Last updated: 8/10/2006

Application For Hearing For Certain Exchanges Of Securities {11}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

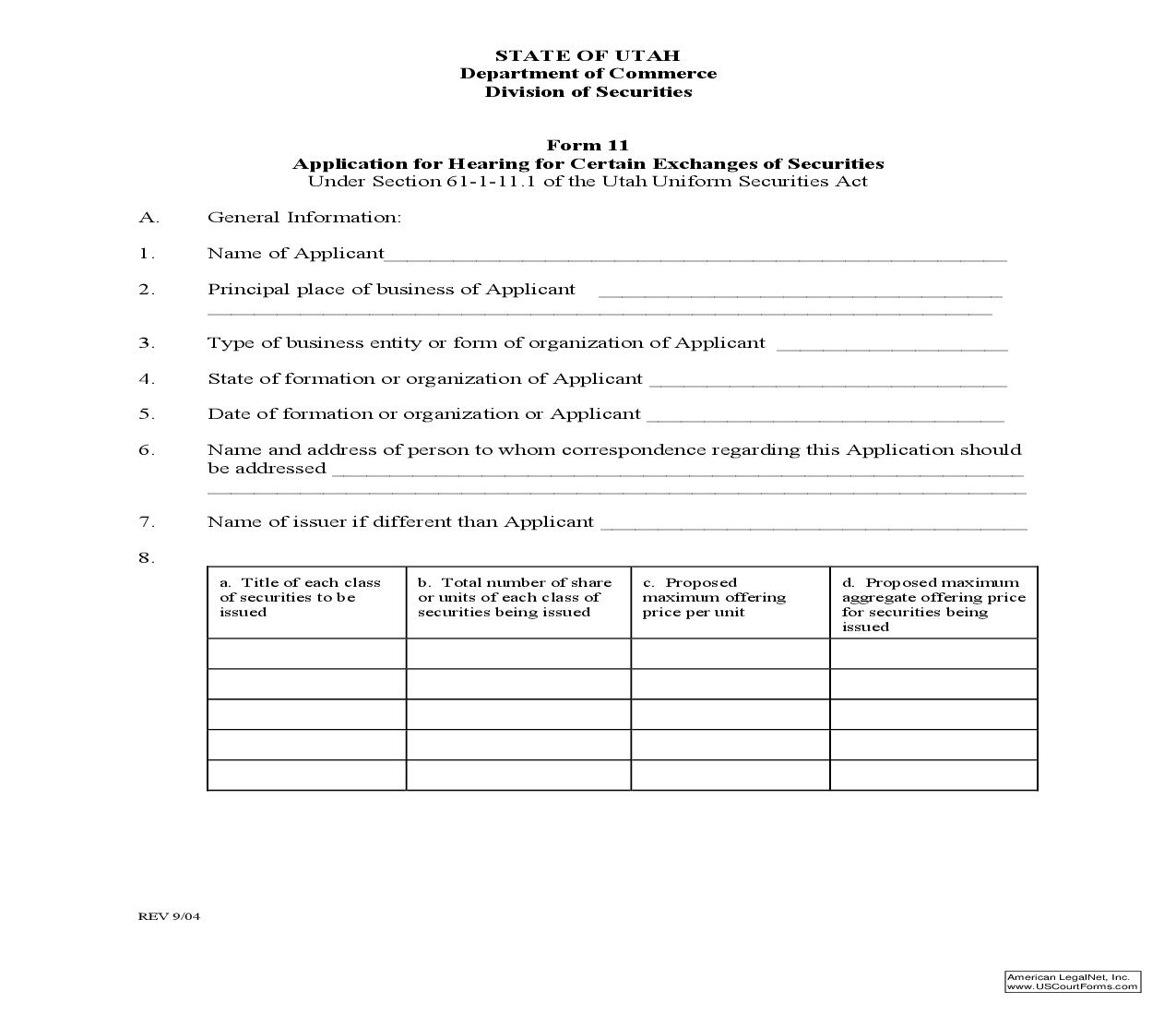

STATE OF UTAH Department of Commerce Division of Securities Form 11 Application for Hearing for Certain Exchanges of Securities Under Section 61-1-11.1 of the Utah Uniform Securities Act A. General Information: 1. Name of Applicant______________________________________________________ 2. Principal place of business of Applicant ____________________________ _______ ____________________________________________________________________ 3. Type of business entity or form of organization of Applicant ____________________ 4. State of formation or organization of Applicant _______________________________ 5. Date of formation or organization or Applicant _______________________________ 6. Name and address of person to whom correspondence regarding this Application should be addressed ___________________________________________________________ _ _______________________________________________________________________ 7. Name of issuer if different than Applicant _________________________________ ____ 8. a. Title of each class b. Total number of share c. Proposed d. Proposed maximum of securities to be or units of each class of maximum offering aggregate offering price issued securities being issued price per unit for securities being issued REV 9/04 American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 2 B. Please provide the following: 1. DESCRIPTION OF PLAN OF EXCHANGE. Describe the material features of the plan, the reasons therefore, the effect on existing security holders, the appr oximate number of securityholders in each entity involved, the vote needed for the plan s approval, the proposed date for the mailing of proxies, if any, and the proposed date of the securityholders meeting. 2. IF THE TRANSACTION INVOLVES a change in the rights, preferences, privileges or restrictions of, or on outstanding securities or an exchange by an issuer with its exis ting security holders, please respond to the following: a. OUTSTANDING SECURITIES TO BE MODIFIED. State the title and amount of outstanding securities to be modified. b. DESCRIPTION OF OUTSTANDING SECURITIES AND MODIFIED SECURITIES. Describe any material differences between the outstanding securities and the modified or new securities. c. DESCRIPTION OF PROPOSED MODIFICATION. State the reasons for the proposed modification, the general effect thereof upon the rights of existing security holders, the basis of the ratio for the exchange of securities by an issuer with its existing securityholders, the vote needed for approval, the pro posed date for the mailing of proxies, if any, and the proposed date of the securityholders meeting. 3. EXECUTION OF PLAN. Describe the method by which the plan described in paragraph B1 above will be carried out, including the names, and CRD numbers, if any, of any broker-dealers or agents, as defined in 61-1-13 of the Utah Uniform Securities Act to be employed by each company in effecting purchases or sales of securities pursuant to the plan. Describe also the compensation or other consideration to be paid to or received by such persons or any other persons in connection with the sale or purchase of the securities. 