Last updated: 2/8/2023

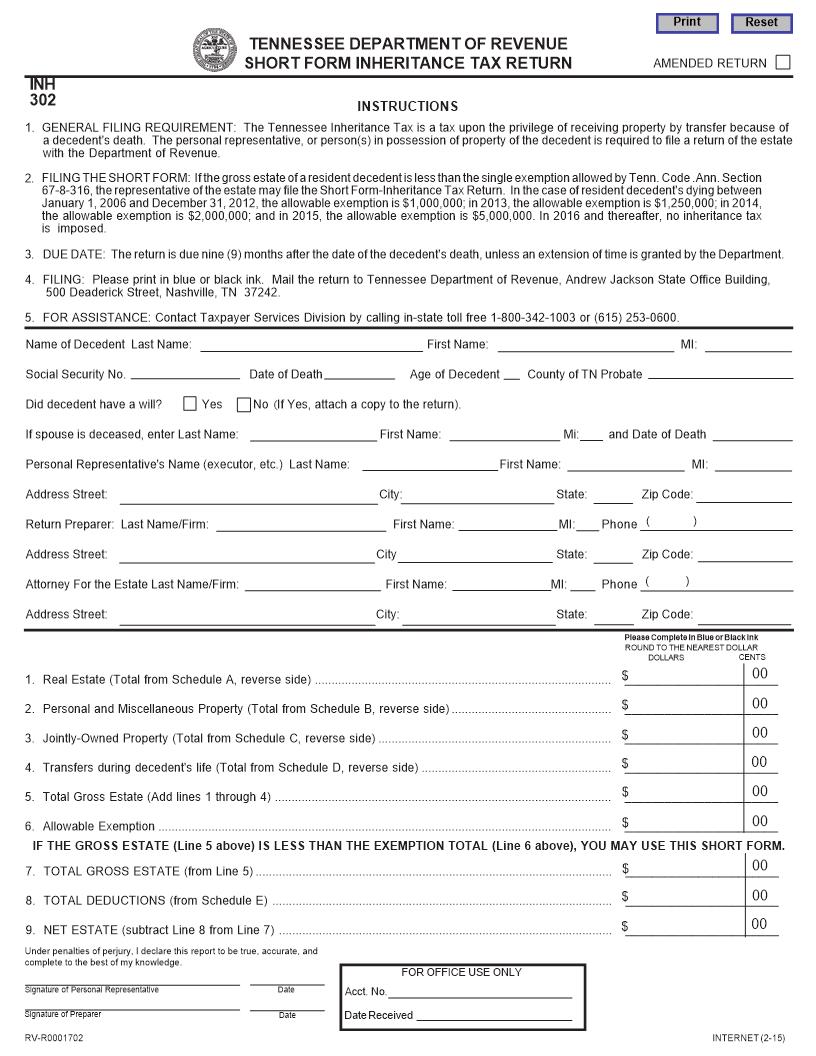

Inheriteance Tax Return {INH 302}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH 302 INSTRUCTIONS AMENDED RETURN 1. GENERAL FILING REQUIREMENT: The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of a decedent's death. The personal representative, or person(s) in possession of property of the decedent is required to file a return of the estate with the Department of Revenue. 2. FILING THE SHORT FORM: If the gross estate of a resident decedent is less than the single exemption allowed by T.C.A. Section 67-8-316, the representative of the estate may file the Short Form-Inheritance Tax Return. In the case of resident decedent's dying between January 1, 1990 and June 30, 1998 the allowable exemption is $600,000; from July 1, 1998 to December 31, 1998 the allowable exemption is $625,000; in 1999 the allowable exemption is $650,000; in 2000 and 2001 the allowable exemption is $675,000; in 2002 and 2003 the allowable exemption is $700,000; in 2004 the allowable exemption is $850,000; in 2005 the allowable exemption is $950,000; in 2006 and thereafter the allowable exemption is $1,000,000. 3. DUE DATE: The return is due nine (9) months after the date of the decedent's death, unless an extension of time is granted by the Department. 4. FILING: Mail the return to Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN 37242. 5. FOR ASSISTANCE: Contact Taxpayer and Vehicle Services Division by calling in-state toll free 1-800-342-1003 or (615) 253-0600. Name of Decedent (deceased person) Date of Death Did decedent have a will? Yes Age of Decedent County of Residence Social Security No. No (If Yes, attach a copy to the return). and Date of Death If spouse is deceased, enter Name Personal Representative's Name (executor, etc.) Address (street, city, state, zip code) Preparer of Return Address (street, city, state, zip code) Attorney Representing Estate Address (street, city, state, zip code) Phone ( ) Phone ( ) ROUND TO THE NEAREST DOLLAR CENTS DOLLARS 00 1. Real Estate (Total from Schedule A, reverse side) ......................................................................................... $ _______________________ 00 2. Personal and Miscellaneous Property (Total from Schedule B, reverse side) ................................................ $ _______________________ 00 3. Jointly-Owned Property (Total from Schedule C, reverse side) ...................................................................... $ _______________________ 00 4. Transfers during decedent's life (Total from Schedule D, reverse side) ......................................................... $ _______________________ 00 5. Total Gross Estate (Add lines 1 through 4) ..................................................................................................... $ _______________________ 00 6. Allowable Exemption ........................................................................................................................................ $ _______________________ IF THE GROSS ESTATE (Line 5 above) IS LESS THAN THE EXEMPTION TOTAL (Line 6 above), YOU MAY USE THIS SHORT FORM. 00 7. TOTAL GROSS ESTATE (from Line 5) ........................................................................................................... $ _______________________ 00 8. TOTAL DEDUCTIONS (from Schedule E) ...................................................................................................... $ _______________________ 00 9. NET ESTATE (subtract Line 8 from Line 7) .................................................................................................... $ _______________________ Under penalties of perjury, I declare this report to be true, accurate, and complete to the best of my knowledge. FOR OFFICE USE ONLY Signature of Personal Representative Signature of Preparer Date Date Acct. No. Date Received INTERNET (8-11) American LegalNet, Inc. www.FormsWorkFlow.com RV-R0001702 SCHEDULES Date of Valuation of assets (check one): Value of assets at date of death or Value of assets 6 months after date of death SCHEDULE A - REAL ESTATE Individually owned and located in Tennessee Description & Location Full Value SCHEDULE B - PERSONAL & MISC. PROPERTY Cash, Notes, Mortgages, Life Insurance, Stocks, Bonds, Annuities, Furnishings, Automobiles, Jewelry, etc. Owned Individually Description Full Value 10. TOTAL (enter on front, Line 1) $ 11. TOTAL (enter on front, Line 2) $ SCHEDULE C (PART 1) - JOINTLY OWNED PROPERTY List property interest held jointly by decedent and spouse Description Full Value 12. Total Property Value 13. One-half (½ ) of Line 12 $ SCHEDULE C (PART 2) - JOINTLY OWNED PROPERTY List property interests held jointly by decedent and persons other than spouse % owned by Decedent Name of Joint Owner Description Full Value Owned by Decedent 14. Total Property Value 15. Total of lines 13 & 14 (enter on front, Line 3) $ SCHEDULE D - TRANSFERS DURING DECEDENT'S LIFE Description of Transfer List all transfers made by decedent within 3 years prior to date of death To Whom (name) Date of Gift Full Value 16. Total Gifts 17. Gift Tax Paid (enter total of State Gift Tax paid on above gifts) 18. Total of lines 16 & 17 (enter on front, Line 4) $ SCHEDULE E - DEDUCTIONS Examples: funeral & burial expenses, administrative expenses (court costs, bonds, etc.) professional fees (attorney, accountant, etc.) taxes (property, individual, etc.), notes & mortgages due (decedent obligations but only ½ of joint obligations), debts of decedent (unpaid at date of death), bequests (public, charitable, religious, & educational), marital deductions (list all property passing to spouse), etc. Description Amount 19. TOTAL AMOUNT ALL DEDUCTIONS (enter on front, Line 8) $ American LegalNet, Inc. www.FormsWorkFlow.com INTERNET (8-11)