Last updated:

Chapter 13 Plan With Determination Of Interest Rates

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

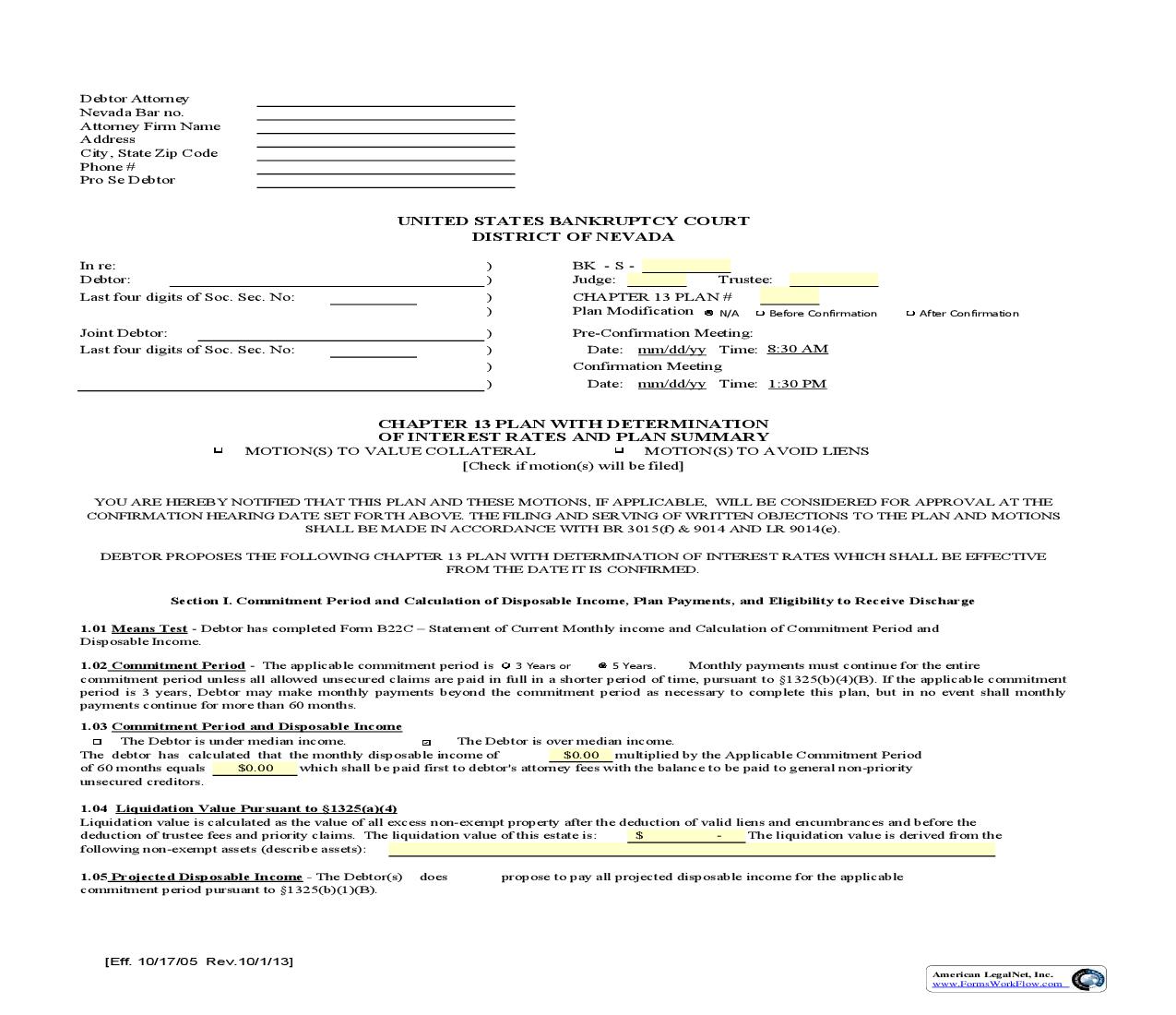

Debtor Attorney Nevada Bar no. Attorney Firm Name Address City, State Zip Code Phone # Pro Se Debtor 1 S Yarnall BAM N Leavitt LBR Van MeteMKN GWZ UNITED STATES BANKRUPTCY COURT DISTRICT OF NEVADA In re: Debtor: Last four digits of Soc. Sec. No: Joint Debtor: Last four digits of Soc. Sec. No: ) ) ) ) ) ) ) ) BK - S Judge: Trustee: Before Confirmation After Confirmation CHAPTER 13 PLAN # Plan Modification N/A Pre-Confirmation Meeting: Date: mm/dd/yy Time: 8:30 AM Confirmation Meeting Date: mm/dd/yy Time: 1:30 PM ## CHAPTER 13 PLAN WITH DETERMINATION OF INTEREST RATES AND PLAN SUMMARY MOTION(S) TO VALUE COLLATERAL MOTION(S) TO AVOID LIENS [Check if motion(s) will be filed] YOU ARE HEREBY NOTIFIED THAT THIS PLAN AND THESE MOTIONS, IF APPLICABLE, WILL BE CONSIDERED FOR APPROVAL AT THE CONFIRMATION HEARING DATE SET FORTH ABOVE. THE FILING AND SERVING OF WRITTEN OBJECTIONS TO THE PLAN AND MOTIONS SHALL BE MADE IN ACCORDANCE WITH BR 3015(f) & 9014 AND LR 9014(e). DEBTOR PROPOSES THE FOLLOWING CHAPTER 13 PLAN WITH DETERMINATION OF INTEREST RATES WHICH SHALL BE EFFECTIVE FROM THE DATE IT IS CONFIRMED. Section I. Commitment Period and Calculation of Disposable Income, Plan Payments, and Eligibility to Receive Discharge 1.01 Means Test - Debtor has completed Form B22C Statement of Current Monthly income and Calculation of Commitment Period and Disposable Income. 5 Years. Monthly payments must continue for the entire 1.02 Commitment Period - The applicable commitment period is 3 Years or commitment period unless all allowed unsecured claims are paid in full in a shorter period of time, pursuant to §1325(b)(4)(B). If the applicable commitment period is 3 years, Debtor may make monthly payments beyond the commitment period as necessary to complete this plan, but in no event shall monthly payments continue for more than 60 months. 1.03 Commitment Period and Disposable Income The Debtor is under median income. The Debtor is over median income. The debtor has calculated that the monthly disposable income of $0.00 multiplied by the Applicable Commitment Period of 60 months equals which shall be paid first to debtor's attorney fees with the balance to be paid to general non-priority $0.00 unsecured creditors. 1.04 Liquidation Value Pursuant to §1325(a)(4) Liquidation value is calculated as the value of all excess non-exempt property after the deduction of valid liens and encumbrances and before the The liquidation value is derived from the $ deduction of trustee fees and priority claims. The liquidation value of this estate is: following non-exempt assets (describe assets): 1.05 Projected Disposable Income - The Debtor(s) commitment period pursuant to §1325(b)(1)(B). does propose to pay all projected disposable income for the applicable does [Eff. 10/17/05 Rev.10/1/13] American LegalNet, Inc. www.FormsWorkFlow.com 1.06 The Debtor(s) shall pay the greater of disposable income as stated in 1.03 or liquidation value as stated in 1.04. does not 1.07 Future Earnings - The future earnings of Debtor shall be submitted to the supervision and control of Trustee as is necessary for the execution of the plan. 1.08 MONTHLY PAYMENTS: a. Debtor