Last updated: 4/4/2024

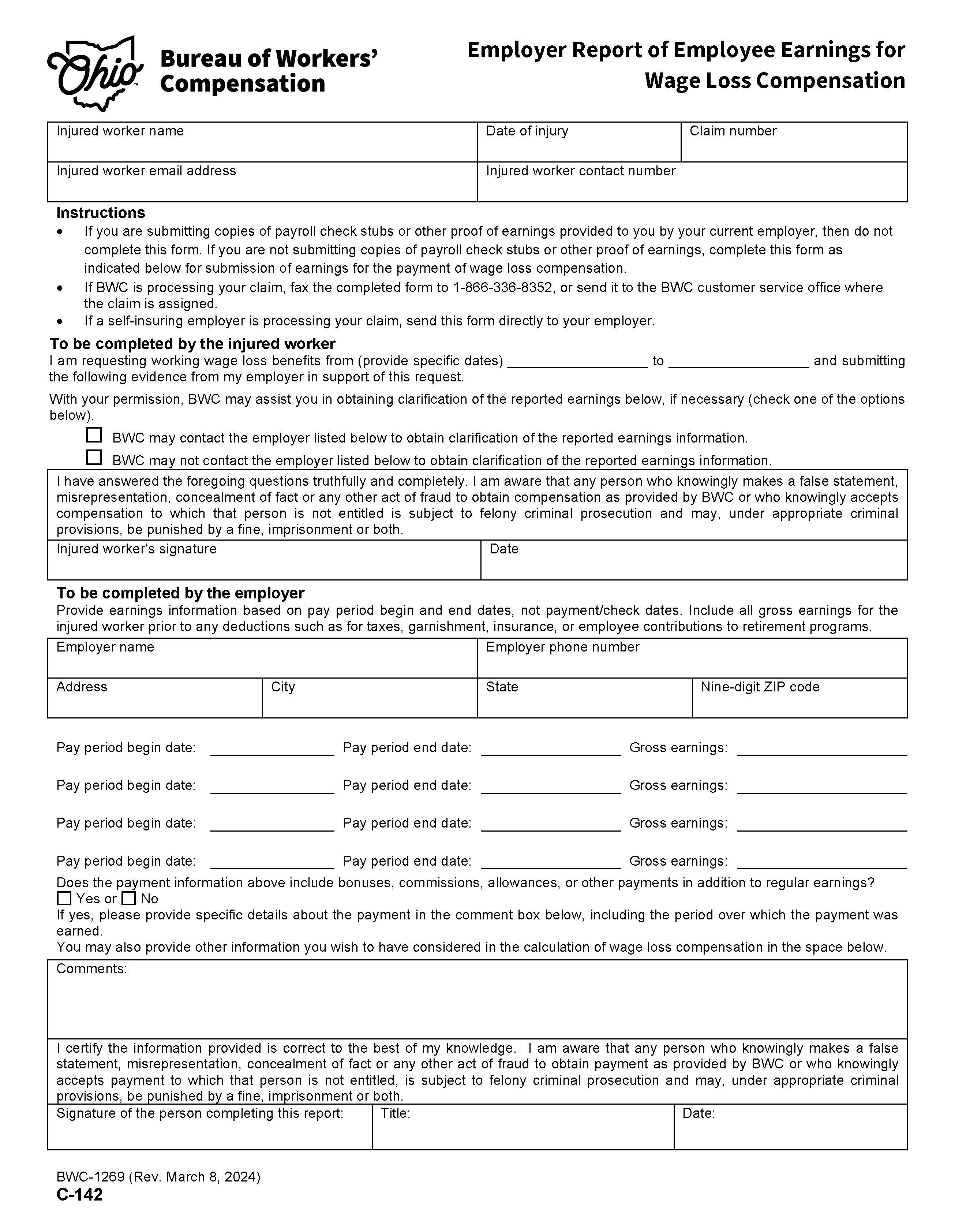

Employer Report Of Employee Earnings For Wage Loss Compensation {BWC-1269}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

