Last updated: 12/1/2021

Instructions For Preliminary Inventory On Side Two Of Affidavit For Collection Of Personal Property Of Decedent {E-203ins}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

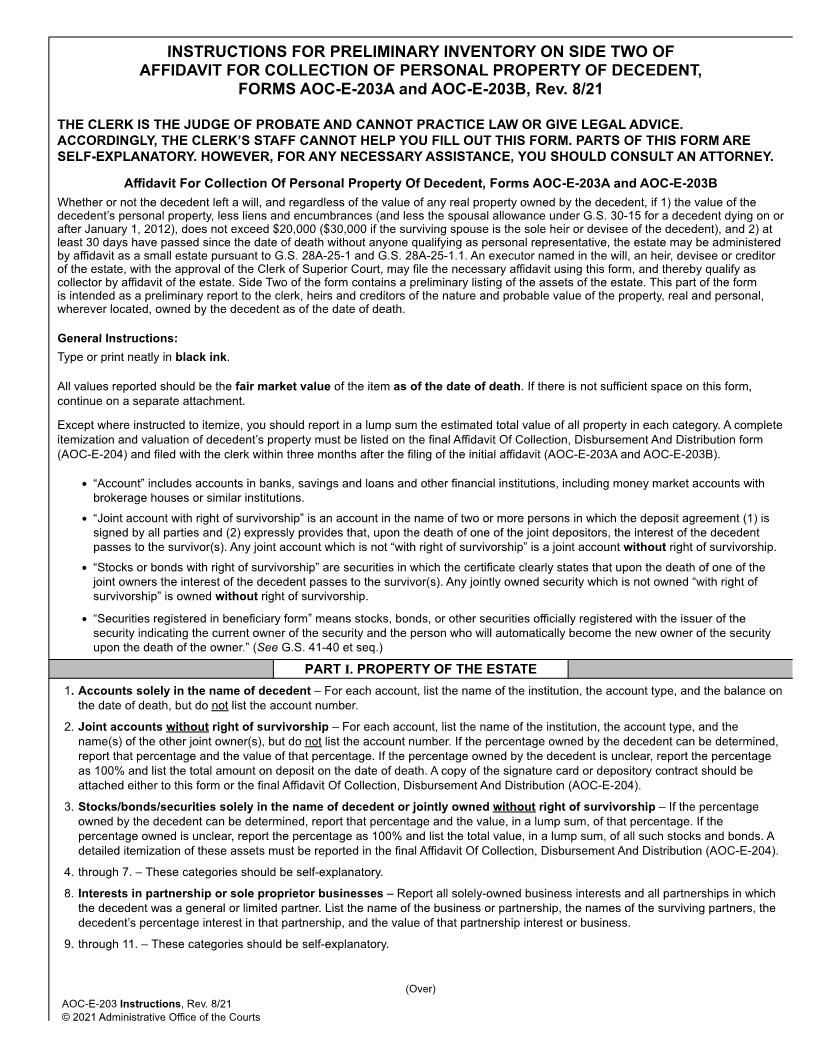

INSTRUCTIONS FOR PRELIMINARY INVENTORY ON SIDE TWO OF AFFIDAVIT FOR COLLECTION OF PERSONAL PROPERTY OF DECEDENT, FORMS AOC-E-203A and AOC-E-203B, Rev. 1/12 THE CLERK IS THE JUDGE OF PROBATE AND CANNOT PRACTICE LAW OR GIVE LEGAL ADVICE. ACCORDINGLY, THE CLERK'S STAFF CANNOT HELP YOU FILL OUT THIS FORM. PARTS OF THIS FORM ARE SELF-EXPLANATORY. HOWEVER, FOR ANY NECESSARY ASSISTANCE, YOU SHOULD CONSULT AN ATTORNEY. Affidavit For Collection Of Personal Property Of Decedent, Forms AOC-E-203A and AOC-E-203B, Rev. 1/12 Whether or not the decedent left a will, and regardless of the value of any real property owned by the decedent, if 1) the value of the decedent's personal property, less liens and encumbrances (and less the spousal allowance under G.S. 30-15 for a decedent dying on or after 1/1/12), does not exceed $20,000 ($30,000 if the surviving spouse is the sole heir or devisee of the decedent), and 2) at least 30 days have passed since the date of death without anyone qualifying as personal representative, the estate may be administered by affidavit as a small estate pursuant to G.S. 28A-25-1 and G.S. 28A-25-1.1. An executor named in the will, an heir, devisee or creditor of the estate, with the approval of the Clerk of Superior Court, may file the necessary affidavit using this form, and thereby qualify as collector by affidavit of the estate. Side Two of the form contains a preliminary listing of the assets of the estate. This part of the form is intended as a preliminary report to the clerk, heirs and creditors of the nature and probable value of the property, real and personal, wherever located, owned by the decedent as of the date of death. General Instructions: Type or print neatly in black ink. All values reported should be the fair market value of the item as of the date of death. If there is not sufficient space on this form, continue on a separate attachment. Except where instructed to itemize, you should report in a lump sum the estimated total value of all property in each category. A complete itemization and valuation of decedent's property must be listed on the final Affidavit Of Collection, Disbursement and Distribution form (AOC-E-204) and filed with the clerk within three months after the filing of the initial affidavit (AOC-E-203A and AOC-E-203B). "Account" includes accounts in banks, savings and loans and other financial institutions, including money market accounts with brokerage houses or similar institutions. "Joint Account With Right Of Survivorship" is an account in the name of two or more persons in which the deposit agreement (1) is signed by all parties and (2) expressly provides that, upon the death of one of the joint depositors, the interest of the decedent passes to the survivor(s). Any joint account which is not "with right of survivorship" is a joint account without right of survivorship. "Stocks Or Bonds With Right Of Survivorship" are securities in which the certificate clearly states that upon the death of one of the joint owners the interest of the decedent passes to the survivor(s). Any jointly owned security which is not owned "with