shall pay to the Trustee the sum of $0.00 for b. Monthly payments shall increase or decrease as set forth below: 60 The sum of $0.00 for The sum of $0.00 for The sum of $0.00 for 0 0 0 0 (# of months) commencing (# of months) commencing (# of months) commencing (# of months) commencing mm/dd/yy . Totaling mm/dd/yy . Totaling mm/dd/yy . Totaling mm/dd/yy . Totaling $0.00 $0.00 $0.00 $0.00 1.09 OTHER PAYMENTS - In addition to the submission of future earnings, Debtor will make non-monthly payment(s) derived from property of the bankruptcy estate or property of Debtor, or from other sources, as follows: Amount of payment Date Source of payment $ mm/yy $ mm/yy $ mm/yy $ mm/yy 1.10 TOTAL OF ALL PLAN PAYMENTS INCLUDING TRUSTEE FEES = 1.11 Trustees fees have been calculated at 10% of all plan payments which totals = $0.00 $0.00 This amount is included in 1.10 above. 1.12 Tax Refunds - Debtor shall turn over to the Trustee and pay into the plan annual tax refunds for the tax years: 2013 2014 2015 2016 2017 is eligible is not eligible 1.13 ELECTION TO PAY 100% OF ALL FILED AND ALLOWED GENERAL NON-PRIORITY UNSECURED CLAIMS a. 100% of all filed and allowed non-priority unsecured claims shall be paid by Trustee pursuant to this Plan. b. General unsecured creditors will be paid interest at the rate of 0% . [Check this box and insert the present value rate of interest - if debtors estate is solvent under §1325(a)(4).] 1.14 Statement of Eligibility to Receive Discharge a. Debtor, none is eligible to receive a Chapter 13 discharge pursuant to §1328 upon completion of all plan obligations. b. Joint Debtor is eligible to receive a Chapter 13 discharge pursuant to §1328 upon completion of all plan obligations. Section II. Claims and Expenses A. Proofs of Claim 2.01 A Proof of Claim must be timely filed by or on behalf of a priority or general non-priority unsecured creditor before a claim will be paid pursuant to this plan. 2.02 A CLASS 2A Secured Real Estate Mortgage Creditor shall be paid all post-petition payments as they become due whether or not a Proof of Claim is filed. The CLASS 2B secured real estate mortgage creditor shall not receive any payments on pre-petition claims unless a Proof of Claim has been filed. 2.03 A secured creditor may file a Proof of Claim at any time. A CLASS 3 or CLASS 4 secured creditor must file a Proof of Claim before the claim will be paid pursuant to this Plan. 2.04 Notwithstanding Section 2.01 and 2.03, monthly contract installments falling due after the filing of the petition shall be paid to each holder of a CLASS 1 and CLASS 6 secured claim whether or not a proof of claim is filed or the plan is confirmed. 2.05 Pursuant to §507(a)(1), payments on domestic support obligations (DSO) and payments on loans from retirement or thrift savings plans described in §362(b)(19) falling due after the filing of the petition shall be paid by Debtor directly to the person or entity entitled to receive such payments whether or not a proof of claim is filed or the plan is confirmed, unless agreed otherwise. 2.06 A Proof of Claim, not this plan or the schedules, shall determine the amount and the classification of a claim. Pursuant to §502(a) such claim or interest is deemed allowed unless objected to and the Court determines otherwise. a. Claims provided for by th

