Last updated: 11/30/2016

Request For Debtor To File Tax Information During Pendency Of Case {LF-4002-3.1}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

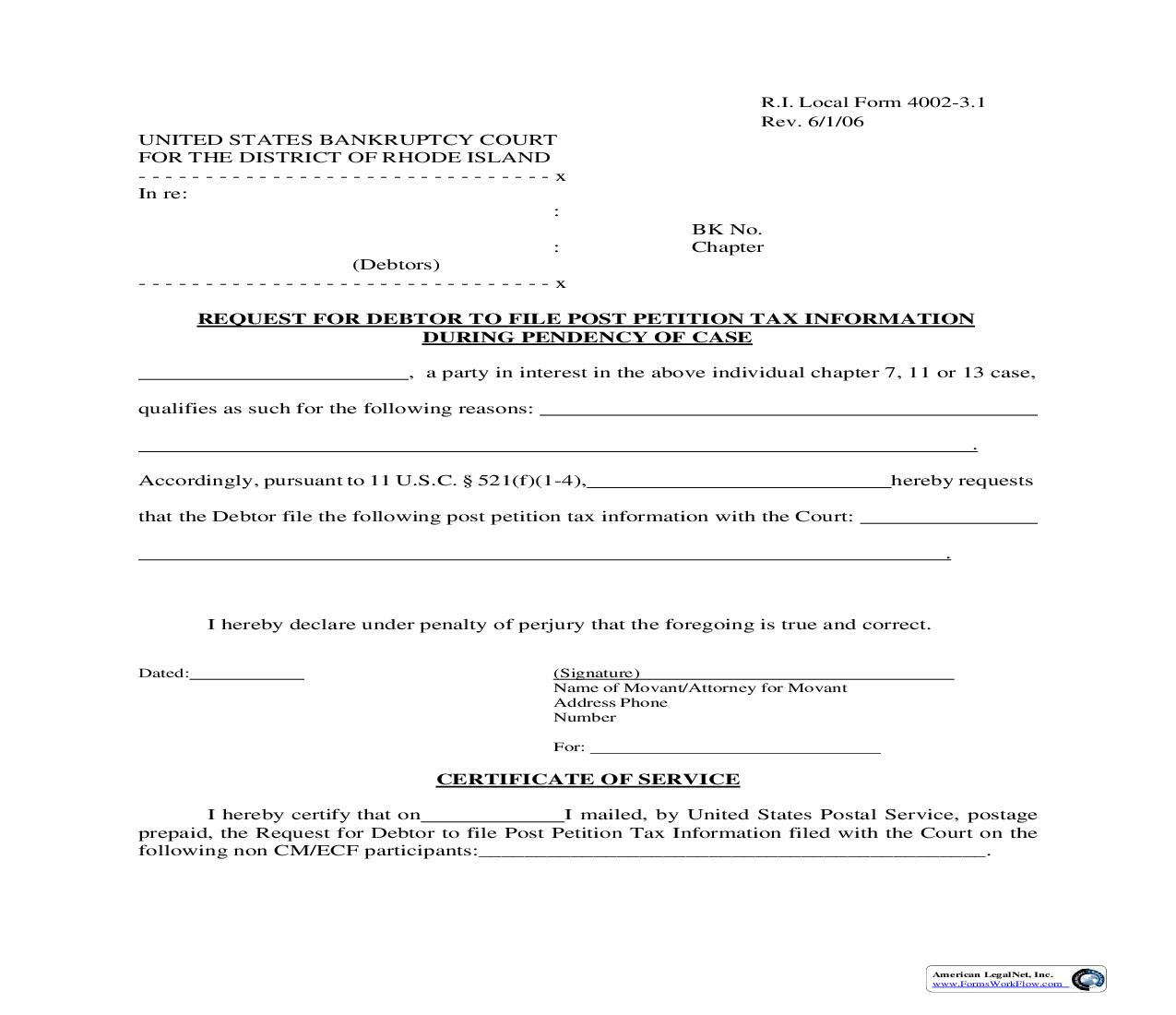

R.I. Local Form 4002-3.1 Rev. 6/1/06 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF RHODE ISLAND -------------------------------x In re: : : (Debtors) -------------------------------x BK No. Chapter REQUEST FOR DEBTOR TO FILE POST PETITION TAX INFORMATION DURING PENDENCY OF CASE , a party in interest in the above individual chapter 7, 11 or 13 case, qualifies as such for the following reasons: . Accordingly, pursuant to 11 U.S.C. § 521(f)(1-4), that the Debtor file the following post petition tax information with the Court: . hereby requests I hereby declare under penalty of perjury that the foregoing is true and correct. Dated: (Signature) Name of Movant/Attorney for Movant Address Phone Number For: CERTIFICATE OF SERVICE I hereby certify that on I mailed, by United States Postal Service, postage prepaid, the Request for Debtor to file Post Petition Tax Information filed with the Court on the following non CM/ECF participants:____________________________________________. American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Combined Plan Of Reorganization And Disclosure Statement For Small Business Debtor

Combined Plan Of Reorganization And Disclosure Statement For Small Business Debtor

Rhode Island/Federal/Bankruptcy Court/ -

Corporate Or Business Indentification Form For Unclaimed Dividends

Corporate Or Business Indentification Form For Unclaimed Dividends

Rhode Island/Federal/Bankruptcy Court/ -

Creditor Change Of Address Form

Creditor Change Of Address Form

Rhode Island/Federal/Bankruptcy Court/ -

Discovery Plan

Discovery Plan

Rhode Island/Federal/Bankruptcy Court/ -

Fee Application Summary Sheet

Fee Application Summary Sheet

Rhode Island/Federal/Bankruptcy Court/ -

Final Fee Allowance Summary

Final Fee Allowance Summary

Rhode Island/Federal/Bankruptcy Court/ -

Identification Form For Unclaimed Dividends (Individual)

Identification Form For Unclaimed Dividends (Individual)