right of survivorship," is owned without right of survivorship. "Securities Registered In Beneficiary Form" means stocks, bonds, or other securities officially registered with the issuer of the security indicating the current owner of the security and the person who will automatically become the new owner of the security upon the death of the owner." (See G.S. 41-40 et. seq.) PART I. PROPERTY OF THE ESTATE 1. Deposits In Sole Name Of Decedent - For each account, list the name of the institution, the account number and the balance on the date of death. 2. Joint Accounts Without Right Of Survivorship - For each account, list the name of the institution, the account number, and the name(s) of the other joint owner(s). If the percentage owned by the decedent can be determined, report that percentage and the value of that percentage. If the percentage owned by the decedent is unclear, report the percentage as 100%, and list the total amount on deposit on the date of death. A copy of the signature card or depository contract should be attached either to this form or the final Affidavit Of Collection, Disbursement And Distribution (AOC-E-204). 3. Stocks And Bonds In Sole Name Of Decedent Or Jointly Owned Without Right Of Survivorship - If the percentage owned by the decedent can be determined, report that percentage and the value, in a lump sum, of that percentage. If the percentage owned is unclear, report the percentage as 100%, and list the total value, in a lump sum, of all such stocks and bonds. A detailed itemization of these assets must be reported in the final Affidavit Of Collection, Disbursement And Distribution (AOC-E-204). 4. through 7. These categories should be self-explanatory. 8. Interest in Partnership Or Sole Proprietor Businesses - Report all solely owned business interest and all partnerships in which the decedent was a general or limited partner. List the name of the business or partnership, the names of the surviving partners, the decedent's percentage interest in that partnership, and the value of that partnership interest or business. 9. through 11. These categories should be self-explanatory. AOC-E-203 Instructions, Rev. 1/12 © 2012 Administrative Office of the Courts (Over) American LegalNet, Inc. www.FormsWorkFlow.com 12. Real Estate Willed To The Estate - (NOTE: (a) Real property willed to any person or entity other than the estate must be reported in Part II, Item 5. (b) If any real estate has been willed to the estate, a personal representative must be appointed.) Indicate only real estate which the decedent devised (willed) to his or her estate or to his or her executor in the capacity as executor (not as an individual). Usually, such a devise is accompanied by a direction to sell the real estate and distribute the proceeds as specified in the will. A listing of all such properties, together with an identification or legal description of each parcel or tract should be reported here, using fair market value as of the date of death. 13. Estimated Annual Income Of The Estate - Income of the estate includes, for example, interest on checking and other accounts opened in the name of the estate, dividends and interest on stocks and bonds owned in the name of the estate, and other income to the estate. Income of the estate does not include interest on accounts, or dividends or interest on stocks

