Last updated: 4/13/2023

Small Estate Affidavit {RTOPR 31}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

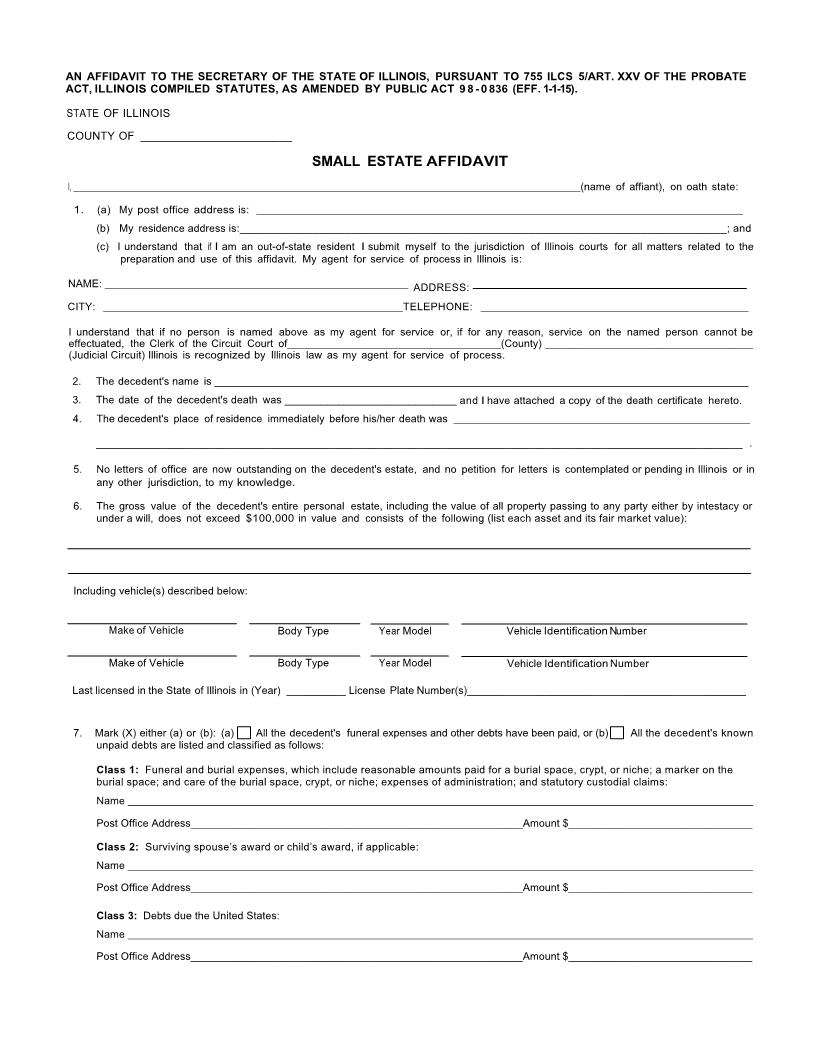

AN AFFIDAVIT TO JESSE WHITE, THE SECRETARY OF THE STATE OF ILLINOIS, PURSUANT TO 755 ILCS 5/ART. XXV OF THE PROBATE ACT, ILLINOIS COMPILED STATUTES, AS AMENDED BY PUBLIC ACT 9 8 - 0 836 (EFF. 1-1-15). STATE OF ILLINOIS COUNTY OF ________________________ SMALL ESTATE AFFIDAVIT I, 1. (a) My post office address is: (b) My residence address is:_______________________________________________________________________________; and (c) I understand that if I am an out-of-state resident I submit myself to the jurisdiction of Illinois courts for all matters related to the preparation and use of this affidavit. My agent for service of process in Illinois is: NAME: CITY: ADDRESS: TELEPHONE: (name of affiant), on oath state: I understand that if no person is named above as my agent for service or, if for any reason, service on the named person cannot be effectuated, the Clerk of the Circuit Court of (County) ___________________________________ (Judicial Circuit) Illinois is recognized by Illinois law as my agent for service of process. 2. 3. 4. The decedent's name is __________________________________________________________________________________________ The date of the decedent's death was _____________________________ and I have attached a copy of the death certificate hereto. The decedent's place of residence immediately before his/her death was __________________________________________________ . 5. No letters of office are now outstanding on the decedent's estate, and no petition for letters is contemplated or pending in Illinois or in any other jurisdiction, to my knowledge. The gross value of the decedent's entire personal estate, including the value of all property passing to any party either by intestacy or under a will, does not exceed $100,000 in value and consists of the following (list each asset and its fair market value): 6. Including vehicle(s) described below: Make of Vehicle Make of Vehicle Body Type Body Type Year Model Year Model Vehicle Identification Number Vehicle Identification Number Last licensed in the State of Illinois in (Year) __________ License Plate Number(s)_______________________________________________ 7. Mark (X) either (a) or (b): (a) All the decedent's funeral expenses and other debts have been paid, or (b) unpaid debts are listed and classified as follows: All the decedent's known Class 1: Funeral and burial expenses, which include reasonable amounts paid for a burial space, crypt, or niche; a marker on the burial space; and care of the burial space, crypt, or niche; expenses of administration; and statutory custodial claims: Name Post Office Address________________________________________________________Amount $_______________________________ Class 2: Surviving spouse's award or child's award, if applicable: Name Post Office Address________________________________________________________Amount $_______________________________ Class 3: Debts due the United States: Name Post Office Address________________________________________________________Amount $_______________________________ American LegalNet, Inc. www.FormsWorkFlow.com Class 4: Money due employees of the decedent of not more than $800 for each claimant for services rendered within four (4) months prior to the decedent's death and expenses attending the last illness: Name Post Office Address________________________________________________________Amount $_______________________________ Class 5: Money and property received or held in trust by the decedent that cannot be identified or traced: Name Post Office Address________________________________________________________Amount $_______________________________ Class 6: Debts due the State of Illinois and any county, township, city, town, village, or school district located within Illinois: Name Post Office Address________________________________________________________Amount $_______________________________ Class 7: All other claims: Name Post Office Address________________________________________________________Amount $_______________________________ 7.5 I understand that all valid claims against the decedent's estate described in paragraph 7 must be paid by me from the decedent's estate before any distribution is made to any heir or legatee. I further understand that the decedent's estate should pay all claims in the order set forth above, and if the decedent's estate is insufficient to pay the claims in any one class, the claims in that class shall be paid pro rata. 8. 9. There is no known unpaid claimant or contested claim against the decedent except as stated in paragraph 7. (a) The names and places of residence of any surviving spouse, minor children and adult dependent* children of the decedent are as follows: Name and Relationship Place of Residence Age of Minor Child *(Note: An adult dependent child is one who is unable to maintain himself and is likely to become a public charge.) (b) The award allowable to the surviving spouse of a decedent who was an Illinois resident is $ ($20,000, plus $10,000 multiplied by the number of minor children and adult dependent children who resided with the surviving spouse at the time of the decedent's death. If any such child did not reside with the surviving spouse at the time of the decedent's death, so indicate in 9(a)}. (c) If there is no surviving spouse, the award allowable to the minor children and adult dependent children of a decedent who was an Illinois resident is $ ($20,000, plus $10,000 multiplied by the number of minor children and adult dependent children), to be divided among them in equal shares. 10. Mark (X) either 10(a) or 10(b): (a) The decedent left no will. The names, places of residence and relationships of the decedent's heirs, and the portion of the estate to which each heir is entitled under the law where decedent died intestate are as follows: Name, Relationship and Place of Residence Age of Minor Portion of Estate (b) The decedent left a will, which has been filed with the clerk of an appropriate court. A certified copy of the will on file is attached. To the best of my knowledge and belief the will on file is the decedent's last will and was signed by the decedent and the attesting witnesses as required by law and would be admittable to probate. The names and places of residence of the legatees and the portion of the estate, if any, to which each legatee is entitled are as follows: Age of Minor Portion of Estate Name, Relationship and Place of Residence (c) Affiant is unaware