Last updated: 6/11/2021

Income Withholding For Support {171-60}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

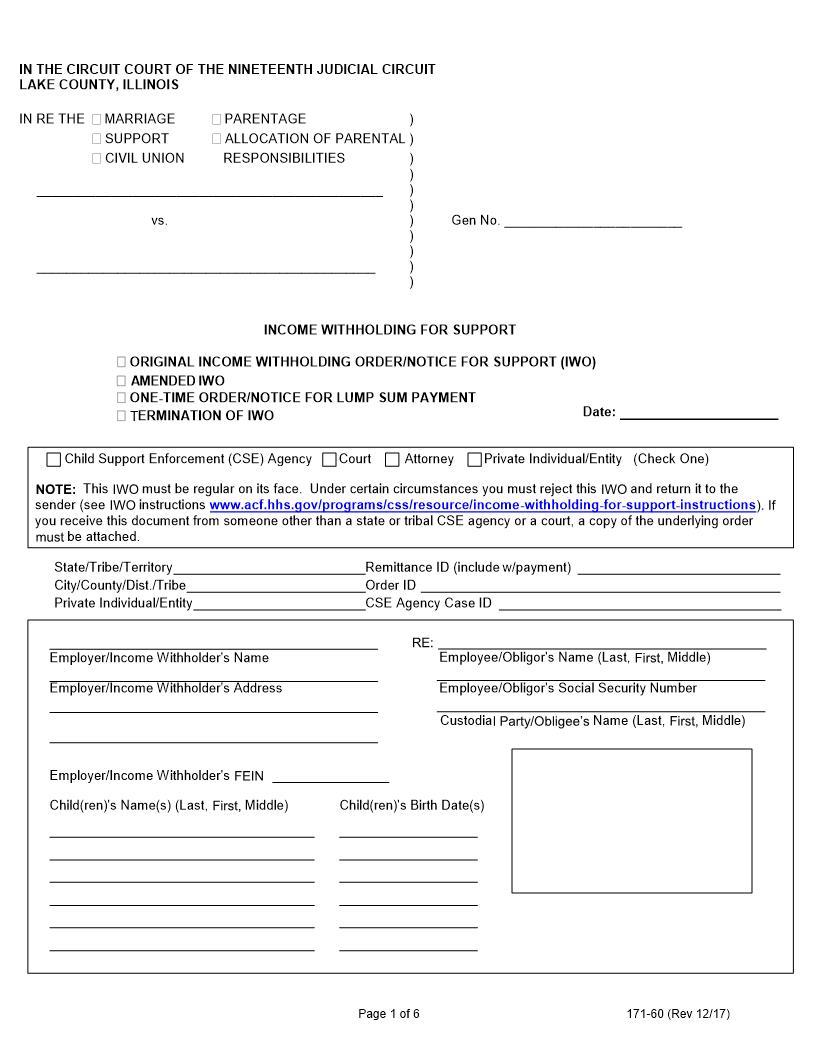

IN THE CIRCUIT COURT OF THE NINETEENTH JUDICIAL CIRCUIT LAKE COUNTY, ILLINOIS IN RE: THE MARRIAGE PARENTAGE ) SUPPORT PARENTAL RESPONSIBILITY ) CIVIL UNION OF ALLOCATION ) ) _____________________________________________________ ) Petitioner, ) ) vs. ) ) ) ____________________________________________________ ) Respondent. ) Case No. ________________________ INCOME WITHHOLDING FOR SUPPORT ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO) AMENDED IWO ONE-TIME ORDER/NOTICE FOR LUMP SUM PAYMENT Date: TERMINATION OF IWO Child Support Enforcement (CSE) Agency Court Attorney Private Individual/Entity (Check One) This must be regular on its face. Under certain circumstances you must reject this and return it to the sender (see instructions www.acf.hhs.gov/programs/css/resource/income-withholding-for-support-instructions you receive this document from someone other than a state or tribal CSE agency or a court, a copy of the underlying order be attached. State/Tribe/Territory City/County/Dist./Tribe Private Individual/Entity Remittance ID (include w/payment) Order ID CSE Agency Case ID Employer/Income Withholder's Name Employer/Income Withholder's Address Employee/Obligor's Name (Last, Middle) Employee/Obligor's Social Security Number Custodial Party/Obligee's Name (Last, Middle) Employer/Income Withholder's Child(ren)'s Name(s) (Last, Middle) Child(ren)'s Birth Date(s) Page 1 of 6 American LegalNet, Inc. www.FormsWorkFlow.com 171-60 (Rev 05/16) Employer's Name: Employee/Obligor's Name: CSE Agency Case Identifier: Employer FEIN: SSN: Order Identifier: _______________________ ORDER INFORMATION: This document is based on the support or withholding order from (State/Tribe). You are required by law to deduct these amounts from the employee/obligor's income until further notice. $ Per current child support past-due child support - Arrears greater than 12 weeks? Yes No $ Per $ Per current cash medical support $ Per past-due cash medical support $ Per current spousal support $ Per past-due spousal support $ Per other (must specify) . for a Total Amount to Withhold of $ per . AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with the Order Information. If your pay cycle does not match the ordered payment cycle, withhold one of the following amounts: $ per weekly pay period $ per semimonthly pay period (twice a month) $ per biweekly pay period (every two weeks)$ per monthly pay period $ Lump Sum Payment: Do not stop any existing IWO unless you receive a termination order. REMITTANCE INFORMATION: If the employee/obligor's principal place of employment is within Illinois (State/Tribe), you must begin withholding no later than the first pay period that occurs Fourteen (14) days after the date of____ . Send payment within Seven (7) working days of the pay date. If you cannot withhold the full amount of support for any or all orders for this employee/obligor, withhold up to % of disposable income. If the obligor is a non-employee, obtain withholding limits from Supplemental Information on page 3. If the employee/obligor's principal place of employment is not