Last updated: 2/19/2014

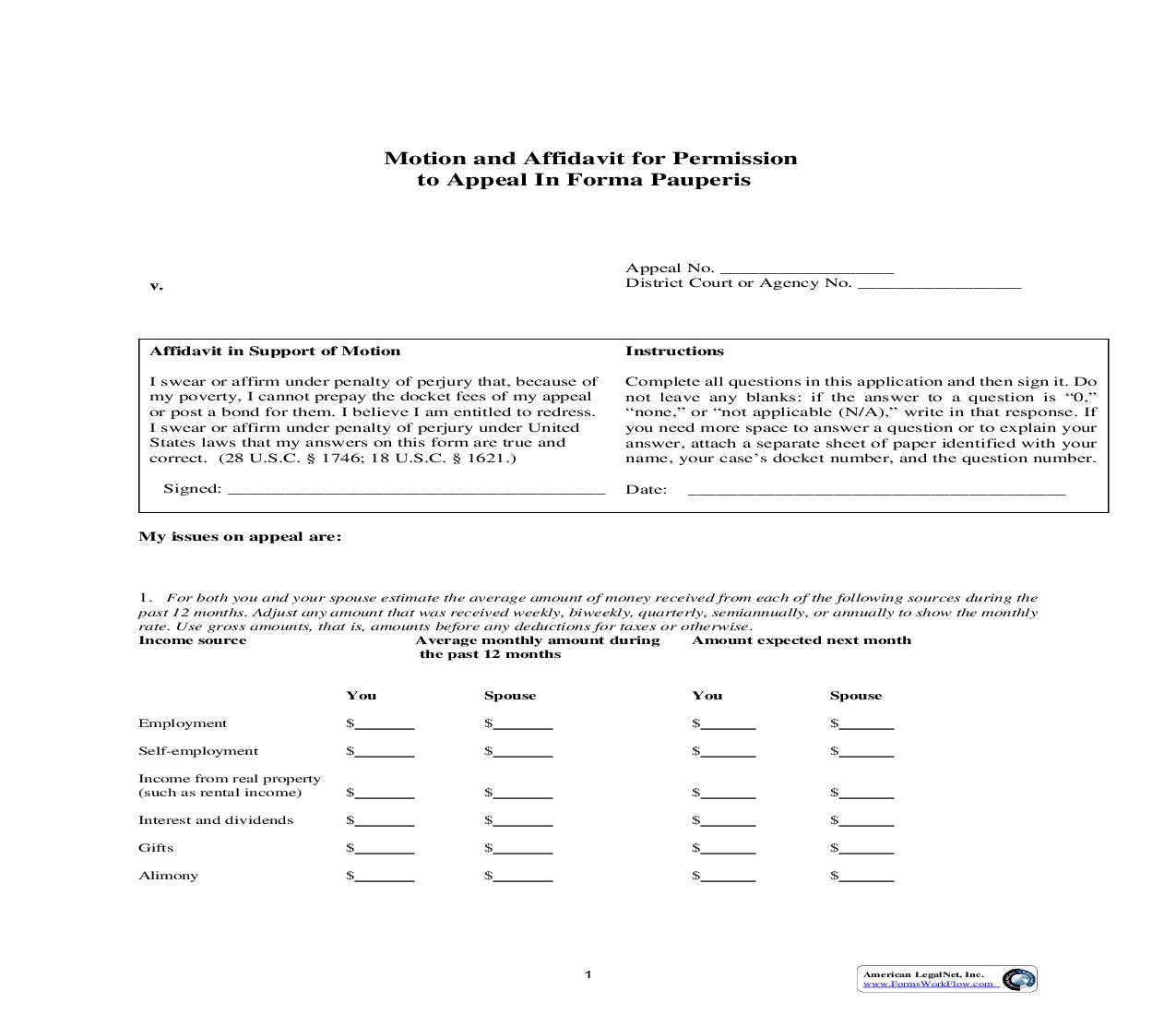

Motion and Affidavit for Permission to Appeal In Forma Pauperis

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Motion and Affidavit for Permission to Appeal In Forma Pauperis v. Appeal No. __________________ District Court or Agency No. _________________ Affidavit in Support of Motion I swear or affirm under penalty of perjury that, because of my poverty, I cannot prepay the docket fees of my appeal or post a bond for them. I believe I am entitled to redress. I swear or affirm under penalty of perjury under United States laws that my answers on this form are true and correct. (28 U.S.C. § 1746; 18 U.S.C. § 1621.) Signed: _______________________________________ Instructions Complete all questions in this application and then sign it. Do not leave any blanks: if the answer to a question is "0," "none," or "not applicable (N/A)," write in that response. If you need more space to answer a question or to explain your answer, attach a separate sheet of paper identified with your name, your case's docket number, and the question number. Date: _______________________________________ My issues on appeal are: 1. For both you and your spouse estimate the average amount of money received from each of the following sources during the past 12 months. Adjust any amount that was received weekly, biweekly, quarterly, semiannually, or annually to show the monthly rate. Use gross amounts, that is, amounts before any deductions for taxes or otherwise. Income source Average monthly amount during Amount expected next month the past 12 months You Employment Self-employment Income from real property (such as rental income) Interest and dividends Gifts Alimony $ $ Spouse $ $ You $ $ Spouse $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1 American LegalNet, Inc. www.FormsWorkFlow.com Child support $ $ $ $ Retirement (such as social security, pensions, annuities, insurance $ Disability (such as social security, insurance payments) $ Unemployment payments $ Public-assistance (such as welfare) Other (specify):___________ $ Total monthly income:$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2. List your employment history, most recent employer first. (Gross monthly pay is before taxes or other deductions.) Employer Address Dates of employment Gross monthly pay ______________________ ______________________ ______________________ _________________________ _________________________ _________________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ 3. List your spouse's employment history, most recent employer first. (Gross monthly pay is before taxes or other deductions.) Employer Address Dates of employment Gross monthly pay ______________________ ______________________ ______________________ _________________________ _________________________ _________________________ ____________________ ____________________ ____________________ ____________________ ____________________ ____________________ 4. How much cash do you and your spouse have? $__________ Below, state any money you or your spouse have in bank accounts or in any other financial institution. Financial institution Type of account Amount you have