Last updated: 11/30/2016

Worksheet1-Basic Net Income And Support Calculation

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

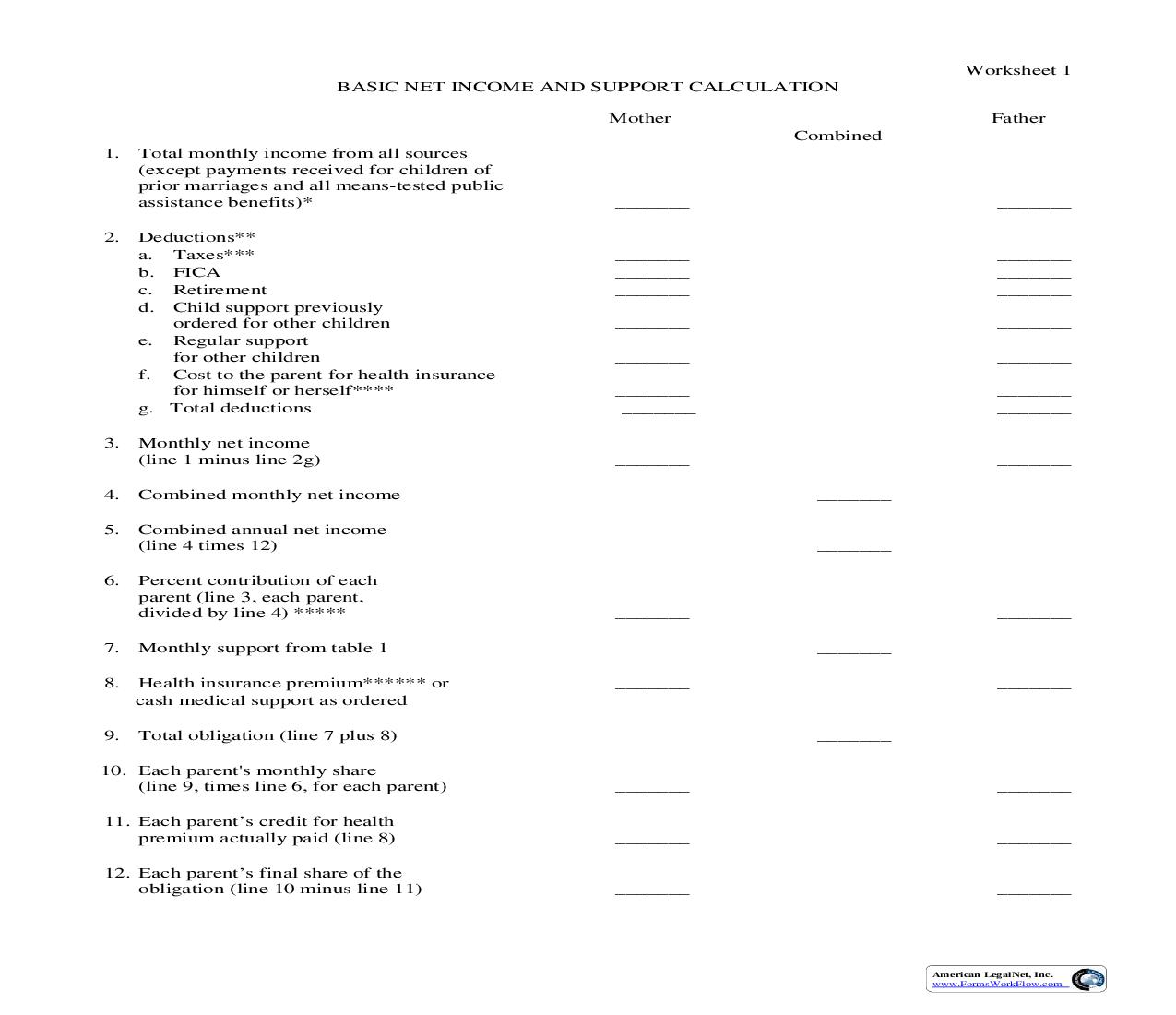

Worksheet 1 BASIC NET INCOME AND SUPPORT CALCULATION Mother Combined 1. Total monthly income from all sources (except payments received for children of prior marriages and all means-tested public assistance benefits)* 2. Deductions** a. Taxes*** b. FICA c. Retirement d. Child support previously ordered for other children e. Regular support for other children f. Cost to the parent for health insurance for himself or herself**** g. Total deductions 3. Monthly net income (line 1 minus line 2g) 4. Combined monthly net income 5. Combined annual net income (line 4 times 12) 6. Percent contribution of each parent (line 3, each parent, divided by line 4) ***** 7. Monthly support from table 1 8. Health insurance premium****** or cash medical support as ordered 9. Total obligation (line 7 plus 8) 10. Each parent's monthly share (line 9, times line 6, for each parent) 11. Each parent's credit for health premium actually paid (line 8) 12. Each parent's final share of the obligation (line 10 minus line 11) _______ Father _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ American LegalNet, Inc. www.FormsWorkFlow.com * Court will require copies of last 2 years' tax returns to verify "total income" figures and copies of present wage stubs to verify the pattern of present wage earnings, except where a party is claiming an allowance of depreciation as a deduction from income, in which case a minimum of 5 years' tax returns shall be required. Income should be annualized and divided by 12 to arrive at monthly amounts. ** All claimed deductions should be annualized and divided by 12 to arrive at monthly amounts. *** Deductions for taxes will be based on the annualized income and the number of exemptions provided by law. **** The parent requesting an adjustment for the cost of health insurance for himself or herself must submit proof of the cost of the premium for the parent. ***** In the event of substantial fluctuations of annual earnings of either party during the immediate past 3 years, the income may be averaged to determine the percent contribution of each parent as shown in item 6. The calculation of the average income shall be attached to this worksheet. ****** The parent requesting an adjustment for health insurance premiums must submit proof of the cost of the premium for the child(ren). Worksheet 1 amended Dec. 23, 1992; amended effective Jan. 1, 1996; amended effective Sept. 1, 2002; amended effective July 1, 2007; amended October 24, 2007; amended July 13, 2011, effective September 1, 2011' amended September 16, 2015, effective January 1, 2016 American LegalNet, Inc. www.FormsWorkFlow.com