Last updated: 10/5/2020

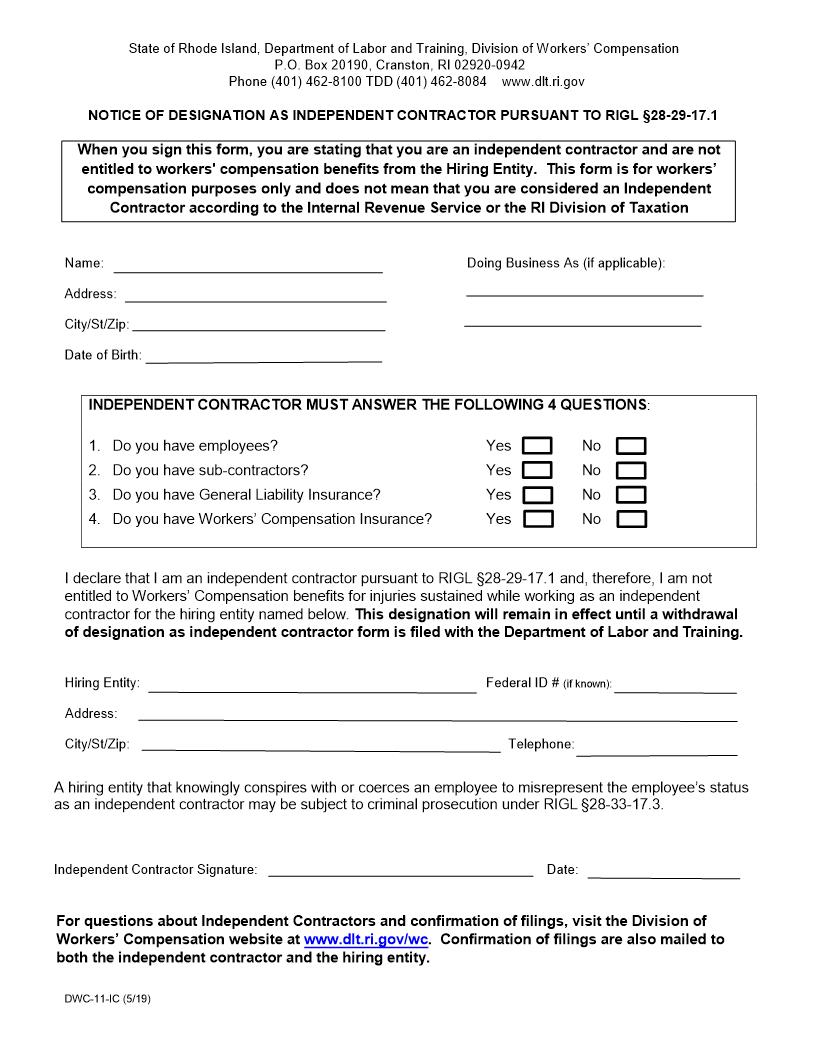

Notice Of Designation Of Independent Contractor {DWC-11-IC}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

State of Rhode Island, Depart ment of Labor and Training, Workers Compensation Unit P.O. Box 20190, Cranston, RI 02920-0942 Phone (401) 462-8100 TDD (401) 462-8006 www.dlt.state.ri.us NOTICE OF DESIGNATION AS INDEPENDENT CONTRACTOR PURSUANT TO R.I.G.L. 28-29-17.1 PLEASE READ OTHER SIDE WARNING No one can force you to sign this form. When you sign this form you are stating that you are an independent contractor and in the event of inju ry, are not entitled to workers compensation benefits. *(Name) _______________________________________ Soc. Sec. No. _____________________________________ * Business Name _______________________________ FEIN __________________________________________ * Address _____________________________________ Business License No. ______________________________ ______________________________________________ Date of Birth ______________________________________ I declare that I am an independent contra ctor pursuant to R.I.G.L. 28-29-17.1 and, therefore, I am not eligible for nor entitled to Workers Compensation benefits pursuant to Title 28, Chapters 29-38, of the Workers Compensation Act of the State of Rhode Island for injuries sustained while working as an independent contractor for the hiring entity named below. This designation will remain in effect while performing services for the named hiring entity or until a withdrawal of designation as independent c ontractor form is filed with the Department of Labor and Training. * Hiring Entity Name______________________________ Soc. Sec. No. ___________________________________ * Address ______________________________________ FEIN __________________________________________ ______________________________________ Bus. License ___________________________________ Warning! This form is for purposes of Workers Compensation only and completion of this form does not mean that you are an Independent Contractor under the rules, regulations or statutes of the Internal Revenue Service or the R. I. Division of Taxation. In formation on this form will be shared within the Department of Labor and Training, the R. I. Divisi on of Taxation and the Internal Revenue Service. Independent Contractor: ____________________________________________________________________ Signature Date A hiring entity that knowingly assists, aids and abets, solicits, conspires with or coerces an employee to misrepresent the employees status as an independent contractor may be subject to criminal prosecution under Rhode Island General Law 28-33-17.3. * This information is available to the public including the Hiring Entitys Workers Compensation Insurance Carrier. FORM IS NOT VALID UNTIL RECEIVED AND DATE STAMPED BY THIS DEPARTMENT. For a dated receipt copy, include a copy with the original sent to the Department of Labor and Training with a SELF-ADDRESSED STAMPED ENVELOPE. The original and copy will be date stamped. The original will be retained for our files. The stamped copy will be returned in the envelope provided. DWC-11-IC (12-02)) <<<<<<<<<********>>>>>>>>>>>>> 2DWC-11-IC Reverse Side This is a form DWC11-IC, Designation of Independent Contractor. This means that you have stated that you are an independent contractor NOT an employee and are NOT eligible for Workers Compensation benefits. Many factors are considered when determining whether someone is an employee or an independent contractor. Some of those factors are: independent contractors set their own work hours, have their own tools and work when and for whom they choose. An employer generally does not have to withhold or pay any taxes on payment to independent contractors, such as social security, Medicare, unemployment and Temporary Disability Insurance (TDI). This form is for purposes of Workers Compensation, and completion of this form does not mean that you are considered an Independent Contractor under the rules, regulations or statutes of the Internal Revenue Service or the R.I. Division of Taxation. SHOULD YOU HAVE ANY QUESTIONS ABOUT WHETHER YOU ARE AN INDEPENDENT CONTRACTOR OR AN EM PLOYEE, PLEASE CONTACT THE R.I. DIVISION OF TAXATION AT (401) 222-3682, OR THE US GOVERNMENT INTERNAL REVENUE SERVICE AT 800-829-1040. IF YOU FEEL YOU HAVE BEEN COERCED OR FORCED TO SIGN THE INDEPENDENT CONTRACTOR FO RM, REPORT THIS TO THE WORKERS COMPENSATION FRA UD PREVENTION UNIT AT (401) 462- 8110. When your work as an independent contractor ends with this employer, complete and return the form titled Notice of Withdrawal of Designation as Independent Contractor, DWC-11-ICR, to the Department of Labor & Training, Workers Compensation Unit. If you have a question, contact the Workers Compensation Unit at (401) 462-8081. For further information, contact the Workers Compensation Information Line at (401) 462-8125. DWC-11-IC (12-02))