BWC- 1269 -- EMPLOYER REPORT OF EMPLOYEE EARNINGS FOR WAGE LOSS COMPENSATION. This form is used for reporting employee earnings for the purpose of wage loss compensation in the context of workers' compensation. It includes sections to be completed by both the injured worker and the employer. The injured worker provides details such as dates of injury, requested wage loss benefits period, and consent for BWC to contact the employer for clarification on reported earnings. The employer provides information on gross earnings for the injured worker during specific pay periods, including any additional payments like bonuses or commissions. If you are submitting copies of payroll check stubs or other proof of earnings provided to you by your current employer, then do not complete this form. If you are not submitting copies of payroll check stubs or other proof of earnings, complete this form for submission of earnings for the payment of wage loss compensation. www.FormsWorkflow.com

Related forms

-

Objection To Tentative Order

Objection To Tentative Order

Ohio/Workers Comp/Employers/ -

Application To Add A Subsidiary To An Existing Self Insured Policy

Application To Add A Subsidiary To An Existing Self Insured Policy

Ohio/7 Workers Comp/Employers/ -

Employer Report Of Employee Earnings

Employer Report Of Employee Earnings

Ohio/Workers Comp/Employers/ -

Filing Of An Allegation Against A Self Insured Employer

Filing Of An Allegation Against A Self Insured Employer

Ohio/7 Workers Comp/Employers/ -

Self Insured Joint Settlement Agreement And Release

Self Insured Joint Settlement Agreement And Release

Ohio/Workers Comp/Employers/ -

Notification Of Policy Update

Notification Of Policy Update

Ohio/Workers Comp/Employers/ -

Pre-audit Questionnaire

Pre-audit Questionnaire

Ohio/Workers Comp/Employers/ -

Election To Withdraw From Claims Reimbursement Fund

Election To Withdraw From Claims Reimbursement Fund

Ohio/Workers Comp/Employers/ -

Notice To BWC Of Agreement To Send Check To Employer

Notice To BWC Of Agreement To Send Check To Employer

Ohio/Workers Comp/Employers/ -

Application For Transitional Work Grant Program

Application For Transitional Work Grant Program

Ohio/7 Workers Comp/Employers/ -

Transitional Work Grant Reimbursement Request Form

Transitional Work Grant Reimbursement Request Form

Ohio/7 Workers Comp/Employers/ -

Application For Disability Relief

Application For Disability Relief

Ohio/Workers Comp/Employers/ -

Waiver Of Appeal Period

Waiver Of Appeal Period

Ohio/Workers Comp/Employers/ -

Initial Application By Employer For Authority To Pay Compensation Directly

Initial Application By Employer For Authority To Pay Compensation Directly

Ohio/Workers Comp/Employers/ -

Request To Add Change Or Terminate Permanent Authorization

Request To Add Change Or Terminate Permanent Authorization

Ohio/Workers Comp/Employers/ -

Transitional Work Offer And Acceptance Form

Transitional Work Offer And Acceptance Form

Ohio/Workers Comp/Employers/ -

Claims Liability Agreement

Claims Liability Agreement

Ohio/Workers Comp/Employers/ -

Temporary Authorization To Review Information

Temporary Authorization To Review Information

Ohio/Workers Comp/Employers/ -

Self Insured Semiannual report Of Claim Payments

Self Insured Semiannual report Of Claim Payments

Ohio/Workers Comp/Employers/ -

Salary Continuation Agreement

Salary Continuation Agreement

Ohio/Workers Comp/Employers/ -

Sharps Injury Form Needlestick Report

Sharps Injury Form Needlestick Report

Ohio/Workers Comp/Employers/ -

Safety Management Self Assessment

Safety Management Self Assessment

Ohio/Workers Comp/Employers/ -

Application For Retrospective Rating Plan For Public Employers

Application For Retrospective Rating Plan For Public Employers

Ohio/Workers Comp/Employers/ -

Application For Retrospective Rating Plan For Private Employers

Application For Retrospective Rating Plan For Private Employers

Ohio/Workers Comp/Employers/ -

Notice Of Intent To Settle

Notice Of Intent To Settle

Ohio/7 Workers Comp/Employers/ -

Employer Trainers Report

Employer Trainers Report

Ohio/Workers Comp/Employers/ -

Employer Report Of Employee Earnings For Wage Loss Compensation

Employer Report Of Employee Earnings For Wage Loss Compensation

Ohio/Workers Comp/Employers/ -

Application For Deductible Program

Application For Deductible Program

Ohio/Workers Comp/Employers/ -

Acknowledgment Of The Self Insured Joint Settlement

Acknowledgment Of The Self Insured Joint Settlement

Ohio/Workers Comp/Employers/ -

Drug Free Safety Program Safety Action Plan

Drug Free Safety Program Safety Action Plan

Ohio/Workers Comp/Employers/ -

Accident Report

Accident Report

Ohio/Workers Comp/Employers/ -

Transitional Work Grant Program Corporate Analysis Questionnaire Work Sheet

Transitional Work Grant Program Corporate Analysis Questionnaire Work Sheet

Ohio/Workers Comp/Employers/ -

Waiver Of Examination Statewide Disability Evaluation System

Waiver Of Examination Statewide Disability Evaluation System

Ohio/Workers Comp/Employers/ -

Lump Sum Settlement (LSS)

Lump Sum Settlement (LSS)

Ohio/Workers Comp/Employers/ -

Complaint (Risk Reduction Program)

Complaint (Risk Reduction Program)

Ohio/7 Workers Comp/Employers/ -

Application For Certification Of Qualified Health Plan (QHP)

Application For Certification Of Qualified Health Plan (QHP)

