Last updated: 7/24/2015

Worksheet For The Connecticut Child Support And Arrearage Guidelines {CCSG-1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

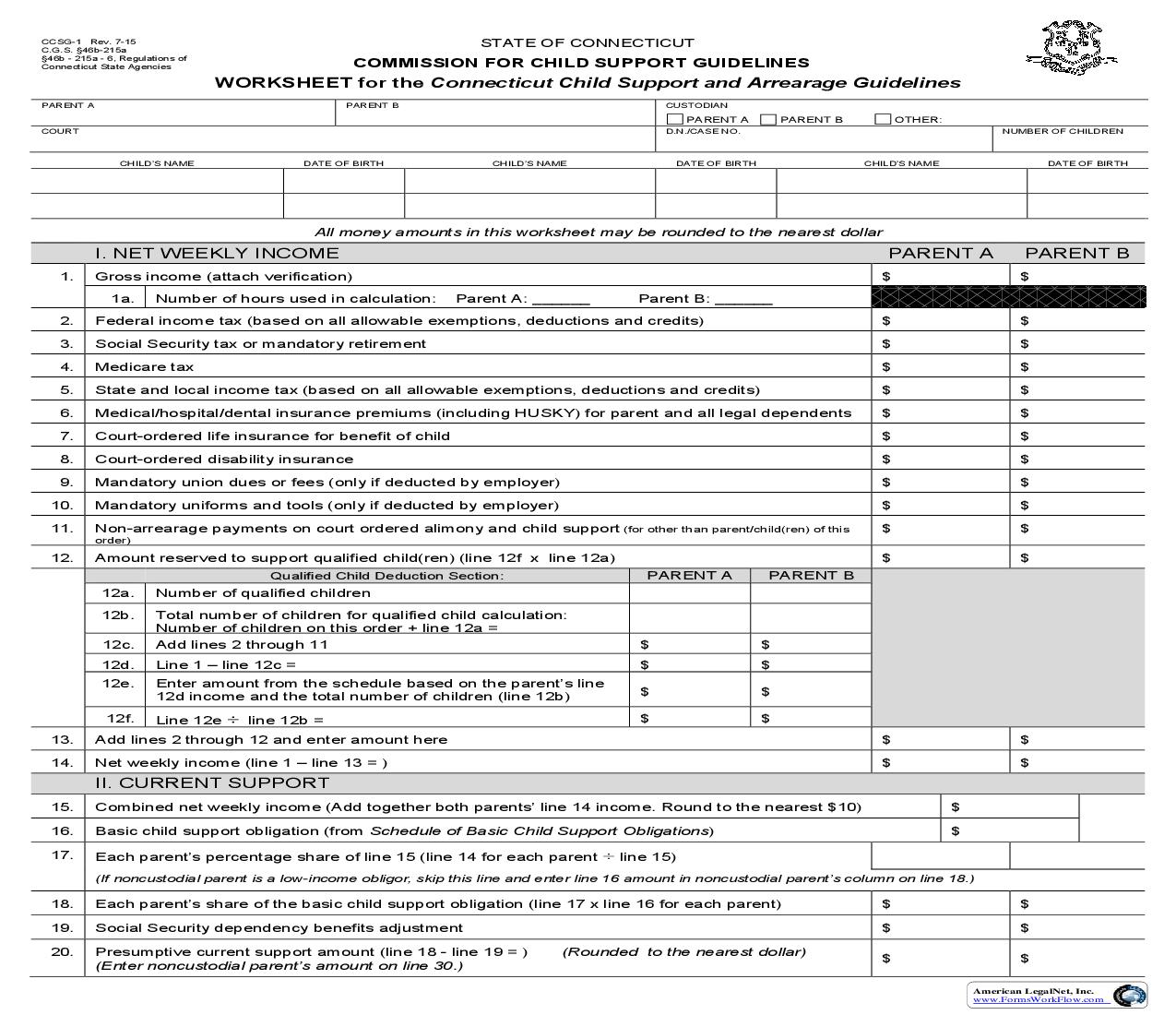

CCSG-1 Rev. 7-15 C.G.S. §46b-215a §46b - 215a - 6, Regulations of Connecticut State Agencies STATE OF CONNECTICUT COMMISSION FOR CHILD SUPPORT GUIDELINES WORKSHEET for the Connecticut Child Support and Arrearage Guidelines PARENT A COURT PARENT B CUSTODIAN PARENT A D.N./CASE NO. PARENT B OTHER: NUMBER OF CHILDREN CHILD'S NAME DATE OF BIRTH CHILD'S NAME DATE OF BIRTH CHILD'S NAME DATE OF BIRTH All money amounts in this worksheet may be rounded to the nearest dollar I. NET WEEKLY INCOME 1. Gross income (attach verification) 1a. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Number of hours used in calculation: Parent A: ______ Parent B: ______ PARENT A $ PARENT B $ Federal income tax (based on all allowable exemptions, deductions and credits) Social Security tax or mandatory retirement Medicare tax State and local income tax (based on all allowable exemptions, deductions and credits) Medical/hospital/dental insurance premiums (including HUSKY) for parent and all legal dependents Court-ordered life insurance for benefit of child Court-ordered disability insurance Mandatory union dues or fees (only if deducted by employer) Mandatory uniforms and tools (only if deducted by employer) Non-arrearage payments on court ordered alimony and child support (for other than parent/child(ren) of this order) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Amount reserved to support qualified child(ren) (line 12f x line 12a) Qualified Child Deduction Section: PARENT A PARENT B 12a. 12b. 12c. 12d. 12e. 12f. 13. 14. 15. 16. 17. Number of qualified children Total number of children for qualified child calculation: Number of children on this order + line 12a = Add lines 2 through 11 Line 1 line 12c = Enter amount from the schedule based on the parent's line 12d income and the total number of children (line 12b) Line 12e ÷ line 12b = $ $ $ $ $ $ $ $ $ $ $ $ $ $ Add lines 2 through 12 and enter amount here Net weekly income (line 1 line 13 = ) II. CURRENT SUPPORT Combined net weekly income (Add together both parents' line 14 income. Round to the nearest $10) Basic child support obligation (from Schedule of Basic Child Support Obligations) Each parent's percentage share of line 15 (line 14 for each parent ÷ line 15) (If noncustodial parent is a low-income obligor, skip this line and enter line 16 amount in noncustodial parent's column on line 18.) 18. 19. 20. Each parent's share of the basic child support obligation (line 17 x line 16 for each parent) Social Security dependency benefits adjustment Presumptive current support amount (line 18 - line 19 = ) (Enter noncustodial parent's amount on line 30.) (Rounded to the nearest dollar) $ $ $ $ $ $ American LegalNet, Inc. www.FormsWorkFlow.com III. NET DISPOSABLE INCOME 21. 22. 23. 24. 