Last updated: 6/29/2021

Chapter 13 Plan And Motion For FRBP Rule 3012 Valuation

Start Your Free Trial $ 33.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

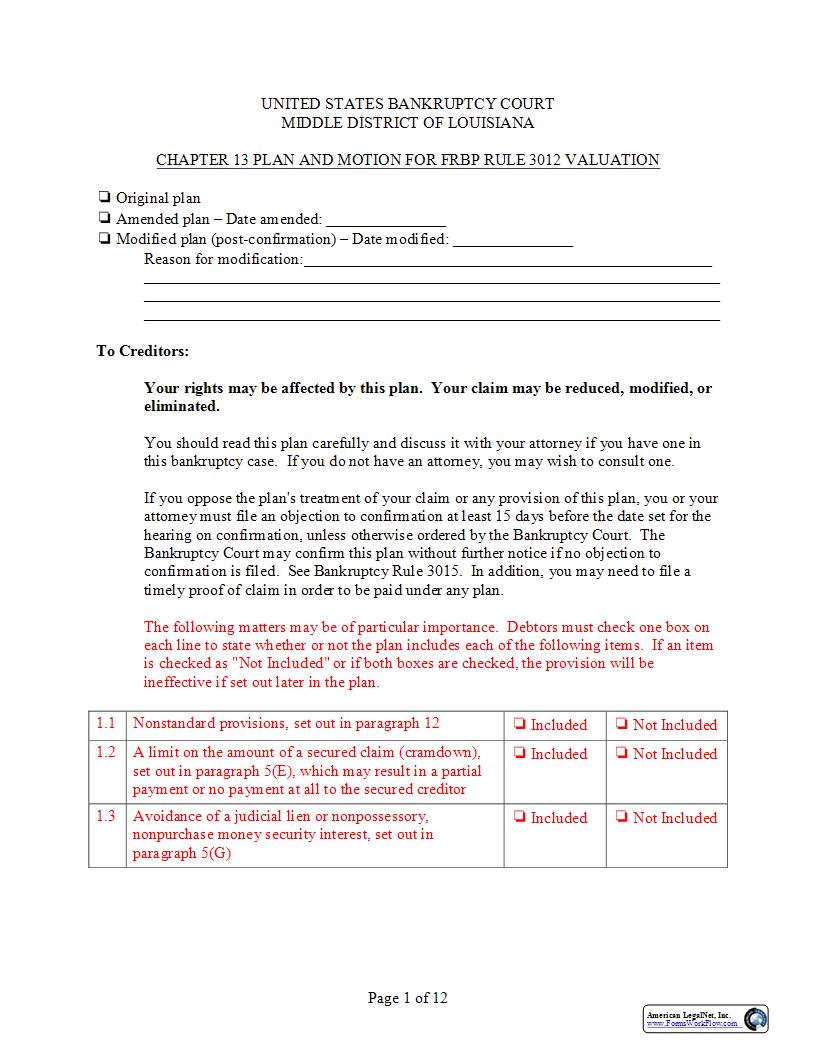

Page 1 of 12 UNITED STATES BANKRUPTCY COURT MIDDLE DISTRICT OF LOUISIANA CHAPTER 13 PLAN AND MOTION FOR FRBP RULE 3012 VALUATION Original plan Amended plan 226 Date amended: Modified plan (post-confirmation) 226 Date modified: Reason for modification: To Creditors: Your rights may be affected by this plan. Your claim may be reduced, modified, or eliminated. You should read this plan carefully and discuss it with your attorney if you have one in this bankruptcy case. If you do not have an attorney, you may wish to consult one. If you oppose the plan's treatment of your claim or any provision of this plan, you or your attorney must file an objection to confirmation at least 15 days before the date set for the hearing on confirmation, unless otherwise ordered by the Bankruptcy Court. The Bankruptcy Court may confirm this plan without further notice if no objection to confirmation is filed. See Bankruptcy Rule 3015. In addition, you may need to file a timely proof of claim in order to be paid under any plan. The following matters may be of particular importance. Debtors must check one box on each line to state whether or not the plan includes each of the following items. If an item is checked as "Not Included" or if both boxes are checked, the provision will be ineffective if set out later in the plan. 1. 1 Nonstandard provisions, set out in paragraph 1 2 Included Not Included 1. 2 A limit on the amount of a secured claim (cramdown) , set out in paragraph 5(E), which may result in a partial payment or no payment at all to the secured creditor Included Not Included 1. 3 Avoidance of a judicial lien or nonpossessory, nonpurchase money security interest, set out in paragraph 5(G) Included Not Included American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 12 (2) Payment and Term The Debtor's future earnings are submitted to the supervision and control of the trustee, and the Debtor shall pay to the trustee $ monthly for months. From the Debtor's payments to the trustee, the trustee shall distribute funds as provided in this plan: (3) Trustee Claims The trustee shall receive $ as an administrative expense entitled to priority under 11 U.S.C. 247507(a)(1) (ten percent (10%) of "payments under the plan"). (4) Priority Claims A. ATTORNEY FEES Attorney's Name Total Fees Fees Debtor paid pre- petition Fees to be paid through the plan Term (Months) Monthly Installment $ $ $ $ B. TAXES The following claims entitled to priority under 11 U.S.C. 247507 shall be paid in full in deferred cash payments unless the holder of a claim has agreed to a different treatment of its claim, as specified in paragraph 12. Name of Creditor Amount of Claim Term (Months) Monthly Installment $ $ $ $ C. DOMESTIC SUPPORT OBLIGATIONS ("DSO") 1. Ongoing DSO claims a. None. If none, skip to paragraph (5) "Secured Claims" below. American LegalNet, Inc. www.FormsWorkFlow.com Page 3 of 12 b. Debtor(s) shall pay all post-petition DSO claims directly to the holder(s) of the claim(s), and not through the chapter 13 trustee. c. List the name(s) and address(es) below of the holder(s) of any DSO as defined in 11 U.S.C. 247101(14A). Do not disclose names of minor children, who must be identified only as "Minor child #1," "Minor child #2," etc. See 11 U.S.C. 247112. Name of DSO claim holder Address, city, state and zip Monthly payment $ $ $ $ 2. DSO Arrearages a. None. If none, skip to paragraph (5) "Secured Claims" below. b. The trustee shall pay DSO arrearages from the Debtor's plan payments. List the name and address of the holder of every DSO arrearage claim, amount of arrearage claim and monthly payment below. Do not disclose names of minor children, who must be identified only as "Minor child #1," "Minor child #2," etc. See 11 U.S.C. 247112. Name and address of DSO claim holder Arrearage Claim Amount Term (Months) Monthly Installment Name: $ $ Address: Name: $ $ Address: Name: $ $ Address: c. Except to the extent arrearages are included in the order, pre-petition