Last updated: 3/12/2021

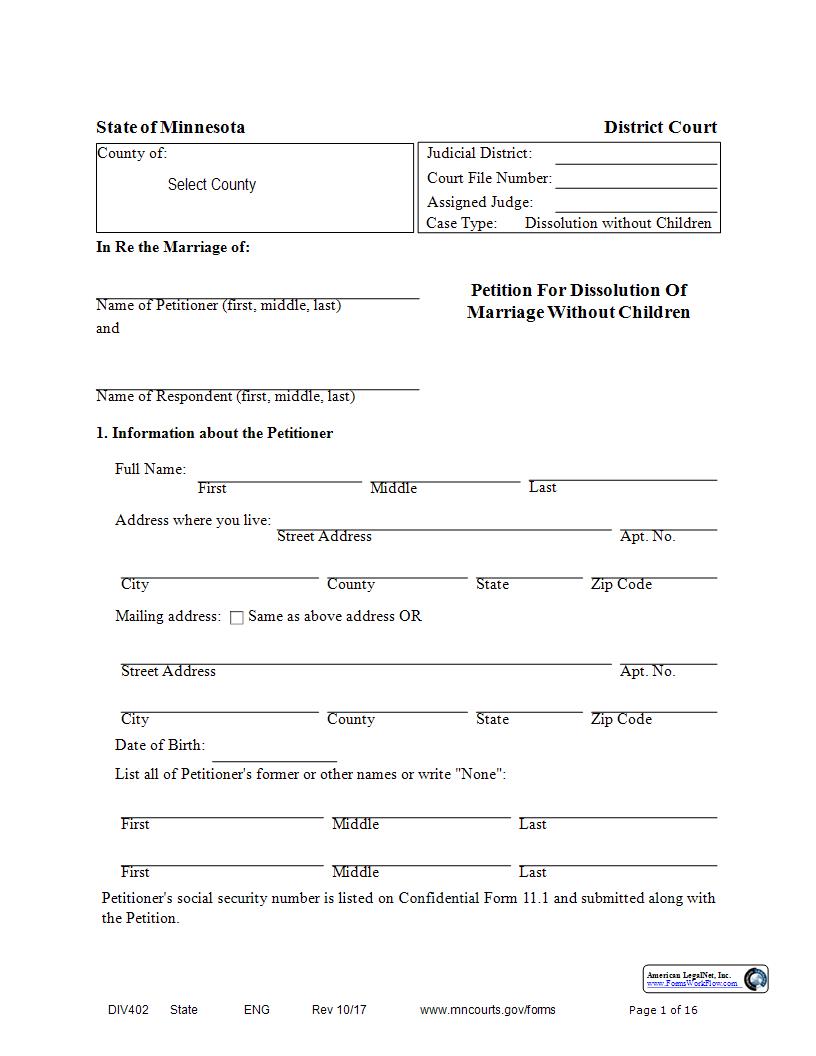

Petition For Dissolution Of Marriage Without Children {DIV-402}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 1 of 16State of Minnesota District CourtCounty of: Select County Judicial District: Court File Number: Assigned Judge: Case Type: Dissolution without Children In Re the Marriage of: Name of Petitioner (first, middle, last)and Name of Respondent (first, middle, last)Petition For Dissolution Of Marriage Without Children1. Information about the PetitionerFull Name: First Middle LastAddress where you live: Street Address Apt. No. City County State Zip CodeMailing address: Same as above address OR Street Address Apt. No. City County State Zip Code Date of Birth:List all of Petitioner's former or other names or write "None": First Middle Last First Middle LastPetitioner's social security number is listed on Confidential Form 11.1 and submitted along with the Petition. American LegalNet, Inc. www.FormsWorkFlow.com DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 2 of 162. Information about the RespondentFull Name: First Middle LastAddress: Street Address Apt. No. City County State Zip Code Respondent's address is unknown to Petitioner. Respondent's Date of Birth:List all of Respondent's former or other names or write "None": First Middle Last First Middle Last3. Our Marriage Petitioner and Respondent were married on (month, day, year) in the City of , County of, State , Country of.4. 180 Day Requirementa. Has Petitioner been living in Minnesota for the past six (6) months? YES NOb. Has Respondent been living in Minnesota for the past six (6) months? YES NO UNKNOWNc. Petitioner and Respondent were married in Minnesota, but neither Petitioner nor Respondent reside in Minnesota, nor reside in a jurisdiction that will allow us to maintain an action for dissolution because of the sex or sexual orientation of the Petitioner and Respondent. YES NO5. Armed Forcesa. Is Petitioner an active duty member of the armed forces? YES NOb. Is Respondent an active duty member of the armed forces? YES NO UNKNOWN American LegalNet, Inc. www.FormsWorkFlow.com DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 3 of 166. Marriage Cannot be SavedThere has been an irretrievable breakdown of my marriage relationship with Respondent and the marriage cannot be saved.7. Physical Living Situationa. Do the Petitioner and Respondent live together at this time? YES NO8. Other Proceedingsa. Has a separate court case for marriage dissolution, legal separation, or annulment already been started by Petitioner or Respondent in Minnesota or elsewhere? YES NO9. Protection or Harassment Ordera. Is an Order for Protection or a Harassment/Restraining Order in effect regarding Petitioner and Respondent? YES NO10. Children "Minor" children are under age 18, or under age 20 and still in high school.a. Do Petitioner and Respondent have minor children together? YES NOb. Do Petitioner and Respondent have any adult dependent children who are not able to support themselves because of a physical or mental condition? YES NOc. Has either Petitioner or Respondent given birth during the marriage to a child who is not a child of the other spouse? YES NOd. Is either spouse pregnant? YES NO UNKNOWN11. Public Assistance from the State of MinnesotaNote: If either party is receiving public assistance from the State of Minnesota or applies for it after this proceeding is started, the Petitioner must give notice of this marriage dissolution action to the Support and Collections office for the county paying for the assistance. See Minn. Stat. 247 518A.44a. Does Petitioner receive public assistance from the State of Minnesota? YES NOb. Does Respondent receive public assistance from the State of Minnesota? YES NO UNKNOWN12. Supplemental Security Income (SSI) American LegalNet, Inc. www.FormsWorkFlow.com DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 4 of 16Supplemental Security Income (SSI) is a Federal income supplement program. It is available to low-income people if they are over age 65, or blind or disabled.a. Does Petitioner receive Supplemental Security Income (SSI)? YES NOb. Does Respondent receive Supplemental Security Income (SSI)? YES NO UNKNOWN13. Petitioner's Employmenta. Is Petitioner employed? YES NOb. Is Petitioner self-employed? YES NO Current Employment: (If Petitioner has more than two jobs at this time, use an attachment for the additional jobs. Name of Petitioner's Employer (If self-employed, list name and business address) Address City State Zip Code Name of Petitioner's Employer (If self-employed, list name and business address) Address City State Zip Code14. Petitioner's Gross IncomeNOTE: This question asks for monthly income. If you are paid weekly, multiply your weekly income by 4.33 to get monthly income. If you are paid every two weeks, multiply by 2.17 to get monthly income. If you are paid twice a month, multiply by 2. If you do not have income in a category, enter zero (0). Do not list public assistance benefits as income (e.g., MFIP, GA, SSI). Source of Income Amount Per Month (or zero) before deductions/taxesSelf Employment Income per month.If you are self employed, calculate your net monthly revenues as follows: (Annual gross revenues minus annual ordinary and necessary business expenses) divided by 12 = Net Monthly Revenue. Also, attach Schedule C from last year's tax return to this Petition. Income from all jobs per month.Your monthly income from a job = Hourly wage x Hours worked per week x 4.33 (weeks per month) American LegalNet, Inc. www.FormsWorkFlow.com DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 5 of 16Commissions from all jobs per month.Unemployment benefits per month.Social Security Retirement, Survivors or Disability Income (RSDI) (do not include SSI) per month.Investment and Rental Income per month.Annuity Payments per month.Pension or Disability from work or military per month.Worker's Compensation per month.Court-ordered spousal maintenance you receive per month. Other per month.Add all of the above: Total gross monthly income $0.00 per month.Does Petitioner receive child support payments? YES NO15. Respondent's Employmenta. Is Respondent employed? YES NO UNKNOWNb. Is Respondent self-employed? YES NO UNKNOWN Current Employment: (If Respondent has more than two jobs at this time, use an attachment for the additional jobs. Name of Respondent's Employer (If self-employed, list name and business address) Address City State Zip Code Name of Respondent's Employer (If self-employed, list name and business address) Address City State Zip Code16. Respondent's Gross Income American LegalNet, Inc. www.FormsWorkFlow.com DIV402 State ENG Rev 10/17www.mncourts.gov/formsPage 6 of 16 a. Petitioner has no information about the Respondent's income OR b. Petitioner does not have detailed information about Respondent's income, but has good c. Petitioner has detailed information about Respondent's income. If this is true, fill out the income information below. reason to believe that Respondent's pay is per week month year, with bonuses, overtime or or commissions in the additional amount of per week month yearThis is Respondent's Net Income (after taxes and deductions) or Gross income (before taxes and deductions.) OR NOTE: This question asks for monthly income. If Respondent is paid weekly, multiply your weekly income by 4.33 to get monthly income. If they are paid every two weeks, multiply by 2.17 to get monthly income. If they are paid twice a month, multiply by 2. If Respondent has no income in a category, enter zero (0). Do not list public assistance benefits as income (e.g., MFIP, GA, SSI). Source of Income Amount Per Month (or zero) before deductions/taxesSelf Employment Income per month.If Respondent is self employed, calculate net monthly revenues as follows: (Annual gross revenues minus annual ordinary and necessary business expenses) divided by 12 = Net Monthly Revenue. Also, attach Schedule C from last year's tax return to this Petition, if available. Job with per month.Your monthly income from a job = Hourly wage x Hours worked per week x 4.33 (weeks per month)Commissions from all jobs per month.Unemployment benefits per month.Social Security Retirement, Survivors or Disability Income (RSDI) (do no