Last updated: 4/13/2015

Second Answer To Writ Of Garnishment For Continuing Lien On Earnings {GARN 01.0770}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

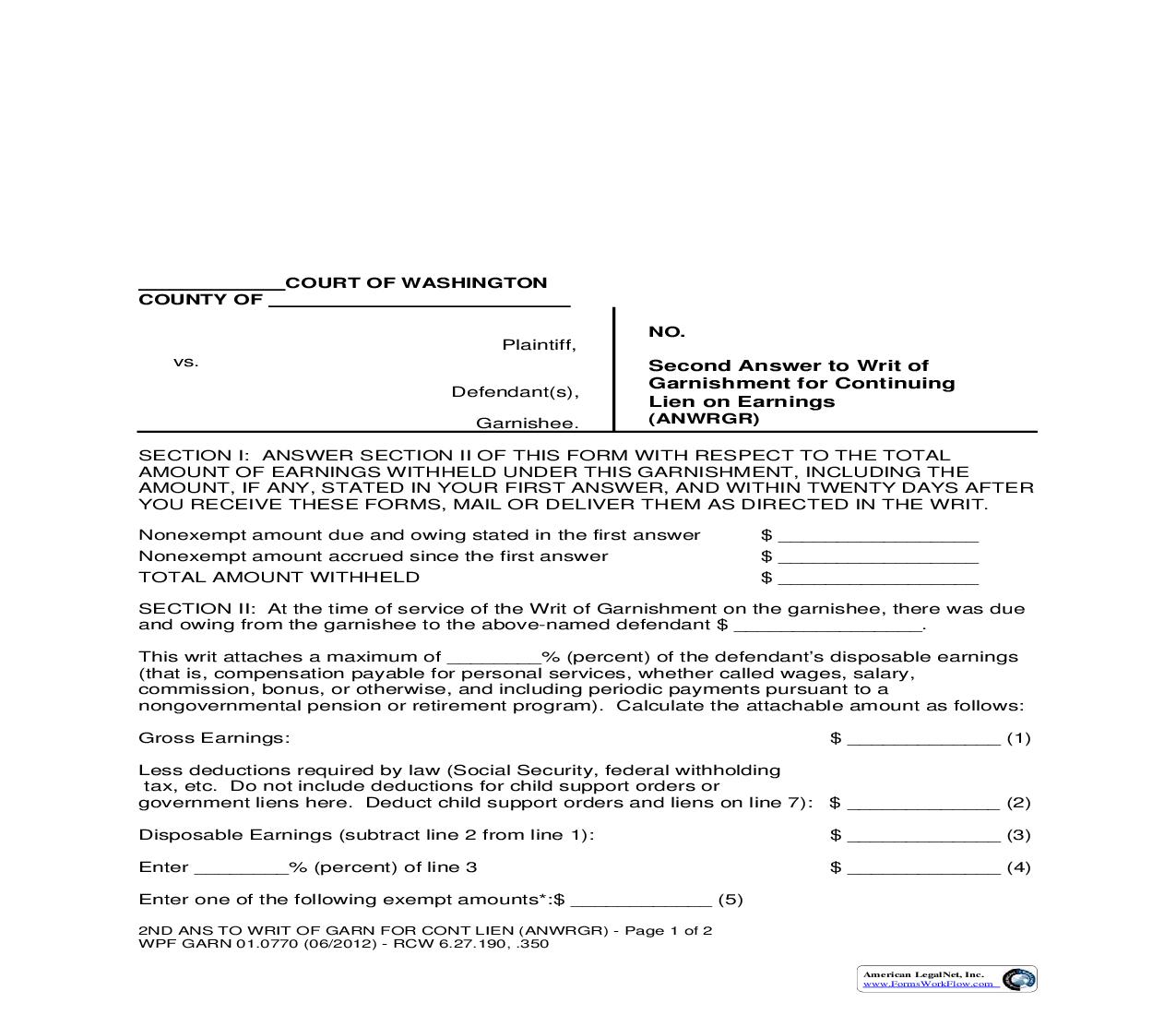

COURT OF WASHINGTON COUNTY OF Plaintiff, vs. Defendant(s), Garnishee. NO. Second Answer to Writ of Garnishment for Continuing Lien on Earnings (ANWRGR) SECTION I: ANSWER SECTION II OF THIS FORM WITH RESPECT TO THE TOTAL AMOUNT OF EARNINGS WITHHELD UNDER THIS GARNISHMENT, INCLUDING THE AMOUNT, IF ANY, STATED IN YOUR FIRST ANSWER, AND WITHIN TWENTY DAYS AFTER YOU RECEIVE THESE FORMS, MAIL OR DELIVER THEM AS DIRECTED IN THE WRIT. Nonexempt amount due and owing stated in the first answer Nonexempt amount accrued since the first answer TOTAL AMOUNT WITHHELD $ _________________ $ _________________ $ _________________ SECTION II: At the time of service of the Writ of Garnishment on the garnishee, there was due and owing from the garnishee to the above-named defendant $ ________________. This writ attaches a maximum of ________% (percent) of the defendant's disposable earnings (that is, compensation payable for personal services, whether called wages, salary, commission, bonus, or otherwise, and including periodic payments pursuant to a nongovernmental pension or retirement program). Calculate the attachable amount as follows: Gross Earnings: $ _____________ (1) Less deductions required by law (Social Security, federal withholding tax, etc. Do not include deductions for child support orders or government liens here. Deduct child support orders and liens on line 7): $ _____________ (2) Disposable Earnings (subtract line 2 from line 1): Enter ________% (percent) of line 3 Enter one of the following exempt amounts*:$ ____________ (5) 2ND ANS TO WRIT OF GARN FOR CONT LIEN (ANWRGR) - Page 1 of 2 WPF GARN 01.0770 (06/2012) - RCW 6.27.190, .350 American LegalNet, Inc. www.FormsWorkFlow.com $ _____________ (3) $ _____________ (4) If paid Weekly $ Semi-monthly $ Bi-weekly $ Monthly $ *These are minimum exempt amounts that the defendant must be paid. If your answer covers more than one pay period, multiply the preceding amount by the number of pay periods and/or fraction thereof your answer covers. If you use a pay period not shown, prorate the monthly exempt amount. Subtract the larger of lines 4 and 5 from line 3: Enter amount (if any) withheld from this paycheck for on-going government liens such as child support: $ ____________ (6) $ ____________ (7) Subtract line 7 from line 6. This amount must be held out for the plaintiff: $ ____________ (8) This is the formula that you will use for withholding each pay period over the required sixty-day garnishment period. Deduct any allowable processing fee you may charge from the amount that is to be paid to the defendant. If there is any uncertainly about your answer give an explanation on the last page or on an attached page. SECTION III: An attorney may answer for the garnishee. Under penalty of perjury, I affirm that I have examined this answer, including accompanied schedules, and to the best of my knowledge and belief it is true, correct, and complete. Signature of Garnishee Defendant Date Signature of person answering for Garnishee Connection with Garnishee Print name of person signing Address of Garnishee If necessary, use this space to supplement your answer from the first and second pages: . 2ND ANS TO WRIT OF GARN FOR CONT LIEN (ANWRGR) - Page 2 of 2 WPF GARN 01.0770 (06/2012) - RCW 6.27.190, .350 American LegalNet, Inc. www.FormsWorkFlow.com