Last updated: 4/13/2015

Writ Of Attachment On A Judgment Garnishment Of Wages {CO-938}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

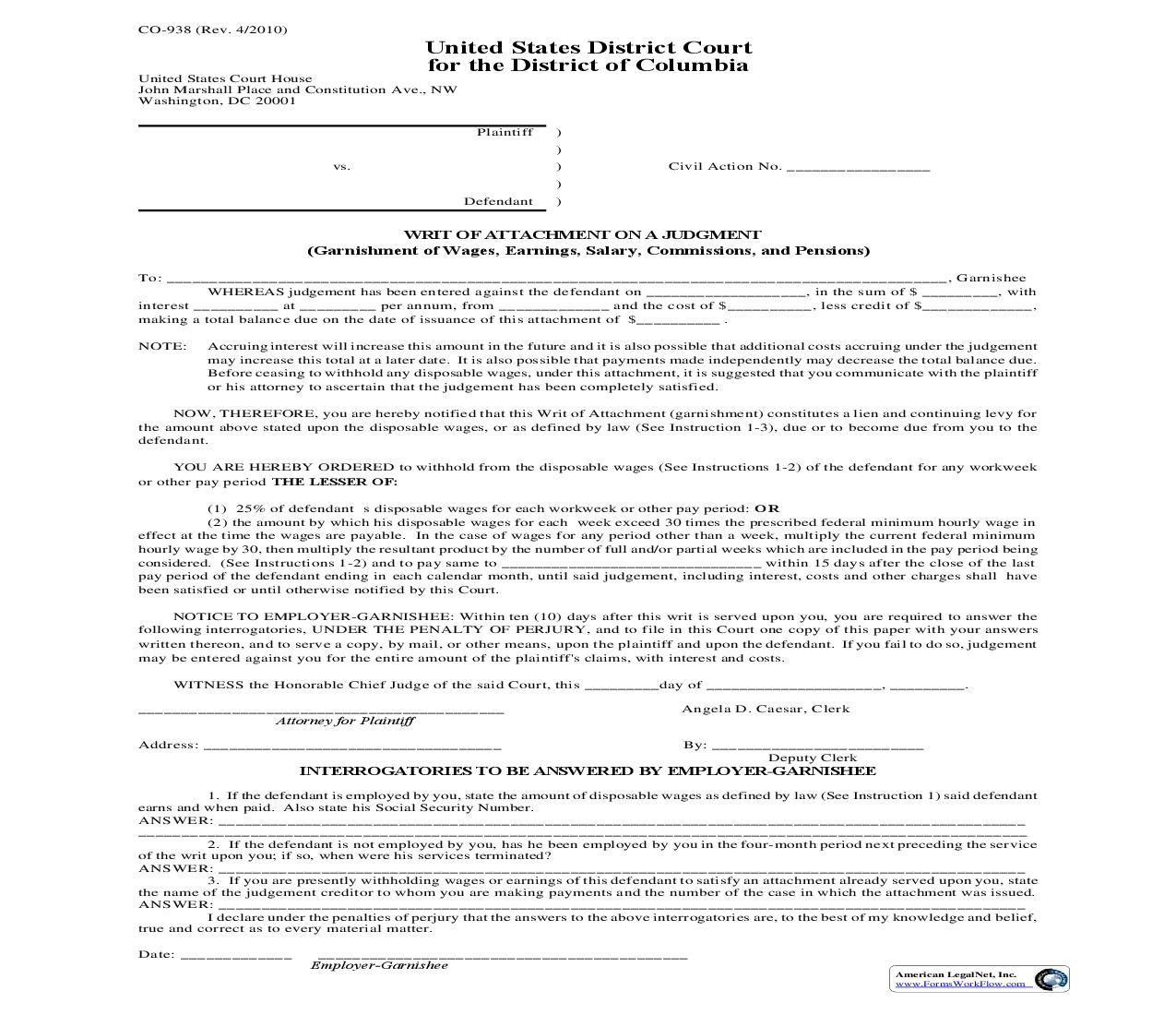

CO-938 (Rev. 4/2010) United States Court House John Marshall Place and Constitution Ave., NW Washington, DC 20001 United States District Court for the District of Columbia Plaintiff vs. Defendant ) ) ) ) ) Civil Action No. _________________ WRIT OF ATTACHMENT ON A JUDGMENT (Garnishment of Wages, Earnings, Salary, Commissions, and Pensions) To: ___________________________________________________________________________________________, Garnishee WHEREAS judgement has been entered against the defendant on ___________________, in the sum of $ _________, with interest __________ at _________ per annum, from _____________ and the cost of $__________, less credit of $_____________, making a total balance due on the date of issuance of this attachment of $__________ . NOTE: Accruing interest will increase this amount in the future and it is also possible that additional costs accruing under the judgement may increase this total at a later date. It is also possible that payments made independently may decrease the total balance due. Before ceasing to withhold any disposable wages, under this attachment, it is suggested that you communicate with the plaintiff or his attorney to ascertain that the judgement has been completely satisfied. NOW, THEREFORE, you are hereby notified that this Writ of Attachment (garnishment) constitutes a lien and continuing levy for the amount above stated upon the disposable wages, or as defined by law (See Instruction 1-3), due or to become due from you to the defendant. YOU ARE HEREBY ORDERED to withhold from the disposable wages (See Instructions 1-2) of the defendant for any workweek or other pay period THE LESSER OF: (1) 25% of defendant's disposable wages for each workweek or other pay period: O R (2) the amount by which his disposable wages for each week exceed 30 times the prescribed federal minimum hourly wage in effect at the time the wages are payable. In the case of wages for any period other than a week, multiply the current federal minimum hourly wage by 30, then multiply the resultant product by the number of full and/or partial weeks which are included in the pay period being considered. (See Instructions 1-2) and to pay same to _______________________________ within 15 days after the close of the last pay period of the defendant ending in each calendar month, until said judgement, including interest, costs and other charges shall have been satisfied or until otherwise notified by this Court. NOTICE TO EMPLOYER-GARNISHEE: Within ten (10) days after this writ is served upon you, you are required to answer the following interrogatories, UNDER THE PENALTY OF PERJURY, and to file in this Court one copy of this paper with your answers written thereon, and to serve a copy, by mail, or other means, upon the plaintiff and upon the defendant. If you fail to do so, judgement may be entered against you for the entire amount of the plaintiff's claims, with interest and costs. WITNESS the Honorable Chief Judge of the said Court, this _________day of _____________________, _________. ___________________________________________ Attorney for Plaintiff Address: ___________________________________ Angela D. Caesar, Clerk INTERROGATORIES TO BE ANSWERED BY EMPLOYER-GARNISHEE By: _________________________ Deputy Clerk 1. If the defendant is employed by you, state the amount of disposable wages as defined by law (See Instruction 1) said defendant earns and when paid. Also state his Social Security Number. ANSWER: ______________________________________________________________________________________________ _______________________________________________________________________________________________________ 2. If the defendant is not employed by you, has he been employed by you in the four-month period next preceding the service of the writ upon you; if so, when were his services terminated? ANSWER: ______________________________________________________________________________________________ 3. If you are presently withholding wages or earnings of this defendant to satisfy an attachment already served upon you, state the name of the judgement creditor to whom you are making payments and the number of the case in which the attachment was issued. ANSWER: ______________________________________________________________________________________________ I declare under the penalties of perjury that the answers to the above interrogatories are, to the best of my knowledge and belief, true and correct as to every material matter. Date: _____________ ___________________________________________ Employer-Garnishee American LegalNet, Inc. www.FormsWorkFlow.com INSTRUCTIONS TO EMPLOYER-GARNISHEE 1(a) The term "wages" means compensation paid or payable for personal services, whether denominated as wages, salary, commission, bonus, or otherwise, and includes periodic payments pursuant to a pension or retirement program; (b) the term "disposable wages" means that part of the earnings of any individual remaining after the deduction from those earnings of any amounts required by law to be withheld. 2. The term Federal minimum hourly wages" means the highest Federal minimum hourly wage prescribed by Sec. 6(a) (1) of the Fair Labor Standards Act of 1938 (29 U.S.C. '206 (a)(l)). (That wage is $3.35 per hour as of _______________ . Any subsequent changes in the Federal minimum hourly wage must be observed by the garnishee.) The District of Columbia Consumer Credit Protection Act of 1971, approved and effective December 17, 1981, eliminates the prior method of withholding the prescribed percentages of gross wages due or to become due to the judgment debtor employee. It adopts the restrictions on garnishment amount of the Federal Consumer Protection Act (Title III), effective July 1, 1970, and provides for an exemption formula which applies directly to the aggregate disposable wages for any workweek or other pay period. In the case of disposable wages which compensate for personal services rendered during a pay period of more than one workweek, in determining which of the two alternative parts of the withholding formula (See front of this Writ) results in the least withholding, as per regulation of the Commissioner of the District of Columbia, (1) the 25% part of the formula is to be applied to the aggregate disposable wages for the entire pay period involved; and (2) the Federal minimum hourly wage part of the formula (as long as the Federal minimum hourly wage is $3.35) is to be compu