Last updated: 10/29/2008

Report Of Gross Annual Income {1614}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

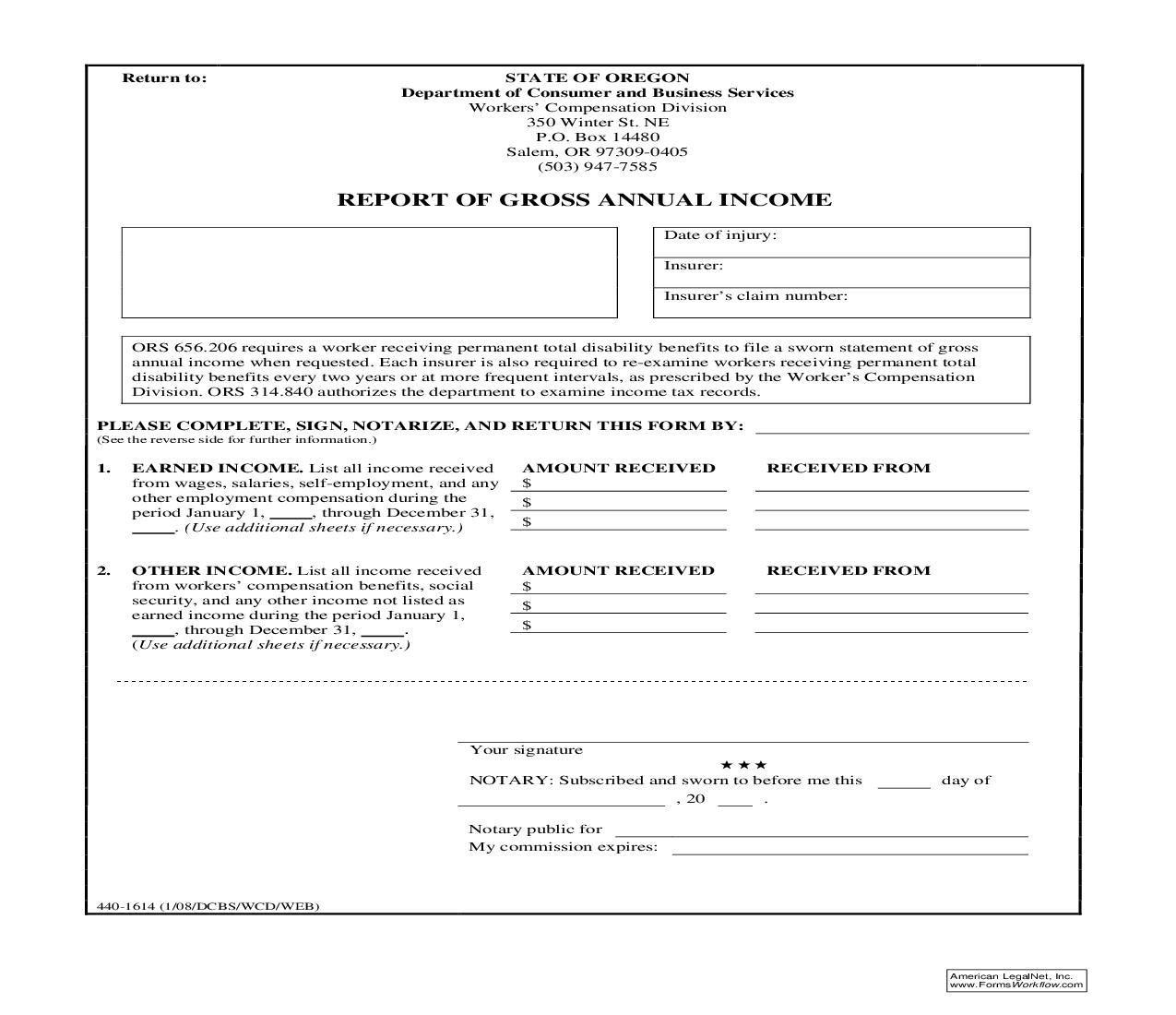

Return to: STATE OF OREGON Department of Consumer and Business Services Workers' Compensation Division 350 Winter St. NE P.O. Box 14480 Salem, OR 97309-0405 (503) 947-7585 REPORT OF GROSS ANNUAL INCOME Date of injury: Insurer: Insurer's claim number: ORS 656.206 requires a worker receiving permanent total disability benefits to file a sworn statement of gross annual income when requested. Each insurer is also required to re-examine workers receiving permanent total disability benefits every two years or at more frequent intervals, as prescribed by the Worker's Compensation Division. ORS 314.840 authorizes the department to examine income tax records. PLEASE COMPLETE, SIGN, NOTARIZE, AND RETURN THIS FORM BY: (See the reverse side for further information.) 1. EARNED INCOME. List all income received from wages, salaries, self-employment, and any other employment compensation during the period January 1, , through December 31, . (Use additional sheets if necessary.) AMOUNT RECEIVED $ $ $ RECEIVED FROM 2. OTHER INCOME. List all income received from workers' compensation benefits, social security, and any other income not listed as earned income during the period January 1, , through December 31, . (Use additional sheets if necessary.) AMOUNT RECEIVED $ $ $ RECEIVED FROM Your signature NOTARY: Subscribed and sworn to before me this , 20 . Notary public for My commission expires: day of 440-1614 (1/08/DCBS/WCD/WEB) American LegalNet, Inc. www.FormsWorkflow.com GENERAL INFORMATION We provide the following information to help you complete this form, which is solely for reporting your income. If you need further assistance, call your insurer. 1. EARNED INCOME Enter all earned income from employment, salaries, or wages received in this section. Enter the gross amounts, not net amounts. Examples include income or wages from farming, jury duty, babysitting, and the sale of livestock or timber. Remember to include the source of this income, i.e. who paid you this money. If you worked outside the state, please provide the complete address of the company that employed you. 2. OTHER INCOME Enter all sources of income not earned from performing a task in this section. Enter the amounts of any checks or payments from workers' compensation, social security, pension funds, insurance policies, interest from banks, rental property, or the sale of property. If you are unable to obtain annual amounts for these earnings enter the amount of your most recent monthly check, indicating that this amount was for one month. Also enter in this section amounts of payments received by your family as a result of your permanent total disability award. Makes three copies of this form. Keep one copy for your records, and mail two copies and the original of this form to the Workers' Compensation Division, Benefits and Certification Unit, 350 Winter St. NE, P.O. Box 14480 Salem, OR 973090405. 3. COMMONLY ASKED QUESTIONS How do I report joint interest from our bank account? Enter the amount in the "other income" section and identify it by writing "jointly owned." I don't know how much money I received from my insurance company for my award. What do I do? Enter the amount of your most recent monthly check, indicating that this figure was for one month only. I sold some trees on my property this year. Where do I report this? Enter this figure in the "earned income" section of the form. Also, provide the name and address of the party to whom you sold the timber. Do I report my spouse's income? Only if that income is a part of your award for permanent total disability. Do I need to have this document notarized? Yes. American LegalNet, Inc. www.FormsWorkflow.com