Related forms

-

Affidavit For Reimbursement Of Unclaimed Dividends

Affidavit For Reimbursement Of Unclaimed Dividends

Nevada/Federal/Bankruptcy Court/ -

Attorney Information Sheet For Proposed Order Shortening Time

Attorney Information Sheet For Proposed Order Shortening Time

Nevada/Federal/Bankruptcy Court/ -

Request For Special Notice

Request For Special Notice

Nevada/Federal/Bankruptcy Court/ -

Verification Of Creditor Matrix

Verification Of Creditor Matrix

Nevada/Federal/Bankruptcy Court/ -

Order Scheduling Settlement Conference - Las Vegas

Order Scheduling Settlement Conference - Las Vegas

Nevada/Federal/Bankruptcy Court/ -

Order Scheduling Settlement Conference - Reno

Order Scheduling Settlement Conference - Reno

Nevada/Federal/Bankruptcy Court/ -

Motion To File On Paper

Motion To File On Paper

Nevada/Federal/Bankruptcy Court/ -

Order Granting Permission To File On Paper

Order Granting Permission To File On Paper

Nevada/Federal/Bankruptcy Court/ -

Certificate Of Service

Certificate Of Service

Nevada/Federal/Bankruptcy Court/ -

Consent To Accept Electronic Service And Notice Of Motions Initiating Contested Matters

