Last updated: 6/27/2016

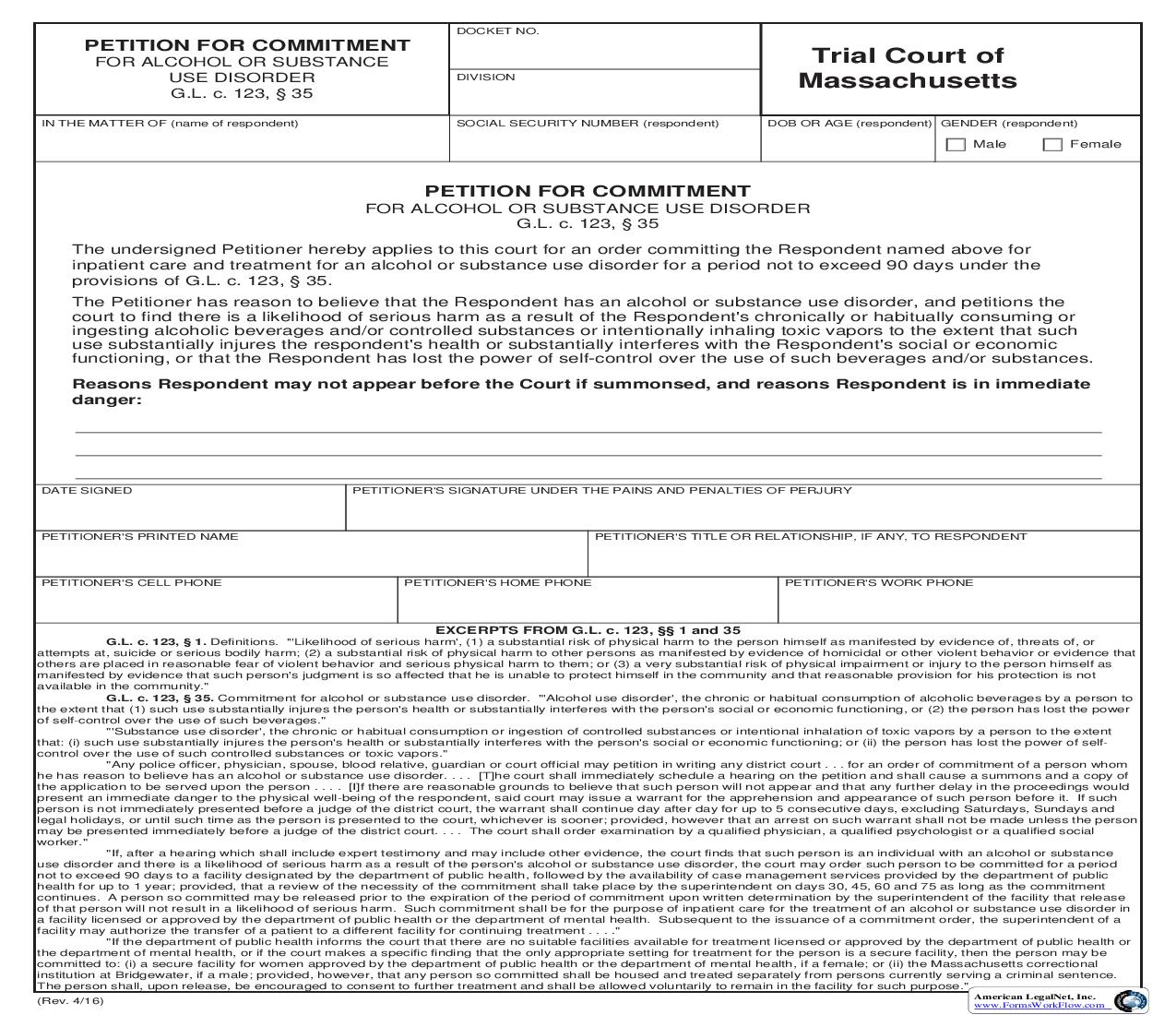

Petition For Commitment For Alcohol Or Substance Use Disorder

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FINANCIAL STATEMENT OF JUDGMENT DEBTORDOCKET NUMBERTrial Court of MassachusettsSmall Claims SessionCASE NAMECOURT DIVISION002003BOSTON MUNICIPAL COURT Division002003DISTRICT COURT Division002003HOUSING COURT DivisionNAME OF JUDGMENT DEBTOR (the person who lost the case and owes money)HOME ADDRESSHOME TELEPHONE NUMBERDATE OF BIRTHSOCIAL SECURITY NUMBERDRIVER220S LICENSE NUMBER & STATEMARITAL STATUSNO. & AGE OF CHILDREN LIVING WITH YOUOCCUPATIONEMPLOYER220S NAME & ADDRESSHOW LONG WITH EMPLOYER? Under the penalties of perjury, I swear that the above information is complete and accurate to the best of my personal knowledge.DATE SIGNEDSIGNATURE OF JUDGMENT DEBTORX INCOME (list all sources)Your Gross Pay: $ ........................ per weekYour Take-Home Pay: $ ........................ per weekSpouse220s Take-Home Pay: $ ........................ per weekChild Support Income: $ ........................ per weekPension: $ ........................ per weekAFDC/SSI: $ ........................ per weekOther (itemize on back): $ ........................ per weekTotal Weekly Income: $ ........................ per week ASSETS (list value of all assets)Real Estate you own or co-own RESIDENCE OTHERAddress: ...............................................Other Owner(s): ................................................Mortgage Balance: $ .................. $ ..................Fair Market Value: $ .................. $ ..................Rental Income: $ .................. $ ..................Vehicle(s)/Boat(s) You Own VEHICLE/BOAT 1 VEHICLE/BOAT 2Year/Make & Model: ................................................Purchase Year: ................................................Purchase Price: $ .................. $ ..................Amount Owed: $ .................. $ ..................Bank Accounts CHECKING SAVINGSBank/Credit Union: ................................................Account No.: ................................................Balance: $ ....................... $ ..................Expected Tax Refund:$ ...............................................How much money do you have in cash? $ ................................Have you disposed of or transferred any asset since this claim was brought? (If so, explain on back.) 002 No 002 Yes(List on back anything of value not listed above that you own or co-own, or that is held for you by another.) EXPENSESRent/Mortgage: $ ........................ per weekUtilities: $ ........................ per weekFood: $ ........................ per weekAlimony/Child Support: $ ........................ per weekChild Care: $ ........................ per weekTransportation: $ ........................ per weekInsurance: $ ........................ per weekEntertainment (including cable): $ ........................ per weekOther (itemize on back): $ ........................ per weekTotal Weekly Expenses: $ ........................ per week DEBTS (list all debts not included above in your expenses 205 e.g., credit card debts)CREDITOR NATURE OF DEBT DATE OF ORIGIN TOTAL DUE WEEKLY PAYMENT1 .............................................................................................................................................. $ ...................... $ ....................2 .............................................................................................................................................. $ ...................... $ ....................3 .............................................................................................................................................. $ ...................... $ .................... Pursuant to Uniform Small Claims Rule 9(c), all information in this affidavit is CONFIDENTIAL.It shall be available to any other party to this litigation, but shall not be available for public inspection unless the Court so orders. American LegalNet, Inc. www.FormsWorkFlow.com Rev. 11/18 INCOME AND PROPERTY THAT ARE EXEMPT FROM PAYMENT ORDERS (This list of exempt income and property is not comprehensive. It is provided to assist the court in avoiding the issuance of orders that would require payment from exempt sources. When requesting a payment order, the creditor bears the burden of proving that the debtor has sufficient non-exempt income or property with which to satisfy the judgment. See G.L. c. 224, 247 16.) 1.INCOME FROM THE FOLLOWING SOURCES is exempt by law from payment orders:267Unemployment Benefits (G.L. c. 151A, 247 36)267Workers Compensation Benefits (G.L. c. 152, 247 47)267Social Security Benefits (42 U.S.C. 247 401)267Federal Old-Age, Survivors & Disability Insurance Benefits (42 U.S.C. 247 407)267Supplementary Security Income (SSI) for Aged, Blind & Disabled (42 U.S.C. 247 1383[d][1])267Other Disability Insurance Benefits up to $400 weekly (G.L. c. 175, 247 110A)267Emergency Aid for Elderly & Disabled (G.L. c. 117A)267Veterans Benefits267Federal Veterans Benefits (38 U.S.C. 247 5301[a])267Special Benefits for Certain WW II Veterans (42 U.S.C. 247 1001)267Medal of Honor Veterans Benefits (38 U.S.C. 247 1562)267State Veterans Benefits (G.L. c. 115, 247 5)267Transitional Aid to Families with Dependent Children (AFDC) Benefits (G.L. c. 118, 247 10)267Maternal Child Health Services Block Grant Benefits (42 U.S.C. 247 701)267Other public assistance benefits (G.L. c. 235, 247 34, cl. fifteenth)267Payouts from certain Massachusetts employee pension plans (G.L. c. 32, 247 19)2.Certain PERSONAL AND REAL PROPERTY is also exempt from payment orders, including:267$2,500 in cash or savings or other deposits in a banking or investment institution (G.L. c. 235, 247 34, cl.fifteenth)267Automobile or vehicle up to exemption limit (G.L. c. 235, 247 34, cl. sixteenth)267Other specific types of personal property are exempt under other clauses of G.L. c. 235, 247 34267Real estate subject to automatic or declared homestead exemption (G.L. c. 188) and, in lieu thereof, theamount of money necessary for rent, up to $2,500 per month (G.L. c. 235, 247 34, cl. fourteenth)267There are also exemptions for 223aggregate224 amounts, up to maximum limits, of certain unused exemptions(G.L. c. 235, 247 34, cl. seventeenth)3.In addition, A PORTION OF WAGES AND CONTRIBUTIONS TO EMPLOYMENT-BASEDRETIREMENT PLANS is exempt by law from payment orders.Massachusetts law exempts the greater of 85% of the debtor222s gross earnings or 50 times the greater of the Federal minimum wage ($7.25 as of 7/24/09) or the Massachusetts minimum wage ($11/hr. until 12/31/18 per G.L. c. 151, 247 1; $12/hr. as of 1/1/19; $12.75/hr. as of 1/1/20; $13.50/hr. as of 1/1/21; $14.25/hr. as of 1/1/22; and $15/hr. as of 1/1/23) for each week or portion thereof (G.L. c. 224, 247 16 & c. 235, 247 34, cl. fifteenth). The amount exempt under federal law (15 U.S.C. 2472471671-1677) may exceed the Massachusetts exemption. If so, the federal exemption applies. See Worksheet for Computing Amount of Wages Exempt From Attachment, Execution and Payment Orders. https://www.mass.gov/media/910531/download/ www.FormsWorkFlow.com