Last updated: 8/21/2023

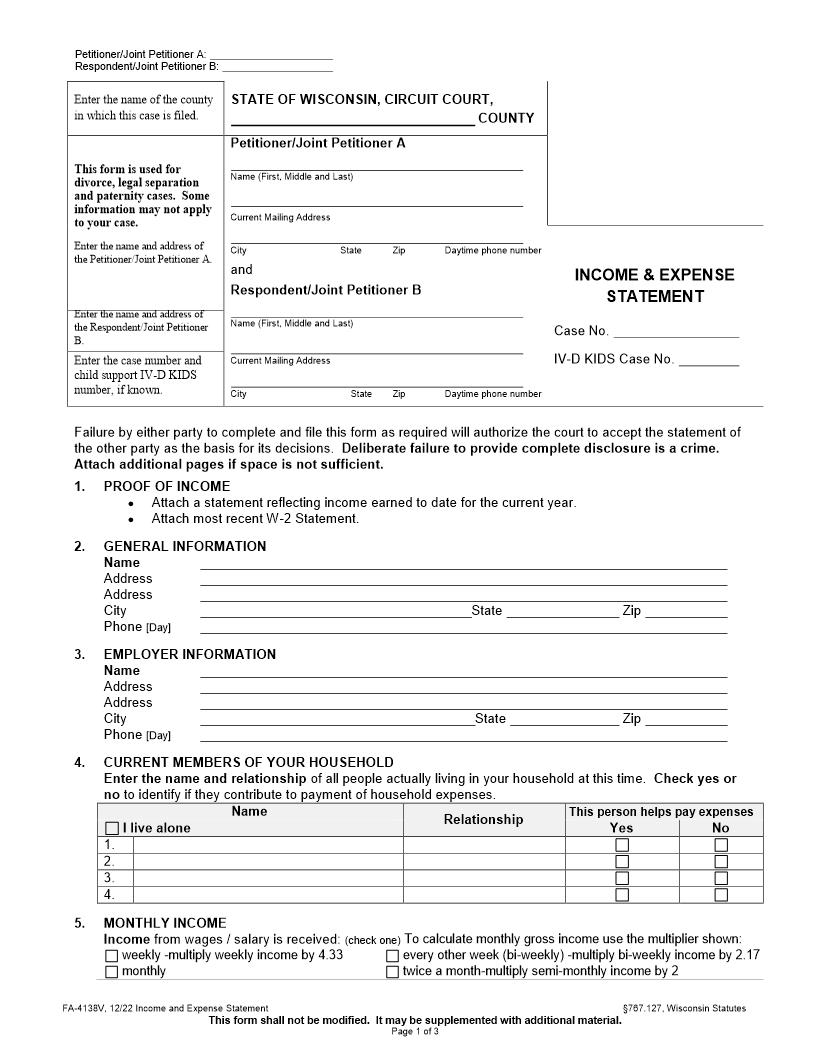

Income And Expense Statement {FA-4138V}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4138V, 05/18 Income and Expense Statement 247247767.127 and 946.32(1)(a), Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 1 of 3 Failure by either party to complete and file this form as required will authorize the court to accept the statement of the other party as the basis for its decisions. Deliberate failure to provide complete disclosure is a crime. Attach additional pages if space is not sufficient. 1. PROOF OF INCOME Attach a statement reflecting income earned to date for the current year. Attach most recent W-2 Statement. 2. GENERAL INFORMATION Name Address Address City State Zip Phone [Day] 3. EMPLOYER INFORMATION Name Address Address City State Zip Phone [Day] 4. CURRENT MEMBERS OF YOUR HOUSEHOLD Enter the name and relationship of all people actually living in your household at this time. Check yes or no to identify if they contribute to payment of household expenses. Name I live alone Relationship This person helps pay expenses Yes No 1. 2. 3. 4. Enter the name of the county in which this case is filed. STATE OF WISCONSIN, CIRCUIT COURT, COUNTY This form is used for divorce, legal separation and paternity cases. Some information may not apply to your case. Enter the name and address of the Petitioner/Joint Petitioner A. Petitioner/Joint Petitioner A Name (First, Middle and Last) Current Mailing Address City State Zip Daytime phone number and Respondent/Joint Petitioner B Name (First, Middle and Last) Current Mailing Address City State Zip Daytime phone number INCOME & EXPENSE STATEMENT Case No. IV - D KIDS Case No. Enter the name and address of the Respondent/Joint Petitioner B. Enter the case number and child support IV - D KIDS number, if known. American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4138V, 05/18 Income and Expense Statement 247247767.127 and 946.32(1)(a), Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 2 of 3 5. MONTHLY INCOME Income from wages / salary is received : (check one) To calculate monthly gross income use the multiplier shown: weekly - multiply weekly income by 4.3 3 every other week (bi - weekly) - m ultiply bi - weekly income by 2.17 monthly twice a month - multiply semi - monthly income by 2 MONTHLY GROSS INCOME 1. 1. Gross monthly income (before taxes and deductions) from salary and wages, including commissions, allowances and overtime. 2. Pensions , retirement funds and social security benefits received 3 . Disability, Unemployment Insurance and/or public assistance funds received 4 . Interest and Dividends received 5 . 7. Child Support and maintenance (spousal support) received 6 . Rental payments received (from property you rent to others) 7 . Bonuses received 8 . Other sources of income received: (please specify) 9 . 