Last updated: 4/20/2020

Chapter 12 Debtors Certifications Regarding Domestic Support Obligations

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

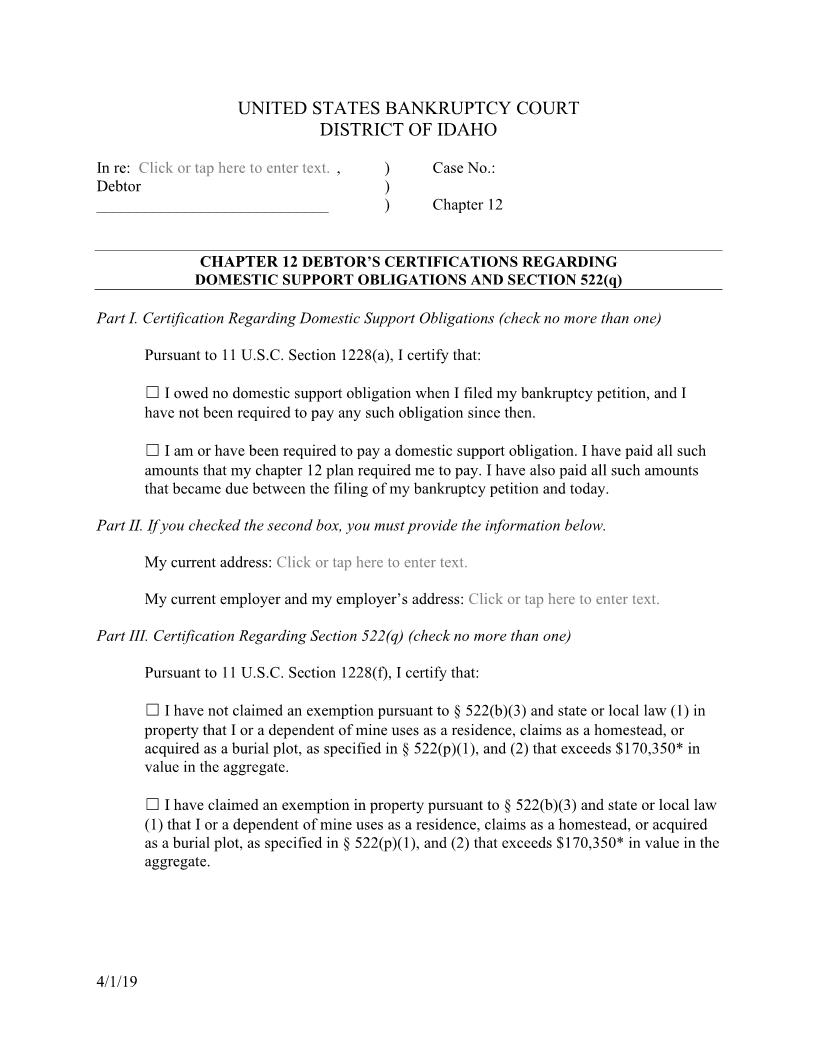

(9/17) UNITED STATES BANKRUPTCY COURT DISTRICT OF IDAHO In re: Click or tap here to enter text. , ) Case No.: Debtor ) ) Chapter 12 CHAPTER 12 DOMESTIC SUPPORT OBLIGATIONS AND SECTION 522(q) Part I. Certification Regarding Domestic Support Obligations (check no more than one) Pursuant to 11 U.S.C. Section 1 2 28(a), I certify that: I owed no domestic support obligation when I filed my bankruptcy petition, and I have not been required to pay any such obligation since then. I am or have been required to pay a domestic support obligation. I have paid all such amounts that my chapter 1 2 plan required me to pay. I have also paid all such amounts that became due between the filing of my bankruptcy petition and today. Part II. If you checked the second box, you must provide the information below. My current address: Click or tap here to enter text. Click or tap here to enter text. Part III. Certification Regarding Section 522(q) (check no more than one) Pursuant to 11 U.S.C. Section 1 2 28( f ), I certify that: I have not claimed an exemption pursuant to 247 522(b)(3) and state or local law (1) in property that I or a dependent of mine uses as a residence, claims as a homestead, or acquired as a burial plot, as specified in 247 522(p)(1), and (2) that exceeds $160,3 75* in value in the aggregate. I have claimed an exemption in property pursuant to 247 522(b)(3) and state or local law (1) that I or a dependent of mine uses as a residence, claims as a homestead, or acquired as a burial plot, as specified in 247 522(p) (1), and (2) that exceeds $160,375* in value in the aggregate. American LegalNet, Inc. www.FormsWorkFlow.com (9/17) I certify under penalty of perjury that the information provided in these certifications is true and correct to the best of my knowledge and belief. Exec uted on Click or tap here to enter text. Date Debtor American LegalNet, Inc. www.FormsWorkFlow.com