Last updated: 6/10/2016

Non-Participating Tobacco Manufacturers Corporate Surety Bond Form {OAG-TOB5}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

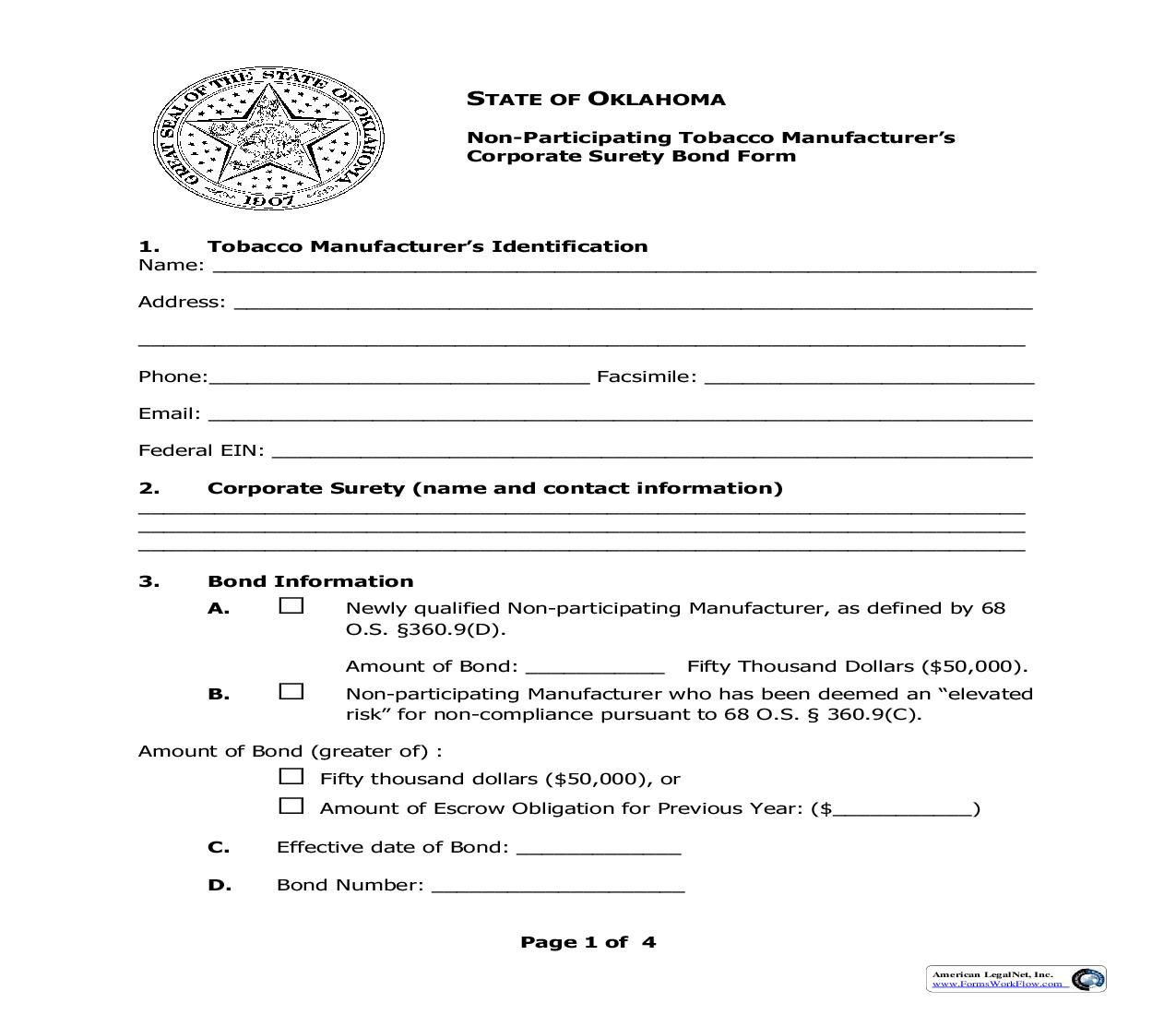

STATE OF OKLAHOMA Non-Participating Tobacco Manufacturer's Corporate Surety Bond Form 1. Tobacco Manufacturer's Identification Name: _________________________________________________________________ Address: _______________________________________________________________ ______________________________________________________________________ Phone:______________________________ Facsimile: __________________________ Email: _________________________________________________________________ Federal EIN: ____________________________________________________________ 2. Corporate Surety (name and contact information) ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ 3. Bond Information A. G G G G Newly qualified Non-participating Manufacturer, as defined by 68 O.S. §360.9(D). Amount of Bond: ___________ Fifty Thousand Dollars ($50,000). B. Non-participating Manufacturer who has been deemed an "elevated risk" for non-compliance pursuant to 68 O.S. § 360.9(C). Amount of Bond (greater of) : Fifty thousand dollars ($50,000), or Amount of Escrow Obligation for Previous Year: ($___________) C. D. Effective date of Bond: _____________ Bond Number: ____________________ Page 1 of 4 American LegalNet, Inc. www.FormsWorkFlow.com 4. We, the Manufacturer and Corporate Surety, Agree to All Terms and Conditions of the Bond as Attached. We Witness our Hands and Seals this ______ day of ______________, 20_____. Signed, Sealed, and Delivered in the Presence of: Authorized Representative for Manufacturer: ____________________________________ Signature ____________________________________ (Print) _______________________________________ Title Authorized Representative for Corporate Surety: _______________________________________ Signature _______________________________________ (Print) _______________________________________ Title (SEAL) Witness: _________________________________ Signature _________________________________ Print Witness: _________________________________ Signature _________________________________ Printed Name Page 2 of 4 American LegalNet, Inc. www.FormsWorkFlow.com Terms and Conditions of this Bond 1. Bases: The manufacturer party to this bond, identified in item 1, is a manufacturer of tobacco products, not party to the Master Settlement Agreement, and sells or intends to sell tobacco products in or into the State of Oklahoma. The manufacturer is required to post this bond because it has never been listed in the Oklahoma Directory of Compliant Non-Participating Manufacturers ("Directory"), or has previously submitted a certification, pursuant to 68 O.S. § 360.4, and has subsequently been deemed a manufacturer at elevated risk for non-compliance with the Oklahoma escrow statute pursuant to 68 O.S. § 360.9 (D)(1). The corporate surety, identified in item 2, is a corporation authorized by the Oklahoma Department of Insurance to transact such business in the State of Oklahoma. The manufacturer of tobacco products and the corporate surety are required to comply with all applicable provisions of 68 § 360.9 (B) which states as