Last updated: 11/14/2019

Judgment On Writ Of Garnishment Claim Of Exemption And Order To Pay {4-811}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

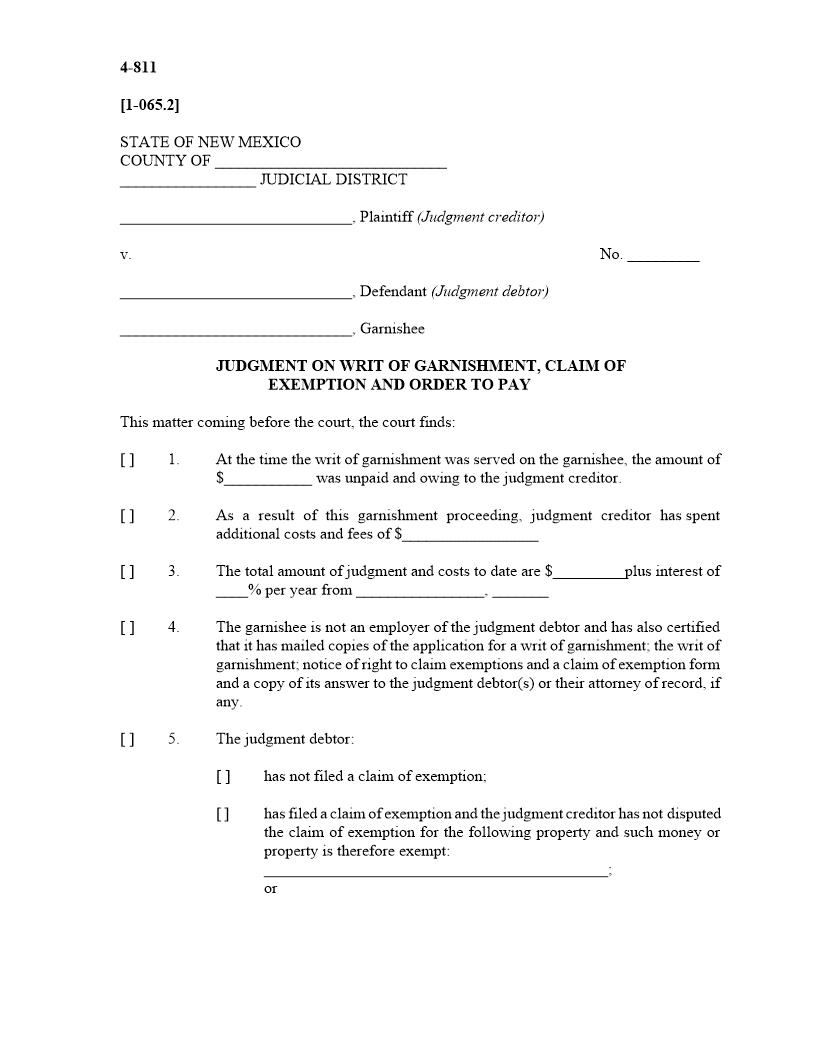

4-811[1-065.2]STATE OF NEW MEXICOCOUNTY OF JUDICIAL DISTRICT, Plaintiff (Judgment creditor)v.No. , Defendant (Judgment debtor), GarnisheeJUDGMENT ON WRIT OF GARNISHMENT, CLAIM OF EXEMPTION AND ORDER TO PAYThis matter coming before the court, the court finds:[ ]1.At the time the writ of garnishment was served on the garnishee, the amount of$ was unpaid and owing to the judgment creditor.[ ]2.As a result of this garnishment proceeding, judgment creditor has spentadditional costs and fees of $[ ]3.The total amount of judgment and costs to date are $plus interest of% per year from , [ ]4.The garnishee is not an employer of the judgment debtor and has also certifiedthat it has mailed copies of the application for a writ of garnishment; the writ ofgarnishment; notice of right to claim exemptions and a claim of exemption formand a copy of its answer to the judgment debtor(s) or their attorney of record, ifany.[ ]5.The judgment debtor:[ ]has not filed a claim of exemption;[ ]has filed a claim of exemption and the judgment creditor has not disputedthe claim of exemption for the following property and such money orproperty is therefore exempt:;or American LegalNet, Inc. www.FormsWorkFlow.com 2[ ]has filed a claim of exemption which has been disputed and after ahearing, the court finds that the following property is exempt fromgarnishment:[ ]6.The garnishee:[ ]is in default;[ ]is indebted to the judgment debtor in the amount of $;[ ]is indebted to the judgment debtor for wages;[ ]is not indebted to the judgment debtor;[ ]holds property of the judgment debtor; [ ]does not hold property of the judgment debtor.[ ]7.Pursuant to the Support Enforcement Act, the garnishee:[ ]is withholding $ of the judgment debtor's income pursuantto a Notice to Withhold Income;or[ ]is not withholding any income of the judgment debtor pursuant to sucha Notice.[ ]8.Pursuant to Section 35-12-16 NMSA 1978, the judgment creditor:[ ]is entitled to additional fees and costs of $; or[ ]is not entitled to additional fees and costs.THE COURT ORDERS:1.Default judgment against garnishee[ ]The judgment creditor recover from the garnishee the sum of $, plus percent per annum interest from the date the application wasexecuted, the garnishee having failed to answer the writ; American LegalNet, Inc. www.FormsWorkFlow.com 3or2.Payment of money other than wages[ ]The judgment creditor recover from the garnishee the sum of $, whichincludes percent per annum interest thereon from the date theapplication was executed to the date the answer was filed, such sum being heldby garnishee other than as wages;or3.Wage withholding other than child or spousal support[ ] The judgment being other than for child or spousal support, the judgment creditorrecover from the garnishee the sum of $, plus interest at the originaljudgment rate, until paid in full, to be deducted from the judgment debtor'swages.The garnishee shall pay the judgment debtor only:(a)75% of judgment debtor's disposable earnings (salary less socialsecurity, federal and state tax withholdings, and any otherdeduction required by law) for any pay period;OR(b)an amount each week equal to forty times the federal minimumhourly wage rate;whichever is greater.The balance of the judgment debtor's disposable earnings shall be paid over tothe judgment creditor each payday until the judgment herein is satisfied, afterthis balance is first used to pay any prior garnishment. If the wages of thejudgment debtor are not subject to garnishment because of the application of theformula set forth above, this order shall continue and shall automatically takeeffect when the wages of the judgment debtor shall increase to an amount whichcreates disposable earnings based upon the formula set forth above.4.Wage withholding for child or spousal support[ ]No prior writ or order. The order or decree being for child or spousal support,the judgment creditor shall recover from the garnishee the sum of $,plus interest at the original judgment rate, until paid in full, to be deducted fromthe judgment debtor's wages. The garnishee shall pay the judgment debtor 50%of judgment debtor's disposable earnings (salary less social security, federal and American LegalNet, Inc. www.FormsWorkFlow.com 4state tax withholdings, and any other deduction required by law) for any payperiod. If there is no prior garnishment, the balance of the judgment debtor'sdisposable earnings each payday shall be paid to satisfy this judgment.