Related forms

-

Affidavit Of Notice To Creditors

Affidavit Of Notice To Creditors

North Carolina/Statewide/Estate/ -

Affidavit Of Subscribing Witnesses For Probate OF Will Codicil To Will

Affidavit Of Subscribing Witnesses For Probate OF Will Codicil To Will

North Carolina/Statewide/Estate/ -

Affidavits For Probate Of Will Witnesses Not Available

Affidavits For Probate Of Will Witnesses Not Available

North Carolina/Statewide/Estate/ -

Authorization For Payment Of Money Owed Decedent

Authorization For Payment Of Money Owed Decedent

North Carolina/Statewide/Estate/ -

Authorization To Release Funds

Authorization To Release Funds

North Carolina/Statewide/Estate/ -

Bond

Bond

North Carolina/Statewide/Estate/ -

Certificate Of Probate

Certificate Of Probate

North Carolina/Statewide/Estate/ -

Civil Contempt Order Failure To File Inventory Account

Civil Contempt Order Failure To File Inventory Account

North Carolina/Statewide/Estate/ -

Estate Tax Certification For Decedents Dying On Or After 1 1 99

Estate Tax Certification For Decedents Dying On Or After 1 1 99

North Carolina/Statewide/Estate/ -

Inheritance And Estate Tax Certification

Inheritance And Estate Tax Certification

North Carolina/Statewide/Estate/ -

Letters

Letters

North Carolina/Statewide/Estate/ -

Letters Of Appointment Guardian Of The Estate

Letters Of Appointment Guardian Of The Estate

North Carolina/Statewide/Estate/ -

Letters Of Appointment Guardian Of The Person

Letters Of Appointment Guardian Of The Person

North Carolina/Statewide/Estate/ -

Notice

Notice

North Carolina/Statewide/Estate/ -

Notice To Beneficiary

Notice To Beneficiary

North Carolina/Statewide/Estate/ -

Notice To File Inventory Annual Account Final Account

Notice To File Inventory Annual Account Final Account

North Carolina/Statewide/Estate/ -

Order Authorizing Issuance Of Letters

Order Authorizing Issuance Of Letters

North Carolina/Statewide/Estate/ -

Order Of Summary Administration

Order Of Summary Administration

North Carolina/Statewide/Estate/ -

Order On Petition For Appointment Of Standby Guardian For Minor

Order On Petition For Appointment Of Standby Guardian For Minor

North Carolina/Statewide/Estate/ -

Order On Standby Guardians Petition For Appointment As Guardian Of Minor

Order On Standby Guardians Petition For Appointment As Guardian Of Minor

North Carolina/Statewide/Estate/ -

Order To Appear And Show Cause For Failure To File Inventory Account

Order To Appear And Show Cause For Failure To File Inventory Account

North Carolina/Statewide/Estate/ -

Order To File Inventory Or Account

Order To File Inventory Or Account

North Carolina/Statewide/Estate/ -

Order To Transfer Estate To Closed Files For Statistical Purposes

Order To Transfer Estate To Closed Files For Statistical Purposes

North Carolina/Statewide/Estate/ -

Receipt

Receipt

North Carolina/Statewide/Estate/ -

Renunciation Of Right To Qualify For Letters Testamentary Or Letters Of Administration

Renunciation Of Right To Qualify For Letters Testamentary Or Letters Of Administration

North Carolina/Statewide/Estate/ -

Oath Affirmation

Oath Affirmation

North Carolina/Statewide/Estate/ -

Affidavit And Collection Disbursement And Distribution

Affidavit And Collection Disbursement And Distribution

North Carolina/Statewide/Estate/ -

Inventory Of Contents Of Lock Box

Inventory Of Contents Of Lock Box

North Carolina/Statewide/Estate/ -

Receipt And Agreement

Receipt And Agreement

North Carolina/Statewide/Estate/ -

Account Continuation Page Receipts

Account Continuation Page Receipts

North Carolina/1 Statewide/Estate/ -

Account Continuation Page Disbursements

Account Continuation Page Disbursements

North Carolina/1 Statewide/Estate/ -

Account Continuance Page Distributions

Account Continuance Page Distributions

North Carolina/1 Statewide/Estate/ -

Renunciation And Waiver Of Spousal Years Allowance

Renunciation And Waiver Of Spousal Years Allowance

North Carolina/1 Statewide/Estate/ -

Certificate Of Validity (Living Probate Only)

