Last updated: 3/11/2021

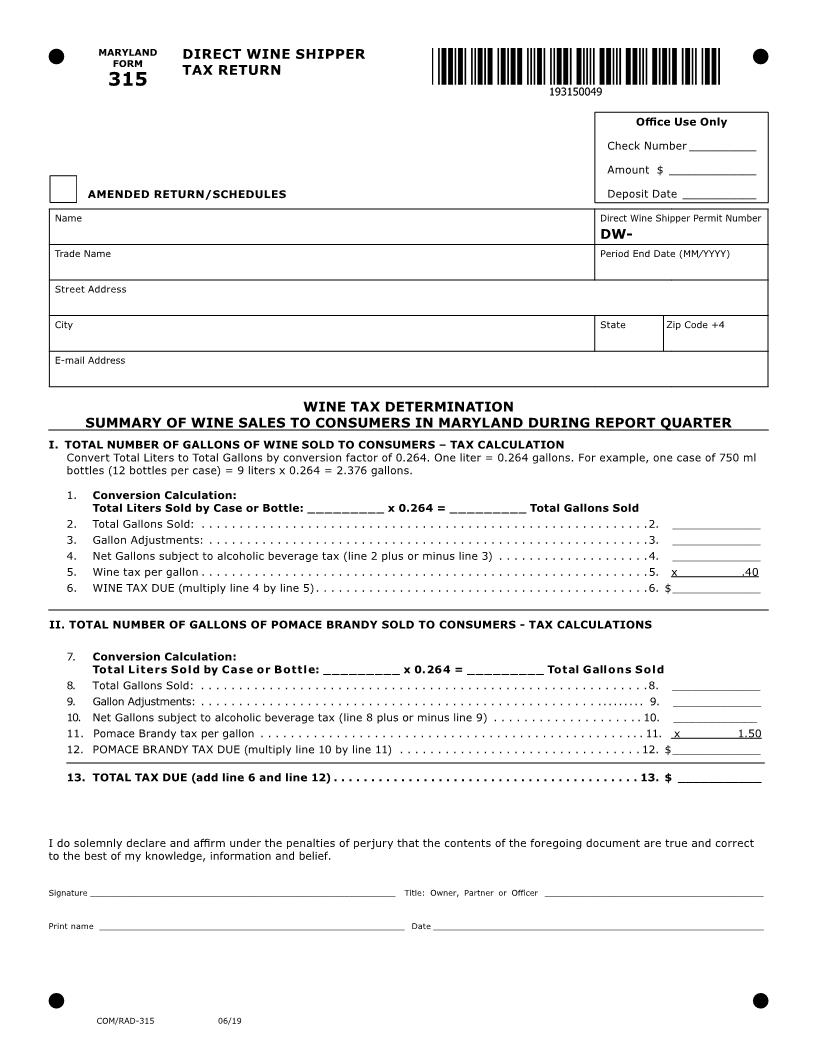

Direct Wine Shipper Tax Return {315}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

