Last updated: 4/13/2015

Articles Of Conversion {X-10}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

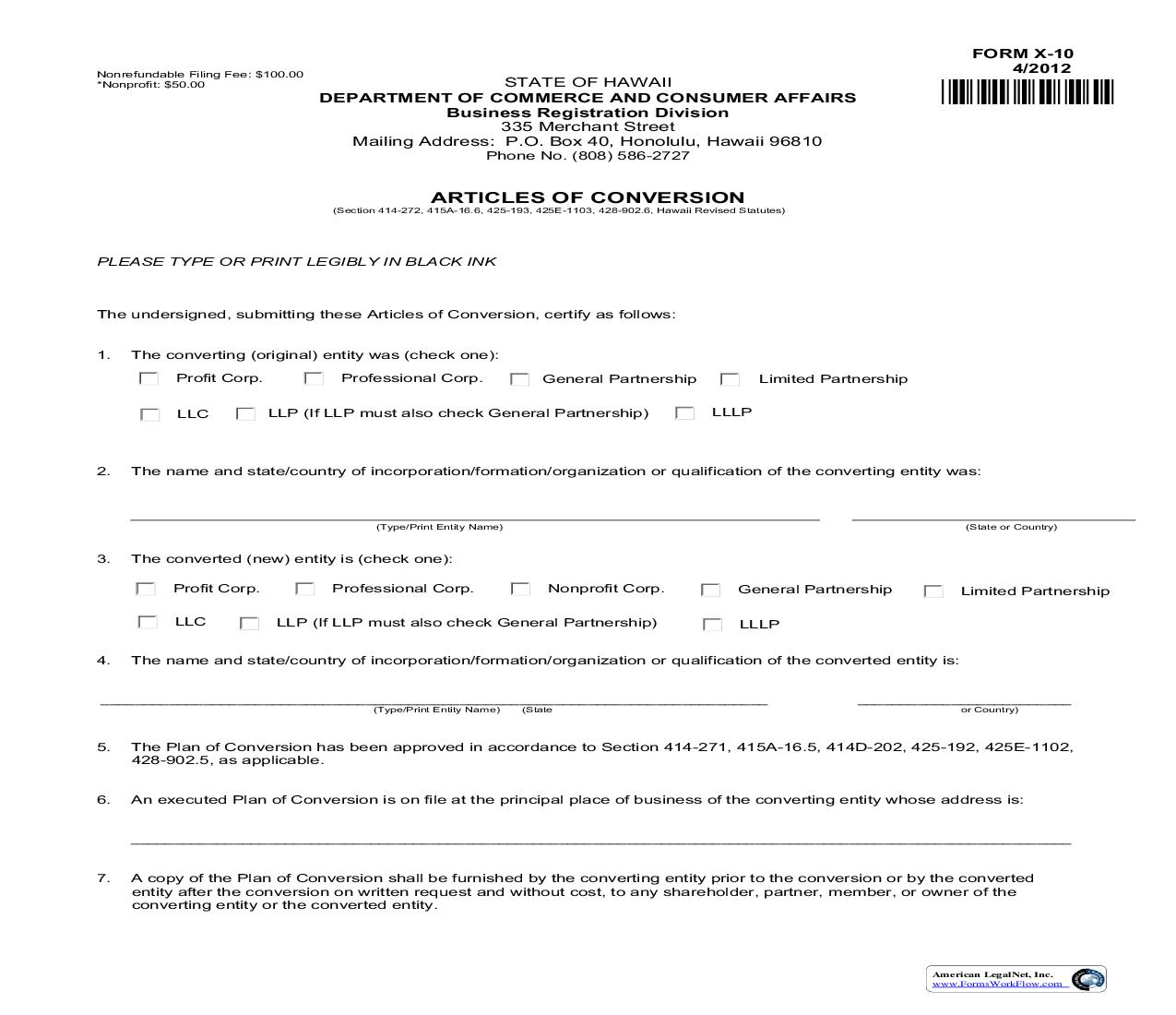

Nonrefundable Filing Fee: $100.00 *Nonprofit: $50.00 STATE OF HAWAII DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS Business Registration Division 335 Merchant Street Mailing Address: P.O. Box 40, Honolulu, Hawaii 96810 Phone No. (808) 586-2727 ' '. FORM X-10 4/2012 ARTICLES OF CONVERSION (Section 414-272, 415A-16.6, 425-193, 425E-1103, 428-902.6, Hawaii Revised Statutes) PLEASE TYPE OR PRINT LEGIBLY IN BLACK INK The undersigned, submitting these Articles of Conversion, certify as follows: 1. The converting (original) entity was (check one): Profit Corp. LLC Professional Corp. General Partnership LLLP Limited Partnership LLP (If LLP must also check General Partnership) 2. The name and state/country of incorporation/formation/organization or qualification of the converting entity was: (Type/Print Entity Name) (State or Country) 3. The converted (new) entity is (check one): Profit Corp. LLC Professional Corp. Nonprofit Corp. General Partnership LLLP Limited Partnership LLP (If LLP must also check General Partnership) 4. The name and state/country of incorporation/formation/organization or qualification of the converted entity is: ______________________________________________________________________________ (Type/Print Entity Name) (State _________________________ or Country) 5. The Plan of Conversion has been approved in accordance to Section 414-271, 415A-16.5, 414D-202, 425-192, 425E-1102, 428-902.5, as applicable. 6. An executed Plan of Conversion is on file at the principal place of business of the converting entity whose address is: ______________________________________________________________________________________________________________ 7. A copy of the Plan of Conversion shall be furnished by the converting entity prior to the conversion or by the converted entity after the conversion on written request and without cost, to any shareholder, partner, member, or owner of the converting entity or the converted entity. American LegalNet, Inc. www.FormsWorkFlow.com FORM X-10 4/2012 8. Complete the applicable section. The Plan of Conversion was approved by the converting entity as follows: A. By vote of the shareholders of the converting domestic profit/professional corporation: Number of Shares Outstanding Class/Series Number of Shares Voting For Conversion Number of Shares Voting Against Conversion OR B. By vote of the converting domestic limited liability company: Total Number of Authorized Votes Number of Votes For the Conversion Number of Votes Against the Conversion OR The converting entity was a foreign profit corporation, a foreign limited liability company, a foreign limited partnership, a foreign limited liability limited partnership, a domestic or a foreign general partnership, or a domestic or foreign limited liability partnership. The approval of the Plan of Conversion was duly authorized and complied with the laws under which the converting entity was incorporated, formed, organized, or qualified. OR The converting entity was a domestic limited partnership or a domestic limited liability partnership and that a majority of the general partners have agreed to the conversion. c. D. 9. The conversion