Certificate Of Validity (Living Probate Only)

North Carolina/1 Statewide/Estate/ -

Affidavit Of Notice To Creditors By Limited Personal Representative

Affidavit Of Notice To Creditors By Limited Personal Representative

North Carolina/1 Statewide/Estate/ -

Addendum To Application For Probate Of Out Of State Will Or Codicil

Addendum To Application For Probate Of Out Of State Will Or Codicil

North Carolina/1 Statewide/Estate/ -

Provisional Order On Petition To Transfer Incompetency Proceeding And Guardianship To Another State

Provisional Order On Petition To Transfer Incompetency Proceeding And Guardianship To Another State

North Carolina/1 Statewide/Estate/ -

Final Order On Petition To Transfer Incompetency Proceeding And Guardianship To Another State

Final Order On Petition To Transfer Incompetency Proceeding And Guardianship To Another State

North Carolina/1 Statewide/Estate/ -

Provisional Order On Petition To Accept Guardianship On Transfer From Another State

Provisional Order On Petition To Accept Guardianship On Transfer From Another State

North Carolina/1 Statewide/Estate/ -

Final Order On Petition To Accept Guardianship On Transfer From Another State

Final Order On Petition To Accept Guardianship On Transfer From Another State

North Carolina/1 Statewide/Estate/ -

Statements In Support Of Registration Of Guardianship From Another State

Statements In Support Of Registration Of Guardianship From Another State

North Carolina/1 Statewide/Estate/ -

Order On Application For Appointment Of Guardian

Order On Application For Appointment Of Guardian

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment Standby General Guardian

Letters Of Appointment Standby General Guardian

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment Standby Guardian Of The Person

Letters Of Appointment Standby Guardian Of The Person

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment General Guardian

Letters Of Appointment General Guardian

North Carolina/1 Statewide/Estate/ -

Order On Motion To Modify Guardianship

Order On Motion To Modify Guardianship

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment Limited Guardian Of The Estate

Letters Of Appointment Limited Guardian Of The Estate

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment Limited Guardian Of The Person

Letters Of Appointment Limited Guardian Of The Person

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment Limited General Guardian

Letters Of Appointment Limited General Guardian

North Carolina/1 Statewide/Estate/ -

Letters Of Appointment As Limited Personal Representative

Letters Of Appointment As Limited Personal Representative

North Carolina/1 Statewide/Estate/ -

Administration By Clerk Records Of Receipts

Administration By Clerk Records Of Receipts

North Carolina/1 Statewide/Estate/ -

Application Or Motion And Order For Modification Of Bond

Application Or Motion And Order For Modification Of Bond

North Carolina/1 Statewide/Estate/ -

Notice To Surety Of Settlement

Notice To Surety Of Settlement

North Carolina/1 Statewide/Estate/ -

Motion To Extend Time To File

Motion To Extend Time To File

North Carolina/1 Statewide/Estate/ -

Order To Extend Time To File

Order To Extend Time To File

North Carolina/1 Statewide/Estate/ -

Faithful Performance Bond

Faithful Performance Bond

North Carolina/1 Statewide/Estate/ -

Account

Account

North Carolina/Statewide/Estate/ -

Affidavit For Removal Of Personal Property Of Deceased Residential Tenant

Affidavit For Removal Of Personal Property Of Deceased Residential Tenant

North Carolina/1 Statewide/Estate/ -

Affidavits For Probate Of Holographic Will

Affidavits For Probate Of Holographic Will

North Carolina/Statewide/Estate/ -

Appointment Of Resident Process Agent

Appointment Of Resident Process Agent

North Carolina/Statewide/Estate/ -

Certificate Of Service (Motion In The Cause To Modify Guardianship)

Certificate Of Service (Motion In The Cause To Modify Guardianship)

