Last updated: 10/21/2019

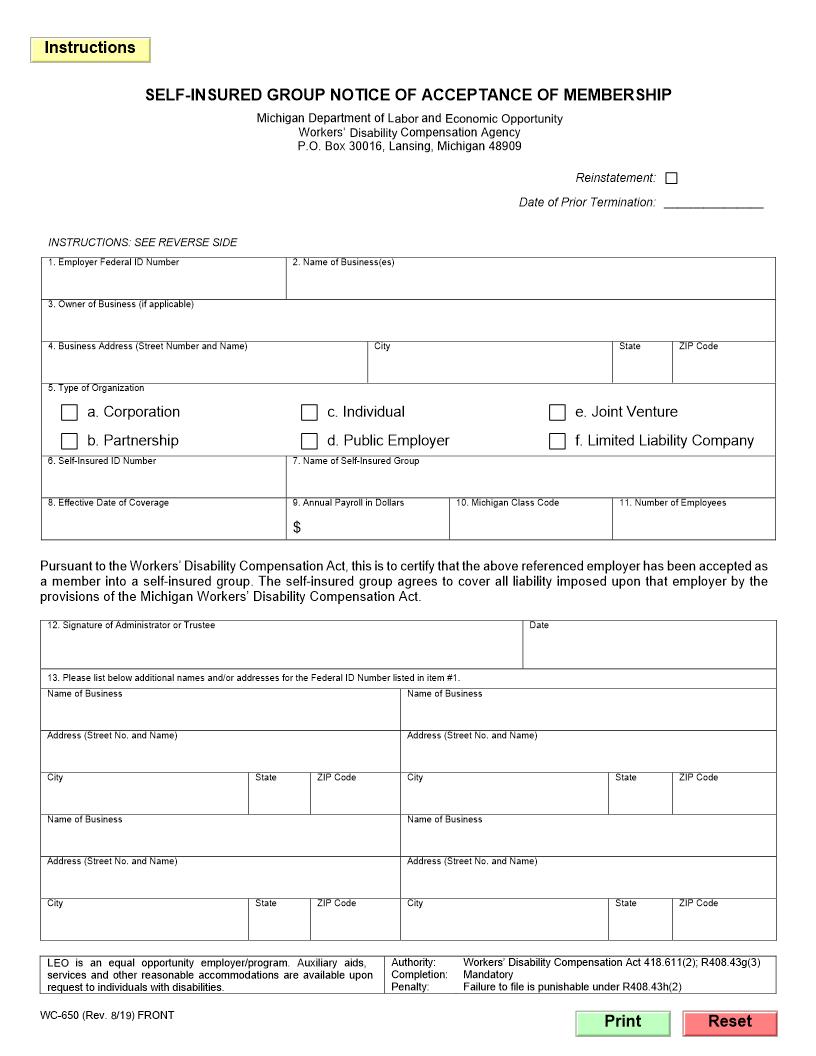

Self-Insured Group Notice Of Acceptance Of Membership {WC-650}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

