Last updated: 1/24/2020

IOLTA Enrollment Form

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

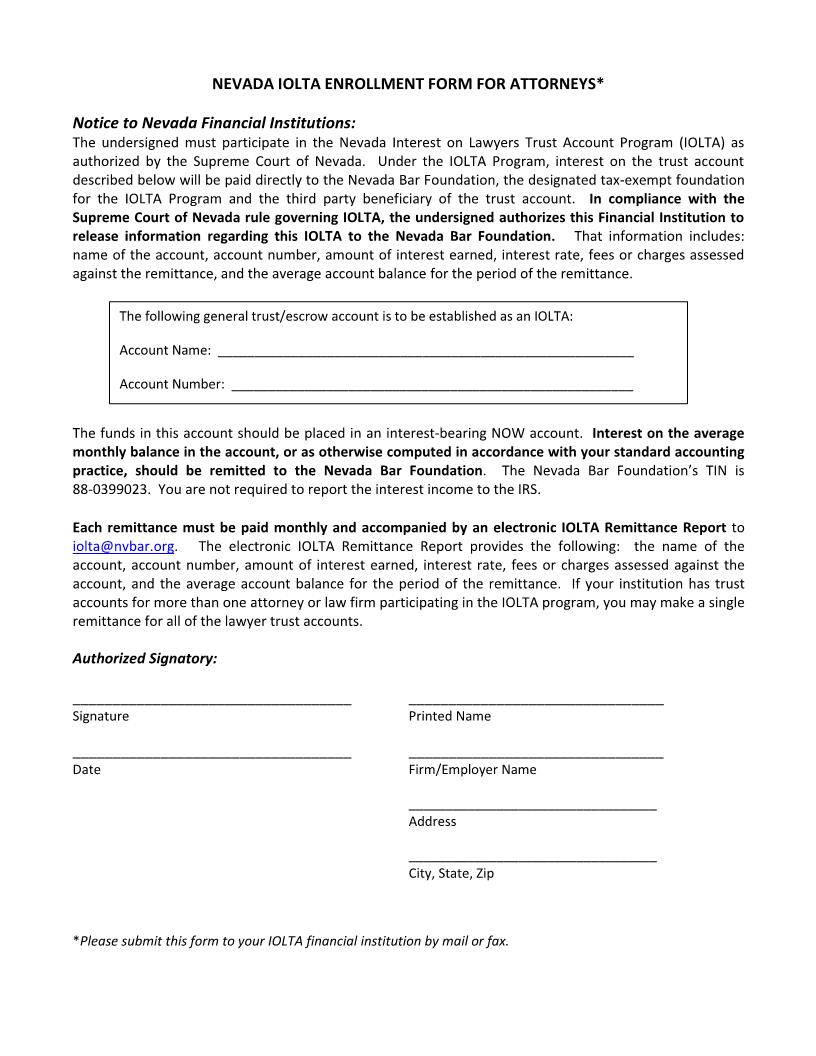

NEVADA IOLTA ENROLLMENT FORM FOR ATTORNEYS* Notice to Nevada Financial Institutions: The undersigned must participate in the Nevada Interest on Lawyers Trust Account Program (IOLTA) as authorized by the Supreme Court of Nevada. Under the IOLTA Program, interest on the trust account described below will be paid directly to the Nevada Bar Foundation, the designated tax-exempt foundation for the IOLTA Program and the third party beneficiary of the trust account. In compliance with the Supreme Court of Nevada rule governing IOLTA, the undersigned authorizes this Financial Institution to release information regarding this IOLTA to the Nevada Bar Foundation. That information includes: name of the account, account number, amount of interest earned, interest rate, fees or charges assessed against the remittance, and the average account balance for the period of the remittance. The funds in this account should be placed in an interest-bearing NOW account. Interest on the average monthly balance in the account, or as otherwise computed in accordance with your standard accounting practice, should be remitted to the Nevada Bar Foundation (P.O. Box 50, Las Vegas, Nevada 89125). The -0399023. You are not required to report the interest income to the IRS. Each remittance must be paid monthly and accompanied by an electronic IOLTA Remittance Report to atj@nvbar.org . The electronic IOLTA Remittance Report provides the following: the name of the account, account number, amount of interest earned, interest rate, fees or charges assessed against the account, and the average account balance for the period of the remittance. If your institution has trust accounts for more than one attorney or law firm participating in the IOLTA program, you may make a single remittance for all of the lawyer trust accounts. Authorized Signatory: Signature Printed Name Date Firm/Employer Name Address City, State, Zip *Please submit this form to your IOLTA financial institution by mail or fax. The following general trust/escrow account is to be established as an IOLTA: Account Name: Account Number: American LegalNet, Inc. www.FormsWorkFlow.com IOLTA Financial Institution Electronic Remittance Reporting Instructions The purpose of the following Electronic Remittance Reporting Instructions is to ensure your reports interface successfully with the software Nevada Bar Foundation uses to analyze reports. The IOLTA Remittance Report must be in TAB delimited file or Excel file and must include the fields listed below. Even if you do not use one of these fields, the tab to indicate the field presence must be included. Please note that each financial institution operates internally according to its own unique operational procedures, so your financial institution might call some of these fields by different names. trustaccount firmname bankprbal gross handling net earningstart earningend rate 12345678 Doe 10000 1 0 1 01/01/2018 01/01/2018 .70 Electronic reporting definitions: trustaccount the Trust Account Number (Please do not include hyphens and spaces.). firmname bankprbal the average account balance during the reporting period. gross the gross interest earned. handling any fees charged to the account. net the interest earned during the reporting period. earningstart the start of the reporting period (MM/DD/YYYY). earningend the end of the reporting period (MM/DD/YYYY). rate the average interest rate paid on the account balance during the reporting period. Please save the file as your bank name and the month of the report (for example: financialinstitutionjan2017). Electronic reports should be emailed to atj@nvbar.org . Feel free to contact the Nevada Bar Foundation with questions at atj@nvbar.org . American LegalNet, Inc. www.FormsWorkFlow.com