Last updated: 8/16/2006

Continuous Surety Bond {A-07}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

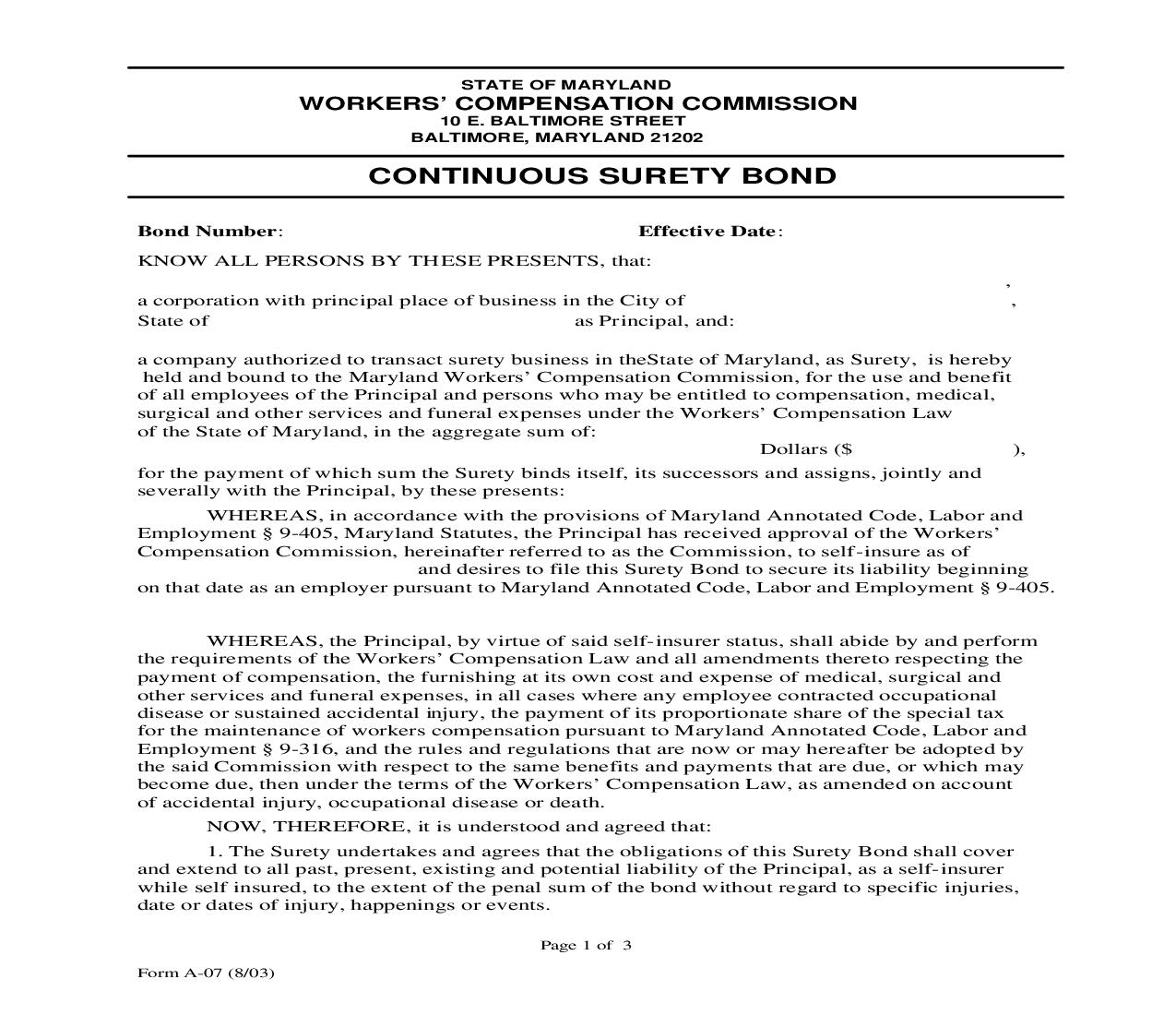

STATE OF MARYLAND WORKERS COMPENSATION COMMISSION 10 E. BALTIMORE STREET BALTIMORE, MARYLAND 21202 CONTINUOUS SURETY BOND Bond Number: Effective Date : KNOW ALL PERSONS BY TH ESE PRESENTS, that: ,a corporation with principal place of business in the City of , State of as Pr incipal, and: a company authorized to transact surety business in theState of Maryland , as Surety, is hereby held and bound to the Maryland Workers Compensation Commission, for the use and benefit of all employees of the Principal and persons who may be entitled to compensation, medical, surgical and other services and funeral expenses under the Workers Compensation Law of the State of Maryland, in the aggregate sum of: Dollars ($ ), for the payment of which sum the Surety binds itself, its successors and assigns, jointly and severally with the Principal, by these presents: WHEREAS, in accordance with the provisions of Maryland Annotated Code, L abor and Employment 9-405, Maryland Statutes, the Principal has received approval of the Workers Compensation Commission, hereinafter referred to as the Commission, to s elf-insure as of and desires to file this Surety Bond to secure its liability beginning on that date as an employer pursuant to Maryland Annotated Code, Labor a nd Employment 9-405. WHEREAS, the Principal, by virtue of said selfinsurer status, shall abide by and perform - the requirements of the Workers Compensation Law and all amendments thereto respecting the payment of compensation, the furnishing at its own cost and expense of m edical, surgical and other services and funeral expenses, in all cases where any employee con tracted occupational disease or sustained accidental injury, the payment of its proportionate share of the special tax for the maintenance of workers compensation pursuant to Maryland Annotat ed Code, Labor and Employment 9-316, and the rules and regulations that are now or may hereafter be adop ted by the said Commission with respect to the same benefits and payments that are du e, or which may become due, then under the terms of the Workers Compensation Law, as amended on account of accidental injury, occupational disease or death. NOW, THEREFORE, it is understood and agreed that: 1. The Surety undertakes and agrees that the obligations of this Surety Bond shall cover and extend to all past, present, existing and potential liability of the Principal, as a selfinsurer - while self insured, to the extent of the penal sum of the bond without regard to specific injuries, date or dates of injury, happenings or events. Page 1 of 3 Form A-07 (8/03) <<<<<<<<<********>>>>>>>>>>>>> 2 2. If the Principal defaults on any payments or obligations due under th e provisions of the Workers Compensation Law, as now or amended, the Surety will become liable to the Commission to the extent of the bond. The Principal is responsible for n otifying the Surety and the Commission of their expected default no later than 48 hours prior to default. Upon default, the Commission will make written demand, served personally or by certified mail, to the Surety for payments to begin on or before 10 days from the date of demand 3. The cost of administration of the bond shall be deducted from the bon d amount. The Commission shall approve such costs. 