Last updated: 1/24/2009

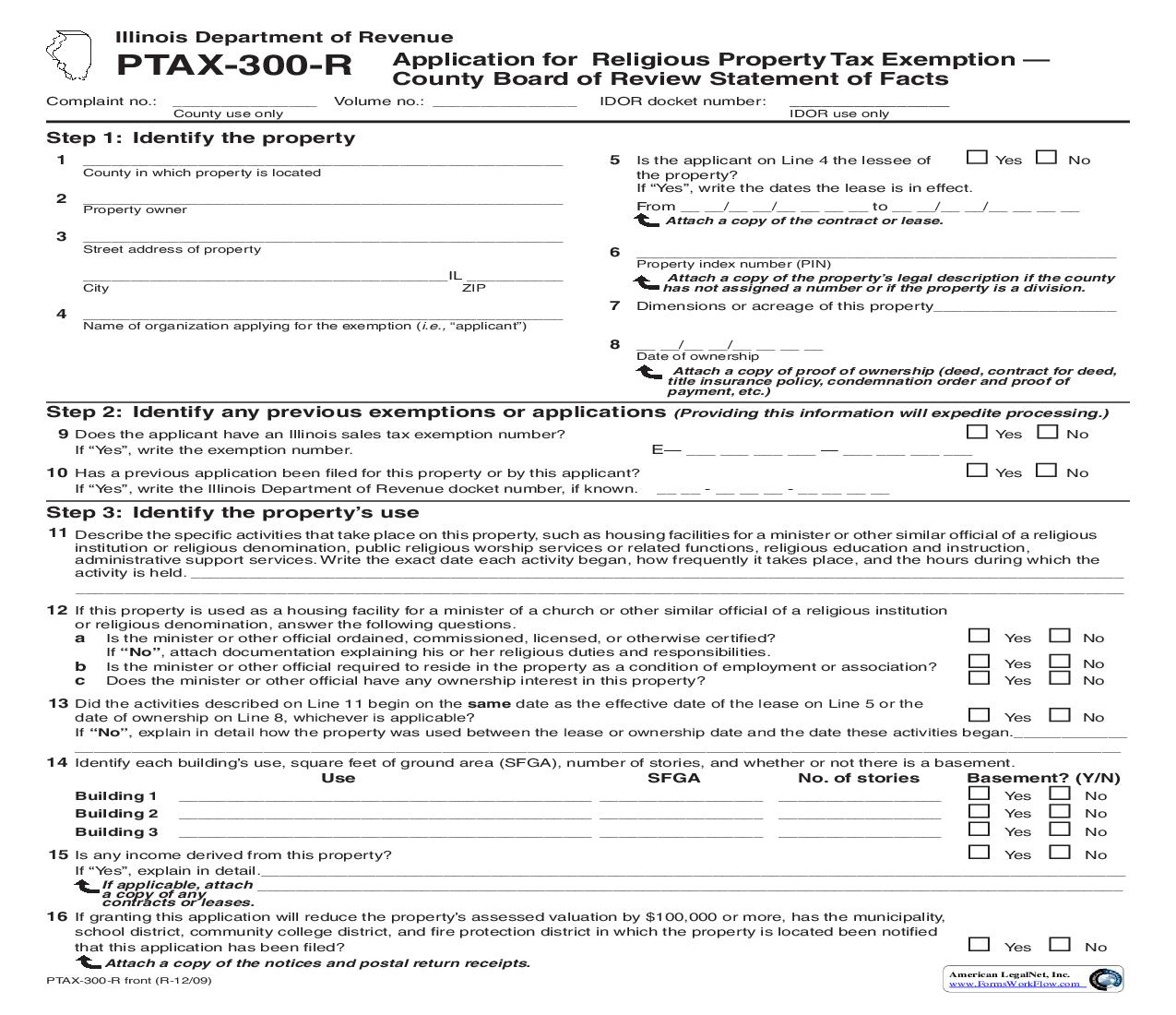

PTAX-300-R Religious Application For Non-Homestead Property Tax Exemption {PTAX-300-R}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Illinois Department of Revenue PTAX-300-R County use only Religious Application for Non-homestead Property Tax Exemption -- County Board of Review Statement of Facts IDOR docket number: Complaint no.: _______________ Volume no.: _______________ _______________ IDOR use only Part 1: Identify the property 1 ____________________________________________________ County in which property is located 6 _____________________________________________________ Parcel identifying number 2 ____________________________________________________ Property owner Attach a copy of the property's legal description if the county has not assigned a number or if the property is a division. 3 ____________________________________________________ Street address of property 7 Dimensions or acreage of this property _____________________ 8 _____________________________________________________ Date of ownership ____________________________________________________ City ZIP 4 ____________________________________________________ Name of organization applying for the exemption (i.e., "applicant") Attach a copy of proof of ownership (deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.) 5 ___ Yes ___ No Is the applicant on Line 4 the lessee of the property? If "Yes," write the dates the lease is in effect. From ______________________ To _______________________ Attach a copy of the contract or lease. Part 2: Identify any previous exemptions or applications (Providing this information will expedite processing.) 9 ___ Yes ___ No Does the applicant have an Illinois sales tax exemption number? If "Yes," write the exemption number. E-- ___ ___ ___ ___ -- ___ ___ ___ ___ 10 ___ Yes ___ No Has a previous application been filed for this property or by this applicant? If "Yes," write the Illinois Department of Revenue docket number, if known. ___ ___ -- ___ ___ ___ -- ___ ___ ___ ___ Part 3: Identify the property's use 11 Describe the specific activities that take place on this property (i.e., housing facilities for a minister or other similar official of a religious institution or religious denomination, public religious worship services or related functions, religious education and instruction, administrative support services). Write the exact date each activity began, how frequently it takes place, and the hours during which the activity is held. _________________________________________________________________________________________________ _____________________________________________________________________________________________________________ _____________________________________________________________________________________________________________ 12 If this property is used as a housing facility for a minister of a church or other similar official of a religious institution or religious denomination, answer the following questions. a ___ Yes ___ No Is the minister or other official ordained, commissioned, licensed, or otherwise certified? If "No," attach documentation explaining his or her religious duties and responsibilities. b___ Yes ___ No Is the minister or other official required to reside in the property as a condition of employment or association? c ___ Yes ___ No Does the minister or other official have any ownership interest in this property? 