North Carolina/1 Statewide/Estate/ -

Instruction For Preliminary Inventory On Side Two Of Application For Probate And Letters

Instruction For Preliminary Inventory On Side Two Of Application For Probate And Letters

North Carolina/Statewide/Estate/ -

Instructions For Preliminary Inventory Inventory On Side Two Of Application For Letters Of Administration

Instructions For Preliminary Inventory Inventory On Side Two Of Application For Letters Of Administration

North Carolina/Statewide/Estate/ -

Instructions For Preliminary Inventory On Side Two Of Affidavit For Collection Of Personal Property Of Decedent

Instructions For Preliminary Inventory On Side Two Of Affidavit For Collection Of Personal Property Of Decedent

North Carolina/Statewide/Estate/ -

Inventory For Decedents Estate

Inventory For Decedents Estate

North Carolina/Statewide/Estate/ -

Inventory For Guardianship Estate

Inventory For Guardianship Estate

North Carolina/Statewide/Estate/ -

Inventory For Trust Under Will

Inventory For Trust Under Will

North Carolina/Statewide/Estate/ -

Notice Of Hearing Appointment Of Guardian Other

Notice Of Hearing Appointment Of Guardian Other

North Carolina/Statewide/Estate/ -

Petition And Order To Reopen Estate

Petition And Order To Reopen Estate

North Carolina/Statewide/Estate/ -

Waiver Of Personal Representatives Bond

Waiver Of Personal Representatives Bond

North Carolina/Statewide/Estate/ -

Election Of Fiscal Year

Election Of Fiscal Year

North Carolina/1 Statewide/Estate/ -

Estate Summons For Trust Proceeding

Estate Summons For Trust Proceeding

North Carolina/1 Statewide/Estate/ -

Estates Proceedings Summons

Estates Proceedings Summons

North Carolina/1 Statewide/Estate/ -

Deficiency Judgment

Deficiency Judgment

North Carolina/Statewide/Estate/ -

Affidavit For Collection Of Personal Property Of Decedent (After 1-1-12)

Affidavit For Collection Of Personal Property Of Decedent (After 1-1-12)

North Carolina/Statewide/Estate/ -

Affidavit For Collection Of Personal Property Of Decedent (Before 12-31-11)

Affidavit For Collection Of Personal Property Of Decedent (Before 12-31-11)

North Carolina/Statewide/Estate/ -

Application For Administration By Clerk

Application For Administration By Clerk

North Carolina/Statewide/Estate/ -

Application For Appointment Of Guardian For A Minor

Application For Appointment Of Guardian For A Minor

North Carolina/Statewide/Estate/ -

Application For Letters Of Administration

Application For Letters Of Administration

North Carolina/Statewide/Estate/ -

Application For Letters Of Guardianship For An Incompetent Person

Application For Letters Of Guardianship For An Incompetent Person

North Carolina/1 Statewide/Estate/ -

Application For Letters Of Trusteeship Under Will

Application For Letters Of Trusteeship Under Will

North Carolina/Statewide/Estate/ -

Application For Probate (Without Representative)

Application For Probate (Without Representative)

North Carolina/1 Statewide/Estate/ -

Application For Probate And Letters

Application For Probate And Letters

North Carolina/Statewide/Estate/ -

Application For Probate And Petition For Summary Administration

Application For Probate And Petition For Summary Administration

North Carolina/Statewide/Estate/ -

Estates Action Cover Sheet

Estates Action Cover Sheet

North Carolina/Statewide/Estate/ -

Petition And Assignment Years Allowance

Petition And Assignment Years Allowance

North Carolina/Statewide/Estate/ -

Petition For Appointment Of Standby Guardian For Minor

Petition For Appointment Of Standby Guardian For Minor

North Carolina/1 Statewide/Estate/ -

Petition To Accept Guardianship On Transfer From Another State

Petition To Accept Guardianship On Transfer From Another State

North Carolina/1 Statewide/Estate/ -

Petition To Transfer Incompetency Proceeding And Guardianship To Another State

Petition To Transfer Incompetency Proceeding And Guardianship To Another State

North Carolina/1 Statewide/Estate/ -

Standby Guardians Petition For Appointment As Guardian

Standby Guardians Petition For Appointment As Guardian

North Carolina/1 Statewide/Estate/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!