Consent To Accept Electronic Service And Notice Of Motions Initiating Contested Matters

Nevada/Federal/Bankruptcy Court/ -

Notice Of Change Of Address Of Attorney

Notice Of Change Of Address Of Attorney

Nevada/Federal/Bankruptcy Court/ -

Scheduling Order Re Pre-Trial And Trial

Scheduling Order Re Pre-Trial And Trial

Nevada/Federal/Bankruptcy Court/ -

Stipulation And Order Requesting New Creditors Meeting And Extension Of Deadlines

Stipulation And Order Requesting New Creditors Meeting And Extension Of Deadlines

Nevada/Federal/Bankruptcy Court/ -

Change Of Address Of Debtor Or Creditor Or Other

Change Of Address Of Debtor Or Creditor Or Other

Nevada/Federal/Bankruptcy Court/ -

Chapter 13 Plan

Chapter 13 Plan

Nevada/Federal/Bankruptcy Court/ -

Application For Trustees Approval Of Post Petition Consumer Credit - Reno

Application For Trustees Approval Of Post Petition Consumer Credit - Reno

Nevada/Federal/Bankruptcy Court/ -

Complaint Of Judicial Misconduct And Disability

Complaint Of Judicial Misconduct And Disability

Nevada/Federal/Bankruptcy Court/ -

Debtors Request For Permanent Exemption From Credit Counseling Or Participation In Financial Management Training

Debtors Request For Permanent Exemption From Credit Counseling Or Participation In Financial Management Training

Nevada/Federal/Bankruptcy Court/ -

Motion (Generic)

Motion (Generic)

Nevada/Federal/Bankruptcy Court/ -

Ex-Parte Motion To Reopen Case For The Issuance Of A Discharge

Ex-Parte Motion To Reopen Case For The Issuance Of A Discharge

Nevada/Federal/Bankruptcy Court/ -

Request For Redaction

Request For Redaction

Nevada/Federal/Bankruptcy Court/ -

Motion To Withdraw Duplicate Document And Waive Fees

Motion To Withdraw Duplicate Document And Waive Fees

Nevada/Federal/Bankruptcy Court/ -

Order Authorizing Withdrawal Of Duplicate Document And Waiver Of Fees

Order Authorizing Withdrawal Of Duplicate Document And Waiver Of Fees

Nevada/Federal/Bankruptcy Court/ -

Motion To Dismiss Duplicate Case And Waive Fees

Motion To Dismiss Duplicate Case And Waive Fees

Nevada/Federal/Bankruptcy Court/ -

Order Authorizing Dismissal Of Duplicate Case And Waiver Of Fees

Order Authorizing Dismissal Of Duplicate Case And Waiver Of Fees

Nevada/Federal/Bankruptcy Court/ -

Order To Value Collateral Order To Avoid Lien

Order To Value Collateral Order To Avoid Lien

Nevada/Federal/Bankruptcy Court/ -

Notice Of Termination Of Claims Agent

Notice Of Termination Of Claims Agent

Nevada/Federal/Bankruptcy Court/ -

Affidavit Of Service (Payment Of Unclaimed Funds)

Affidavit Of Service (Payment Of Unclaimed Funds)

-

Chapter 13 Plan With Determination Of Interest Rates

Chapter 13 Plan With Determination Of Interest Rates

-

CM-ECF Limited Use Registration (Mortgage Modification Mediation)

CM-ECF Limited Use Registration (Mortgage Modification Mediation)

