Last updated: 7/10/2014

Notice Of Income Assignment

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

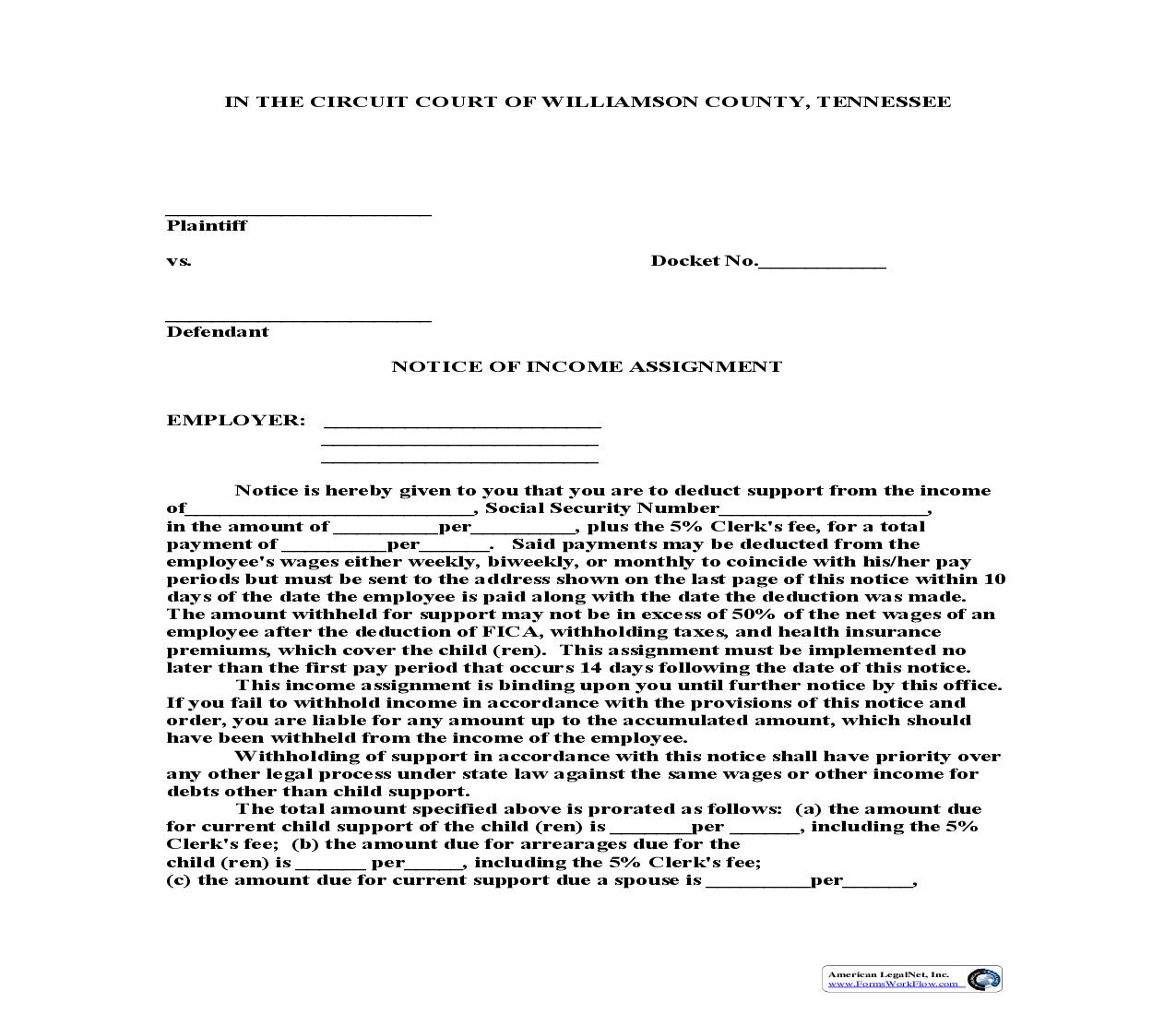

IN THE CIRCUIT COURT OF WILLIAMSON COUNTY, TENNESSEE _______________________ Plaintiff vs. _______________________ Defendant NOTICE OF INCOME ASSIGNMENT EMPLOYER: ________________________ ________________________ ________________________ Notice is hereby given to you that you are to deduct support from the income of_________________________, Social Security Number__________________, in the amount of _________per_________, plus the 5% Clerk's fee, for a total payment of _________per______. Said payments may be deducted from the employee's wages either weekly, biweekly, or monthly to coincide with his/her pay periods but must be sent to the address shown on the last page of this notice within 10 days of the date the employee is paid along with the date the deduction was made. The amount withheld for support may not be in excess of 50% of the net wages of an employee after the deduction of FICA, withholding taxes, and health insurance premiums, which cover the child (ren). This assignment must be implemented no later than the first pay period that occurs 14 days following the date of this notice. This income assignment is binding upon you until further notice by this office. If you fail to withhold income in accordance with the provisions of this notice and order, you are liable for any amount up to the accumulated amount, which should have been withheld from the income of the employee. Withholding of support in accordance with this notice shall have priority over any other legal process under state law against the same wages or other income for debts other than child support. The total amount specified above is prorated as follows: (a) the amount due for current child support of the child (ren) is _______per ______, including the 5% Clerk's fee; (b) the amount due for arrearages due for the child (ren) is ______ per_____, including the 5% Clerk's fee; (c) the amount due for current support due a spouse is _________per______, Docket No.___________ American LegalNet, Inc. www.FormsWorkFlow.com including the 5% Clerk's fee; and (d) the amount due for arrearages due a spouse is _______per____, including the 5% Clerk's fee. If you receive any income assignment for current child support against the employee's income which would cause the deductions from any two (2) or more assignments for current child support to exceed 50% of the employee's income after FICA, withholding taxes, and a health insurance premium which covers the child (ren) are deducted, you shall determine the total of all current child support ordered withheld by all income assignments. You will then calculate the percentage that each current child support order represents of the total. The available income will be allocated by you according to the percentage, which each income assignment for current child support bears to the total of all income assignments for current child support. In the event all current child support obligations are met from the assignments and child support arrearages exist in more that one case and there is not sufficient income to pay all ordered child support arrearages, then the child support arrearages will be allocated by you on