Last updated: 8/23/2016

Application For Self Insurance {30}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

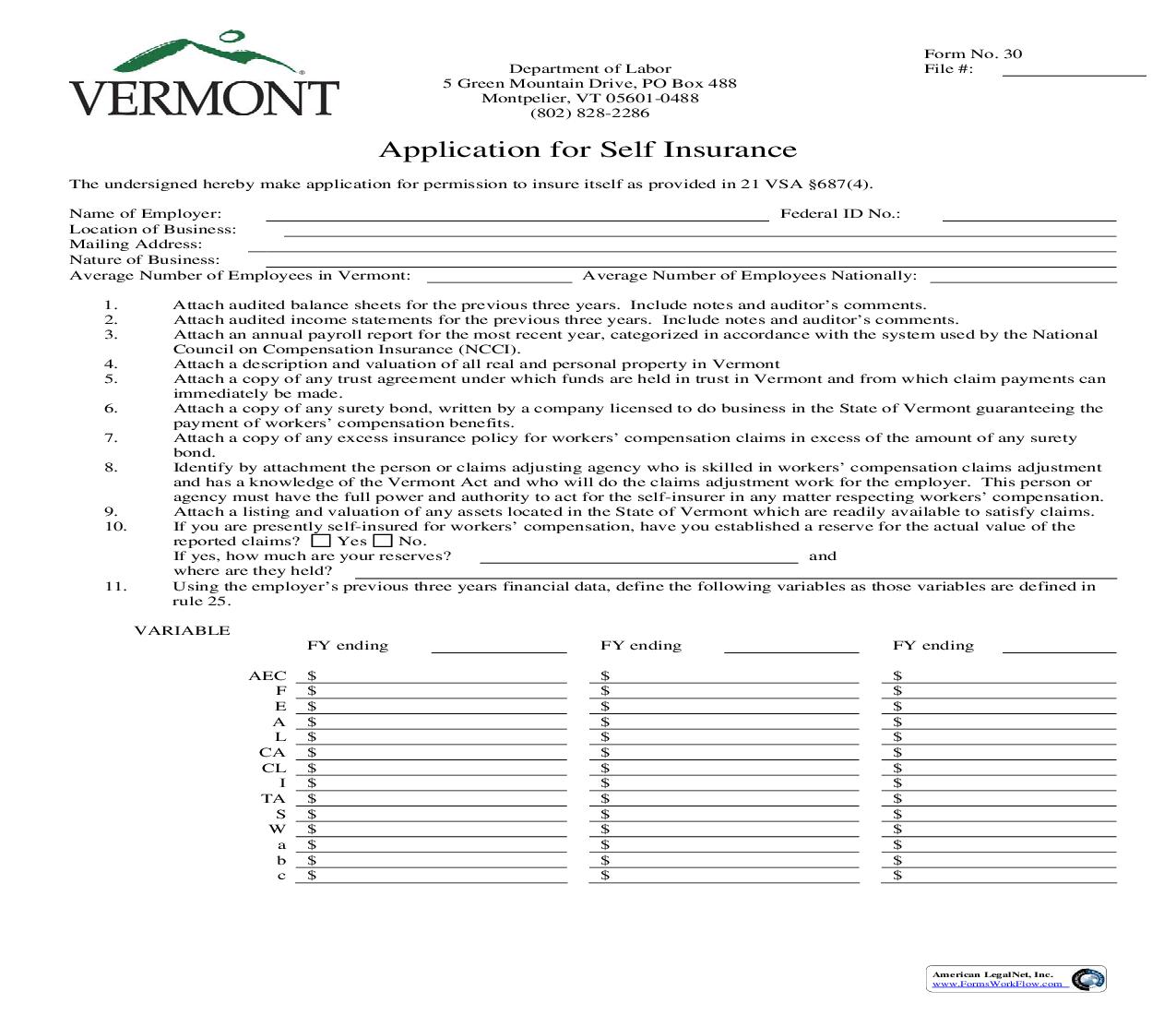

Department of Labor 5 Green Mountain Drive, PO Box 488 Montpelier, VT 05601-0488 (802) 828-2286 Form No. 30 File #: Application for Self Insurance The undersigned hereby make application for permission to insure itself as provided in 21 VSA §687(4). Name of Employer: Location of Business: Mailing Address: Nature of Business: Average Number of Employees in Vermont: 1. 2. 3. 4. 5. 6. 7. 8. Federal ID No.: Average Number of Employees Nationally: 9. 10. 11. Attach audited balance sheets for the previous three years. Include notes and auditor's comments. Attach audited income statements for the previous three years. Include notes and auditor's comments. Attach an annual payroll report for the most recent year, categorized in accordance with the system used by the National Council on Compensation Insurance (NCCI). Attach a description and valuation of all real and personal property in Vermont Attach a copy of any trust agreement under which funds are held in trust in Vermont and from which claim payments can immediately be made. Attach a copy of any surety bond, written by a company licensed to do business in the State of Vermont guaranteeing the payment of workers' compensation benefits. Attach a copy of any excess insurance policy for workers' compensation claims in excess of the amount of any surety bond. Identify by attachment the person or claims adjusting agency who is skilled in workers' compensation claims adjustment and has a knowledge of the Vermont Act and who will do the claims adjustment work for the employer. This person or agency must have the full power and authority to act for the self-insurer in any matter respecting workers' compensation. Attach a listing and valuation of any assets located in the State of Vermont which are readily available to satisfy claims. If you are presently self-insured for workers' compensation, have you established a reserve for the actual value of the Yes No. reported claims? If yes, how much are your reserves? and where are they held? Using the employer's previous three years financial data, define the following variables as those variables are defined in rule 25. VARIABLE FY ending AEC F E A L CA CL I TA S W a b c $ $ $ $ $ $ $ $ $ $ $ $ $ $ FY ending $ $ $ $ $ $ $ $ $ $ $ $ $ $ FY ending $ $ $ $ $ $ $ $ $ $ $ $ $ $ American LegalNet, Inc. www.FormsWorkFlow.com 12. Using the variables derived above compute each of the following tests for financial years indicated. FY Ending FY Ending FY Ending a. Cash Flow Minimum: F CL + AEC 0.25 b. Minimum Liquidity: CA-I CL+AEC CAb-Ib CLb and CA-I CL+AEC > 0.5 c. Minimum Working Capital: CA-CL-AEC S Cab-CLb Sb and Ca-CL-AEC S > 0.05 d. Minimum Net Worth to Debt: A-L L+AEC Ab-Lb Lb and A-L L+AEC > 0.25 e. Minimum Profitability: If E-AEC < 0 in not more than one of the three previous years, the employer shall meet the following test: E-AEC TA Eb TAb and E-AEC TA > 0.03 If E-AEC < 0 in two of the three years, but not in the most recent year, the employer shall meeting the following test: E-AEC TA Ea TAa and E-AEC TA > 0.03 If E-AEC < 0 in two of the three years, including the most recent year the employer shall meet the following test: