Last updated: 4/3/2017

Sales And Use Tax Return {ST-12}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

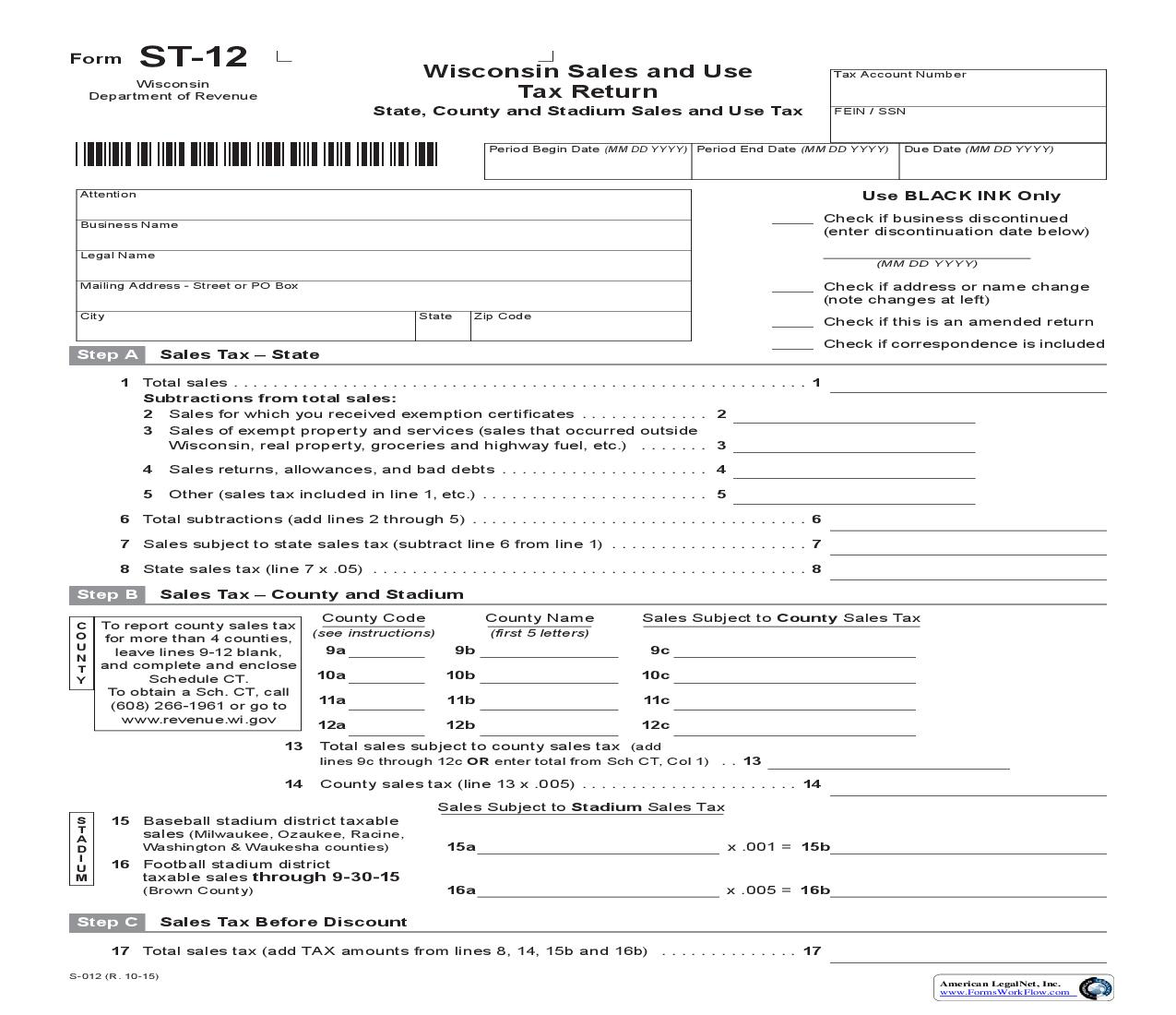

Form ST-12 Wisconsin Department of Revenue State, County and Stadium Sales and Use Tax Wisconsin Sales and Use Tax Return Tax Account Number FEIN / SSN Period Begin Date (MM DD YYYY) Period End Date (MM DD YYYY) Due Date (MM DD YYYY) Attention Business Name Legal Name Mailing Address - Street or PO Box City State Zip Code Use BLACK INK Only Check if business discontinued (enter discontinuation date below) (MM DD YYYY) Check if address or name change (note changes at left) Check if this is an amended return Check if correspondence is included Step A Sales Tax State 1 Total sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Subtractions from total sales: 2 Salesforwhichyoureceivedexemptioncertificates . . . . . . . . . . . . . 2 3 Sales of exempt property and services (sales that occurred outside Wisconsin, real property, groceries and highway fuel, etc.) . . . . . . . 3 4 Sales returns, allowances, and bad debts . . . . . . . . . . . . . . . . . . . . . 4 5 Other (sales tax included in line 1, etc.) . . . . . . . . . . . . . . . . . . . . . . . 5 6 Total subtractions (add lines 2 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 7 Sales subject to state sales tax (subtract line 6 from line 1) . . . . . . . . . . . . . . . . . . . . 7 8 State sales tax (line 7 x .05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Step B Sales Tax County and Stadium County Code (see instructions) C To report county sales tax O for more than 4 counties, U leave lines 9-12 blank, N and complete and enclose T Schedule CT. Y County Name (first 5 letters) Sales Subject to County Sales Tax 9c 10c 11c 12c 9a 10a 11a 12a 9b 10b 11b 12b To obtain a Sch. CT, call (608) 266-1961 or go to www.revenue.wi.gov 13 14 S T A D I U M Total sales subject to county sales tax (add lines 9c through 12c OR enter total from Sch CT, Col 1) . . 13 County sales tax (line 13 x .005) . . . . . . . . . . . . . . . . . . . . . . 14 Sales Subject to Stadium Sales Tax 15a 16a x .001 = 15b x .005 = 16b 15 Baseball stadium district taxable sales (Milwaukee, Ozaukee, Racine, Washington & Waukesha counties) 16 Football stadium district taxable sales through 9-30-15 (Brown County) Step C Sales Tax Before Discount 17 Total sales tax (add TAX amounts from lines 8, 14, 15b and 16b) . . . . . . . . . . . . . . 