Last updated: 6/17/2021

Notice Of Exemption Rights

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

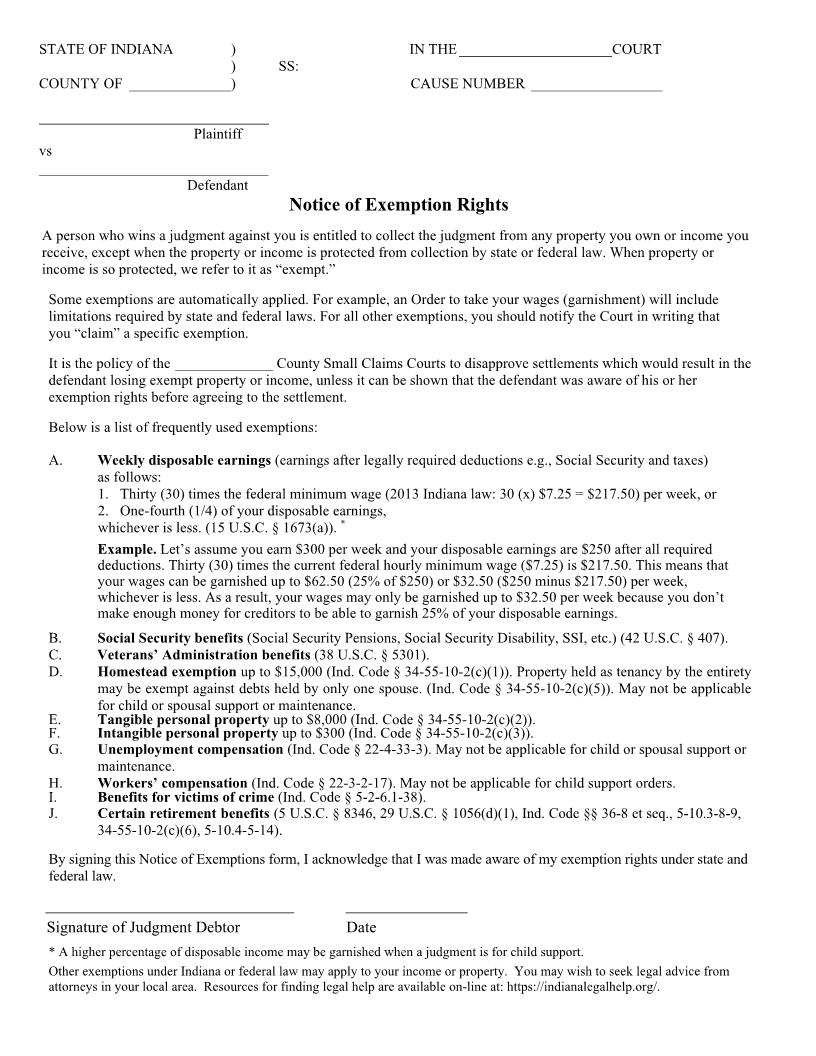

STATE OF INDIANA COUNTY OF ) ) SS: ) Plaintiff Defendant IN THE CAUSE NUMBER _COURT vs Notice of Exemption Rights A person who wins a judgment against you is entitled to collect the judgment from any property you own or income you receive, except when the property or income is protected from collection by state or federal law. When property or income is so protected, we refer to it as "exempt." Some exemptions are automatically applied. For example, an Order to take your wages (garnishment) will include limitations required by state and federal laws. For all other exemptions, you should notify the Court in writing that you "claim" a specific exemption. It is the policy of the County Small Claims Courts to disapprove settlements which would result in the defendant losing exempt property or income, unless it can be shown that the defendant was aware of his or her exemption rights before agreeing to the settlement. Below is a list of frequently used exemptions: A. Weekly disposable earnings (earnings after legally required deductions e.g., Social Security and taxes) as follows: 1. Thirty (30) times the federal minimum wage (2013 Indiana law: 30 (x) $7.25 = $217.50) per week, or 2. One-fourth (1/4) of your disposable earnings, whichever is less. (15 U.S.C. § 1673(a)). * Example. Let's assume you earn $300 per week and your disposable earnings are $250 after all required deductions. Thirty (30) times the current federal hourly minimum wage ($7.25) is $217.50. This means that your wages can be garnished up to $62.50 (25% of $250) or $32.50 ($250 minus $217.50) per week, whichever is less. As a result, your wages may only be garnished up to $32.50 per week because you don't make enough money for creditors to be able to garnish 25% of your disposable earnings. B. C. D. E. F. G. H. I. Social Security benefits (Social Security Pensions, Social Security Disability, SSI, etc.) (42 U.S.C. § 407). Veterans' Administration benefits (38 U.S.C. § 5301). Homestead exemption up to $15,000 (Ind. Code § 34-55-10-2(c)(1)). Property held as tenancy by the entirety may be exempt against debts held by only one spouse. (Ind. Code § 34-55-10-2(c)(5)). May not be applicable for child or spousal support or maintenance. Intangible personal property up to $300 (Ind. Code § 34-55-10-2(c)(3)). Unemployment compensation (Ind. Code § 22-4-33-3). May not be applicable for child or spousal support or maintenance. Workers' compensation (Ind. Code § 22-3-2-17). May not be applicable for child support orders. Benefits for victims of crime (Ind. Code § 5-2-6.1-38). Certain retirement benefits (5 U.S.C. § 8346, 29 U.S.C. § 1056(d)(1), Ind. Code §§ 36-8 et seq., 5-10.3-8-9, 34-55-10-2(c)(6), 5-10.4-5-14). By signing this Notice of Exemptions form, I acknowledge that I was made aware of my exemption rights under state and federal law. Signature of Judgment Debtor *A Date higher percentage of disposable income may be garnished when a judgment is for child support. Other exemptions under Indiana or federal law may apply to your income or property. You may wish to seek legal advice from attorneys in your local area. Resources for finding legal help are available on-line at: http://www.in.gov/judiciary/probono/2343.htm. American LegalNet, Inc. www.FormsWorkFlow.com