Last updated: 10/29/2019

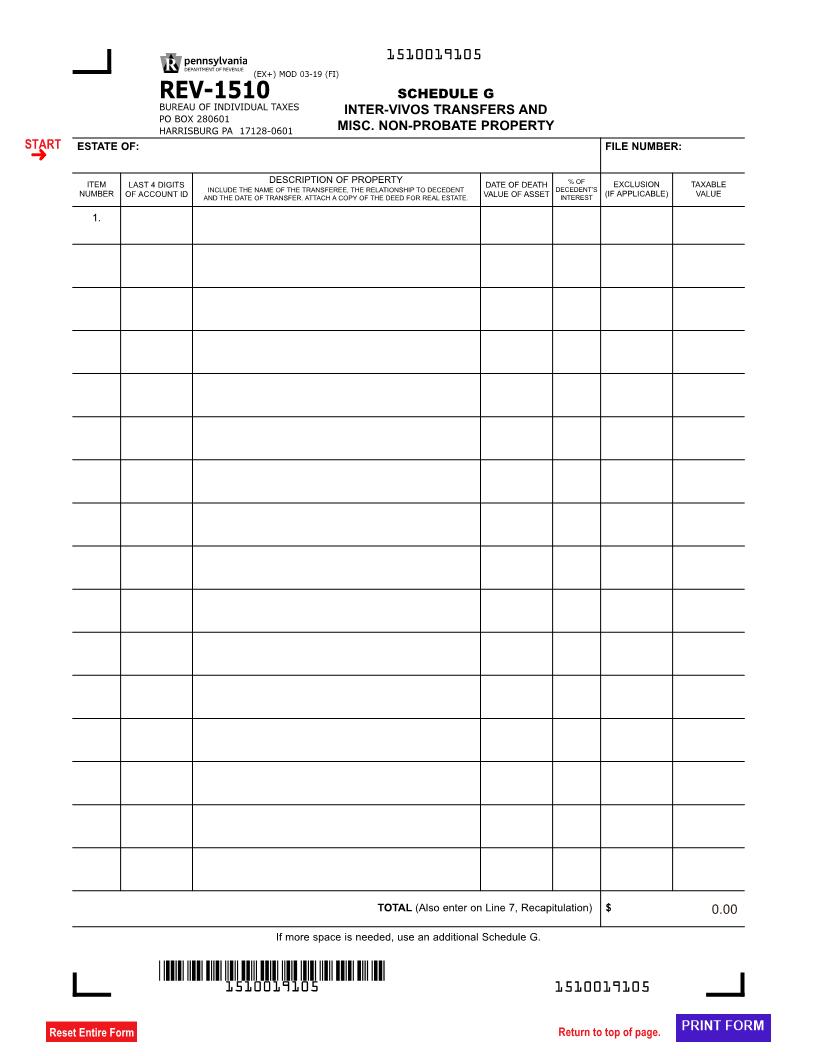

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property {REV-1510}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

REV-1510 EX+ (02-15) SCHEDULE G INHERITANCE TAX RETURN RESIDENT DECEDENT INTER-VIVOS TRANSFERS AND MISC. NON-PROBATE PROPERTY FILE NUMBER ESTATE OF This schedule must be completed and filed if the answer to any of questions 1 through 4 on page three of the REV-1500 is yes. ITEM NUMBER 1. DESCRIPTION OF PROPERTY INCLUDE THE NAME OF THE TRANSFEREE, THEIR RELATIONSHIP TO DECEDENT AND THE DATE OF TRANSFER. ATTACH A COPY OF THE DEED FOR REAL ESTATE. DATE OF DEATH % OF DECD'S VALUE OF ASSET INTEREST EXCLUSION (IF APPLICABLE) TAXABLE VALUE TOTAL (Also enter on Line 7, Recapitulation) $ If more space is needed, use additional sheets of paper of the same size. American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Out Of Existence Withdrawal Affidavit

Out Of Existence Withdrawal Affidavit

Pennsylvania/Statewide/Department Of Revenue/ -

Shedule H Funeral Expenses And Administrative Costs

Shedule H Funeral Expenses And Administrative Costs

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule O Deferral-Election Of Spousal Trusts

Schedule O Deferral-Election Of Spousal Trusts

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule M Future Interest Compromise

Schedule M Future Interest Compromise

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule K Life Estate Annuity And Term Certain

Schedule K Life Estate Annuity And Term Certain

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-1 Closely-Held Corporate Stock Information Report

Schedule C-1 Closely-Held Corporate Stock Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule N Spousal Poverty Credit

Schedule N Spousal Poverty Credit

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule A Real Estate

Schedule A Real Estate

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-2 Partnership Information Report

Schedule C-2 Partnership Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule D Mortgages And Notes Receivable

Schedule D Mortgages And Notes Receivable

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule E Cash Bank Deposits And Misc Personal Property

Schedule E Cash Bank Deposits And Misc Personal Property

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule J Beneficiaries

Schedule J Beneficiaries

Pennsylvania/Statewide/Department Of Revenue/ -

Estate Information Sheet

Estate Information Sheet

Pennsylvania/Statewide/Department Of Revenue/ -

Realty Transfer Tax Statement Of Value

Realty Transfer Tax Statement Of Value

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Nonresident Decedent

Inheritance Tax Return Nonresident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule F Jointly-Owned Property

Schedule F Jointly-Owned Property

Pennsylvania/Statewide/Department Of Revenue/ -

Safe Deposit Box Inventory

Safe Deposit Box Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Transfer

Notice Of Transfer

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule C-SB Qualified Family Owned Business Exemption

Schedule C-SB Qualified Family Owned Business Exemption

Pennsylvania/1 Statewide/Department Of Revenue/ -

Register Of Wills Monthly Report

Register Of Wills Monthly Report

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule AU Agriculture Use Exemptions

Schedule AU Agriculture Use Exemptions

Pennsylvania/1 Statewide/Department Of Revenue/ -

Appliction For Refund Of Inheritance Or Estate Tax

Appliction For Refund Of Inheritance Or Estate Tax

Pennsylvania/1 Statewide/Department Of Revenue/ -

Stocks And Or Bonds Inventory

Stocks And Or Bonds Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-1 Remainder Prepayment Election Assets

Schedule L-1 Remainder Prepayment Election Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-2 Remainder Prepayment Election Credits

Schedule L-2 Remainder Prepayment Election Credits

Pennsylvania/1 Statewide/Department Of Revenue/ -

Nonresident Decedent Affidavit Of Domicile

Nonresident Decedent Affidavit Of Domicile

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule A Part I Real Estate In Pennsylvania

Schedule A Part I Real Estate In Pennsylvania

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule E Part I Miscellaneous Personal Property

Schedule E Part I Miscellaneous Personal Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule F Part I Jointly Owned Assets

Schedule F Part I Jointly Owned Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/1 Statewide/Department Of Revenue/ -

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Pennsylvania/1 Statewide/Department Of Revenue/ -

Extension To File Inheritance Tax Return

Extension To File Inheritance Tax Return

Pennsylvania/1 Statewide/Department Of Revenue/ -

Identity Theft Affidavit

Identity Theft Affidavit

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Intent To Enter Safe Deposit Box

Notice Of Intent To Enter Safe Deposit Box

Pennsylvania/1 Statewide/Department Of Revenue/ -

Board Of Appeals Petition Form

Board Of Appeals Petition Form

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Resident Decedent

Inheritance Tax Return Resident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Sales Tax Exemption

Application For Sales Tax Exemption

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Tax Clearance Certificate

Application For Tax Clearance Certificate

Pennsylvania/Statewide/Department Of Revenue/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!