Last updated: 5/29/2015

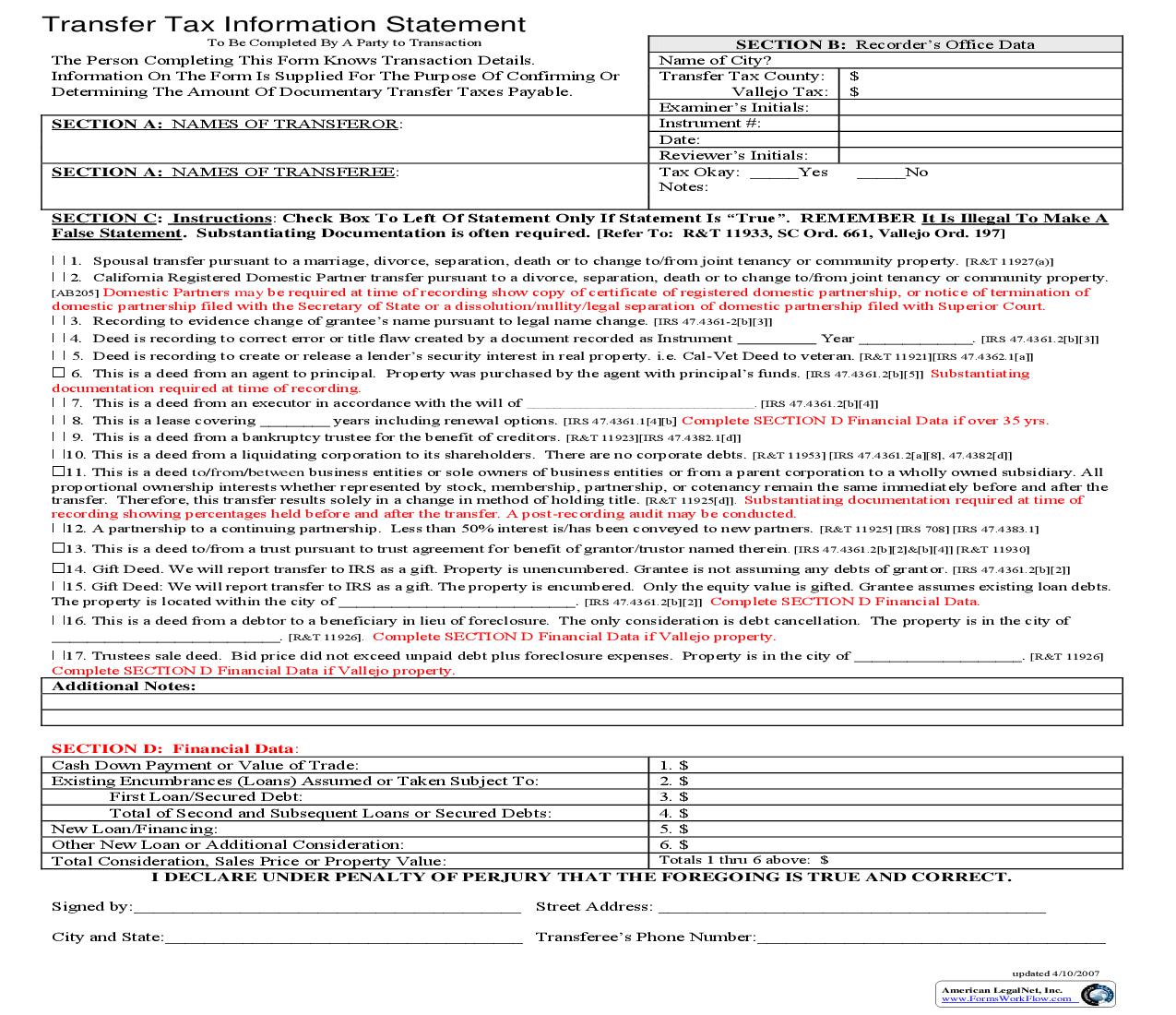

Transfer Tax Information Statement

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Transfer Tax Information Statement To Be Completed By A Party to Transaction The Person Completing This Form Knows Transaction Details. Information On The Form Is Supplied For The Purpose Of Confirming Or Determining The Amount Of Documentary Transfer Taxes Payable. SECTION A: NAMES OF TRANSFEROR: SECTION A: NAMES OF TRANSFEREE: SECTION B: Recorder's Office Data Name of City? Transfer Tax County: $ Vallejo Tax: $ Examiner's Initials: Instrument #: Date: Reviewer's Initials: Tax Okay: _____Yes _____No Notes: SECTION C: Instructions: Check Box To Left Of Statement Only If Statement Is "True". REMEMBER It Is Illegal To Make A False Statement. Substantiating Documentation is often required. [Refer To: R&T 11933, SC Ord. 661, Vallejo Ord. 197] 1. Spousal transfer pursuant to a marriage, divorce, separation, death or to change to/from joint tenancy or community property. [R&T 11927(a)] 2. California Registered Domestic Partner transfer pursuant to a divorce, separation, death or to change to/from joint tenancy or community property. [AB205] Domestic Partners may be required at time of recording show copy of certificate of registered domestic partnership, or notice of termination of domestic partnership filed with the Secretary of State or a dissolution/nullity/legal separation of domestic partnership filed with Superior Court. 3. Recording to evidence change of grantee's name pursuant to legal name change. [IRS 47.4361-2[b][3]] 4. Deed is recording to correct error or title flaw created by a document recorded as Instrument Year _____________. [IRS 47.4361.2[b][3]] 5. Deed is recording to create or release a lender's security interest in real property. i.e. Cal-Vet Deed to veteran. [R&T 11921][IRS 47.4362.1[a]] 6. This is a deed from an agent to principal. Property was purchased by the agent with principal's funds. [IRS 47.4361.2[b][5]] Substantiating documentation required at time of recording. 7. This is a deed from an executor in accordance with the will of __________________________________. [IRS 47.4361.2[b][4]] 8. This is a lease covering ________ years including renewal options. [IRS 47.4361.1[4][b] Complete SECTION D Financial Data if over 35 yrs. 9. This is a deed from a bankruptcy trustee for the benefit of creditors. [R&T 11923][IRS 47.4382.1[d]] 10. This is a deed from a liquidating corporation to its shareholders. There are no corporate