Last updated: 9/21/2023

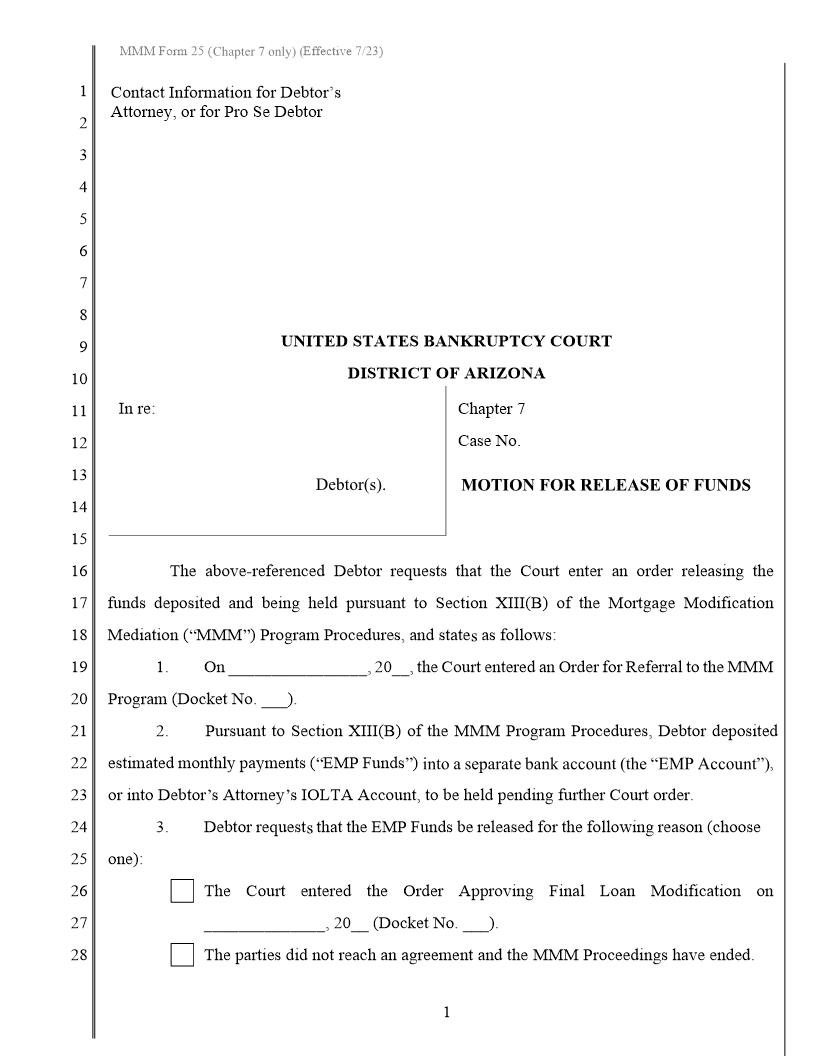

Motion For Release Of Funds {MMM Form 25}

Start Your Free Trial $ 20.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

[Attorney name, bar # Attorney address Attorney city, state zip Attorney phone number Attorney fax number Attorney email] UNITED STATES BANKRUPTCY COURT DISTRICT OF ARIZONA In re [Debtor name(s)], Case No. [case number] CHAPTER 13 PLAN AND APPLICATION FOR PAYM ENT OF ADM INISTRATIVE EXPENSES Debtor(s). SSN xxx-xx-_____ [Debtor address] SSN xxx-xx-_____ Q Q Q Q Original [state if First, Second] Amended [state if First, Second] Modified Plan payments include post-petition mortgage payments This Plan may affect creditor rights. If you object to the treatment of your claim as proposed in this Plan, you must file a written objection by the deadline set forth in a Notice of Date to File Objections to Plan served on parties in interest. If this is a joint case, then %22Debtor%22 means both Debtors. This plan does not allow claims or affect the timeliness of any claim. To receive payment on your claim, you must file a proof of claim with the Bankruptcy Court, even if this Plan provides for your debt. The applicable deadlines to file a proof of claim were specified in the Notice of Commencement of Case. Except as provided in § 1323(c), a creditor who disagrees with the proposed treatment of its debt in this Plan must timely file an objection to the Plan. If this is an Amended or Modified Plan, the reasons for filing this Amended or Modified Plan are: [state reasons]. (A) Plan Payments and Property to be Submitted to the Plan. (1) Plan payments start on ______________, 200___. The Debtor shall pay the Trustee as follows: $_______ each month for month _____ through month ______. $_______ each month for month _____ through month ______. $_______ each month for month _____ through month ______. The proposed plan duration is ____ months. The applicable commitment period is ____ months. Section 1325(b)(4). (2) In addition to the plan payments, Debtor will submit the following property to the Trustee: [Describe or state none] (B) Trustee's Percentage Fee. Pursuant to 28 U.S.C. § 586(e), the Trustee may collect the percentage fee from all payments and property received, not to exceed 10%. (C) Treatment of Administrative Expenses, Post-Petition Mortgage Payments and Claims. Except adequate protection payments under (C)(1), post-petition mortgage payments under (C)(4), or as otherwise ordered by the Court, the Trustee will make disbursements to creditors after the Court confirms this Plan. Unless otherwise provided in Section (J), disbursements by the Trustee shall be pro rata by class (except adequate protection payments) and made in the following order: (1) Adequate protection payments. Section 1326(a)(1)(C) requires adequate protection payments to be made to creditors secured by personal property. Pursuant to Local Bankruptcy Rule 2084-6, the Trustee is authorized to make preconfirmation adequate protection payments to the certain secured creditors without a Court order, provided the claim is properly listed on Schedule D, the creditor files a secured proof of claim that includes documentation evidencing a perfected security agreement, and the debtor or creditor sends a letter to the Trustee requesting payment of