is effective on the date and time of filing the Articles of Conversion or at a later date and time, no more than 30 days after the filing, if so stated. Check one of the following statements: Conversion is effective on the date and time of filing the Articles of Conversion. Conversion is effective on ________________________________________________, at __________________. m. , Hawaiian Standard Time, which date is not later than 30 days after the filing of the Articles of Conversion. I/we certify under the penalties of Section 414-20, 415A-25, 414D-12, 425-13, 425-172, 425E-208, and 428-1302, Hawaii Revised Statutes, as applicable, that I/we have read the above statements, I/we are authorized to sign this Articles of Conversion, and that the above statements are true and correct. Signed this ____________day of ___________________________________, __________ ______________________________________________________ (Type/Print Name & Title) _________________________________________________________ (Signature) ______________________________________________________ (Type/Print Name & Title) _________________________________________________________ (Signature) SEE INSTRUCTIONS ON REVERSE SIDE. The articles must be signed by an officer, partner, or other duly authorized representative of the converting entity. American LegalNet, Inc. www.FormsWorkFlow.com FORM X-10 4/2012 Instructions: Articles must be typewritten or printed in black ink, and must be legible. The articles must be signed by an officer, partner, or other duly authorized representative of the converting entity. All signatures must be in black ink. Submit articles together with the appropriate fee. Line 1. Check what type of entity was the converting (original) entity. Note: If the converting entity was a domestic or foreign limited liability partnership, the general partnership box must also be checked. State the name and state or country of incorporation, formation, organization, or qualification of the converting entity. Check what type of entity is the converted (new) entity. State the name and state or country of incorporation, formation, organization, or qualification of the converted entity. State the complete address (including number, street, city, state, and zip code) of the principal place of business of the converting entity where the Plan of Conversion is on file. Complete the application section on how the Plan of Conversion was approved by the converting entity. If the converting entity was a domestic profit or professional corporation, complete A. If the converting entity was a domestic limited liability company, complete B. If the converting entity was a foreign profit corporation, foreign limited liability company, a foreign limited partnership, a foreign limited liability limited partnership, a domestic or foreign general partnership, or a domestic or foreign limited liability partnership, check the box next to C. If the converting entity was a domestic limited partnership or a domestic limited liability limited partnership, check the box next to D. If the converted entity is a domestic corporation, the Articles of Incorporation of the domestic corporation must be filed together with the Articles of Conversion. If the converted entity is a domestic general partnership, the Registration Statement