Last updated: 6/29/2015

Foreign Nonprofit Corporation Annual Report {F2}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

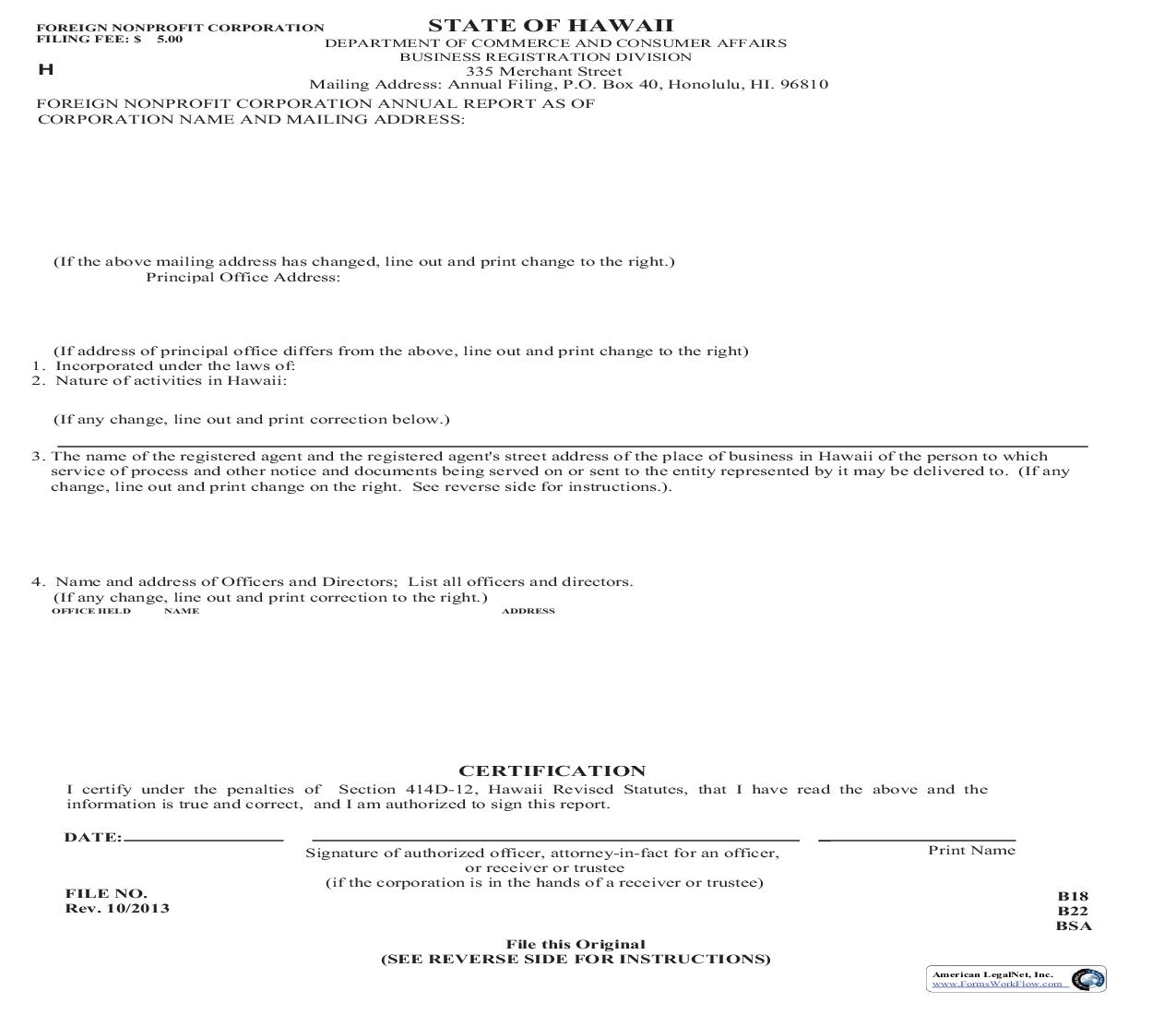

)25(,*1 121352),7 &25325$7,21 ),/,1* )(( DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS 67$7( 2) +$:$,, 335 Merchant Street Mailing Address: Annual Filing, P.O. Box 40, Honolulu, HI. 96810 FOREIGN NONPROFIT CORPORATION ANNUAL REPORT AS OF CORPORATION NAME AND MAILING ADDRESS: H BUSINESS REGISTRATION DIVISION (If the above mailing address has changed, line out and print change to the right.) Principal Office Address: (If address of principal office differs from the above, line out and print change to the right) 1. Incorporated under the laws of: 2. Nature of activities in Hawaii: (If any change, line out and print correction below.) 3. The name of the registered agent and the registered agent's street address of the place of business in Hawaii of the person to which service of process and other notice and documents being served on or sent to the entity represented by it may be delivered to. (If any change, line out and print change on the right. See reverse side for instructions.). 4. Name and address of Officers and Directors; List all officers and directors. (If any change, line out and print correction to the right.) 2)),&( +(/' 1$0( $''5(66 &(57,),&$7,21 I certify under the penalties of Section 414D-12, Hawaii Revised Statutes, that I have read the above and the information is true and correct, and I am authorized to sign this report. '$7( Signature of authorized officer, attorney-in-fact for an officer, or receiver or trustee (if the corporation is in the hands of a receiver or trustee) Print Name % % %6$ ),/( 12 5HY )LOH WKLV 2ULJLQDO 6(( 5(9(56( 6,'( )25 ,16758&7,216 American LegalNet, Inc. www.FormsWorkFlow.com ,16758&7,216 (If any questions, call (808) 586-2727) The annual report must be typewritten or printed in Black Ink, and must be legible. The report must be signed in black ink and certified by an authorized corporate officer, attorney-in-fact for an officer, receiver, trustee or other court-appointed fiduciary. The filing fee of $ 5.00 must be submitted with the report. Make check payable to the DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS. Filing fee is not refundable. Your cancelled check is your receipt. There is a $ 25.00 charge for all dishonored checks. The Director of Commerce and Consumer Affairs may revoke the certificate of authority of a foreign corporation authorized to transact business in Hawaii, for failure to file an annual report for a period of two years. 