Last updated: 9/14/2020

Guide For Articles Of Correction To The Articles Of Organization Of A Domestic Limited Liability Company {LLC-1011.1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

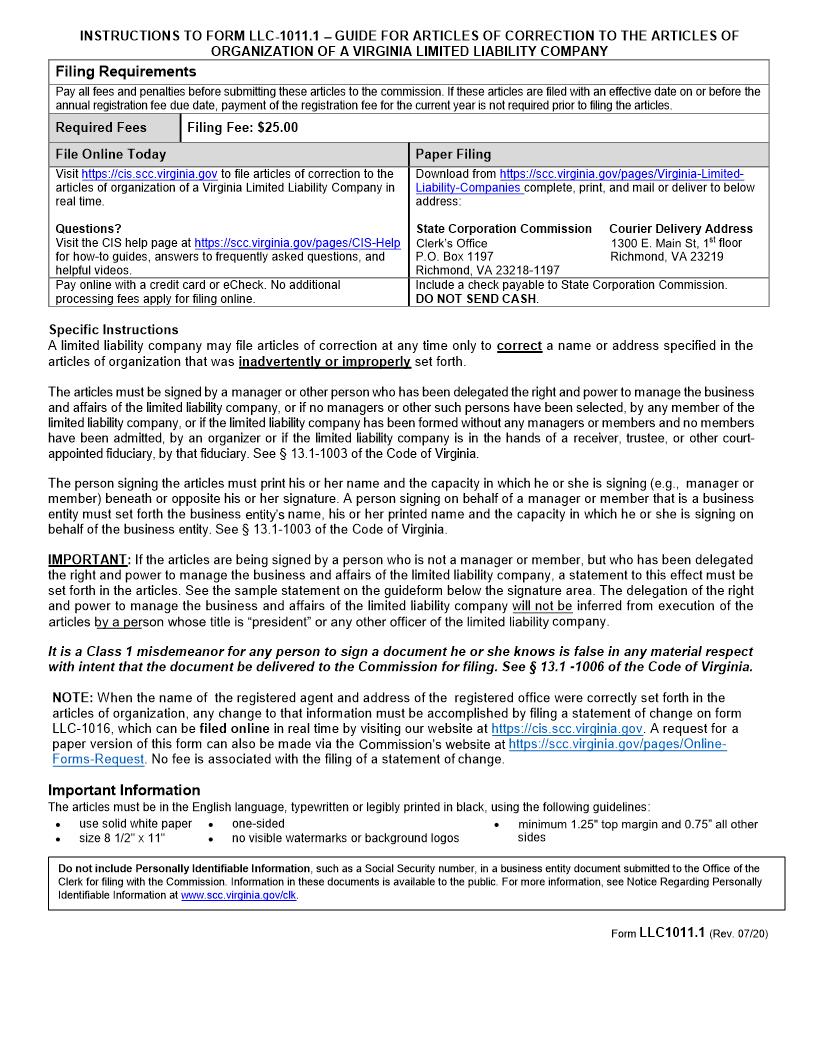

COMMONWEALTH OF VIRGINIA STATE CORPORATION COMMISSION GUIDE FOR ARTICLES OF CORRECTION TO THE ARTICLES OF ORGANIZATION OF A VIRGINIA LIMITED LIABILITY COMPANY ARTICLES OF CORRECTION OF (limited liability company's name as currently on record with the SCC) The undersigned, on behalf of the limited liability company set forth below, pursuant to § 13.1-1011.1 of the Code of Virginia, states as follows: 1. The name of the limited liability company is (name currently on record with the SCC) . LLC-1011.1 (02/13) 2. (Set forth a statement of the nature of the error necessitating each correction.) 3. (Set forth the text of each correction. NOTE: Articles of correction can correct only a name or address specified in the articles of organization that was inadvertently or improperly set forth.) 4. (Set forth the manner by which the correction(s) was (were) adopted on behalf of the limited liability company; only set forth the applicable option listed below.) The correction(s) to the articles of organization was (were) approved: Option A: Option B: By a majority vote of the managers. By a majority vote of the members entitled to vote. Manager action was not required because the limited liability company was formed without any managers and no managers have been appointed. By a vote of at least [insert the supermajority fraction or percentage] of the members entitled to vote as required by the articles of organization. Manager action was not required because the limited liability company was formed without any managers and no managers have been appointed. By a majority vote of the organizers of the limited liability company. Neither manager nor member action was required because the limited liability company was formed without any managers or members, and no members have been admitted. Option C: Option D: Executed in the name of the limited liability company by: (signature) (printed name) (limited liability company's SCC ID no.) (date) (title (e.g., manager or member)) (telephone number (optional)) (If applicable, set forth the following statement: The person signing the articles has been delegated the right and power to manage the business and affairs of the limited liability company. See instructions.) (The articles must be executed in the name of the limited liability company by any manager or other person who has been delegated the right and power to manage the business and affairs of the limited liability company, or if no managers or such other persons have been selected, by any member of the limited liability company, or if the limited liability company was formed without any managers or members and no members have been admitted, by an organizer.) Personal Information, such as a social security number, should NOT be included in a business entity document submitted to the Office of the Clerk for filing with the Commission. For more information, see Notice Regarding Personal Identifiable Information on the Clerk's Office Home Page. THIS FORM IS TO BE USED AS A GUIDE ONLY. SEE INSTRUCTIONS ON THE REVERSE American LegalNet, Inc. www.FormsWorkFlow.com INSTRUCTIONS TO FORM LLC-1011.1 