Rhode Island/Federal/Bankruptcy Court/ -

Individual Debtor(s) Motion For Entry Of Discharge And Certificate Of Plan Confirmation

Individual Debtor(s) Motion For Entry Of Discharge And Certificate Of Plan Confirmation

Rhode Island/Federal/Bankruptcy Court/ -

Interim Fee Allowance Summary

Interim Fee Allowance Summary

Rhode Island/Federal/Bankruptcy Court/ -

Motion To Be Excused From Court

Motion To Be Excused From Court

Rhode Island/Federal/Bankruptcy Court/ -

Notice Of Joint Administration Of Cases And Requirements For Filing Documents

Notice Of Joint Administration Of Cases And Requirements For Filing Documents

Rhode Island/Federal/Bankruptcy Court/ -

Requirements For Joint Pretrial Order And Exhibit List Regarding 4001-1.2

Requirements For Joint Pretrial Order And Exhibit List Regarding 4001-1.2

Rhode Island/Federal/Bankruptcy Court/ -

Requirements For Joint Pretrial Order And Exhibit List Regarding 7016-1

Requirements For Joint Pretrial Order And Exhibit List Regarding 7016-1

Rhode Island/Federal/Bankruptcy Court/ -

Statement Of Exigent Circumstances

Statement Of Exigent Circumstances

Rhode Island/Federal/Bankruptcy Court/ -

Debtors Electronic Noticing Request (DeBN)

Debtors Electronic Noticing Request (DeBN)

Rhode Island/Federal/Bankruptcy Court/ -

Certification By Pro Se Debtor

Certification By Pro Se Debtor

Rhode Island/Federal/Bankruptcy Court/ -

Expense Information For Fee Waiver Application

Expense Information For Fee Waiver Application

Rhode Island/Federal/Bankruptcy Court/ -

Chapter 11 Confirmation Worksheet And Certification

Chapter 11 Confirmation Worksheet And Certification

Rhode Island/Federal/Bankruptcy Court/ -

Ballot For Accepting Or Rejecting Plan Of Reorganization

Ballot For Accepting Or Rejecting Plan Of Reorganization

Rhode Island/Federal/Bankruptcy Court/ -

Attorney Certification In Support Of Motion For Admission Pro Hac Vice

Attorney Certification In Support Of Motion For Admission Pro Hac Vice

Rhode Island/Federal/Bankruptcy Court/ -

Application For Final Decree (Chapter 11)

Application For Final Decree (Chapter 11)