assignment orders shall remain in effect and the Debtor shall continue to make payments pursuant to the terms of the order. American LegalNet, Inc. www.FormsWorkFlow.com Page 4 of 12 3. DSO assigned or owed to a governmental unit under 11 U.S.C. 247507(a)(1)(B) a. None. If none, skip to paragraph (5) "Secured Claims" below. b. Pursuant to any pre-petition income assignment order, the Debtor shall make all post-petition payments on DSO claims assigned to a governmental unit directly to the assignee of the claim. c. List the name and address of the holder of every assigned DSO arrearage claim, amount of arrearage claim and monthly payment amount or other special provisions below. The Debtor also shall describe in detail any special provisions for payments of these claims in paragraph 12 of this plan. Name and address of DSO claim holder Arrearage Claim Amount Term (Months) Monthly Installment Name: $ $ Address: Name: $ $ Address: Name: $ $ Address: (5) Secured Claims A. PRINCIPAL RESIDENCE 1. Current Payments Except as otherwise provided in this plan or by court order, and pursuant to 11 U.S.C. 2471322(b)(5) and (c), after the date of the petition and throughout this chapter 13 case, the Debtor shall timely make all usual and regular payments required by the debt instruments secured by non-voidable liens on real property (i.e., immovable property) that is the Debtor's principal residence, directly to each of the following lien creditors: American LegalNet, Inc. www.FormsWorkFlow.com Page 5 of 12 Lienholder Security Interest Address of Property/Collateral Monthly Installment* $ $ $ $ $ *Monthly installment subject to escrow and interest rate changes as provided in note and mortgage. 2. Cure of Arrearages From funds available for distribution, the trustee shall pay arrearages to lienholders identified in paragraph 5(A)(1) in monthly installments until the allowed arrearage claim of each lienholder has been satisfied. See 11 USC 2471322(b)(3), (5) and (c). Lienholder Pre - or Post- Petition Total Amount of Arrearages Remaining Term (Months) Monthly Installment $ $ $ $ $ $ $ $ $ $ B. SURRENDER OF PROPERTY Confirmation of this plan shall constitute the Debtor's surrender to the following holders of secured claims, in satisfaction of their secured claims, all the Debtor's rights under the Bankruptcy Code, this plan, or applicable non-bankruptcy law to the Debtor's interest in the property securing the claims: American LegalNet, Inc. www.FormsWorkFlow.com Page 6 of 12 Lienholder Amount of Secured Claim* Description of Collateral $ $ $ $ $ *Creditors contesting the proposed amount of a secured claim must file an objection by the time prescribed by applicable local rules. The court will take evidence to determine the value of the secured claim at the hearing on confirmation, pursuant to Federal Rule of Bankruptcy Procedure 3012. The creditor must file a timely proof of claim in order to be paid. Confirmation of this plan will terminate the stay under 11 USC 247247362 and 1301 to allow lienholders to exercise non-bankruptcy law remedies as to the collateral. No further motion seeking stay relief is required. C. PRE-CONFIRMATION ADEQUATE PROTECTION Pursuant to the order of the court, all adequate protection payments to secured creditors required by 2471326(a)(1) shall be made through the Chapter 13 trustee, unless otherwise ordered, in the amount provided in the plan for that creditor. Adequate protection payments shall be subject to the trustee's fee as set by the designee of the United States Attorney General and shall be made in the ordinary course of the trustee's business from funds on hand as funds are available for distribution to creditors who have filed a claim. American LegalNet, Inc. www.FormsWorkFlow.com Page 7 of 12 Creditor name, address, and last four digits of account number Security Claim Amount Term (Months) Monthly Installment Name: $ $ Address: Last 4 digits of acc't no: Name: $ $ Address: Last 4 digits of acc't no: Name: $ $ Address: Last 4 digits of acc't no: Name: $ $ Address: Last 4 digits of acc't no: D. SECURED CLAIMS NOT DETERMINED UNDER 11 U.S.C. 247506 This subsection provides for treatment of allowed claims