Last updated: 4/11/2019

Chapter 13 Plan {3015-1}

Start Your Free Trial $ 29.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

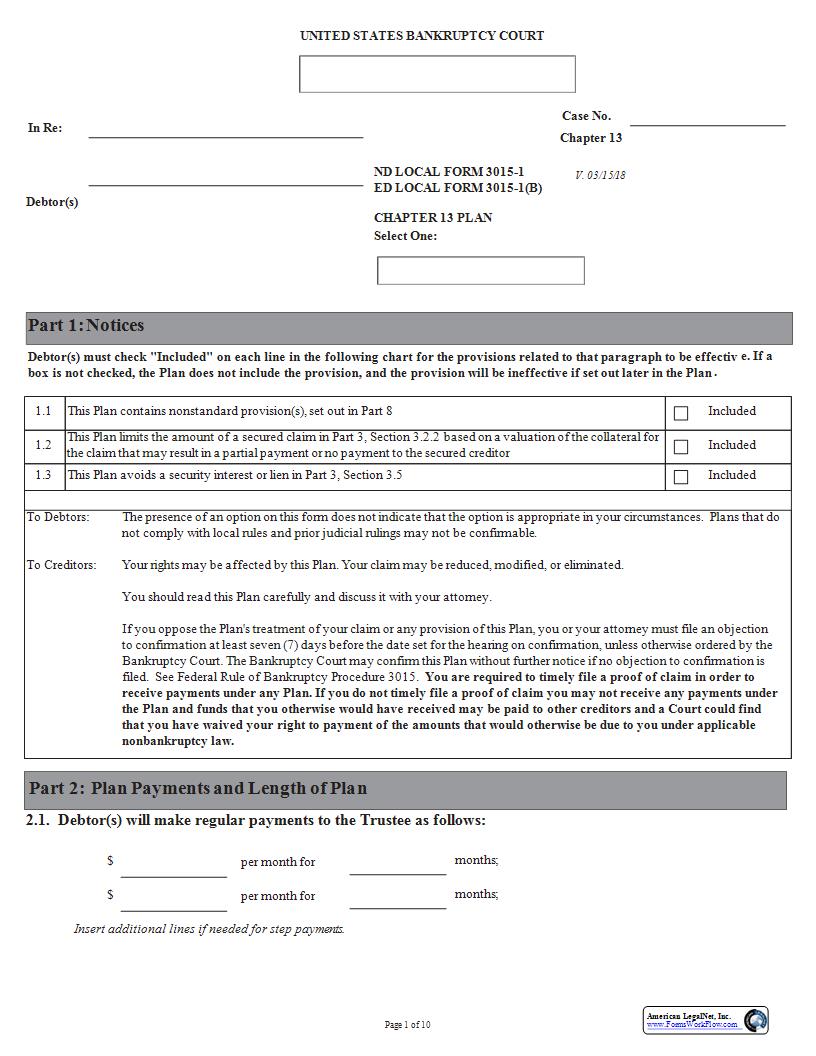

Page 1 of 10 UNITED STATES BANKRUPTCY COURT Case No.Chapter 13ND LOCAL FORM 3015-1 ED LOCAL FORM 3015-1(B)Select One:CHAPTER 13 PLAN Part 1:NoticesDebtor(s) must check "Included" on each line in the following chart for the provisions related to that paragraph to be effective. If a box is not checked, the Plan does not include the provision, and the provision will be ineffective if set out later in the Plan.Debtor(s) In Re: V. 03/15/18 1.1 This Plan contains nonstandard provision(s), set out in Part 8 Included 1.2 This Plan limits the amount of a secured claim in Part 3, Section 3.2.2 based on a valuation of the collateral for the claim that may result in a partial payment or no payment to the secured creditor Included 1.3 This Plan avoids a security interest or lien in Part 3, Section 3.5 Included To Debtors: The presence of an option on this form does not indicate that the option is appropriate in your circumstances. Plans that do not comply with local rules and prior judicial rulings may not be confirmable. To Creditors: Your rights may be affected by this Plan. Your claim may be reduced, modified, or eliminated. You should read this Plan carefully and discuss it with your attorney. If you oppose the Plan's treatment of your claim or any provision of this Plan, you or your attorney must file an objection to confirmation at least seven (7) days before the date set for the hearing on confirmation, unless otherwise ordered by the Bankruptcy Court. The Bankruptcy Court may confirm this Plan without further notice if no objection to confirmation is filed. See Federal Rule of Bankruptcy Procedure 3015. You are required to timely file a proof of claim in order to receive payments under any Plan. If you do not timely file a proof of claim you may not receive any payments under the Plan and funds that you otherwise would have received may be paid to other creditors and a Court could find that you have waived your right to payment of the amounts that would otherwise be due to you under applicable nonbankruptcy law. Part 2:Plan Payments and Length of Plan2.1. Debtor(s) will make regular payments to the Trustee as follows: $per month for months; $per month for months;Insert additional lines if needed for step payments. American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 10Plan payments to the Trustee shall commence on or before 30 days after the Chapter 13 Petition is filed. The Trustee's preset percentage fee established by the Attorney General of the United States or its designee shall be deducted from each payment upon receipt and transferred to the Chapter 13 Expense Account. If the Trustee is paying current ongoing postpetition mortgage payments under Section 3.1 of this Plan, upon the filing of a Notice of Payment Change by the mortgage servicer under Federal Rule of Bankruptcy Procedure 3002.1(b), or a Notice of Fees, Expenses and Charges under Federal Rule of Bankruptcy Procedure 3002.1(c), the Trustee is authorized (but not required) to increase the Debtor(s)' Plan payments to accommodate any increases stated in the notice(s) without necessity of formal modification of the Plan. In the event that the Plan payment is increased by the Trustee under this provision, the Debtor(s) and Debtor(s)' Attorney will be given seven (7) days' notice and opportunity to object to such increase.2.2 Income tax refunds. Debtor(s) will timely file all required income tax returns and supply the Trustee with a complete copy (including all attachments) of each income tax return (both state and federal) filed during the Plan term within fourteen (14) days of filing the return and will turn over to the Trustee all net income tax refunds, minus earned income tax credits, received during the Plan term. Income tax refunds shall be paid to the Trustee in addition to the Plan payments stated above. 