Ohio/Workers Comp/Employers/ -

Request To Correct Employer And Or Policy Number Assignment

Request To Correct Employer And Or Policy Number Assignment

Ohio/Workers Comp/Employers/ -

Self-Insurers Agreement As To Compensation On Account Of Death

Self-Insurers Agreement As To Compensation On Account Of Death

Ohio/Workers Comp/Employers/ -

Opt Out Of .99 EM Construction Cap Program

Opt Out Of .99 EM Construction Cap Program

Ohio/Workers Comp/Employers/ -

Unconditional And Continuing Guarantee

Unconditional And Continuing Guarantee

Ohio/Workers Comp/Employers/ -

Self-Insured Employer Injured Worker Screening

Self-Insured Employer Injured Worker Screening

Ohio/Workers Comp/Employers/ -

Division Of Safety And Hygiene Annual Report

Division Of Safety And Hygiene Annual Report

Ohio/7 Workers Comp/Employers/ -

Sponsor Certification Application

Sponsor Certification Application

Ohio/Workers Comp/Employers/ -

Application For Adjudication Hearing

Application For Adjudication Hearing

Ohio/Workers Comp/Employers/ -

Settlement Application For Non-complying Employer Claims

Settlement Application For Non-complying Employer Claims

Ohio/Workers Comp/Employers/ -

Waiver Of Workers Compensation Benefits For Recreational Or Fitness Activities

Waiver Of Workers Compensation Benefits For Recreational Or Fitness Activities

Ohio/Workers Comp/Employers/ -

Contract For Coverage Of State Agency Of Political Subdivision

Contract For Coverage Of State Agency Of Political Subdivision

Ohio/Workers Comp/Employers/ -

Professional Employer Organization Client Relationship Notification

Professional Employer Organization Client Relationship Notification

Ohio/Workers Comp/Employers/ -

Self-Insured Construction Project Application

Self-Insured Construction Project Application

Ohio/Workers Comp/Employers/ -

Application For Transitional Work Bonus Program

Application For Transitional Work Bonus Program

Ohio/Workers Comp/Employers/ -

Request For Business Transfer Information

Request For Business Transfer Information

Ohio/Workers Comp/Employers/ -

Self-Insured Employers Certification Of Assignment After Initial Allowance

Self-Insured Employers Certification Of Assignment After Initial Allowance

Ohio/Workers Comp/Employers/ -

Amended True-Up Payroll Report

Amended True-Up Payroll Report

Ohio/Workers Comp/Employers/ -

Fall Protection In Construction Supplemental Questions

Fall Protection In Construction Supplemental Questions

Ohio/7 Workers Comp/Employers/ -

Labor Lease Transaction Claims

Labor Lease Transaction Claims

Ohio/Workers Comp/Employers/ -

Labor Lease Transaction Payroll

Labor Lease Transaction Payroll

Ohio/Workers Comp/Employers/ -

Request To Charge Surplus Fund For Vehicle Accident

Request To Charge Surplus Fund For Vehicle Accident

Ohio/Workers Comp/Employers/ -

Non Ohio Amended Payroll Report

Non Ohio Amended Payroll Report

Ohio/Workers Comp/Employers/ -

Other States Coverage Trucking Supplemental Application