4. This Surety Bond may be cancelled as of 12:01 am on a specified date by the Surety by and in a written notice of cancellation given by certified mail to the C ommission at: Workers Compensation Commission, 10 E. Baltimore Street, Baltimore, Md. 21201, a nd to the Principal. Such cancellation shall not be effective, however, unless the specified date thereof occurs at least 60 days after the date of receipt by the Commission of such notice and n ot earlier. Such cancellation shall in no way limit the liability of the Surety for subsequent defaults of the Principals obligations incurred under the Workers Compensation L aw prior to such termination. Provided, however, the liability of the Surety hereunder s hall be fully discharged in the event the Principal files substitute security covering all past, present, existing and potent ial liability of said Principal. 5. If the Surety shall undertake or continue the handling of claims agai nst the Principal, the Surety shall use a third party administrator registered and approved by and with the Commission. 6. If the Surety bond is with a surety whose financial standing accordin g to AM Best falls below an A-, the Principal must replace the Surety with another company with an A- or above rating within 60 days of notification by the Commission. If the Surety assumes responsibility forthe payment of claims against the principal and its AM Best rating falls below A-, the Commission at its sole discretion may demand that the full amount of the bond, net of any payments against it, s hall be placed in a Maryland depository in the name of the Maryland Wo rkers Compensation Commission, for the use and benefit of all employees of the Principal an d persons who may be entitled to compensation, medical, surgical and other services and funer al expenses under the Workers Compensation Law of the State of Maryland. The surety may dr aw down such amounts approved by the Commission as necessary to pay the expenses cove red herein and any earnings on the amounts deposited and invested by the depository as provided for in LE 9-405(b)(1)(i). Upon request, the Commission will release all unspen t security back to the Surety after determination that all workers compensation liabilities of the principal while self-insured have been satisfied. 7. Within 60 days of assuming responsibility for the payment of claims, and every three (3) years thereafter, the Surety shall provide the Commission, at its own expense, an independently prepared actuarial report on the remaining liability of th e Principal for workers compensation while a self-insured employer. 8. In the event that the security bond is demanded and responsibility f or payment of claims is transferred to the Surety or other party approved by the Commi ssion, the Principal shall immediately release all workers compensation files and reports including indemnity and medical case records and files, related records on paid, incurred, case reserve and IBNR estimates and other reports required by the Commission or surety, during the period of self-insurance to the Surety or designated third party administrator. Page 2 of 3 Form A-07 (8/03) <<<<<<<<<********>>>>>>>>>>>>> 3