17 S-012 (R. 10-15) American LegalNet, Inc. www.FormsWorkFlow.com Step D Discount and Net Sales Tax 18 Totalsalestax(fillinamountfromline17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 19 Discount Applies only if return is filedandtaxispaidbyduedate { If line 18 is $0 to $10, enter the amount from line 18. If line 18 is $10 to $2,000, enter $10. If line 18 is greater than $2,000, multiply line 18 by .005 and enter the result. } 19 20 Net sales tax (subtract line 19 from line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 Step E Use Tax State .x .05 = 21b 21 Purchases subject to state use tax 21a Step F Use Tax County and Stadium County Code County Name (first 5 letters) Purchases Subject to County Use Tax 22c 23c 24c 25c C To report county use tax O for more than 4 counties, U leave lines 22-25 blank, N T and complete and enclose Schedule CT. Y (see instructions) 22a 23a 24a 25a 22b 23b 24b 25b To obtain a Sch. CT, call (608) 266-1961 or go to www.revenue.wi.gov 26 27 S T A D I U M Total purchases subject to county use tax (add lines 22c through 25c OR enter total from Sch CT, Col 2) . .26 County use tax (line 26 x .005) . . . . . . . . . . . . . . . . . . . . . . . 27 Purchases Subject to Stadium Use Tax 28 Baseball stadium district taxable purchases (Milwaukee, Ozaukee, Racine, Washington & Waukesha counties) . . . . . . 28a x .001 = 28b 29 Football stadium district taxable purchases through 9-30-15 (Brown County) . . . . . . . . . . . . . . . . . . 29a x .005 = 29b Step G Total Amount Due 30 Total sales and use taxes (add TAX amounts from lines 20, 21b, 27, 28b and 29b) . . . 30 31 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 32 Latefilingfee($20.00)andnegligencepenalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 33 Total amount due (add lines 30 through 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 Step H Signature and Mailing Information I hereby certify that this return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct, and complete return. Contact Person (please print clearly) Phone Number Signature Date Mail to: Wisconsin Department of Revenue PO Box 8921 Madison WI 53708-8921 S-012 (R. 10-15) For tax questions, call (608) 266-2776 -2- American LegalNet, Inc. www.FormsWorkFlow.com