Last updated: 8/28/2014

Claim For Exemptions

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

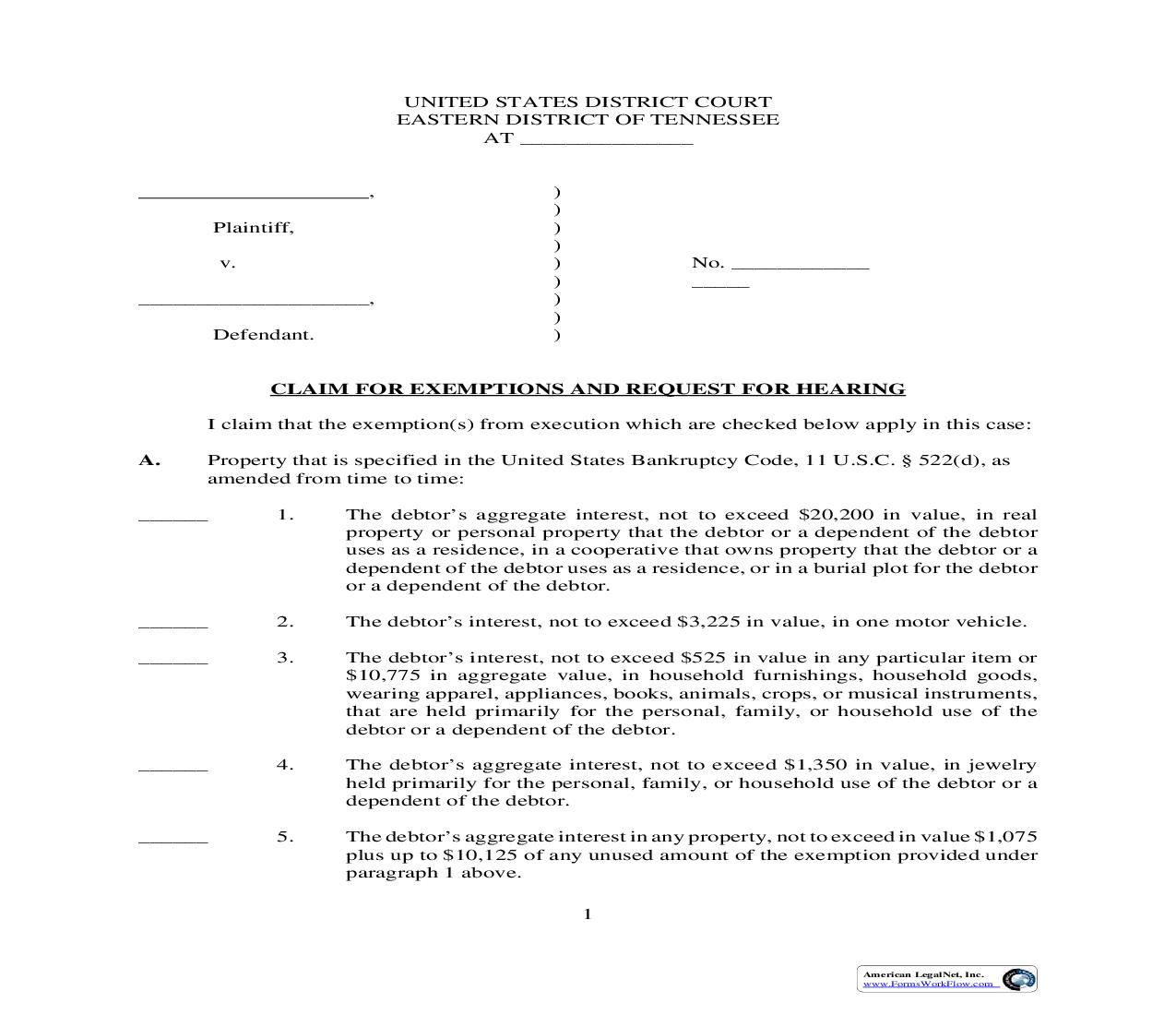

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF TENNESSEE AT _______________ , Plaintiff, v. ____________________, Defendant. ) ) ) ) ) ) ) ) ) No. ____________ _____ CLAIM FOR EXEMPTIONS AND REQUEST FOR HEARING I claim that the exemption(s) from execution which are checked below apply in this case: A. Property that is specified in the United States Bankruptcy Code, 11 U.S.C. § 522(d), as amended from time to time: 1. The debtor's aggregate interest, not to exceed $20,200 in value, in real property or personal property that the debtor or a dependent of the debtor uses as a residence, in a cooperative that owns property that the debtor or a dependent of the debtor uses as a residence, or in a burial plot for the debtor or a dependent of the debtor. The debtor's interest, not to exceed $3,225 in value, in one motor vehicle. The debtor's interest, not to exceed $525 in value in any particular item or $10,775 in aggregate value, in household furnishings, household goods, wearing apparel, appliances, books, animals, crops, or musical instruments, that are held primarily for the personal, family, or household use of the debtor or a dependent of the debtor. The debtor's aggregate interest, not to exceed $1,350 in value, in jewelry held primarily for the personal, family, or household use of the debtor or a dependent of the debtor. The debtor's aggregate interest in any property, not to exceed in value $1,075 plus up to $10,125 of any unused amount of the exemption provided under paragraph 1 above. 1 ______ ______ ______ 2. 3. ______ 4. ______ 5. American LegalNet, Inc. www.FormsWorkFlow.com ______ 6. The debtor's aggregate interest, not to exceed $2,025 in value, in any implements, professional books, or tools, of the trade of the debtor or the trade of a dependent of the debtor. Any unmatured life insurance contract owned by the debtor, other than a credit life insurance contract. The debtor's aggregate interest, not to exceed in value $10,775 less any amount of property of the estate transferred in the manner specified in 11 U.S.C. section 542(d) in any accrued dividend or interest under, or loan value of, any unmatured life insurance contract owned by the debtor under which the insured is the debtor or an individual of whom the debtor is a dependent. Professionally prescribed health aids for the debtor or a dependent of the debtor. The debtor's right to receive: (A) a social security benefit, unemployment compensation, or a local public assistance benefit; a veterans' benefit; a disability, illness, or unemployment benefit; alimony, support, or separate maintenance, to the extent reasonably necessary for the support of the debtor and any dependent of the debtor; a payment under a stock bonus, pension, profitsharing, annuity, or similar plan or contract on account of illness, disability, death, age, or length of service, to the extent reasonably necessary for the support of the debtor and any dependent of the debtor, unless: (i) such plan or contract was established by or under the auspices of an insider that employed the debtor at the time the debtor's rights under such plan or contract arose; such payment is on account of age or length of service; and such plan or contract does not qualify under section 401(a), 403(a), 403(b), or 408 of the Internal Revenue Code of 1986. ______ 7. ______ 8. ______ 9. 