Other States Coverage Trucking Supplemental Application

Ohio/Workers Comp/Employers/ -

BWC Subrogation Referral Form

BWC Subrogation Referral Form

Ohio/Workers Comp/Employers/ -

Application For Representative Identification Number (RIN)

Application For Representative Identification Number (RIN)

Ohio/Workers Comp/Employers/ -

Agreement To Select A State Other Then Ohio As The State Of Exclusive Remedy

Agreement To Select A State Other Then Ohio As The State Of Exclusive Remedy

Ohio/Workers Comp/Employers/ -

Agreement To Select The State Of Ohio As The State Of Exclusive Remedy

Agreement To Select The State Of Ohio As The State Of Exclusive Remedy

Ohio/Workers Comp/Employers/ -

Application For Or Request To Cancel Elective Coverage

Application For Or Request To Cancel Elective Coverage

Ohio/Workers Comp/Employers/ -

Application For Workers Compensation Coverage

Application For Workers Compensation Coverage

Ohio/Workers Comp/Employers/ -

Apprenticeship Elective Coverage Contract

Apprenticeship Elective Coverage Contract

Ohio/Workers Comp/Employers/ -

Certification Safety Agreement For Sponsors And Affiliate Sponsors

Certification Safety Agreement For Sponsors And Affiliate Sponsors

Ohio/7 Workers Comp/Employers/ -

Notice Of Election To Obtain Coverage From Other States

Notice Of Election To Obtain Coverage From Other States

Ohio/Workers Comp/Employers/ -

Lapse And Penalty Forgiveness

Lapse And Penalty Forgiveness

Ohio/Workers Comp/Employers/ -

True Up Forgiveness

True Up Forgiveness

Ohio/Workers Comp/Employers/ -

Application For Claim Impact Reduction Program

Application For Claim Impact Reduction Program

Ohio/Workers Comp/Employers/ -

Application For Exemption From Ohio Workers Coverage And Waiver Of Benefits

Application For Exemption From Ohio Workers Coverage And Waiver Of Benefits

Ohio/Workers Comp/Employers/ -

Notification Of Business Aquisition Or Merger Or Purchase Or Sale

Notification Of Business Aquisition Or Merger Or Purchase Or Sale

Ohio/Workers Comp/Employers/ -

State Fund Employers Agreement To Accept Claim Assignment

State Fund Employers Agreement To Accept Claim Assignment

Ohio/Workers Comp/Employers/ -

Transitional Work Grant Agreement

Transitional Work Grant Agreement

Ohio/Workers Comp/Employers/ -

Self-Insured Claims Reimbursement (Sysco) Application

Self-Insured Claims Reimbursement (Sysco) Application

Ohio/Workers Comp/Employers/ -

Application For Substance Use Prevention And Recovery Program

Application For Substance Use Prevention And Recovery Program

Ohio/Workers Comp/Employers/ -

Employer Authorized Representative

Employer Authorized Representative

Ohio/Workers Comp/Employers/ -

Settlement Agreement And Application For Approval Of Settlement Agreement

Settlement Agreement And Application For Approval Of Settlement Agreement

Ohio/Workers Comp/Employers/ -

MCO Selection Form

MCO Selection Form

Ohio/Workers Comp/Employers/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!