13 ___ Yes ___ No Did the activities described on Line 11 begin on the same date as the effective date of the lease on Line 5 or the date of ownership on Line 8, whichever is applicable? If "No," explain in detail how the property was used between the lease or ownership date and the date these activities began. _______________________________________________ ______________________________________________________________________________________________ 14 Identify each building's use, square feet of ground area (SFGA), number of stories, and whether or not there is a basement. Use SFGA No. of stories Basement? (Y/N) Building 1 ___________________________________________ Building 2 ___________________________________________ Building 3 ___________________________________________ _________________ _________________ _________________ _________________ _________________ _________________ _________________ _________________ _________________ 15 16 ___ Yes ___ No Is any income derived from this property? If "Yes," explain in detail. _________________________________________ If applicable, attach a copy ______________________________________________________________________________________________ of any ______________________________________________________________________________________________ contracts or leases. ___ Yes ___ No If granting this application will reduce the property's assessed valuation by $100,000 or more, has the municipality, school district, and community college district in which the property is located been notified that this application has Attach a copy of the been filed? notices and postal return receipts. American LegalNet, Inc. This form is authorized as outlined by the Illinois Compiled Statutes, 35 ILCS 200/15-5, 16-70, and 16-130. Disclosure of this information is REQUIRED. This form has been approved by the Forms Management Center. IL-492-3149 www.FormsWorkflow.com PTAX-300-R front (R-3/03) Part 4: Attach documentation The following documents must be attached: · Proof of ownership (copy of the deed, contract for deed, title insurance policy, condemnation order and proof of payment, etc.) · Picture of the property · Notarized affidavit of use · Copies of any contracts or leases on the property The documents identified on Lines 17 through 23 may be attached to expedite processing. Mark an "X" next to any documents that are attached. 17 ___ Audited financial statements for the most recent year 18 ___ Copy of the applicant's constitution, bylaws, and complete 21 ___ Plot plan of each building's location on the property with each building and land area labeled with parcel identifying numbers certified recorded copy of Articles of Incorporation, including and specific uses purpose clause and all amendments 22 ___ Copy of any Illinois Department of Revenue Exemption 19 ___ Church bulletin and/or newsletter Certificate 20 ___ Copy of the notices to the municipality, school district, and 23 ___ Other (list) ________________________________________ community college district in which the property is located _________________________________________________ and postal return receipts if granting this appli