Last updated: 9/27/2018

Chapter 13 Plan Attachment B Request To Avoid Lien {H113}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

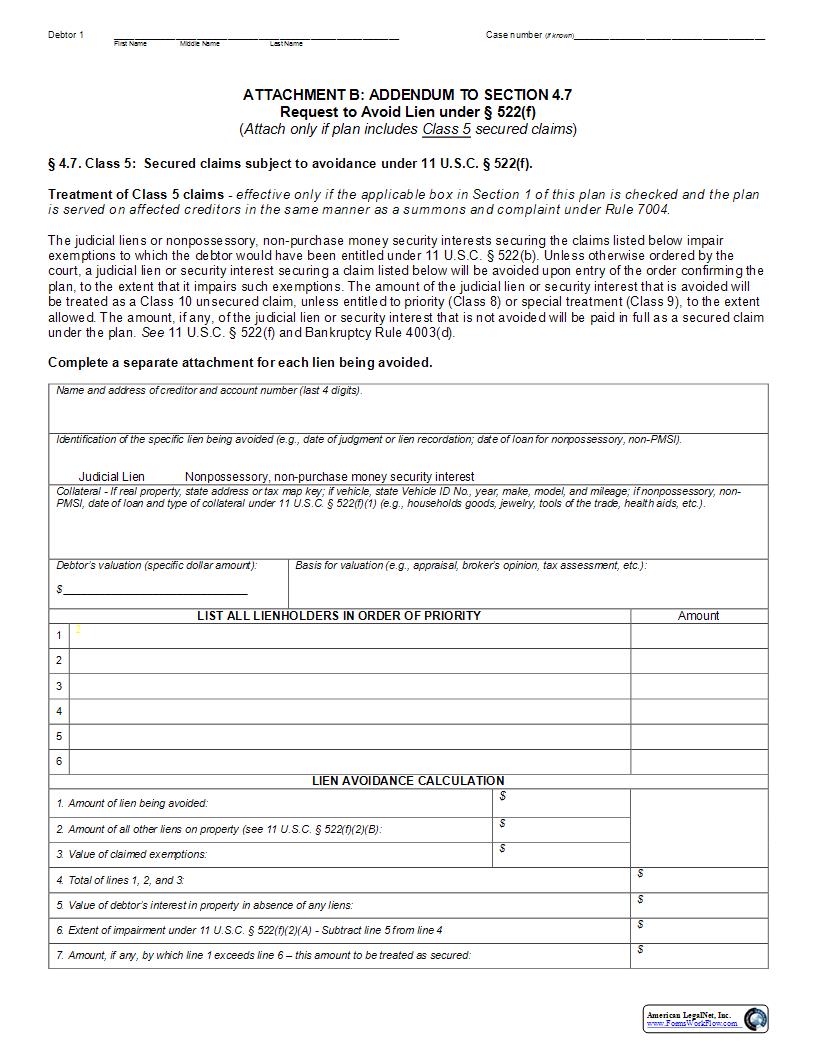

Debtor 1 Case number (if known) First Name Middle Name Last Name ATTACHMENT B: ADDENDUM TO SECTION 4.7 Request to Avoid Lien under 247 522(f) (Attach only if plan includes Class 5 secured claims) 247 4.7. Class 5: Secured claims subject to avoidance under 11 U.S.C. 247 522(f). Treatment of Class 5 claims - effective only if the applicable box in Section 1 of this plan is checked and the plan is served on affected creditors in the same manner as a summons and complaint under Rule 7004.Name and address of creditor and account number (last 4 digits). I dentification of the specific lien being avoided ( e.g., date of judgment or lien recordation ; date of loan for nonpossessory, non - PMSI ) . Judicial Lien Nonpossessory, non - purchase money security interest Collateral - I f real property, state address or tax map key; if vehicle, state Vehicle ID No., year, make, model, and mileage; if nonpossessory, non - PMSI, date of loan and type of collateral under 11 U.S.C. 247 522(f)(1) (e.g., households goods, jewelry, tools of the trade, health aids, etc.). Debtor222s valuation (specific dollar amount): $ Basis for valuation (e.g., appraisal, broker222s opinion, tax assessment, etc.): LIST ALL LIENHOLDERS IN O RDER OF PRIORITY Amount 1 2 2 3 4 5 6 LIEN AVOIDANCE CALCULATION 1. Amount of lien being avoided: $ $ 3. Value of claimed exemptions: $ 4. Total of lines 1, 2, and 3: $ 5. Value of debtor222s interest in property in absence of any liens: $ 6. Extent of impairment under 11 U.S.C. 247 522(f)(2)(A) $ 7. Amount, if any, by which line 1 exceeds line 6 226 this amount to be treated as secured: $ American LegalNet, Inc. www.FormsWorkFlow.com