Last updated: 7/21/2016

Order Of Referral To Program Mediator With The Residential Mortgage Mediation Program {Form D-1}

Start Your Free Trial $ 19.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

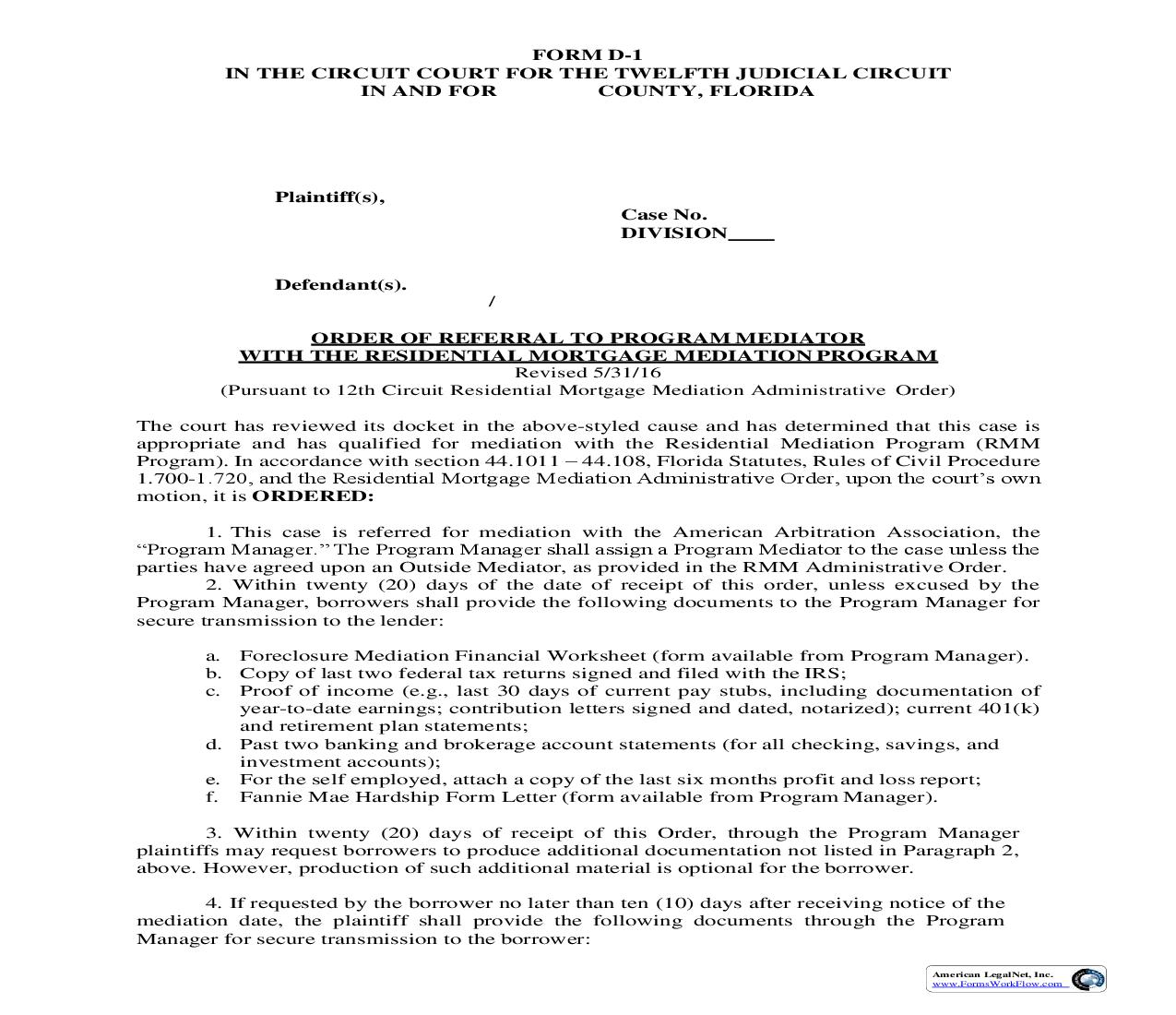

FORM D-1 IN THE CIRCUIT COURT FOR THE TWELFTH JUDICIAL CIRCUIT IN AND FOR COUNTY, FLORIDA Plaintiff(s), Case No. DIVISION Defendant(s). / ORDER OF REFERRAL TO PROGRAM MEDIATOR WITH THE RESIDENTIAL MORTGAGE MEDIATION PROGRAM Revised 5/31/16 (Pursuant to 12th Circuit Residential Mortgage Mediation Administrative Order) The court has reviewed its docket in the above-styled cause and has determined that this case is appropriate and has qualified for mediation with the Residential Mediation Program (RMM Program). In accordance with section 44.1011 44.108, Florida Statutes, Rules of Civil Procedure 1.700-1.720, and the Residential Mortgage Mediation Administrative Order, upon the court's own motion, it is ORDERED: 1. This case is referred for mediation with the American Arbitration Association, the "Program Manager." The Program Manager shall assign a Program Mediator to the case unless the parties have agreed upon an Outside Mediator, as provided in the RMM Administrative Order. 2. Within twenty (20) days of the date of receipt of this order, unless excused by the Program Manager, borrowers shall provide the following documents to the Program Manager for secure transmission to the lender: a. Foreclosure Mediation Financial Worksheet (form available from Program Manager). b. Copy of last two federal tax returns signed and filed with the IRS; c. Proof of income (e.g., last 30 days of current pay stubs, including documentation of year-to-date earnings; contribution letters signed and dated, notarized); current 401(k) and retirement plan statements; d. Past two banking and brokerage account statements (for all checking, savings, and investment accounts); e. For the self employed, attach a copy of the last six months profit and loss report; f. Fannie Mae Hardship Form Letter (form available from Program Manager). 3. Within twenty (20) days of receipt of this Order, through the Program Manager plaintiffs may request borrowers to produce additional documentation not listed in Paragraph 2, above. However, production of such additional material is optional for the borrower. 4. If requested by the borrower no later than ten (10) days after receiving notice of the mediation date, the plaintiff shall provide the following documents through the Program Manager for secure transmission to the borrower: American LegalNet, Inc. www.FormsWorkFlow.com a. Documentary evidence that plaintiff is the owner and holder in due course of the note and mortgage sued upon; b. A history showing the application of all payments by the borrowers during the life of the loan; c. A statement of the plaintiff's position of the present net value of the mortgage loan; d. The most current appraisal of the property available to plaintiff. The requested documents shall be provided by the plaintiff to the Program Manager at least 10 days prior to the date set for mediation. 5. Unless previously provided by plaintiff to the Program Manager in Form A, within twenty (20) days of the date of receipt of this Order, the plaintiff must provide the Program Manager with the name and email address of the single person designated by plaintiff to receive the borrower's financial disclosure for mediation. 