1 0 . Tot al Gross Income (add lines 1 - 9 ) MONTHLY DEDUCTIONS 11. Number of tax exemptions claimed 12. Monthly federal and state income tax , Social Security, and Medicare withholdings 13. Medical insurance 14. Other insurance (Life, disability, etc.) 15. Union or other dues 16. Retirement, pension and/or deferred compensation fund 17. Child sup port or spousal support payment deductions 18. Other deductions: (please specify) 19. 20. 21. Total Monthly Deductions (add lines 12 2 0 ) MONTHLY NET INCOM E (subtract line 21 from line 10 ) 6. CURRENT MONTHLY HOUSEHOLD EXPENSES Monthly Household Expenses 1. Rent/ mortgage payment /property taxes/home or rent insurance (primary residence) 2. Food 3. Utilities (electricity, heat, water, sewage, trash) 4. Telephone (loc al, long distance & cellular) 5. Cable/Satellite and Internet Services 6. Insurance (life, health, accident, auto, liability, disability, excluding insurance that is paid through payroll deductions) 7. Auto payments (loans/leases), auto expenses (gas, oil, repairs, maintenance), and transportation (other than automobile) 8 . Medical, dental and prescription drug expenses (not covered by insurance) 9 . Childcare (babysitting and day care) 10 . Child support or spousal support payments (Exclude payments made through payroll deductions) 11. Other expenses Other Monthly installment payments: 12 . Mortgage (other than primary mortgage) 13 . Other vehicle payments (RV, boat, ATV) 14 . Credit card debt (total minimum monthly payments) 15 . Court ordered obligations 16 . Student loans American LegalNet, Inc. www.FormsWorkFlow.com Petitioner/Joint Petitioner A: Respondent/Joint Petitioner B: FA-4138V, 05/18 Income and Expense Statement 247247767.127 and 946.32(1)(a), Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. Page 3 of 3 17 . Other p ersonal loans 18. TOTAL MONTHLY EXPENSES (Add lines 1 - 18 ) 7. I do do not have assets (vehicles, real estate, personal property, stocks, retirement accounts, etc.) with a total fair market value of $10,000 or more at this time. 8. DECLARATION: I declare under penalty of perjury that the above, including all attachments are complete, true and correct. Sign and print your name. Enter the date on which you signed your name. Note: This signature does not need to be notarized. Signature Print or Type Name Date American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Order To Establish Account And Authorize Transfers

Order To Establish Account And Authorize Transfers

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit To Seal Identifying Information In A Child Custody Proceeding

Affidavit To Seal Identifying Information In A Child Custody Proceeding

Wisconsin/Statewide/Circuit Court/Family Court/ -

Confidential Petition Addendum

Confidential Petition Addendum

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit Of Nonmilitary Service

Affidavit Of Nonmilitary Service

Wisconsin/Statewide/Circuit Court/Family Court/ -

Civil Process Worksheet

Civil Process Worksheet

Wisconsin/Statewide/Circuit Court/Family Court/ -

Temporary Order Without Minor Children

Temporary Order Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Dismissing Divorce-Legal Separation