Amount your spouse has ___________________ _______________________ $_______ $_______ ___________________ _______________________ $_______ $_______ ___________________ _______________________ $_______ $_______ If you are a prisoner, you must attach a statement certified by the appropriate institutional officer showing all receipts, expenditures, and balances during the last six months in your institutional accounts. If you have multiple accounts, perhaps because you have been in multiple institutions, attach one certified statement of each account. 5. List the assets, and their values, which you own or your spouse owns. Do not list clothing and ordinary household furnishings. 2 American LegalNet, Inc. www.FormsWorkFlow.com Home (Value) Other real estate (Value) Motor vehicle #1 (Value) _____________________________ _____________________________ _____________________________ Motor vehicle #2 (Value) Make & year: Model: Registration #: _________________ _________________ _________________ _____________________________ _____________________________ _____________________________ Other assets (Value) _____________________________ _____________________________ _____________________________ Make & year:_____________________ Model: ____________________ Registration #: ____________________ Other assets (Value) _____________________________ _____________________________ _____________________________ 6. State every person, business, or organization owing you or your spouse money, and the amount owed. Person owing you or your spouse Amount owed to you Amount owed to your spouse money _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ _____________________________ 7. State the persons who rely on you or your spouse for support. Name Relationship ________________________________ __________________________________ __________________________________ __________________________________ ________________________________ ________________________________ Age ________________ ________________ ________________ 8. Estimate the average monthly expenses of you and your family. Show separately the amounts paid by your spouse. Adjust any payments that are made weekly, biweekly, quarterly, semiannually, or annually to show the monthly rate. You Rent or home-mortgage payment (include lot rented for mobile home) Are real-estate taxes included? 9 Yes Is property insurance included?9 Yes Your Spouse $ $ 9 No 9 No Utilities (electricity, heating fuel, water, sewer, and telephone) Home maintenance (repairs and upkeep) Food Clothing $ $ $ $ $ $ $ $ 3 American LegalNet, Inc. www.FormsWorkFlow.com Laundry and dry-cleaning Medical and dental expenses Transportation (not including motor vehicle payments) Recreation, entertainment, newspapers, magazines, etc. Insurance (not deducted from wages or included in Mortgage payments) Homeowner's or renter's Life Health Motor Vehicle Other: ___________________ Taxes (not deducted from wages or included in Mortgage payments) (specify): ____________________ Installment payments Motor Vehicle Credit card (name): Department Store (name): Other: Alimony, maintenance, and support paid to others Regular expenses for operation of business, profession, or farm (attach detai