within Illinois (State/Tribe), obtain withholding limitations, time requirements, and any allowable employer fees at www.acf.hhs.gov/programs/css/resource/state-income-withholding-contacts-and- program-information for the employee/obligor's principal place of employment. For electronic payment requirements and centralized payment collection and disbursement facility information (State Disbursement Unit (SDU)), see www.acf.hhs.gov/programs/css/employers/electronic-payments. Include the Remittance ID with the payment and if necessary this FIPS code: Remit payment to the Illinois State Disbursement Unit at P. O. Box 5400, Carol Stream, IL 60197-5400. Return to Sender [Completed by Employer/Income Withholder]. Payment must be directed to an SDU in accordance with 42 USC §666(b)(5) and (b)(6) or Tribal Payee (see Payments to SDU below). If payment is not directed to an SDU/Tribal Payee or this IWO is not regular on its face, you must check this box and return the IWO to the sender. Signature of Judge/Issuing Official (if Required by State or Tribal Law): Print Name of Judge/Issuing Official: Title of Judge/Issuing Official: Date of Signature: If the employee/obligor works in a state or for a tribe that is different from the state or tribe that issued this order, a copy of this IWO must be provided to the employee/obligor. If checked, the employer/income withholder must provide a copy of this form to the employee/obligor. ADDITIONAL INFORMATION FOR EMPLOYERS/INCOME WITHHOLDERS State-specific contact and withholding information can be found on the Federal Employer Services website located at www.acf.hhs.gov/programs/css/resource/state-income-withholding-contacts-and-program-information. OMB Expiration Date - 7/31/2017. The OMB Expiration Date has no bearing on the termination date of the IWO; it identifies the version of the form currently in use. . Page 2 of 6 American LegalNet, Inc. www.FormsWorkFlow.com 171-60 (Rev 05/16) Employer's Name: Employee/Obligor's Name: CSE Agency Case Identifier: Employer FEIN: SSN: Order Identifier: _____________________ Priority: Withholding for support has priority over any other legal process under State law against the same income (42 USC §666(b)(7)). If a federal tax levy is in effect, please notify the sender. Combining Payments: When remitting payments to an SDU or tribal CSE agency, you may combine withheld amounts from more than one employee/obligor's income in a single payment. You must, however, separately identify each employee/obligor's portion of the payment. Payments To SDU: You must send child support payments payable by income withholding to the appropriate SDU or to a tribal CSE agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the custodial party, court, or attorney), you must check the box above and return this notice to the sender. Exception: If this IWO was sent by a court, attorney, or private individual/entity and the initial order was entered before January 1, 1994 or the order was issued by a tribal CSE agency, you must follow the "Remit payment to" instructions on this form. Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the amount was withheld from the employee/obligor's wages. You must comply with the law of the state (or tribal law if appl