315 FORM MARYLAND DIRECT WINE SHIPPER TAX RETURN Federal Employer ID Number (FEIN) 2015 Direct Wine Shipper's Name Street Address City E-mail Address - Office Use Only Check Number __________ Amount $ _____________ State Zip Code Deposit Date____________ Direct Wine Shipper's Permit Number For Calendar Quarter DW- January March July September April June October - December WINE TAX DETERMINATION SUMMARY OF WINE SALES TO CONSUMERS IN MARYLAND DURING REPORT QUARTER I. TOTAL NUMBER OF GALLONS OF WINE SOLD TO CONSUMERS TAX CALCULATION Convert Total Liters to Total Gallons by conversion factor of 0.264. One liter = 0.264 gallons. For example, one case of 750 ml bottles (12 bottles per case) = 9 liters x 0.264 = 2.376 gallons. 1. Conversion Calculation: Total Liters Sold by Case or Bottle: _________ x 0.264 = _________ Total Gallons Sold Total Gallons Sold: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. Adjustments: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. Net Gallons subject to alcoholic beverage tax (line 2 plus or minus line 3) . . . . . . . . . . . . . . . . . . . . 4. Wine tax per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. _____________ _____________ _____________ x .40 2. 3. 4. 5. 6. WINE TAX DUE (multiply line 4 by line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. $ _____________ II. TOTAL NUMBER OF GALLONS OF POMACE BRANDY SOLD TO CONSUMERS - TAX CALCULATIONS 7. Conversion Calculation: Total Liters Sold by Case or Bottle: _________ x 0.264 = _________ Total Gallons Sold Total Gallons Sold: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Adjustments: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. _____________ _____________ _____________ x 1.50 8. 9. 10. Net Gallons subject to alcoholic beverage tax (line 8 plus or minus line 9) . . . . . . . . . . . . . . . . . . . 10. 11. Pomace Brandy tax per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. 12. POMACE BRANDY TAX DUE (multiply line 8 by line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. $ _____________ 13. TOTAL TAX DUE (add line 6 and line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. $ _____________ I do solemnly declare and affirm under the penalties of perjury that the contents of the foregoing document are true and correct to the best of my knowledge, information and belief. Print name ____________________________________________________________ Title: Owner, Partner or Officer ___________________________________________ Signature ____________________________________________________________ Date _________________________________________________________________ COM/RAD-315 American LegalNet, Inc. www.FormsWorkFlow.com Page 1 315 2015 FORM MARYLAND DIRECT WINE SHIPPER TAX RETURN Page 2 Direct Wine Shipper's Name Federal Employer ID Number (FEIN) A Date of Sale B Date of Shipment C Brand of Wine D Price Charged E Name of Consumer Shipped to F Address of Consumer Shipped to - G Total Liters Sold 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. In lieu of using this form to report each sale, a hard-copy report with the same information may be submitted. COM/RAD-315 American LegalNet, Inc. www.FormsWorkFlow.com 315 2015 FORM INSTRUCTIONS - MARYLAND DIRECT WINE SHIPPER'S TAX RETURN Page 2 Each Wine Sale to Consumers Column A B C D E F G Line 1-15 1-15 1-15 1-15 1-15 1-15 1-15 Date of sale of wine to consumer Page 3 This tax return, together with payment of the wine tax due, shall be properly filed and physically received by the Revenue Administration Division no later than the 10th day of the quarter following the quarter in which wine was sold and shipped to consumers in Maryland. Tax Period January March April June July September October December Due Date April 10th July 10th October 10th January 10th Date of shipment of wine to consumer Brand of wine sold. State name of each brand of wine and varietal sold Price charged Name of consumer shipping label shipped to on Payment shall be in the form of a check or money order payable to the "Comptroller of Maryland". Page 1 Wine Tax Determination Summary of Wine Sales to Consumers in Maryland Line 1 If a size is not listed on the form, state the size in the blank box and indicate number of cases and bottles sold Number of cases of wine sold to consumers for each size Number of bottles of wine sold to consumers for each size Total amount of all liters of wine sold by case or bottle (Milliliters must be converted to liters, e.g., 750ml = 0.75 liters) Convert total liters of wine sold on Line 4 to total gallons by multiplying amount by 0.264. For example, 500 liters sold is calculated as follows: 500 x 0.264 = 132 gallons Total Gallons Sold Adjustments (if taking a debit or credit, please submit supporting documentation) Net gallons of wine subject to alcoholic beverage tax (Line 6 plus or minus Line 7 adjustments) Maryland wine tax rate of $0.40 per gallon Wine tax due (Multiply Line 8 by Line 9) Address of consumer shipped to on shipping label Total liters of wine sold to address of consumer shipped to This tax return must be signed by the owner, partner, or officer of the corporation. If this is a corporation, an officer (President, Vice President, Secretary or Treasurer) must sign. Mail tax return to: Comptroller of Maryland Revenue Administration Division Returns Processing P.O. Box 2999 Annapolis, Maryland 21404 For more information: Telephone: 410-260-7127 or 1-800-638-2937 Fax: 410-260-7924 http://compnet.comp.state.md.us/ http://www.marylandtaxes.com 2 3 4 5 6 7 8 9 10 COM/RAD-315 American LegalNet, Inc. www.FormsWorkFlow.com