debts. [R&T 11953] [IRS 47.4361.2[a][8], 47.4382[d]] 11. This is a deed to/from/between business entities or sole owners of business entities or from a parent corporation to a wholly owned subsidiary. All proportional ownership interests whether represented by stock, membership, partnership, or cotenancy remain the same immediately before and after the transfer. Therefore, this transfer results solely in a change in method of holding title. [R&T 11925[d]]. Substantiating documentation required at time of recording showing percentages held before and after the transfer. A post-recording audit may be conducted. 12. A partnership to a continuing partnership. Less than 50% interest is/has been conveyed to new partners. [R&T 11925] [IRS 708] [IRS 47.4383.1] 13. This is a deed to/from a trust pursuant to trust agreement for benefit of grantor/trustor named therein. [IRS 47.4361.2[b][2]&[b][4]] [R&T 11930] 14. Gift Deed. We will report transfer to IRS as a gift. Property is unencumbered. Grantee is not assuming any debts of grantor. [IRS 47.4361.2[b][2]] 15. Gift Deed: We will report transfer to IRS as a gift. The property is encumbered. Only the equity value is gifted. Grantee assumes existing loan debts. The property is located within the city of ___________________________. [IRS 47.4361.2[b][2]] Complete SECTION D Financial Data. 16. This is a deed from a debtor to a beneficiary in lieu of foreclosure. The only consideration is debt cancellation. The property is in the city of __________________________. [R&T 11926]. Complete SECTION D Financial Data if Vallejo property. 17. Trustees sale deed. Bid price did not exceed unpaid debt plus foreclosure expenses. Property is in the city of ___________________. [R&T 11926] Complete SECTION D Financial Data if Vallejo property. Additional Notes: SECTION D: Financial Data: Cash Down Payment or Value of Trade: 1. $ Existing Encumbrances (Loans) Assumed or Taken Subject To: 2. $ First Loan/Secured Debt: 3. $ Total of Second and Subsequent Loans or Secured Debts: 4. $ New Loan/Financing: 5. $ Other New Loan or Additional Consideration: 6. $ Totals 1 thru 6 above: $ Total Consideration, Sales Price or Property Value: I DECLARE UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT. Signed by:________________________________________ Street Address: ________________________________________ City and State:_____________________________________ Transferee's Phone Number:____________________________________ updated 4/10/2007 American LegalNet, Inc. www.FormsWorkFlow.com