preconfirmation adequate protection payments. The Trustee will apply adequate protection payments to the creditor's secured claim. After confirmation, unless the Court orders otherwise, adequate protection payments will continue in the same amount until claims to be paid before these claimants are paid in full, unless the confirmed plan or a court order specifies a different amount. If a secured creditor disagrees with the amount of the proposed adequate protection payments or the plan fails to provide for such payments, the creditor may file an objection to confirmation of this plan, file a motion pursuant to §§ 362, 363, or do both. American LegalNet, Inc. www.FormsWorkFlow.com Creditor [Creditor name or state none] Property Description [Brief property description] Monthly Amount $[Amount] See Section (J), Varying Provisions. (2) Administrative expenses. Section 507(a)(2). (a) Attorney fees. Debtor's attorney received $_______ before filing. The balance of $_________ or an amount approved by the Court upon application shall be paid by the Trustee. See Section (F) for any fee application. (b) Other Administrative Expenses. [Describe] See Section (J), Varying Provisions. (3) Leases and Unexpired Executory Contracts. Pursuant to § 1322(b), the Debtor assumes or rejects the following lease or unexpired executory contract. For a lease or executory contract with an arrearage to cure, the arrearage will be cured in the plan payments with regular monthly payments to be paid direct by the Debtor. The arrearage amount to be adjusted to the amount in the creditor's allowed proof of claim. (a) Assumed: Creditor & Property Description [Creditor name or state none] [Brief property description] (b) Rejected: Creditor [Creditor name or state none] Property Description [Brief property description] Estimated Arrearage Amount $[Amount] Arrearage Through Date [Date] See Section (J), Varying Provisions. (4) Claims Secured Solely by Security Interest in Real Property. A creditor identified in this paragraph may mail the Debtor all correspondence, notices, statements, payment coupons, escrow notices, and default notices concerning any change to the monthly payment or interest rate without such being a violation of the automatic stay. Unless stated below, Debtor is to pay post-petition payments direct to the creditor and prepetition arrearages shall be cured through the Trustee. No interest will be paid on the prepetition arrearage or debt unless otherwise stated. The arrearage amount is to be adjusted to the amount in the creditor's allowed proof of claim. Except as provided in Local Bankruptcy Rule 2084-23, if a creditor gets unconditional stay relief the actual cure amount to be paid shall be adjusted by the Trustee pursuant to the creditor's allowed proof of claim. If the Debtor is surrendering an interest in real property, such provision is in paragraph (E). The Debtor is retaining real property and provides for each such debt as follows: Creditor/Servicing Agent & Property Description [Creditor name or state none] [Brief property description] Collateral Value & Valuation Method $[Value] [Valuation method] Post-Petition Mortgage Payments $[Amount] Q Q Debtor will pay direct to creditor; or Included in Plan payment. Trustee will pay creditor. Estimated Arrearage $[Amount] Arrearage Through Date [Date] See