Last updated: 5/20/2019

Articles Of For Profit Conversion {SS-9409}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

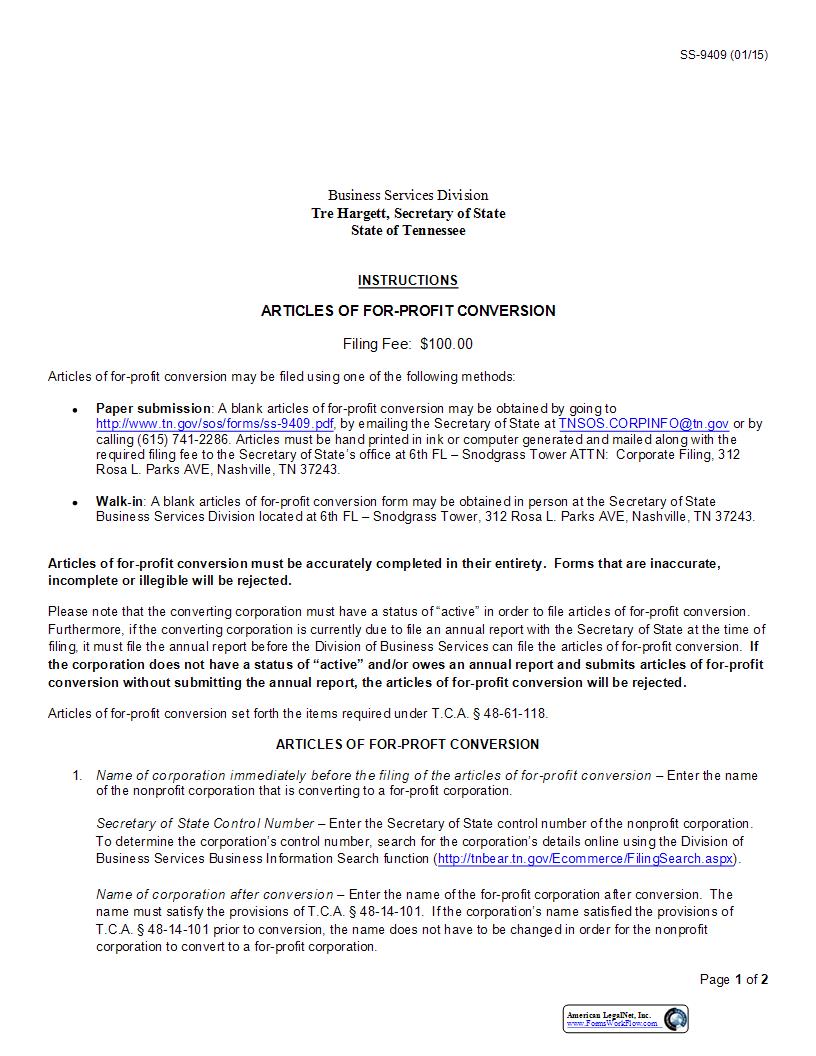

SS-9409 (01/15) Business Services Division Tre Hargett, Secretary of State State of Tennessee INSTRUCTIONS ARTICLES OF FOR-PROFIT CONVERSION Filing Fee: $100.00 Articles of for-profit conversion may be filed using one of the following methods: Paper submission: A blank articles of for-profit conversion may be obtained by going to http://www.tn.gov/sos/forms/ss-9409.pdf, by emailing the Secretary of State at TNSOS.CORPINFO@tn.gov or by calling (615) 741-2286. Articles must be hand printed in ink or computer generated and mailed along with the required filing fee to the Secretary of State222s office at 6th FL 226 Snodgrass Tower ATTN: Corporate Filing, 312 Rosa L. Parks AVE, Nashville, TN 37243. Walk-in: A blank articles of for-profit conversion form may be obtained in person at the Secretary of State Business Services Division located at 6th FL 226 Snodgrass Tower, 312 Rosa L. Parks AVE, Nashville, TN 37243. Articles of for-profit conversion must be accurately completed in their entirety. Forms that are inaccurate, incomplete or illegible will be rejected. Please note that the converting corporation must have a status of 223active224 in order to file articles of for-profit conversion. Furthermore, if the converting corporation is currently due to file an annual report with the Secretary of State at the time of filing, it must file the annual report before the Division of Business Services can file the articles of for-profit conversion. If the corporation does not have a status of 223active224 and/or owes an annual report and submits articles of for-profit conversion without submitting the annual report, the articles of for-profit conversion will be rejected. Articles of for-profit conversion set forth the items required under T.C.A. 247 48-61-118. ARTICLES OF FOR-PROFT CONVERSION 1. Name of corporation immediately before the filing of the articles of for-profit conversion 226 Enter the name of the nonprofit corporation that is converting to a for-profit corporation. Secretary of State Control Number 226 Enter the Secretary of State control number of the nonprofit corporation. To determine the corporation222s control number, search for the corporation222s details online using the Division of Business Services Business Information Search function (http://tnbear.tn.gov/Ecommerce/FilingSearch.aspx ). Name of corporation after conversion 226 Enter the name of the for-profit corporation after conversion. The name must satisfy the provisions of T.C.A. 247 48-14-101. If the corporation222s name satisfied the provisions of T.C.A. 247 48-14-101 prior to conversion, the name does not have to be changed in order for the nonprofit corporation to convert to a for-profit corporation. Page 1 of 2 American LegalNet, Inc. www.FormsWorkFlow.com If the new name contains the word 223bank224, 223banks224, 223banking224, 223credit union224 or 223trust224, written approval must first be obtained from the Tennessee Department of Financial Institutions before documents can be accepted for filing with the Division of Business Services. If the new name contains the phrase 223insurance company224, written approval must first be obtained from the Tennessee Department of Commerce & Insurance before documents can be accepted for filing with the Division of Business Services. 