[ ]Prior writ or order. If there is a prior garnishment (one that was served on thegarnishee prior to the date and time the garnishment in this case was served), upto fifty percent (50%) of the judgment debtor's disposable earnings each payperiod shall be paid as follows:first, the amount provided for in the judgment entered on the prior writof garnishment shall be applied to the prior garnishment. If a judgmenthas not yet been entered on the prior writ of garnishment, the garnisheeshall withhold the amount ordered by the prior writ of garnishment to beapplied to the prior writ of garnishment when the judgment is entered;next, until all prior writs have been fully satisfied, the remainder of thebalance of fifty percent (50%) of the judgment debtor's disposableearnings shall be paid to this judgment creditor to satisfy the child orspousal support order. Upon satisfaction of all prior writs ofgarnishment, the entire balance of the judgment debtor's disposableearnings shall be applied to satisfy this child or spousal support orderjudgment. If the wages of the judgment debtor are not subject togarnishment because of the application of the formula set forth above,this order shall continue and shall automatically take effect when thewages of the judgment debtor shall increase to an amount which createsdisposable earnings based upon the formula set forth above.[ ]Prior child or spousal support writ. Upon motion of the judgment debtor, thiscourt orders the distribution of the judgment debtor's child or spousal supportobligations as follows: If the moneys being withheld pursuant to a notice to withhold income under theSupport Enforcement Act exceed the otherwise garnishable amounts thisgarnishment shall continue in effect until the notice to withhold income has beenvoided, modified, suspended or terminated, at which time the full amountallowed for garnishment shall be paid to the judgment creditor.If the wages being withheld pursuant to a notice to withhold income under theSupport Enforcement Act are less than twenty-five percent (25%) of thejudgment debtor's disposable earnings, the difference between the amountwithheld for child or spousal support and the amount equal to twenty-five percent(25%) of the judgment debtor's disposable earnings shall be paid to the judgmentcreditor, until the child or spousal support notice to withhold income has beenvoided, modified, suspended or terminated, at which time the full amountallowed for garnishment shall be paid to the judgment creditor. American LegalNet, Inc. www.FormsWorkFlow.com 55.Money or property other than wages[ ]The money or property held by the garnishee is exempt from garnishment and thewrit of garnishment in this case is hereby released and discharged; and thegarnishee no longer has any obligation to withhold wages, money or propertyfrom the judgment debtor on account of that writ.[ ]The garnishee, having no money or property of the judgment debtor, isdischarged and released from the writ of garnishment.[ ]The garnishee shall turn over to the judgment creditor the property of thejudgment debtor shown on Exhibit A attached hereto.6.Costs and fees[ ]The judgment creditor is awarded, in addition to the above amounts, the sum of$ as additional costs and fees pursuant to Section 35-12-16 NMSA1978.[ ]The garnishee shall be reimbursed $ for its costs and $for its attorney's fee, the same to be paid by the . If paid bythe judgment debtor said sum shall be paid from the first moneys otherwisepayable to the judgment creditor but shall not reduce the amount the judgmentcreditor is to be paid, as ordered above.7.PaymentsPayments under this order shall be sent to:(name of judgment creditor)(address of judgment creditor)(city, sta