Order Dismissing Divorce-Legal Separation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Revoke Suspension Of Proceedings To Effect Reconciliation

Order To Revoke Suspension Of Proceedings To Effect Reconciliation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Converting Legal Separation To Divorce

Order Converting Legal Separation To Divorce

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Vacating Judgment Of Divorce Or Legal Separation And Order To Impound The Record{FA-4164VB}

Order Vacating Judgment Of Divorce Or Legal Separation And Order To Impound The Record{FA-4164VB}

Wisconsin/Statewide/Circuit Court/Family Court/ -

Arrest Bench Warrant

Arrest Bench Warrant

Wisconsin/Statewide/Circuit Court/Family Court/ -

Disclosure Of Sealed Identifying Information In A Child Custody Proceeding

Disclosure Of Sealed Identifying Information In A Child Custody Proceeding

Wisconsin/Statewide/Circuit Court/Family Court/ -

Notice Of Limited Appearance

Notice Of Limited Appearance

Wisconsin/Statewide/Circuit Court/Family Court/ -

Notice Of Termination Of Limited Appearance

Notice Of Termination Of Limited Appearance

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Appear

Order To Appear

Wisconsin/Statewide/Circuit Court/Family Court/ -

Family Medical History-Questionnaire

Family Medical History-Questionnaire

Wisconsin/Statewide/Circuit Court/Family Court/ -

Motion Converting Legal Separation To Divorce

Motion Converting Legal Separation To Divorce

Wisconsin/Statewide/Circuit Court/Family Court/ -

Motion To Revoke Suspension Of Proceedings To Effect Reconciliation

Motion To Revoke Suspension Of Proceedings To Effect Reconciliation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Objection To Relocate

Objection To Relocate

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Parties Approval Of Findings Of Fact, Conclusions Of Law And Judgment With Minor Children

Parties Approval Of Findings Of Fact, Conclusions Of Law And Judgment With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Parties Approval Of Findings Of Fact, Conclusions Of Law And Judgment Without Minor Children{FA-4161VB}

Parties Approval Of Findings Of Fact, Conclusions Of Law And Judgment Without Minor Children{FA-4161VB}

Wisconsin/Statewide/Circuit Court/Family Court/ -

Peitition For Appointment Of Guardian Ad Litem

Peitition For Appointment Of Guardian Ad Litem

Wisconsin/Statewide/Circuit Court/Family Court/ -

Publication Summons

Publication Summons

Wisconsin/Statewide/Circuit Court/Family Court/ -

Request For Status Conference

Request For Status Conference

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation Dismissing Divorce-Legal Separation

Stipulation Dismissing Divorce-Legal Separation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation Suspending Proceedings To Effect Reconciliation

Stipulation Suspending Proceedings To Effect Reconciliation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Request for Court Ordered Mediation

Request for Court Ordered Mediation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation Vacating Judgment Of Divorce Or Legal Separation

Stipulation Vacating Judgment Of Divorce Or Legal Separation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Objection To Registration Of Out Of State Judgment Or Order

Objection To Registration Of Out Of State Judgment Or Order

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Decision On Motion Or OSC To Change Custody-Placement-Support Or Other

Decision On Motion Or OSC To Change Custody-Placement-Support Or Other

Wisconsin/Statewide/Circuit Court/Family Court/ -

Interim Financial Summary To Child Support Agency

Interim Financial Summary To Child Support Agency

Wisconsin/Statewide/Circuit Court/Family Court/ -

Notice Of Motion And Motion To Change

Notice Of Motion And Motion To Change

Wisconsin/Statewide/Circuit Court/Family Court/ -

Notice Of Motion And Motion To Relocate With Children

Notice Of Motion And Motion To Relocate With Children

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Abridgement Regarding Surname

Abridgement Regarding Surname

Wisconsin/Statewide/Circuit Court/Family Court/ -

Motion For And Notice Of New (De Novo) Hearing

Motion For And Notice Of New (De Novo) Hearing

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Relating To

Order Relating To

Wisconsin/Statewide/Circuit Court/Family Court/ -

Abridgement Affecting Title To Real Estate

Abridgement Affecting Title To Real Estate

Wisconsin/Statewide/Circuit Court/Family Court/ -

Summons With Minor Children

Summons With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Joint Petition Without Minor Children

Joint Petition Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order On Stipulation To Change