-

Debtors Electronic Noticing Request (DeBN)

Debtors Electronic Noticing Request (DeBN)

-

Declaration Re Electronic Filing Of Petition, Statements And Plan

Declaration Re Electronic Filing Of Petition, Statements And Plan

-

Designation Of Local Counsel And Consent Thereto (Adversary)

Designation Of Local Counsel And Consent Thereto (Adversary)

-

Designation Of Local Counsel And Consent Thereto (Bankruptcy)

Designation Of Local Counsel And Consent Thereto (Bankruptcy)

-

Notice Of Hearing On Confirmation Of Chapter 13 Plan

Notice Of Hearing On Confirmation Of Chapter 13 Plan

-

Notice Of Hearing

Notice Of Hearing

-

Order Administratively Closing Individual Chapter 11 Case

Order Administratively Closing Individual Chapter 11 Case

-

Verified Petition For Permission To Practice (Not Admitted - Adversary)

Verified Petition For Permission To Practice (Not Admitted - Adversary)

-

Verified Petition For Permission To Practice (Not Admitted - Bankruptcy)

Verified Petition For Permission To Practice (Not Admitted - Bankruptcy)

-

Section 362 Information Sheet

Section 362 Information Sheet

Nevada/Federal/Bankruptcy Court/ -

Notice Of Hearing On Pro Se Debtors Motion To Approve Final Loan Modification Agreement

Notice Of Hearing On Pro Se Debtors Motion To Approve Final Loan Modification Agreement

Nevada/3 Federal/Bankruptcy Court/ -

Notice Of Election To Accept The Presumptive Fee In A Chapter 13 Case

Notice Of Election To Accept The Presumptive Fee In A Chapter 13 Case

Nevada/3 Federal/Bankruptcy Court/ -

Attorney Trustee Consent Form For Filing Agents

Attorney Trustee Consent Form For Filing Agents

Nevada/3 Federal/Bankruptcy Court/ -

CM ECF Limited Use Registration

CM ECF Limited Use Registration

Nevada/Federal/Bankruptcy Court/ -

CM ECF Auditor Registration Form

CM ECF Auditor Registration Form

Nevada/Federal/Bankruptcy Court/ -

Statement Of Responsibility For Attorneys Who Allow Staff To File Documents Electronically

Statement Of Responsibility For Attorneys Who Allow Staff To File Documents Electronically