2. The plan of for-profit conversion was duly approved by the members, if any, in the manner required by this chapter and the charter - By signing the articles of for-profit conversion, the signer acknowledges the statement to be true. 3. If the converting entity is a public benefit nonprofit corporation 226 Mark the appropriate statement that is required if the nonprofit entity that is converting is a public benefit nonprofit corporation. 4. Attached is the charter, except that provisions that would not be required to be included in a charter of a domestic for-profit corporation may be omitted 226 Articles of for-profit conversion must be accompanied by the charter of the new Tennessee for-profit corporation. A for-profit corporation charter form may be obtained at http://www.tn.gov/sos/forms/ss-4417.pdf . 5. If the document is not to be effective upon filing by the Secretary of State, the delayed effective date and time is 226 If the conversion is the take place upon a future date, enter the future date. In no event can the future date be more than ninety calendar days from the filing of the articles of entity conversion. If no time is provided with the delayed effective date, the delayed effective time will be 4:30 P.M. Central Time. SIGNATURE The person executing the document must sign it and indicate the date of signature in the appropriate spaces. Failure to sign and date the document will result in the document being rejected. Type or Print Name. Failure to type or print the signature name will result in the document being rejected. Type or Print Signer222s Capacity. The signer must indicate the capacity in which such person signs. Failure to indicate the signer222s capacity will result in the document being rejected. FILING FEE The filing fee for articles of for-profit conversion is $100.00. Please note that the filing fee ($100) for the accompanying for-profit corporation charter must be tendered along with the filing fee for the articles of for-profit conversion. Failure to tender the fee for each submitted document will result in all documents being rejected. Make check, cashier222s check or money order payable to the Tennessee Secretary of State. Cash is only accepted for walk-in filings. Applications submitted without the proper filing fee will be rejected. Checks, cashier222s checks or money orders made out to any other payee than the Tennessee Secretary of State will not be accepted and will result in the rejection of document. Page 2 of 2 American LegalNet, Inc. www.FormsWorkFlow.com ARTICLES OF FOR-PROFIT CONVERSION (SS-9409) Business Services DivisionTre Hargett, Secretary of StateState of Tennessee312 Rosa L. Parks AVE, 6th Fl.Nashville, TN 37243-1102(615) 741-2286Filing Fee: $100.00 þ þ þ þ and the charter. 5 þ þ þ þ *Note: Pursuant to T.C.A. 247 10-7-503 all information on this form is public record. þ þ / þ / þ þ þ þ þ þ þ þ þ þ þ þ Name (printed or typed) þ þ þ þ þ þ ) þ American LegalNet, Inc. www.FormsWorkFlow.com