6. The fee structure for the RMM Program is based on experiences with prior foreclosure mediation programs and the assumption that a successful mediation can be accomplished with one mediation session, two hours in length. Accordingly, pursuant to rule 1.720(g), Florida Rules of Civil Procedure, the reasonable mediation fees including the managed mediation process and the mediator's fee is a total of $450.00, allocated as follows: a. For each residential property to be foreclosed, to defer the cost of mediation $225.00 is required to be paid by plaintiff to the American Arbitration Association when the complaint is filed. This sum is non-refundable. b. To defer the cost of mediation $225.00 shall be paid by borrowers to the American Arbitration Association at such time as the borrower elects to participate in mediation. Remittance shall be made to "American Arbitration Association" and upon receipt shall constitute borrowers' agreement to participate in the Program and to be subject to its rules and procedures. This mediation fee shall be paid to the Program Manager and is nonrefundable. Payment of the borrower's mediation fee shall include the borrower's name and court case file number. Unless otherwise agreed by the Program Manager and the Mediator, the Program Manager shall pay mediators for their services a minimum rate of $225.00. Borrowers shall accept or reject the RMM Program within 20 days of being contacted by the RMM Program or their written request to participate in the Program, and shall pay the required mediation fee. Failure to timely accept the program confirmed by the payment of the required mediation fee shall be deemed a rejection of the RMM Program, unless borrower informs the RMM Program in writing that borrower wishes to participate in mediation and is indigent. In the event the assigned judge determines borrower is indigent, mediation shall proceed as provided by this Administrative Order without charge to the borrower. A borrower determined not to be indigent by the assigned judge shall have 10 days after the court's ruling to pay the mediation fee; failure of a non-indigent borrower to timely pay the mediation fee shall be deemed a rejection of the RMM Program. c. No mediation shall be scheduled for less than two hours. If the mediation session cannot be concluded within two hours, no further conferences shall be required unless the parties agree in writing to the terms and financial responsibility for mediation fees for an extended or subsequent session. American LegalNet, Inc. www.FormsWorkFlow.com d. All program fees shall be paid directly to the Program Manager in a form agreeable to the Program Manager. e. In the presiding judge's discretion, at the conclusion of the case the prevailing party shall be entitled to assess as court costs against the opposing party the expense of mediation in whole or in part. 7. Within ten (10) days of the date of receipt of this Order, the borrower may submit a Borrowers Request for Plaintiff's Disclosure for Mediation to the Program Manager (Form G). 8. The Program Manager shall schedule all mediations that are assigned to a Program Mediator and shall provide notice to the plaintiff and borrowers of the mediation date. 9. The plaintiff, its attorney, and the borrowers and