Rhode Island/Federal/Bankruptcy Court/ -

Amended Chapter 13 Plan And Applicable Motion

Amended Chapter 13 Plan And Applicable Motion

Rhode Island/Federal/Bankruptcy Court/ -

Chapter 13 Agreement Between Debtor And Counsel

Chapter 13 Agreement Between Debtor And Counsel

Rhode Island/Federal/Bankruptcy Court/ -

Motion By Party In Interest For Access To Debtors Tax Information (Attorney Signature)

Motion By Party In Interest For Access To Debtors Tax Information (Attorney Signature)

Rhode Island/Federal/Bankruptcy Court/ -

Motion For Entry Of Appearance Pro Hac Vice

Motion For Entry Of Appearance Pro Hac Vice

Rhode Island/Federal/Bankruptcy Court/ -

Notice Of Filing Of Proposed Order Of Distribution

Notice Of Filing Of Proposed Order Of Distribution

Rhode Island/Federal/Bankruptcy Court/ -

Notice Of Intended Public Sale Of Estate Property

Notice Of Intended Public Sale Of Estate Property

Rhode Island/Federal/Bankruptcy Court/ -

Notice Of Substitute Counsel

Notice Of Substitute Counsel

Rhode Island/Federal/Bankruptcy Court/ -

Order Confirming Chapter 11 Plan

Order Confirming Chapter 11 Plan

Rhode Island/Federal/Bankruptcy Court/ -

Order Confirming Chapter 13 Plan

Order Confirming Chapter 13 Plan

Rhode Island/Federal/Bankruptcy Court/ -

Petition For Payment Of Unclaimed Funds

Petition For Payment Of Unclaimed Funds

Rhode Island/Federal/Bankruptcy Court/ -

Proposed Order Of Distribution (Chapter 11)

Proposed Order Of Distribution (Chapter 11)

Rhode Island/Federal/Bankruptcy Court/ -

Relief From Stay Worksheet

Relief From Stay Worksheet

Rhode Island/Federal/Bankruptcy Court/ -

Report On Ballots (Chapter 11 Plan)

Report On Ballots (Chapter 11 Plan)

Rhode Island/Federal/Bankruptcy Court/ -

Request For Debtor To File Tax Information During Pendency Of Case

Request For Debtor To File Tax Information During Pendency Of Case

Rhode Island/Federal/Bankruptcy Court/ -

Requirements For Joint Pretrial Order And Exhibit List Regarding 9014-1.1

Requirements For Joint Pretrial Order And Exhibit List Regarding 9014-1.1

Rhode Island/Federal/Bankruptcy Court/ -

Requirements For Joint Pretrial Order And Exhibit List Regarding 9070-1.1

Requirements For Joint Pretrial Order And Exhibit List Regarding 9070-1.1

Rhode Island/Federal/Bankruptcy Court/ -

Notice To Added Creditors Of Pending Bankruptcy

Notice To Added Creditors Of Pending Bankruptcy

Rhode Island/Federal/Bankruptcy Court/ -

Certification Of Supplemental Proof Of Claim Documents

Certification Of Supplemental Proof Of Claim Documents

Rhode Island/Federal/Bankruptcy Court/ -

Debtors Motion For Waiver Of Credit Counseling

Debtors Motion For Waiver Of Credit Counseling

Rhode Island/Federal/Bankruptcy Court/ -

Order Confirming Chapter 11 Plan In Subchapter V Case

Order Confirming Chapter 11 Plan In Subchapter V Case

Rhode Island/2 Federal/Bankruptcy Court/ -

Request to Access Remote Hearing

Request to Access Remote Hearing

Rhode Island/2 Federal/Bankruptcy Court/ -

Chapter 13 Plan

Chapter 13 Plan

Rhode Island/2 Federal/Bankruptcy Court/ -

Application For Access To Electronic Drop Box

Application For Access To Electronic Drop Box

Rhode Island/2 Federal/Bankruptcy Court/ -

Notice To Creditors In Chapter 11 Case Scheduled As Disputed Contingent Or Unliquidated

Notice To Creditors In Chapter 11 Case Scheduled As Disputed Contingent Or Unliquidated

Rhode Island/Federal/Bankruptcy Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!