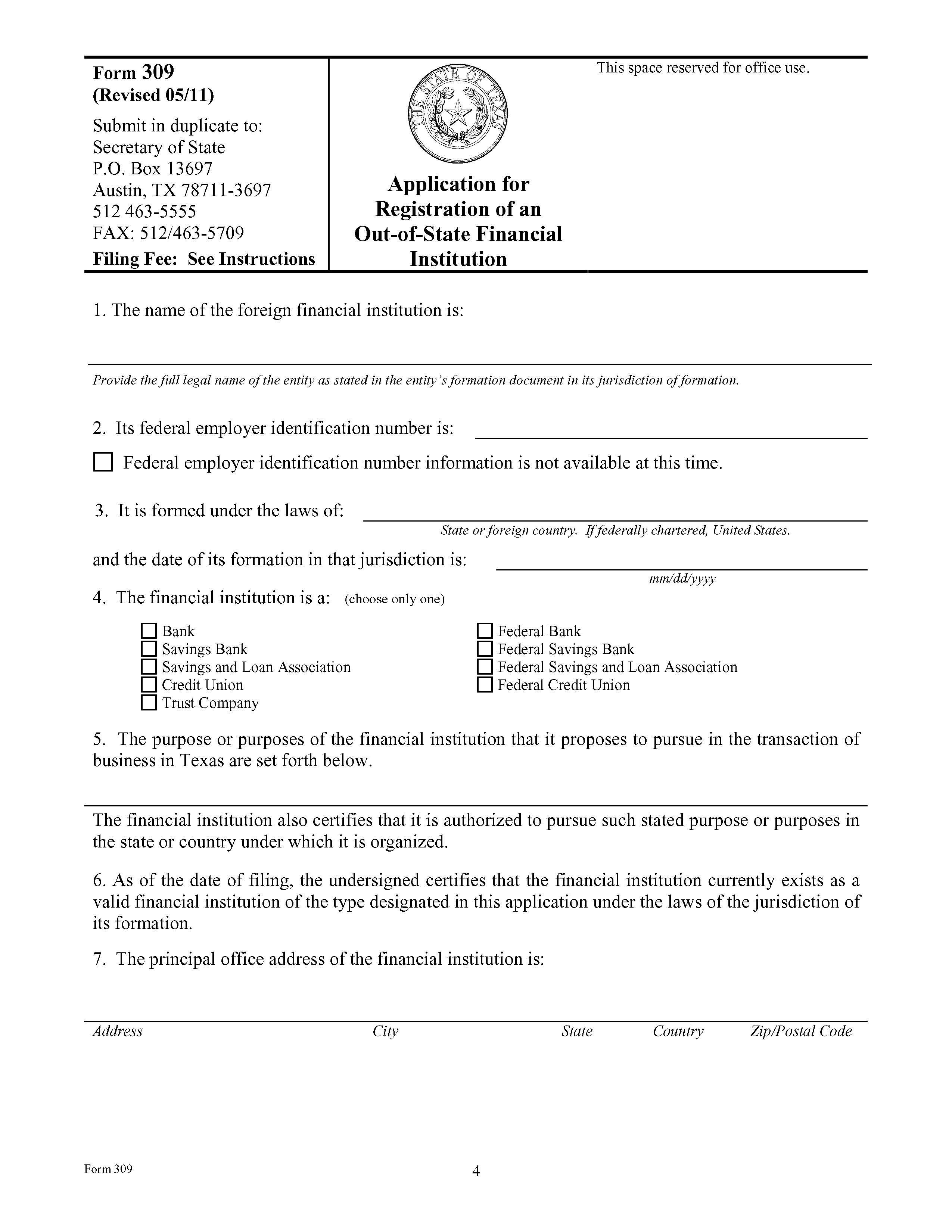

Application For Registration Of An Out-Of-State Financial Institution {309}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 309 - APPLICATION FOR REGISTRATION OF AN OUT-OF-STATE FINANCIAL INSTITUTION. An out-of-state financial institution means a bank, savings bank, savings association, savings and loan association, credit union or trust company that is not chartered under the laws of this state and that has its main or principal office in another state. Section 201.102 of the Texas Finance Code requires an out-of-state financial institution to comply with the law of this state relating to foreign corporations transacting business in the state before operating a branch or other office in this state. The applicable law is the Texas Business Organizations Code (BOC). In this regard, the out-of-state financial institution is required to file an application for registration with the secretary of state and continuously maintain a registered agent and registered office address in Texas until the institution terminates or withdraws its registration to transact business in Texas. Should the out-of-state financial institution change its name as provided by the laws governing its formation, the institution will be required to file an amendment to its application for registration (Form 411). Out-of-state institutions may be subject to a state franchise tax. www.FormsWorkflow.com

