Last updated: 11/14/2017

Non-Foreign Affidavit Under IRC 1445 {RE-1007CL}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

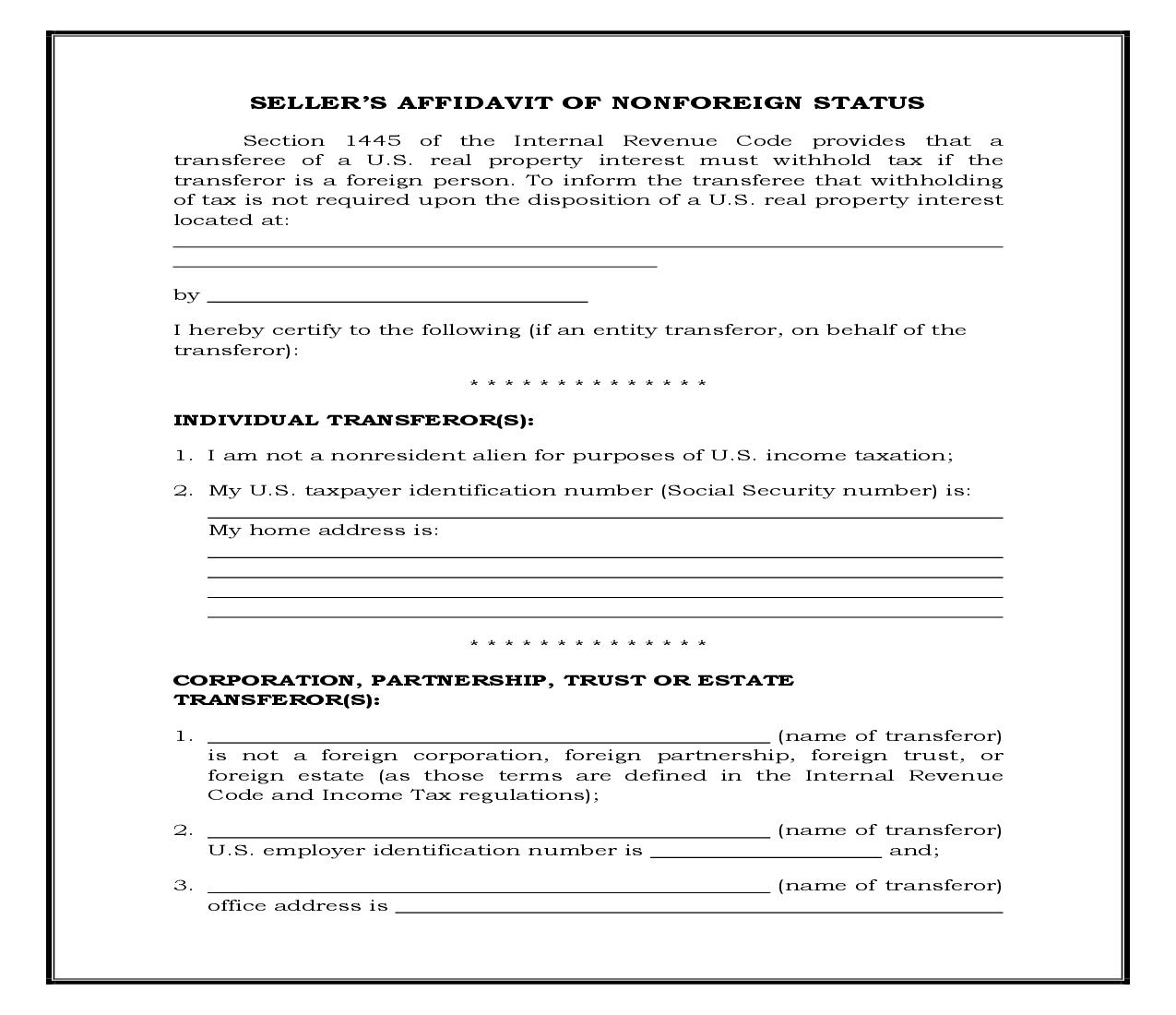

SELLER?S AFFIDAVIT OF NONFOREIGN STATUS Section 1445 of the Internal Revenue Code provides that a transferee of a U.S. real property interest must withhold tax if the transferor is a foreign person. To inform the transferee that withholding of tax is not required upon the disposition of a U.S. real property interest located at: by I hereby certify to the following (if an entity transferor, on behalf of the transferor): * * * * * * * * * * * * * * INDIVIDUAL TRANSFEROR(S): 1. I am not a nonresident alien for purposes of U.S. income taxation; 2. My U.S. taxpayer identification number (Social Security number) is: My home address is: * * * * * * * * * * * * * * CORPORATION, PARTNERSHIP, TRUST OR ESTATE TRANSFEROR(S): 1. (name of transferor) is not a foreign corporation, foreign partnership, foreign trust, or foreign estate (as those terms are defined in the Internal Revenue Code and Income Tax regulations); 2. (name of transferor) U.S. employer identification number is and; 3. (name of transferor) office address is * * * * * * * * * * * * * * , (name of transferor) understands that this certification my be disclosed to the Internal Revenue Service by transferee and that any false statements I have made here (or, for entity transferor, contained herein) could be punished by fine, imprisonment, or both. Under penalties of perjury I declare that I have examined this certification and to the best of my knowledge and belief it is true, correct and complete and, for entity transferor, I further declare that I have authority to sign this document on behalf of (name of transferor). Dated: Signature: Name: NOTICE TO TRANSFEROR AND TRANSFEREE: An affidavit should be signed by each individual or entity transferor to whom or which it applies. Before you sign, any questions relating to the legal sufficiency of this form, or to whether it applies to a particular transaction or to the definition of any of the terms used, should be referred to a certified public accountant, attorney, or other professional tax advisor, or to the Internal Revenue Service. American LegalNet, Inc. © www.FormsWorkFlow.com