Last updated: 2/7/2020

Accounting By Personal Representative {20}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

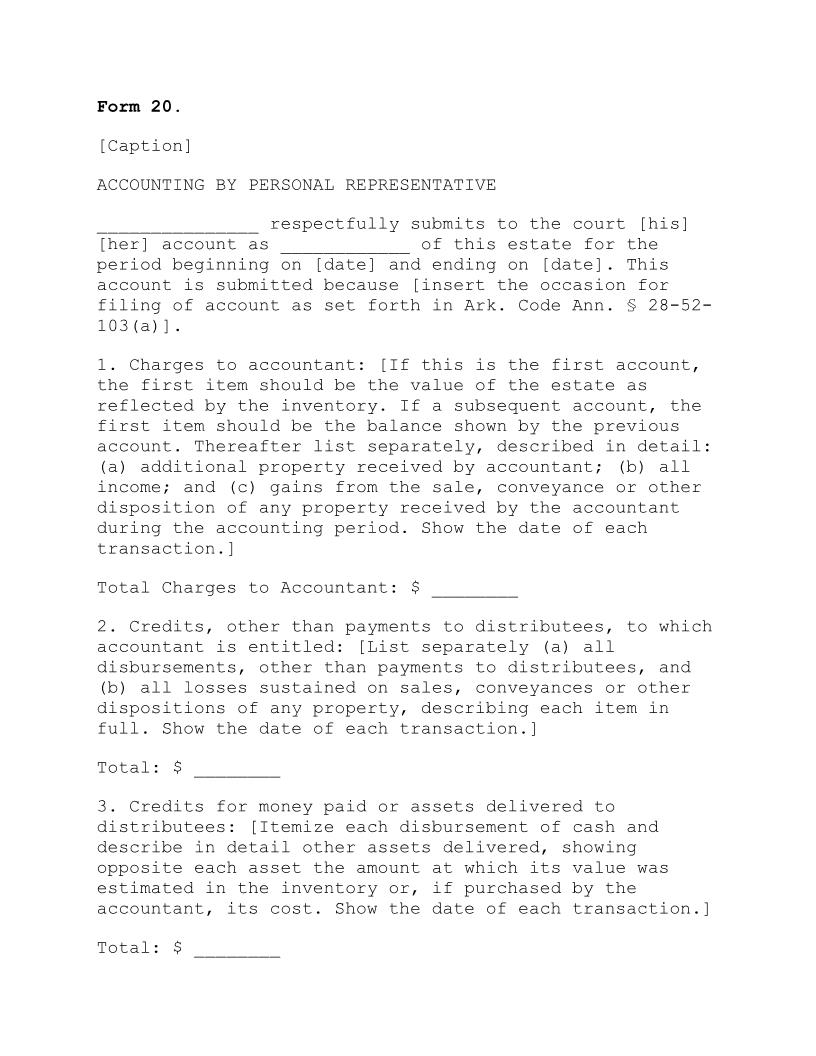

11/30/2016 Form 20 Accounting by Personal Representative Form 20. [Caption] ACCOUNTING BY PERSONAL REPRESENTATIVE _______________ respectfully submits to the court [his] [her] account as ____________ of this estate for the period beginning on [date] and ending on [date]. This account is submitted because [insert the occasion for filing of account as set forth in Ark. Code Ann. § 2852103(a)]. 1. Charges to accountant: [If this is the first account, the first item should be the value of the estate as reflected by the inventory. If a subsequent account, the first item should be the balance shown by the previous account. Thereafter list separately, described in detail: (a) additional property received by accountant (b) all income and (c) gains from the sale, conveyance or other disposition of any property received by the accountant during the accounting period. Show the date of each transaction.] Total Charges to Accountant: $ ________ 2. Credits, other than payments to distributees, to which accountant is entitled: [List separately (a) all disbursements, other than payments to distributees, and (b) all losses sustained on sales, conveyances or other dispositions of any property, describing each item in full. Show the date of each transaction.] Total: $ ________ 3. Credits for money paid or assets delivered to distributees: [Itemize each disbursement of cash and describe indetail other assets delivered, showing opposite each asset the amount at which its value was estimated in the inventory or, if purchased by the accountant, its cost. Show the date of each transaction.] Total: $ ________ SUMMARY OF ACCOUNT Charges to accountant: $ ________ Credits as per paragraph 2: $ ________ Credits as per paragraph 3: $ ________ Total Credits: $ ________ Balance remaining in hands of accountant: $ ________ 4. Description of balance remaining in hands of accountant: [List separately and describe in detail each item of property remaining in the accountant's hands, showing the inventory value or cost of each.] https://courts.arkansas.gov/system/files/form20.html American LegalNet, Inc. www.FormsWorkFlow.com 1/2 11/30/2016 Form 20 Accounting by Personal Representative 5. Changes in form of assets not affecting balance: [List separately and describe in detail all changes in the form of assets resulting from collections or sales at inventory or cost value and other such transactions. Show the date of each transaction.] 6. All outstanding liabilities of the estate of which accountant has knowledge are: Total Liabilities: $ ________ Vouchers evidencing cash disbursements and receiptsevidencing other assets delivered for which accountant has taken credit are attached to this account. THEREFORE, having fully accounted for the administration of this estate for the period set out above, accountant requests that, after proper advertisement and notice, if any, required by law or by the court, this account be examined, approved, and confirmed by the court, and that accountant be allowed the sum of $ ________ as [his] [her] fee for services rendered during the period covered by this account. ________________________________ [Signature] [Affidavit] Reporter's Notes to Form 20: See Ark. Code Ann. §§ 2852103 2852104. In the case of a final account, a request for an order of final distribution should be added, pursuant to Ark. Code Ann. § 2852105(b). This form should be filed by the personal representative unless the requirement is waived pursuant to Ark. Code Ann. § 2852104(c). Verification of the account is required by Ark. Code Ann. § 2852103(a). Form 31 is to be used for an accounting by a guardian. https://courts.arkansas.gov/system/files/form20.html American LegalNet, Inc. www.FormsWorkFlow.com 2/2