Last updated: 4/23/2021

Chapter 13 Plan

Start Your Free Trial $ 25.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

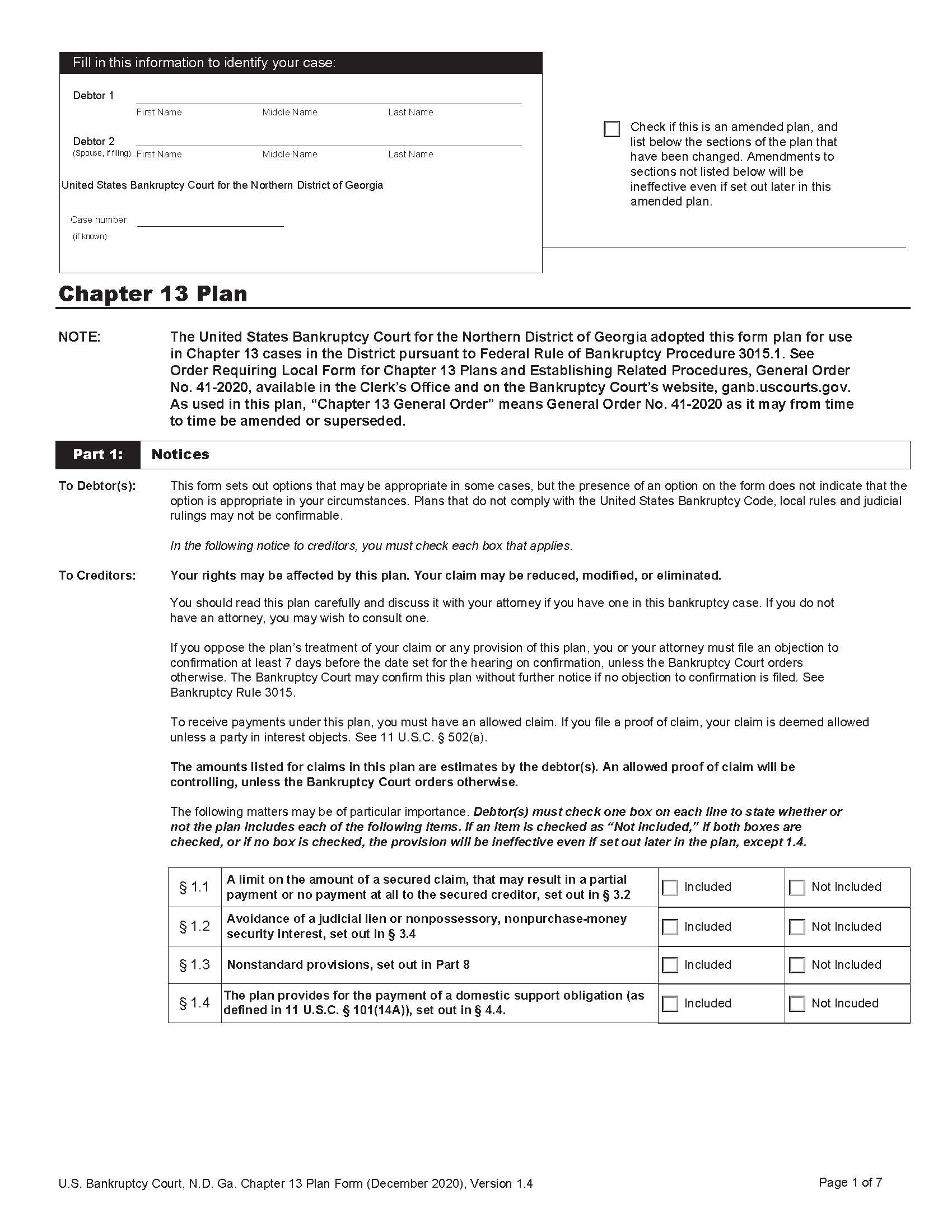

CHAPTER 13 PLAN. This is the mandatory local plan form used by individual debtors filing Chapter 13 bankruptcy cases in the U.S. Bankruptcy Court for the Northern District of Georgia, adopted pursuant to Federal Rule of Bankruptcy Procedure 3015.1 and General Order No. 41-2020. This form sets out the debtor’s proposed repayment plan, including the length of the plan (36 or 60 months), regular payments to the Chapter 13 trustee, treatment of tax refunds and additional income, and the method of payment. The plan details how secured claims, priority claims (including domestic support obligations and attorney’s fees), and nonpriority unsecured claims will be treated, and may include lien avoidance, surrender of collateral, or assumption of executory contracts and leases. The plan must be signed by the debtor(s) and, if represented, their attorney, and is subject to trustee review and court confirmation to become binding. www.FormsWorkflow.com