10. ______ ______ ______ ______ (B) (C) (D) ______ (E) (ii) (iii) 2 American LegalNet, Inc. www.FormsWorkFlow.com 11. ______ ______ The debtor's right to receive, or property that is traceable to: (A) (B) an award under a crime victim's reparation law; a payment on account of the wrongful death of an individual of whom the debtor was a dependent, to the extent reasonably necessary for the support of the debtor and any dependent of the debtor; a payment under a life insurance contract that insured the life of an individual of whom the debtor was a dependent on the date of such individual's death, to the extent reasonably necessary for the support of the debtor and any dependent of the debtor; a payment, not to exceed $20,200, on account of personal bodily injury, not including pain and suffering or compensation for actual pecuniary loss, of the debtor or an individual of whom the debtor is a dependent; or a payment in compensation of loss of future earnings of the debtor or an individual of whom the debtor is or was a dependent, to the extent reasonably necessary for the support of the debtor and any dependent of the debtor. ______ (C) ______ (D) ______ (E) ______ 12. Retirement funds to the extent that those funds are in a fund or account that is exempt from taxation under section 401, 403, 408, 408A, 414, 457, or 501(a) of the Internal Revenue Code of 1986; or B. Any property that is exempt under federal law, other than paragraph (A), or state or local law that is applicable on the date of the filing of the application for a remedy under this chapter at the place in which the debtor's domicile has been located for the 180 days immediately preceding the date of the filing of such application, or for a longer portion of such 180-day period than in any other place; and any interest in property in which the debtor had, immediately before the filing of such application, an interest as a tenant by the entirety or joint tenant, or an interest in a community estate, to the extent that such interest is exempt from process under applicable non-bankruptcy law. If you claim exemptions under this paragraph, check the applicable exemption below or otherwise identify the applicable law. ______ 13. Homestead or residential property - amount as allowed by statute for real property used as a principal place of residence. Joint debtors may together only exempt statutory amount in a shared home. Such homestead, however, is not exempt from sale for the payment of public taxes or for the satisfaction of a debt for improvements. (TCA §§ 26-2-301 through 26-2-306; Tenn. Const., Art. 11, § 11 ) 3 American LegalNet, Inc. www.FormsWorkFlow.com ______ 14. Selected personal property - Personal property to the aggregate value of the allowable statutory amount, but only those items of "property for which this exemption has been claimed in writing and filed with the court of jurisdiction prior to this execution." (TCA §§ 26-2-102, -114) Other personal property - Certain clothing, household items, and personal goods. (TCA §§ 26-2-102, -102, -103, and -109, Tenn. Const.. Art. 11 § 11) Trade implements - allowable