Last updated: 7/3/2018

2330. Implied Obligation of Good Faith and Fair Dealing Explained

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

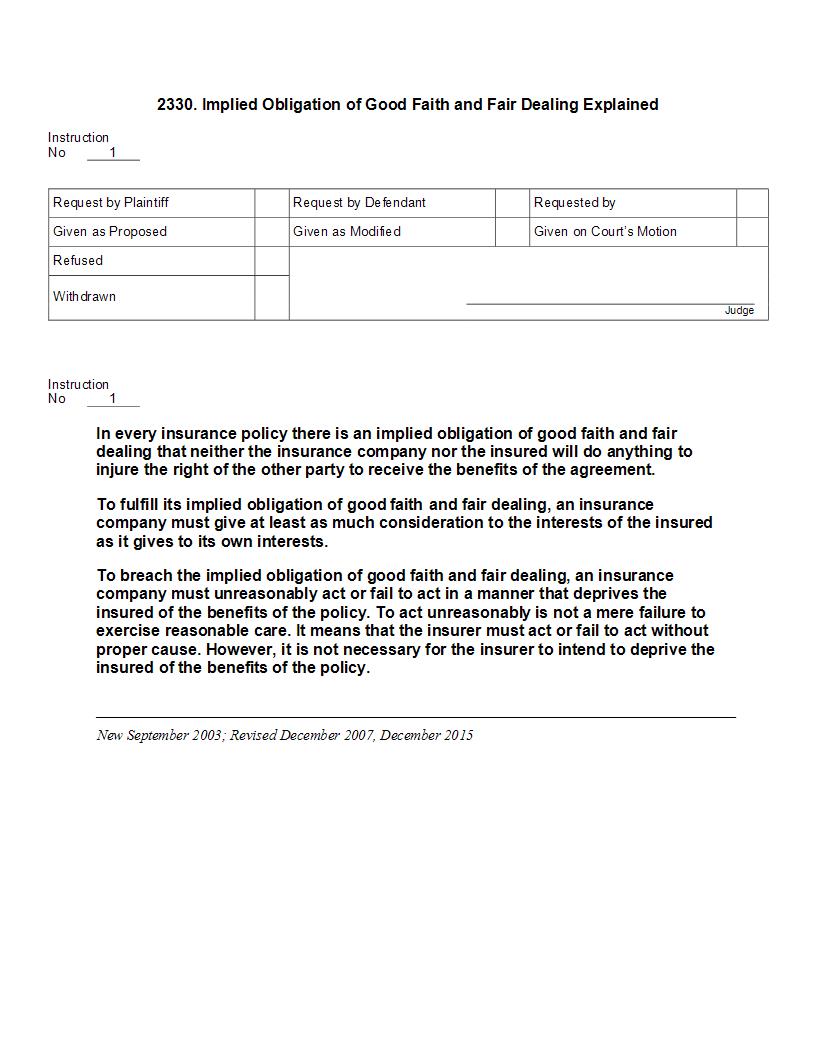

2330. Implied Obligation of Good Faith and Fair Dealing Explained Instruction No 1 Request by Plaintiff Request by Defendant Requested by Given as Proposed Given as Modified Given on Court?s Motion Refused Withdrawn Judge Instruction No 1 In every insurance policy there is an implied obligation of good faith and fair dealing that neither the insurance company nor the insured will do anything to injure the right of the other party to receive the benefits of the agreement. To fulfill its implied obligation of good faith and fair dealing, an insurance company must give at least as much consideration to the interests of the insured as it gives to its own interests. To breach the implied obligation of good faith and fair dealing, an insurance company must unreasonably act or fail to act in a manner that deprives the insured of the benefits of the policy. To act unreasonably is not a mere failure to exercise reasonable care. It means that the insurer must act or fail to act without proper cause. However, it is not necessary for the insurer to intend to deprive the insured of the benefits of the policy. New September 2003; Revised December 2007, December 2015

Related forms

-

2330. Implied Obligation of Good Faith and Fair Dealing Explained

2330. Implied Obligation of Good Faith and Fair Dealing Explained

California Jury Instructions/23 Insurance Litigation/ -

2335. Bad Faith Advice of Counsel

2335. Bad Faith Advice of Counsel

California Jury Instructions/23 Insurance Litigation/ -

2360. Judgment Creditors Action Against Insurer Essential Factual Elements

2360. Judgment Creditors Action Against Insurer Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2322. Affirmative Defense Insureds Voluntary Payment