1. List the State or Country of incorporation of the corporation. 2. State a brief description of the nature of business. If inactive for the period, state INACTIVE. (Annual report must be filed for the period, even though the corporation was inactive.) 3. State the name of the registered agent and the complete street address (including number, street, city, state, and zip code) in Hawaii. The agent must be an individual resident of Hawaii, a domestic entity, or a foreign entity authorized to transact business or conduct affairs in the State of Hawaii. (The Director of Commerce and Consumer Affairs may revoke the certificate of authority of a foreign corporation authorized to transact business in this state for failure to maintain a registered agent and registered office.) 4. State the names and business addresses of all corporate officers and directors. (P=President; V=Vice-President; S=Secretary; T=Treasurer; D=Director) Due Date: Effective January 1, 2003, for a domestic or foreign corporation whose date of incorporation or registration in this State falls between: (1) January 1 and March 31, an annual report shall be filed on or before March 31 of each year and shall reflect the state of the corporation's affairs as of January 1 of the year when filed; (2) April 1 and June 30, an annual report shall be filed on or before June 30 of each year and shall reflect the state of the corporation's affairs as of April 1 of the year when filed; (3) July 1 and September 30, an annual report shall be filed on or before September 30 of each year and shall reflect the state of the corporation's affairs as of July 1 of the year when filed; and (4) October 1 and December 31, an annual report shall be filed on or before December 31 of each year and shall reflect the state of the corporation's affairs as of October 1 of the year when filed. New corporations: An annual report is not required to be filed in the year the corporation was registered. This material can be made available for individuals with special needs. Please call the Division Secretary, Business Registration Division, DCCA, at 586-2744, to submit your request. All Business Registration filings are open to public inspection. (Section 92F-11, HRS) Mail the completed report with fee to: Annual filing - BREG P.O. Box 40 Honolulu, HI 96810 ',' <28 5(0(0%(5 72 6,*1 <285 5(3257 $1' &+(&." 5HQHZ RQOLQH DW ZZZHKDZDLLJRYDQQXDOV American LegalNet, Inc. www.FormsWorkFlow.com