the same basis as set forth above. You must provide for each case the following information: docket number, county, state, full ordered amount, the percentage that each current support order represents of the total, and the date the amount is deducted from employee's income. EXAMPLE OF A PRORATION: Assume the employee's net income after taxes, FICA, and health insurance is $900, the available income is $450 (50%). If the employee is ordered to pay $250.00/month under support order A; $200.00/month for support order B; and $150.00/month for support order C; then the total assignments are $600.00. This exceeds income available for income assignment [after deduction for taxes, FICA and health insurance premiums which cover the child (ren)]. Then you will pay the percentage of the available income that each assignment represents to the total assignment, thus; Order A = $250/$600 42% x $450 = $189.00 Order B = $200/$600 33% x $450 = $148.50 Order C = $150/$600 25% x $450 = $112.50 If the employee has sufficient available income to satisfy all current child support orders, but not all ordered child support arrearages, you would apply this same proration procedure to the child support arrearages using the total monthly child support arrearage payment as the denominator and each order's monthly child support arrearage payment as the numerator. It is your responsibility to promptly notify this office when the employee terminates employment with you and to provide this office the last known address and the name and address of his/her new employer if known. This assignment is binding upon successive employers 14 days after it is mailed to them. If you (employer) use the income assignment as a basis to refuse to employ a person or to discharge the employee or for any disciplinary action against the employee, you (employer) shall be subject to a fine for a Class C misdemeanor under T.C.A. Section 36-5-501 (h). If you are required to withhold support from more than one person it is allowable to combine withheld amount in a single payment to each appropriate court American LegalNet, Inc. www.FormsWorkFlow.com ordering the assignments and separately identify the portion of the single payment which is attributable to each individual. If amounts are included which represent assignments for more than one pay period, the amounts representing each pay period must be separately identified. The date the support was deducted from the obligor's paycheck must be provided with each payments transmitted to the Court Clerk. If you are unable to deduct the full amount specified in this order due to the 50% limitation, the payment should also specify for each obligor, the individual's income after taxes, FICA and health insurance premiums covering the child (ren) which are deducted and whether you have received prior orders of income assignment which prevent you from fully complying with this order. You may, at your discretion, charge the employee an amount of up to 5%, not to exceed $5.00 per month, for your cost in complying with this order. Checks should be made payable to the _________________________________ ________________________________________________________________________ and should be mailed along with the date the payments were deducted from the employee's income to: ____________