Last updated: 9/5/2006

Bill Of Costs

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

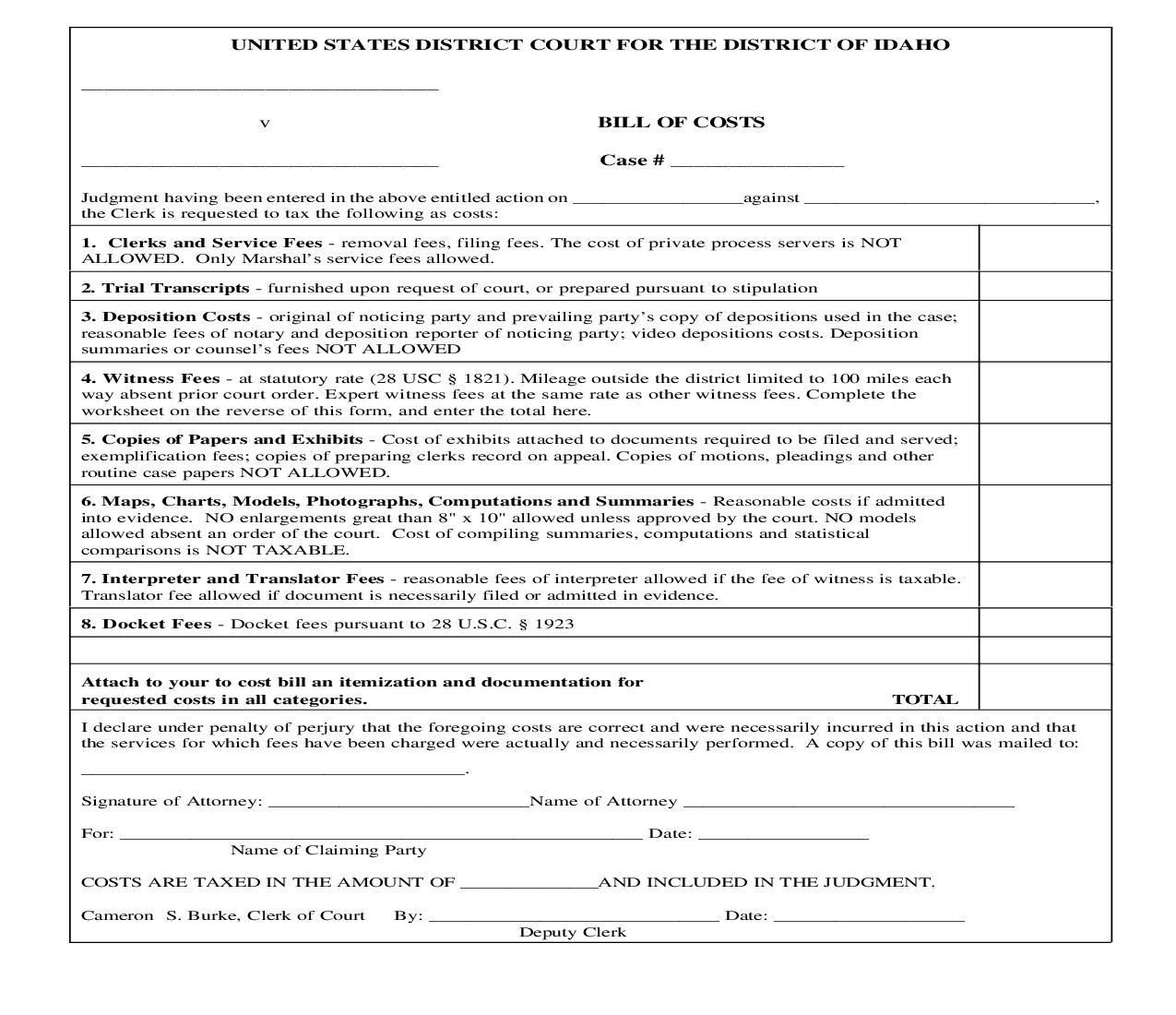

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF IDAHO_______________________________ v BILL OF COSTS_______________________________ Case # _______________Judgment having been entered in the above entitled action on _________________against ______ _______________________,the Clerk is requested to tax the following as costs:1. Clerks and Service Fees - removal fees, filing fees. The cost of private process servers is NOT ALLOWED. Only Marshals service fees allowed.2. Trial Transcripts - furnished upon request of court, or prepared pursuant to stipulation 3. Deposition Costss copy of depositions used in the case;ytpar - original of noticing party and prevailingreasonable fees of notary and deposition reporter of noticing party; vid eo depositions costs. Depositionsummaries or counsels fees NOT ALLOWED 4. Witness Fees - at statutory rate (28 USC 1821). Mileage outside the district limited to 100 miles eachway absent prior court order. Expert witness fees at the same rate as ot her witness fees. Complete theworksheet on the reverse of this form, and enter the total here.5. Copies of Papers and Exhibits - Cost of exhibits attached to documents required to be filed and serve d;exemplification fees; copies of preparing clerks record on appeal. Copie s of motions, pleadings and otherroutine case papers NOT ALLOWED.6. Maps, Charts, Models, Photographs, Computations and Summaries - Reasonable costs if admittedinto evidence. NO enlargements great than 8" x 10" allowed unless appro ved by the court. NO modelsallowed absent an order of the court. Cost of compiling summaries, comp utations and statisticalcomparisons is NOT TAXABLE. 7. Interpreter and Translator Fees - reasonable fees of interpreter allowed if the fee of witness is taxab le.Translator fee allowed if document is necessarily filed or admitted in e vidence.8. Docket Fees - Docket fees pursuant to 28 U.S.C. 1923 Attach to your to cost bill an itemization and documentation forrequested costs in all categories. TOTALI declare under penalty of perjury that the foregoing costs are correct and were necessarily incurred in this action and thatthe services for which