Related forms

-

Amendment To Registration By An Out-Of-State Financial Institution

Amendment To Registration By An Out-Of-State Financial Institution

Texas/Secretary Of State/General Business/ -

Amendment To Registration

Amendment To Registration

Texas/Secretary Of State/General Business/ -

Application For Registration Of An Entity Name

Application For Registration Of An Entity Name

Texas/Secretary Of State/General Business/ -

Application For Registration Of An Out-Of-State Financial Institution

Application For Registration Of An Out-Of-State Financial Institution

Texas/Secretary Of State/General Business/ -

Application For Renewal Of Registration Of An Entity Name

Application For Renewal Of Registration Of An Entity Name

Texas/Secretary Of State/General Business/ -

Application For Reservation Or Renewal Of Reservation Of An Entity Name

Application For Reservation Or Renewal Of Reservation Of An Entity Name

Texas/Secretary Of State/General Business/ -

Certificate Of Correction

Certificate Of Correction

Texas/Secretary Of State/General Business/ -

Certificate Of Withdrawal Of Registration

Certificate Of Withdrawal Of Registration

Texas/Secretary Of State/General Business/ -

Change By Registered Agent To Name Or Address

Change By Registered Agent To Name Or Address

Texas/Secretary Of State/General Business/ -

Resignation Of Registered Agent

Resignation Of Registered Agent

Texas/Secretary Of State/General Business/ -

Statement Of Change Of Registered Office Agent

Statement Of Change Of Registered Office Agent

Texas/Secretary Of State/General Business/ -

Certificate Of Amendment

Certificate Of Amendment

Texas/Secretary Of State/General Business/ -

Certificate Of Termination Of A Nonprofit Corporation Or Cooperative Association

Certificate Of Termination Of A Nonprofit Corporation Or Cooperative Association

Texas/Secretary Of State/General Business/ -

Resolution Relating To A Series Of Shares

Resolution Relating To A Series Of Shares

Texas/Secretary Of State/General Business/ -

Termination Of Registration

Termination Of Registration

Texas/Secretary Of State/General Business/ -

Statement Of Event Or Fact

Statement Of Event Or Fact

Texas/Secretary Of State/General Business/ -

Abandonment Of Assumed Name Certificate

Abandonment Of Assumed Name Certificate

Texas/Secretary Of State/General Business/ -

Amendment To Appointment Of Statutory Agent

Amendment To Appointment Of Statutory Agent

Texas/Secretary Of State/General Business/ -

Acceptance Of Appointment And Consent To Serve As Registered Agent

Acceptance Of Appointment And Consent To Serve As Registered Agent

Texas/Secretary Of State/General Business/ -

Appointment Of Statutory Agent

Appointment Of Statutory Agent

Texas/Secretary Of State/General Business/ -

Cancellation Of Appointment Of Statutory Agent

Cancellation Of Appointment Of Statutory Agent

Texas/Secretary Of State/General Business/ -

Rejection Of Appointment

Rejection Of Appointment

Texas/Secretary Of State/General Business/ -

Resignation Of Appointed Statutory Agent

Resignation Of Appointed Statutory Agent

Texas/Secretary Of State/General Business/ -

Amendment To Registration To Disclose A Change Resulting From A Conversion Of Merger

Amendment To Registration To Disclose A Change Resulting From A Conversion Of Merger

Texas/Secretary Of State/General Business/ -

Certificate Of Abandonment

Certificate Of Abandonment

Texas/Secretary Of State/General Business/ -

Certificate Of Merger Domestic Entity Divisional Merger

Certificate Of Merger Domestic Entity Divisional Merger

Texas/Secretary Of State/General Business/ -

Notice Of Transfer Of Reservation Of An Entity Name

Notice Of Transfer Of Reservation Of An Entity Name

Texas/Secretary Of State/General Business/ -

Notice Of Withdrawal Of Entity Name Reservation

Notice Of Withdrawal Of Entity Name Reservation

Texas/Secretary Of State/General Business/ -

Notice Of Withdrawal Of Entity Name Registration

Notice Of Withdrawal Of Entity Name Registration

Texas/Secretary Of State/General Business/ -

Restated Certificate Of Formation With New Amendments

Restated Certificate Of Formation With New Amendments

Texas/Secretary Of State/General Business/ -

Restated Certificate Of Formation Without Further Amendments

Restated Certificate Of Formation Without Further Amendments

Texas/Secretary Of State/General Business/ -

Restriction On The Transfer Of Shares

Restriction On The Transfer Of Shares

Texas/Secretary Of State/General Business/ -

Consent To Use Of Similar Name

Consent To Use Of Similar Name

Texas/Secretary Of State/General Business/ -

Amendment To Registrtion Of A Foreign Limited Partnership

Amendment To Registrtion Of A Foreign Limited Partnership

Texas/Secretary Of State/General Business/ -

Certificate Of Conversion (Professional Association To LLC)

Certificate Of Conversion (Professional Association To LLC)

Texas/Secretary Of State/General Business/ -

Certificate Of Withdrawal Of Registration Of A Foreign Limited Liability Partnership

Certificate Of Withdrawal Of Registration Of A Foreign Limited Liability Partnership

Texas/Secretary Of State/General Business/ -

Fee Schedule

Fee Schedule

Texas/Secretary Of State/General Business/ -

Assumed Name Certificate

Assumed Name Certificate

Texas/Secretary Of State/General Business/ -

Certificate Of Reinstatement

Certificate Of Reinstatement

Texas/Secretary Of State/General Business/ -

Certificate Of Conversion (General Partnership To Filing Entity)

Certificate Of Conversion (General Partnership To Filing Entity)

Texas/Secretary Of State/General Business/ -

Certificate Of Termination Of A Domestic Entity

Certificate Of Termination Of A Domestic Entity

Texas/Secretary Of State/General Business/ -

Application For Reinstatement And Request To Set Aside Tax Forfeiture

Application For Reinstatement And Request To Set Aside Tax Forfeiture

Texas/Secretary Of State/General Business/ -

Request For Official Certificate Or Apostille Adoption Proceedings

Request For Official Certificate Or Apostille Adoption Proceedings

Texas/Secretary Of State/General Business/ -

Payment Form

Payment Form

Texas/Secretary Of State/General Business/ -

Request For Universal Apostille

Request For Universal Apostille

Texas/Secretary Of State/General Business/ -

Texas Medical Power Of Attorney

Texas Medical Power Of Attorney

Texas/Secretary Of State/General Business/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!