Order On Stipulation To Change

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Enforce Physical Placement Order

Order To Enforce Physical Placement Order

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation For Temporary Order With Minor Children

Stipulation For Temporary Order With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation For Temporary Order Without Minor Children

Stipulation For Temporary Order Without Minor Children

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Stipulation To Change

Stipulation To Change

Wisconsin/Statewide/Circuit Court/Family Court/ -

Summons Without Minor Children

Summons Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Temporary Order With Minor Children

Temporary Order With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Income And Expense Statement

Income And Expense Statement

Wisconsin/Statewide/Circuit Court/Family Court/ -

Petition Without Minor Children

Petition Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Proposed Parenting Plan

Proposed Parenting Plan

Wisconsin/Statewide/Circuit Court/Family Court/ -

Financial Disclosure Statement

Financial Disclosure Statement

Wisconsin/Statewide/Circuit Court/Family Court/ -

Findings Of Fact, Conclusions Of Law, And Judgment With Minor Children

Findings Of Fact, Conclusions Of Law, And Judgment With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Findings Of Fact, Conclusions Of Law, And Judgment Without Minor Children

Findings Of Fact, Conclusions Of Law, And Judgment Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Show Cause For Finding Of Contempt

Order To Show Cause For Finding Of Contempt

Wisconsin/Statewide/Circuit Court/Family Court/ -

Stipulation Converting Legal Separation To Divorce

Stipulation Converting Legal Separation To Divorce

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Suspending Proceedings To Effect Reconciliation

Order Suspending Proceedings To Effect Reconciliation

Wisconsin/Statewide/Circuit Court/Family Court/ -

Notice Of Registration Of Out Of State Judgment Or Order

Notice Of Registration Of Out Of State Judgment Or Order

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Notice Of Hearing And Motion To Enforce Physical Placement Order

Notice Of Hearing And Motion To Enforce Physical Placement Order

Wisconsin/Statewide/Circuit Court/Family Court/ -

Joint Petition With Minor Children

Joint Petition With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Response And Counterclaim

Response And Counterclaim

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order Converting Legal Separation To Divorce

Order Converting Legal Separation To Divorce

Wisconsin/Statewide/Circuit Court/Family Court/ -

Publication Affidavit Of Mailing

Publication Affidavit Of Mailing

Wisconsin/Statewide/Circuit Court/Family Court/ -

Petition With Minor Children

Petition With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Show Cause Without Minor Children{FA-4129VB}

Order To Show Cause Without Minor Children{FA-4129VB}

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Show Cause With Minor Children{FA-4128VB}

Order To Show Cause With Minor Children{FA-4128VB}

Wisconsin/Statewide/Circuit Court/Family Court/ -

Order To Show Cause And To Change

Order To Show Cause And To Change

Wisconsin/Statewide/Circuit Court/Family Court/ -

Motion And Affidavit In Support Of Warrant

Motion And Affidavit In Support Of Warrant

Wisconsin/Statewide/Circuit Court/Family Court/ -

Marital Settlement Agreement With Minor Children

Marital Settlement Agreement With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Marital Settlement Agreement (Without Minor Children)

Marital Settlement Agreement (Without Minor Children)

Wisconsin/Statewide/Circuit Court/Family Court/ -

Decision And Order for Contempt

Decision And Order for Contempt

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit To Show Cause And To Change

Affidavit To Show Cause And To Change

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit To Show Cause And Request For Hearing For Temporary Order Without Minor Children

Affidavit To Show Cause And Request For Hearing For Temporary Order Without Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit To Show Cause And Request For Hearing For Temporary Order With Minor Children

Affidavit To Show Cause And Request For Hearing For Temporary Order With Minor Children

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit Of Service

Affidavit Of Service

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit Of Mailing

Affidavit Of Mailing

Wisconsin/Statewide/Circuit Court/Family Court/ -

Affidavit Of Efforts To Serve Respondent

Affidavit Of Efforts To Serve Respondent

Wisconsin/1 Statewide/Circuit Court/Family Court/ -

Affidavit For Finding Of Contempt

Affidavit For Finding Of Contempt

Wisconsin/Statewide/Circuit Court/Family Court/ -

Admission Of Service

Admission Of Service

Wisconsin/Statewide/Circuit Court/Family Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!