follows: The bond shall be posted by corporate surety located within the United States in an amount equal to the greater of Fifty Thousand Dollars ($50,000.00), or the amount of escrow the manufacturer in either its current or predecessor form was required to deposit as a result of its sales in the previous calendar year in Oklahoma. The Bond shall be written in favor of the State of Oklahoma and shall be conditioned on the performance by the Non-participating Manufacturer, or its United States Importer that undertakes joint and several liability for the performance of the manufacturer in accordance with Section 13 of this act, of all of its duties and obligations under the Prevention of Youth Access to Tobacco Act and the Master Settlement Agreement Complementary Act during the year in which the certification is filed and the next succeeding calendar year. 2. Effective Date of the Bond: This Bond is effective when the Oklahoma Office of the Attorney General Tobacco Enforcement Unit accepts this bond; notice to manufacturer or corporate surety is not required. The effective date of the bond is stated in item 3 of this bond. If however, no date is listed, the date of execution in item 4 will be listed as the effective date. Liability: The manufacturer, as the entity who sells or intends to sell tobacco products in or into Oklahoma and does not participate with the Master Settlement Agreement, agrees to deposit funds into a qualified escrow fund for each "unit sold" for which it is liable pursuant to 37 O.S.§ 600.21 et seq. Furthermore, the manufacturer will make such payments in quarterly installments as required by the Oklahoma Office of the Attorney General and Oklahoma Tax Commission Rule 710: 70-9-4. Until all obligations accrued under 37 O.S.§ 600.21 et seq. have been fully satisfied, this bond remains in full force and effect for the manufacturer identified herein. Failure to make the required deposits shall result in the forfeiture of this bond in an amount equal to all funds due under 37 O.S.§ 600.21 et seq., plus any applicable penalties, costs, fees and interest owing the State of Oklahoma. Effectiveness of Bond: For a "newly qualified non-participating manufacturer," as defined in 68 O.S. § 360.9 (D), and identified on this bond in item 1, this bond shall remain in effect for the year in which the certification is filed and the next succeeding calendar year. The Office of the Attorney General may require renewal of the bond for the first three (3) years of listing, or longer if the company is determined to pose an elevated risk for noncompliance. For manufacturers currently or previously listed in the Directory and subsequently deemed to pose an elevated risk for non-compliance, this bond shall remain in effect for the year in which it is executed and three (3) calendar years thereafter, or longer if the company is determined to continue to pose an elevated risk for noncompliance. 3. 4. Page 3 of 4 American LegalNet, Inc. www.FormsWorkFlow.com 5. Compliance: If the manufacturer complies with all provisions of 37 O.S.§ 600.21 et seq., and Oklahoma Tax Commission Rule 710: 70-9-4, at the expiration of the relevant statutory time period, this obligation shall be null and void. If the manufacturer or th