Guideform LLC-1011.1 has been produced by the Commission as a guide for the preparation of articles of correction. Please note, however, that a marked-up version of this guideform will not be accepted. The articles must be separately prepared, using this form as a guide, inserting appropriate information and omitting all inapplicable portions, including the header, seal of the Commission, italicized text, and the text of options not utilized. The articles must be in the English language, typewritten or printed in black on white, opaque paper 8 1/2" by 11" in size, legible and reproducible, and free of visible watermarks and background logos. A minimum of 1" must be provided on the left, top and bottom margins and 1/2" on the right margin. Use only one side of a page. You can download this guideform from our website at www.scc.virginia.gov/clk/formfee.aspx. A limited liability company may file articles of correction at any time only to correct a name or address specified in the articles of organization that was inadvertently or improperly set forth. The articles must be signed by a manager or other person who has been delegated the right and power to manage the business and affairs of the limited liability company, or if no managers or other such persons have been selected, by any member of the limited liability company, or if the limited liability company has been formed without any managers or members and no members have been admitted, by an organizer or if the limited liability company is in the hands of a receiver, trustee, or other court-appointed fiduciary, by that fiduciary. See § 13.1-1003 of the Code of Virginia. The person signing the articles must print his or her name and the capacity in which he or she is signing (e.g., manager or member) beneath or opposite his or her signature. A person signing on behalf of a manager or member that is a business entity must set forth the business entity's name, his or her printed name and the capacity in which he or she is signing on behalf of the business entity. See § 13.1-1003 of the Code of Virginia. IMPORTANT: If the articles are being signed by a person who is not a manager or member, but who has been delegated the right and power to manage the business and affairs of the limited liability company, a statement to this effect must be set forth in the articles. See the sample statement on the guideform below the signature area. The delegation of the right and power to manage the business and affairs of the limited liability company will not be inferred from execution of the articles by a person whose title is "president" or any other officer of the limited liability company. It is a Class 1 misdemeanor for any person to sign a document he or she knows is false in any material respect with intent that the document be delivered to the Commission for filing. See § 13.1 -1006 of the Code of Virginia. These articles may not be filed with the Commission until all fees and penalties to be collected by the Commission under the Virginia Limited Liability Company Act have been paid by or on behalf of the limited liability company; provided, however, that an assessed annual registration fee does not have to be paid if these articles are filed with an effective date that is on or before the due date of the annual registration fee payment. See § 13.1-1065 of the Code of V