4. DESCRIPTION OF BUSINESS. Describe the business of the issuer and every other company involved in the transaction. 5. DIVIDENDS IN ARREARS OR DEFAULTS. A statement concerning any dividends in arrears or defaults in principal or interest with respect to any securities of the issuer and any other company involved in the transaction, and concerning the effect of the plan thereon. 6. HIGH AND LOW SALES PRICES WITHIN TWO YEARS. As to each class of securities of the issuer and of every other company involved in the transaction which is listed for trading on a securities exchange or with respect to which a market otherwise exists, and that will be affected materially by the plan, state the high and low sale prices (or, in the absence of such information, the range of the bid prices) for each quarterly REV 9/04 American LegalNet, Inc. www.USCourtForms.com<<<<<<<<<********>>>>>>>>>>>>> 3 period within two years of the date of this application. 7. DIRECTORS AND OFFICERS. a. List the names of all directors and officers of the issuer and of every other company involved in the transaction, indicating all positions and offices he ld by each person named. b. Describe any disciplinary actions, judgments, material litigation, felony convictions of any type, or misdemeanor convictions in connection with the offer, sale, or purchase of a security or involving fraud or deceit, including, without limitation, forgery, embezzlement, obtaining money under false pretenses, larceny, or conspiracy to defraud. 8. PRINCIPAL HOLDERS OF SECURITIES. State any material interest in the transaction of each person who, with respect to the issuer or any other company involved in the transaction, is a director, promoter, officer, person occupying a similar status or performing similar functions, or owns of record or beneficially 10 percent of more of the outstanding securities of any class of equity securities. 9. EXCHANGE RATIO. State the basis of the ratio for every exchange of secu rities being proposed as part of the transaction to be approved. C. Attach and incorporate by reference the following exhibits (any exhibit which is inapplicable should be listed by letter on the form followed simply by the word inapplicable.) 1. Audited financial statements as required by Rule R164-10-2(F) with respect to the issuer and every other company involved in the transaction, and pro forma financial statements giving effect to the proposed transaction. 2. A copy of the plan of reorganization or recapitalization to be approved if it is set forth in a written document, including any request for delayed effectiveness of the filing of such document with the Division of Corporations or similar authority. 3. Copies (which may be in a restated or composite form) of the current charter documents of the issuer as required by Rule R164-10-2(I) and of each constituent company involved in a merger or consolidation. 4. A copy of any agreement made or to be made by the issuer affecting any of the rights, preferences, privileges, or transferability of the securities. 5. A copy of any agreement made or to be made by or among securityholders of the issuer that materially affects, or will materially affect, any of the rights, preferences, privileges or restrictions of or on securities of the issuer or the management of the is