fees have been charged were actually and necessar ily performed. A copy of this bill was mailed to: ______________________________________. Signature of Attorney: __________________________Name of Attorney ______ ___________________________For: ____________________________________________________ Date: ________ _________ Name of Claiming PartyCOSTS ARE TAXED IN THE AMOUNT OF ______________AND INCLUDED IN THE JUDGM ENT.Cameron S. Burke, Clerk of Court By: _____________________________ Date: ___________________ Deputy Clerk<<<<<<<<<********>>>>>>>>>>>>> 2 WITNESS FEES (computation, cf. 28 U.S.C. 1821 for statutory fees) ATTENDANCE SUBSISTENCE MILEAGE Total Total Total Total Cost NAME AND RESIDENCE Days Days Miles Cost Cost Cost Each Witness TOTAL NOTICE Section 1924, Title 28, U.S. Code (effective September 1, 1948) provides: Sec. 1924. Verification of bill of costs. Before any bill of costs is taxed, the party claiming any item of cost or disbursement shall attach theretoan affidavit, made by himself or by his duly authorized attorney or agent having knowledge of the facts, that suchitem is correct and has been necessarily incurred in the case and that the services for which fees have been chargedwere actually and necessarily performed. See also Section 1920 of Title 28, which reads in part as follows: A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree. The Federal Rules of Civil Procedure contain the following provisions: Rule 54 (d) Except when express provision therefor is made either in a statute of the United States or in these rules,costs shall be allowed as of course to the prevailing party unless the court otherwise directs, but costs against theUnited States, its officers, and agencies shall be imposed only to the extent permitted by law. Costs may be taxedby the clerk on one days notice. On motion served within 5 days thereafter, the action of the clerk may be reviewedby the court. Rule 6(e) Whenever a party has the right or is required to do some act or take some proceedings within a prescribedperiod after the service of a notice or other paper upon him and the notice or paper is served upon him by mail, 3days shall be added to the prescribed period. Rule 58 (In Part) Entry of the judgment shall not be delayed for the taxing of costs.