E-AEC TA Ec TAc and E-AEC TA > 0.03 If E-AEC < 0 for each of the three years, the employer does not meet the test for minimum profitability. f. Turnover Minimum: A-L-AEC S Ab-Lb Sb and A-L-AEC S > 0.05 I swear under the pains and penalties of perjury that the foregoing information and attachments are accurate and correct. __________________________________________ Applicant's Signature At ____________________________ in the County of ___________________________ and State of _____________________________________ this __________________day of ________________________, 20______ personally appeared ________________________________________________________________ and made oath to the truth of the foregoing statement. Before me, ___________________________________________ Notary Public American LegalNet, Inc. www.FormsWorkFlow.com Rule 26.0000 SELF-INSURANCE 26.1100 An employer desiring to self-insure under 21 V.S.A. §687(3) shall annually apply to the Commissioner for approval on a form provided by the Commissioner. The applicant shall submit, for each of the employer's three fiscal years immediately preceding the application: 26.1110 an audited balance sheet and income statement; 26.1120 an annual payroll report, categorized in accordance with the system used by the National Council on Compensation Insurance (NCCI) Occupational Classifications; and 26.1130 the workers' compensation insurance rate including the disease rate for each $100.00 of payroll category above as most recently determined by NCCI and as filed with and approved by the Commissioner of Financial Regulation. Copies of that filing may be obtained from NCCI, One Penn Plaza, New York, NY 10119. 26.1200 Using the information obtained in Rule 26.1100, the Commissioner shall annually determine whether or not the employer meets each of the following tests for each of the preceding three years: Cash Flow Minimum: F -------------CL - AEC and Ca - CL - AEC -------------------- > 0.05 S Minimum Liquidity: CA - I CAb - Ib -------- > ---------CA + AEC CLb and Minimum Net Worth to Debt: A-L Ab - Lb ---------- > -----------L + AEC Lb and > 0.25 Minimum Working Capital: CA - CL - AEC Cab - CLb ---------------------- > -----------------S Sb CA - I ------------- > 0.5 CL + AEC Minimum Profitability: AL -------- > 0.25 L + AEC American LegalNet, Inc. www.FormsWorkFlow.com If E - AEC 0 in not more than one of the three previous years, the employer shall meet the following test: E - AEC Eb ------- > -------TA TAb and E AEC ------------ > 0.03 TA If E - AEC 0 in two of the three years, but not in the most recent year, the employer shall meet the following test: E - AEC Ea ----------- > -------TA TAa and E - AEC ------------ > 0.03 TA If E - AEC 0 for each of the three years, the employer does not meet the test for minimum profitability. Turnover Minimum: A - L - AEC Ab - Lb ---------------- > ------------S Sa 26.1300 For the purposes of Rule 26.1200: 26.1310 AEC = Average Expected Claims = the sum of the products of the actual payroll as determined by category under Rule 26.1120, multiplied by the rate for each payroll category as determined in Rule 26.1130, divided by 100. 26.1311 F = cash flow = net income after taxes plus allowances for depreciation and depletion. 26.1320 E = earnings = net income before taxes and extraor