Nevada/Federal/Bankruptcy Court/ -

Fee Application Cover Sheet

Fee Application Cover Sheet

Nevada/Federal/Bankruptcy Court/ -

CM ECF Registration Consent And Acknowledgment Of Responsibility

CM ECF Registration Consent And Acknowledgment Of Responsibility

Nevada/3 Federal/Bankruptcy Court/ -

Motion For Referral To The Mortgage Modification Program

Motion For Referral To The Mortgage Modification Program

Nevada/3 Federal/Bankruptcy Court/ -

Order On Motion For Referral To The Mortgage Modification Program

Order On Motion For Referral To The Mortgage Modification Program

Nevada/3 Federal/Bankruptcy Court/ -

Third Party Consent To Attend And Participate In Mortgage Modification Program

Third Party Consent To Attend And Participate In Mortgage Modification Program

Nevada/3 Federal/Bankruptcy Court/ -

Interim Report Of Program Manager

Interim Report Of Program Manager

Nevada/3 Federal/Bankruptcy Court/ -

Final Report Of Program Manager

Final Report Of Program Manager

Nevada/3 Federal/Bankruptcy Court/ -

Ex Parte Motion To Approve Trial Loan Modification Agreement

Ex Parte Motion To Approve Trial Loan Modification Agreement

-

Order Approving Trial Loan Modification Agreement

Order Approving Trial Loan Modification Agreement

-

Motion To Approve Final Loan Modification Agreement

Motion To Approve Final Loan Modification Agreement

-

Order Approving Final Loan Modification Agreement

Order Approving Final Loan Modification Agreement

-

Request For Mortgage Modification Status Conference

Request For Mortgage Modification Status Conference

Nevada/3 Federal/Bankruptcy Court/ -

Notice Of Hearing On Request For Mortgage Modification Status Conference

Notice Of Hearing On Request For Mortgage Modification Status Conference

Nevada/3 Federal/Bankruptcy Court/ -

Ex Parte Application For Compensation And Reimbursement Of MMP Expenses

Ex Parte Application For Compensation And Reimbursement Of MMP Expenses

-

Order Approving Ex Parte Application For Compensation And Reimbursement Of MMP Expenses

Order Approving Ex Parte Application For Compensation And Reimbursement Of MMP Expenses

Nevada/3 Federal/Bankruptcy Court/ -

Certificate Of Non Compliance

Certificate Of Non Compliance

Nevada/Federal/Bankruptcy Court/ -

Notice Of Remote Hearing (Bankruptcy)

Notice Of Remote Hearing (Bankruptcy)

Nevada/Federal/Bankruptcy Court/ -

Notice Of Remote Hearing (Adversary)

Notice Of Remote Hearing (Adversary)

Nevada/Federal/Bankruptcy Court/ -

Order Form For Court Hearing Recordings

Order Form For Court Hearing Recordings

Nevada/Federal/Bankruptcy Court/ -

Application For Payment Of Unclaimed Funds

Application For Payment Of Unclaimed Funds

Nevada/3 Federal/Bankruptcy Court/ -

Transcript Order Form

Transcript Order Form

Nevada/Federal/Bankruptcy Court/ -

Standard Discovery Plan Or Request For Waiver Of Filing Discovery Plan

Standard Discovery Plan Or Request For Waiver Of Filing Discovery Plan

Nevada/Federal/Bankruptcy Court/ -

Motion For Exemption From Payment Of The Pacer User Fee

Motion For Exemption From Payment Of The Pacer User Fee

Nevada/Federal/Bankruptcy Court/ -

Certificate Of Compliance In a Subchapter V Of Chapter 11 Case

Certificate Of Compliance In a Subchapter V Of Chapter 11 Case

Nevada/3 Federal/Bankruptcy Court/ -

Ex Parte Motion To Reopen Case For Issuance Of Discharge

Ex Parte Motion To Reopen Case For Issuance Of Discharge

-

Order Reopening Case For The Issuance Of A Discharge

Order Reopening Case For The Issuance Of A Discharge

Nevada/Federal/Bankruptcy Court/ -

Proof Of Interest

Proof Of Interest

Nevada/Federal/Bankruptcy Court/ -

Exhibit (Log)

Exhibit (Log)

Nevada/Federal/Bankruptcy Court/ -

Debtors Certificate Of Compliance With Conditions Reated To Entry Of Discharge

Debtors Certificate Of Compliance With Conditions Reated To Entry Of Discharge

Nevada/3 Federal/Bankruptcy Court/ -

Chapter 13 Debtors Certificate Of Compliance Regarding Plan Payments

Chapter 13 Debtors Certificate Of Compliance Regarding Plan Payments

Nevada/3 Federal/Bankruptcy Court/ -

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (Leavitt)

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (Leavitt)

Nevada/Federal/Bankruptcy Court/ -

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (VanMeter)

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (VanMeter)

Nevada/Federal/Bankruptcy Court/ -

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (Yarnall)

Debtors Certificate Of Compliance Related To Motion For Hardship Discharge (Yarnall)

Nevada/Federal/Bankruptcy Court/ -

Writ Of Execution (Adversary)

Writ Of Execution (Adversary)

Nevada/Federal/Bankruptcy Court/ -

Writ Of Execution

Writ Of Execution

Nevada/Federal/Bankruptcy Court/ -

Entry Of Deafult

Entry Of Deafult

Nevada/Federal/Bankruptcy Court/ -

Creditor Matrix

Creditor Matrix

Nevada/Federal/Bankruptcy Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!