2322. Affirmative Defense Insureds Voluntary Payment

California Jury Instructions/23 Insurance Litigation/ -

2351. Insurers Claim for Reimbursement of Costs of Defense of Uncovered Claims

2351. Insurers Claim for Reimbursement of Costs of Defense of Uncovered Claims

California Jury Instructions/23 Insurance Litigation/ -

2331. Breach of Implied Oblig of Gd Faith Fair Dealing Failure Delay in Pmt (1st Party) Ess Fact Els

2331. Breach of Implied Oblig of Gd Faith Fair Dealing Failure Delay in Pmt (1st Party) Ess Fact Els

California Jury Instructions/23 Insurance Litigation/ -

2308. Affirmative Defense Misrepresentation or Concealment in Insurance Application

2308. Affirmative Defense Misrepresentation or Concealment in Insurance Application

California Jury Instructions/23 Insurance Litigation/ -

2332. Bad Faith (First Party) Failure to Properly Investigate Claim Essential Factual Elements

2332. Bad Faith (First Party) Failure to Properly Investigate Claim Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2333. Bad Faith (First Party) Breach of Duty to Inform Insured of Rights Essential Factual Elements

2333. Bad Faith (First Party) Breach of Duty to Inform Insured of Rights Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2336. Bad Faith (Third Party) Unreasonable Failure to Defend Essential Factual Elements

2336. Bad Faith (Third Party) Unreasonable Failure to Defend Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2337. Factors to Consider in Evaluating Insurers Conduct

2337. Factors to Consider in Evaluating Insurers Conduct

California Jury Instructions/23 Insurance Litigation/ -

2350. Damages for Bad Faith

2350. Damages for Bad Faith

California Jury Instructions/23 Insurance Litigation/ -

2361. Negligent Failure to Obtain Insurance Coverage Essential Factual Elements

2361. Negligent Failure to Obtain Insurance Coverage Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2300. Breach of Contractual Duty to Pay a Covered Claim

2300. Breach of Contractual Duty to Pay a Covered Claim

California Jury Instructions/23 Insurance Litigation/ -

2301. Breach of Insurance Binder Essential Factual Elements

2301. Breach of Insurance Binder Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2302. Breach of Contract for Temporary Life Insurance Essential Factual Elements

2302. Breach of Contract for Temporary Life Insurance Essential Factual Elements

California Jury Instructions/23 Insurance Litigation/ -

2303. Affirmative Defense Insurance Policy Exclusion

2303. Affirmative Defense Insurance Policy Exclusion

California Jury Instructions/23 Insurance Litigation/ -

2304. Exception to Insurance Policy Exclusion Burden of Proof

2304. Exception to Insurance Policy Exclusion Burden of Proof

California Jury Instructions/23 Insurance Litigation/ -

2305. Lost or Destroyed Insurance Policy

2305. Lost or Destroyed Insurance Policy

California Jury Instructions/23 Insurance Litigation/ -

2306. Covered and Excluded Risks Predominant Cause of Loss

2306. Covered and Excluded Risks Predominant Cause of Loss

California Jury Instructions/23 Insurance Litigation/ -

2307. Insurance Agency Relationship Disputed

2307. Insurance Agency Relationship Disputed

California Jury Instructions/23 Insurance Litigation/ -

2309. Termination of Insurance Policy for Fraudulent Claim

2309. Termination of Insurance Policy for Fraudulent Claim

California Jury Instructions/23 Insurance Litigation/ -

2320. Affirmative Defense Failure to Provide Timely Notice

2320. Affirmative Defense Failure to Provide Timely Notice

California Jury Instructions/23 Insurance Litigation/ -

2321. Affirmative Defense Insureds Breach of Duty to Cooperate in Defense

2321. Affirmative Defense Insureds Breach of Duty to Cooperate in Defense

California Jury Instructions/23 Insurance Litigation/ -

2334. Bad Faith (3rd Party) Refusal Reasonable Settlement Demand Ess Fact Els

2334. Bad Faith (3rd Party) Refusal Reasonable Settlement Demand Ess Fact Els

California Jury Instructions/23 Insurance Litigation/ -

VF 2300. Breach of Contractual Duty to Pay a Covered Claim

VF 2300. Breach of Contractual Duty to Pay a Covered Claim

California Jury Instructions/23 Insurance Litigation/ -

VF 2301. Breach of Implied Obligation of Gd Faith Fair Dealing Failure or Delay in Payment

VF 2301. Breach of Implied Obligation of Gd Faith Fair Dealing Failure or Delay in Payment

California Jury Instructions/23 Insurance Litigation/ -

VF 2303. Bad Faith (First Party) Breach of Duty to Inform

VF 2303. Bad Faith (First Party) Breach of Duty to Inform

California Jury Instructions/23 Insurance Litigation/ -

VF 2304. Bad Faith (Third Party) Refusal Reasonable Settlement Demand

VF 2304. Bad Faith (Third Party) Refusal Reasonable Settlement Demand

California Jury Instructions/Insurance Litigation/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!