2.3 Additional payments. Check one. None. If "None" is checked, the rest of 247 2.3 need not be completed or reproduced. Debtor(s) will make additional payment(s) to the Trustee from other sources, as specified below. Describe the source, estimated amount, and date of each anticipated payment. Part 3: Treatment of Secured Claims3.1 Maintenance of payments on claims secured only by principal residence of Debtor(s) and cure of default, if any. Check one. None. If "None" is checked, the rest of 247 3.1 need not be completed or reproduced. Debtor(s) will maintain the current ongoing postpetition installment payments on the secured claims listed below, with any changes required by the applicable contract and noticed in conformity with any applicable rules. The current ongoing monthly payments will be disbursed either by the Trustee or directly by the Debtor(s), as specified below. Any existing arrearage on a listed claim will be paid in full through disbursements by the Trustee, with interest, if any, at the rate stated. Unless otherwise ordered by the Court, the amounts stated on a timely filed proof of claim under Federal Rule of Bankruptcy Procedure 3002(c) shall control over any contrary amounts stated below with respect to the current installment payment and the total amount of arrearage. If relief from the automatic stay is ordered as to the principal residence listed in this paragraph, then, unless otherwise specifically ordered by the Court, all payments under this paragraph as to that collateral or principal residence including arrearage payments will cease, and all secured claims based on that collateral will no longer be treated by the Plan. The final column includes only payments disbursed by the Trustee rather than by the Debtor(s). Provision for Ongoing Monthly Mortgage Payments on Principal Residence American LegalNet, Inc. www.FormsWorkFlow.com Insert additional claims as needed. Payments received by holders and/or servicers of mortgage claims for ongoing postpetition installment payments shall be applied and credited to the Debtor(s)' mortgage account as if the account were current and no prepetition default existed on the petition date. No late charges, fees or other monetary amounts shall be assessed due to the timing of any payments made by the Trustee under thePlan. Insert additional claims as needed. *For purposes of this Plan, when the ongoing postpetition mortgage payment is disbursed by the Trustee, the term 223Gap Payment224 is defined as the ongoing postpetition mortgage payment(s) thatbecomes due between the petition date and the first day of the month following the due date of the first Plan payment to the Trustee. Check one or more as applicable. If "None" is checked, the rest of 247 3.2 need not be completed or reproduced. American LegalNet, Inc. www.FormsWorkFlow.com Page 4 of 10 Name of Creditor Collateral This claim is provided Adequate Protection* (Indicate Yes or No) Amount of Secured Claim Interest Rate Monthly Payments and Number of Payments** Total of Monthly payments $ % $ $ $ % $ $ Insert additional claims as needed. *If 223Yes224 is indicated in this column, the named creditor is provided adequate protection under the provisions of 11 U.S.C. 247 1326(a)(1)(C) in the manner stated inLocal Rule 3070-2. If 223No224 is indicated in this column, or if the column is left blank, the creditor shall not be entitled to adequate protection. ** For example: $400 / Mo. 1-48 3.2.2 Requests for valuation of collateral and modification of undersecured claims. This subsection will be effective only if the box at Section 1.2 of this Plan is checked. The Debtor(s) request that the Court determine the value of collateral secured by the claims listed below with respect to non-governmental units. For each non-governmental secured claim listed below, the Debtor(s) state that the amount of the secured claim should be determined to be the amount stated in the column headed 223Amount of Secured Claim.224 For secured claims of governmental units, unless otherwise ordered by the Court, the amount of a secured claim listed in a timely filed proof of claim controls over any contrary amount listed below. The amount stated below in the 223Monthly Payments and Number of Payments224 column for each secured creditor shall be binding on that creditor, including govern