25. Line 14 + line 30 (for custodial parent); line 14 - line 30 (for noncustodial parent) Noncustodial parent's line 19 amount (Social Security dependency benefits for child) Line 21 + line 22 (for custodial parent); line 21 - line 22 (for noncustodial parent) PARENT A $ $ $ $ PARENT B $ $ IV. UNREIMBURSED MEDICAL EXPENSE Add both parents' line 23 amounts and enter it here: (combined net disposable income) Each parent's percentage share of combined net disposable income % (Line 23 for each parent % line 24; then x 100 and round to the nearest whole %) If the noncustodial parent is a low-income obligor (based on line 14 Net Weekly Income), go to line 26. If the noncustodial parent is not a low-income obligor (based on line 14 Net Weekly Income), enter these percentages on line 33b. Compare the noncustodial parent's line 25 amount to 50%. Enter the lower percentage on line 33b for the noncustodial parent. Then take 100 line 33b for the noncustodial parent and enter the amount on line 33b for the custodial parent. % 26. V. CHILD CARE CONTRIBUTION 27. 28. Does the noncustodial parent's line 23 amount fall within the shaded area of the schedule? If yes, go to line 28. If no, skip line 28 and enter the noncustodial parent's line 25 percentage on line 34b. Does the custodial parent's line 23 amount fall within the shaded area of the schedule? If no, enter 20% on line 34b as the noncustodial parent's child care contribution. If yes, compare the line 25 amount for the noncustodial parent to 50% and enter the lower amount on line 34b. VI. ARREARAGE PAYMENT (Enter line 29 amount on line 31.) 29. Line 30 x .20 = $ OR amount determined in A, B, C or D, below (check box that applies and enter amount here): $ A. If noncustodial parent is a low income obligor, enter the greater of 10% of line 30 or $1 per week, unless paragraph B below applies. B. If the child is living with the obligor, enter: (1) $1 per week if the obligor's gross income is less than or equal to 250% of poverty level, OR (2) 20% of an imputed support obligation for the child if the obligor's gross income is greater than 250% of poverty level. C. If there is no current support order and paragraph B above does not apply, enter: (1) 20% of an imputed support obligation if the parents have a present duty to provide support for the child, OR (2) 100% of an imputed support obligation if the parents have no present duty to provide support for the individual. D. If paragraphs A, B and C above, do not apply and the sum of the current support and arrearage payments would exceed 55% of the noncustodial parent's line 14 amount, enter 55% of the noncustodial parent's line 14 amount - line 30 amount. VII. SUMMARY OF WORKSHEET 30. 31. 32. 33. 34. 35. Presumptive current support (from line 20): $ Arrearage payment (from line 29): $ Total arrearage: $ _____________ (broken down as noted below:) State arrearage: $ _____________ Family arrearage: $ ____________ a. Cash medical : $ b. Unreimbursed medical expenses: Parent A a. Child Care Contribution: $ b. Child Care Contribution: % % / Parent B % Total Child Support Award Calculation: Line 30 Amount: $ Line 31 Amount: $ Line 33a. Amount: $ Line 34 Amounts: a. Cash child care amount: $ b. $ equivalent of % (if known) + $ _______ Total Child Support Award $ (enter this amount on line 35a.) a. Total child support award (excluding % amounts for unknown costs): $________________ b. Total child support award as a % of the obligor's net income: ______________% (line 35a ÷ line 14 of the obligor; then x 100) VIII. DEVIATION CRITERIA (Attach additional sheet if necessary.) 36. Reason(s) for deviation from presumptive support amounts: (Check all boxes that apply.) check here if requesting a deviation by agre