SELF-INSURED GROUP NOTICE OF ACCEPTANCE OF MEMBERSHIP Michigan Department of Licensing and Regulatory Affairs Workers' Compensation Agency P.O. Box 30016, Lansing, Michigan 48909 Reinstatement: Date of Prior Termination: _______________ INSTRUCTIONS: SEE REVERSE SIDE 1. Employer Federal ID Number 2. Name of Business(es) 3. Owner of Business (if applicable) 4. Business Address (Street Number and Name) City State ZIP Code 5. Type of Organization a. Corporation b. Partnership 6. Self-Insured ID Number c. Individual d. Public Employer 7. Name of Self-Insured Group e. Joint Venture f. Limited Liability Company 8. Effective Date of Coverage 9. Annual Payroll in Dollars 10. Michigan Class Code 11. Number of Employees $ Pursuant to the Workers' Disability Compensation Act, this is to certify that the above referenced employer has been accepted as a member into a self-insured group. The self-insured group agrees to cover all liability imposed upon that employer by the provisions of the Michigan Workers' Disability Compensation Act. 12. Signature of Administrator or Trustee Date 13. Please list below additional names and/or addresses for the Federal ID Number listed in item #1. Name of Business Name of Business Address (Street No. and Name) Address (Street No. and Name) City State ZIP Code City State ZIP Code Name of Business Name of Business Address (Street No. and Name) Address (Street No. and Name) City State ZIP Code City State ZIP Code LARA is an equal opportunity employer/program. Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities. WC-650 (Rev. 9/11) FRONT Authority: Completion: Penalty: Workers' Disability Compensation Act 418.611(2); R408.43g(3) Mandatory Failure to file is punishable under R408.43h(2) American LegalNet, Inc. www.FormsWorkFlow.com Purpose of Form WC-650: To notify the Michigan Workers' Compensation Agency that an employer has become a member of a self-insured group. When Required: Must be filed with the Agency after the employer has been accepted as a member into a self-insured group. General Guidelines for Filing Form WC-650: (a) (b) (c) Form WC-650 is a continuous filing. Form WC-651, Self-Insured Group Notice of Termination of Membership, only needs to be filed when terminating membership for an employer, if there is a name change, or if an entity of the employer has been sold or is out of business. If a new entity is to be added to an existing membership, Form WC-650 must be filed which shows the additional business name, Federal ID Number, Michigan address, etc. Do not file Form WC-651 in this situation. If there are only address changes, a letter should be sent to the Agency identifying the business name, owner name, Federal ID Number of the employer, addresses to be added or deleted, and effective date for each address change. Form WC-650 and Form WC-651 should not be filed for address changes. INSTRUCTIONS FOR COMPLETION Item #1 Employer Federal Identification Number Enter the employer's Federal Identification Number. This is a nine digit number. If an individual (sole proprietor) does not have a Federal Identification Number, the Social Security Number of the individual will be accepted. A Federal ID number or a Social Security Number is required on all Form WC-650 filings. Item #2 Name of Business Enter the complete names of all the businesses including all assumed names (even if the names are not registered) and division names which operate under the same Federal ID Number listed in item #1. Additional assumed names or division names operating under the same Federal ID Number should be listed in item #13 on the lower portion of this form. If there are more than four additional names, another Form WC-650 must be completed. Do not place additional business or division names on the back of the Form WC-650. Separate Form WC-650's must be filed for each business which has a different Federal ID Number. Item #3 Owner Name List the complete name of the corporation, partnership, individual, public employer, joint venture, or limited liability company which owns the business. If item #2 is identical to item #3, leave item #3 blank. Item #4 Business Address The complete address of the business, including city, state, and zip code must be identified. Use street addresses, not post office box numbers. Additional Michigan addresses should be placed in item #13. If there are more than four additional addresses, they should be placed on an attached sheet which clearly identifies the Federal ID Number, name of business, and owner of the business. Item #5 Type of Organization State whether the employer is a corporation, partnership, individual, public employer, joint venture, or limited liability company. Item #6 Self-Insured ID Number Enter 8-digit Agency assigned self-insured group ID number and 3 digit service company ID number, if applicable. Item #7 Name of Self-Insured Group The full name of the group. Item #8 Effective Date of Coverage Date coverage is effective. Numeric (month/day/year). Item #9 Annual Payroll in Dollars Anticipated or actual annual payroll in dollars for the employer. Item #10 Michigan Class Code Use class code found in the Michigan Workers' Compensation Statistical Plan which shows the highest amount of payroll (other than standard exceptions). Item #11 Number of Employees Enter the number of employees for employer who are employed in Michigan. Item #12 Signature of Administrator or Trustee Must have an original signature in black or blue ink. Typed signatures are not acceptable. Include the date the form was signed. Item #13 Additional Names and/or Addresses of the Business See item #2 and item #4 for instructions. WC-650 (Rev. 9/11) BACK American LegalNet, Inc. www.FormsWorkFlow.com