Related forms

-

Order To Employer To Deduct And Remit Portion Of Debtors Earnings For Voluntary Payment Of Debts (Ch 13)

Order To Employer To Deduct And Remit Portion Of Debtors Earnings For Voluntary Payment Of Debts (Ch 13)

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Pro Se Affidavit To Accompany Petition For Order Of Relief

Pro Se Affidavit To Accompany Petition For Order Of Relief

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Motion For Order Under 362(c)(4)(A)(ii) Confirming No Automatic Stay Is In Effect

Motion For Order Under 362(c)(4)(A)(ii) Confirming No Automatic Stay Is In Effect

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Motion For Order Under 362(j) Confirming Termination Of Automatic Stay

Motion For Order Under 362(j) Confirming Termination Of Automatic Stay

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Report Of Rule 26(f) Conference

Report Of Rule 26(f) Conference

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Secured Claim Worksheet

Secured Claim Worksheet

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Declaration And Request To File Document On CD

Declaration And Request To File Document On CD

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Debtors Certificate

Debtors Certificate

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Notification Of Request For Redaction

Notification Of Request For Redaction

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Notification Of Submission Of Redaction Statement

Notification Of Submission Of Redaction Statement

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Request For Change Of Address

Request For Change Of Address

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Statement Of Chapter 13 Debtor Regarding Exemption

Statement Of Chapter 13 Debtor Regarding Exemption

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Application For Admission Pro Hac Vice

Application For Admission Pro Hac Vice

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Statement Regarding Payment Advices

Statement Regarding Payment Advices

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Certificate Of Service

Certificate Of Service

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Request For Transmittal Of Transcript

Request For Transmittal Of Transcript

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Stipulation On Motion For Relief From Stay

Stipulation On Motion For Relief From Stay

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Order And Notice Of Hearing And Temporary Extension Of Automatic Stay (Judge Ellis-Monro)

Order And Notice Of Hearing And Temporary Extension Of Automatic Stay (Judge Ellis-Monro)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Application To Pay Filing Fee In Installments

Application To Pay Filing Fee In Installments

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Chapter 13 Plan

Chapter 13 Plan

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Notice Of Hearing On Confirmation Of Modified Plan And Of Deadline For Objections

Notice Of Hearing On Confirmation Of Modified Plan And Of Deadline For Objections

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Request For Entry Of Order To Employer To Deduct Earnings

Request For Entry Of Order To Employer To Deduct Earnings

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Statement Of Modified Plan

Statement Of Modified Plan

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Granting Motion To Avoid Security Interest (Judge Baisier)

Order Granting Motion To Avoid Security Interest (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order And Notice Establishing Bar Date (Judge Baisier)

Order And Notice Establishing Bar Date (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Contingent Fee Chapter 7) (Judge Baisier)

Order Approving Special Counsel (Contingent Fee Chapter 7) (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Flat Fee Chapter 7) (Judge Baisier)

Order Approving Special Counsel (Flat Fee Chapter 7) (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Hourly Fee Chapter 7) (Judge Baisier)

Order Approving Special Counsel (Hourly Fee Chapter 7) (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Contingent Fee Chapter 13) (Judge Baisier)

Order Approving Special Counsel (Contingent Fee Chapter 13) (Judge Baisier)

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Flat Fee Chapter 13) (Judge Baisier)

Order Approving Special Counsel (Flat Fee Chapter 13) (Judge Baisier)

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Order Approving Special Counsel (Hourly Fee Chapter 13) (Judge Baisier)

Order Approving Special Counsel (Hourly Fee Chapter 13) (Judge Baisier)

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Order Granting Motion For Examination Pursuant to Procedure 2004 (Judge Baisier)

Order Granting Motion For Examination Pursuant to Procedure 2004 (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Order Granting Motion To Avoid Judicial Lien (Judge Baisier)

Order Granting Motion To Avoid Judicial Lien (Judge Baisier)

Georgia/4 Federal/Bankruptcy Court/Northern District/General/ -

Notice Of Hearing On Reaffirmation Agreement

Notice Of Hearing On Reaffirmation Agreement

Georgia/Federal/Bankruptcy Court/Northern District/General/ -

Notice Of Hearing

Notice Of Hearing

Georgia/Federal/Bankruptcy Court/Northern District/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!