Last updated: 3/26/2007

Child Support Allocation Worksheet

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

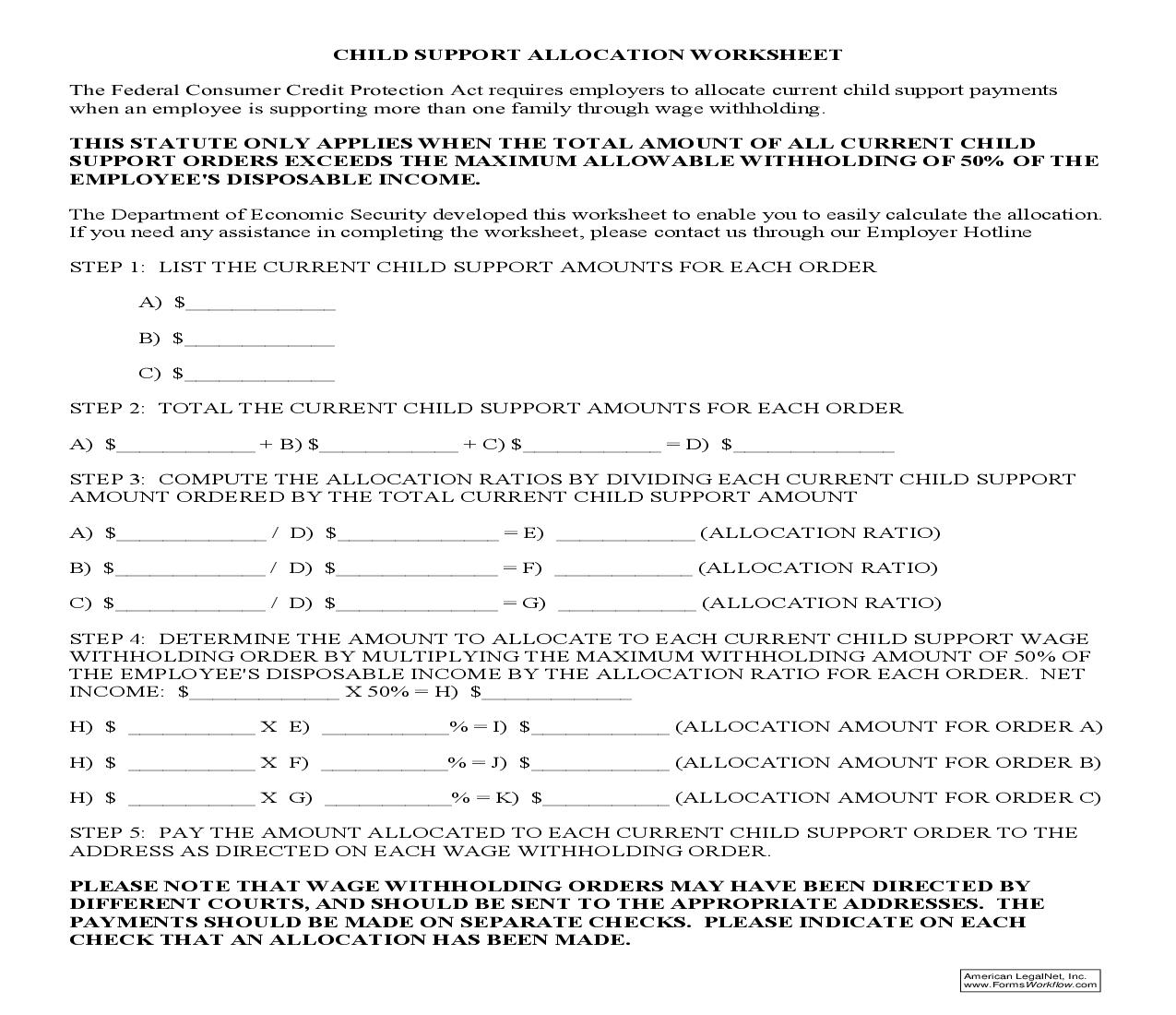

CHILD SUPPORT ALLOCATION WORKSHEET The Federal Consumer Credit Protection Act requires employers to allocate current child support payments when an employee is supporting more than one family through wage withholding. THIS STATUTE ONLY APPLIES WHEN THE TOTAL AMOUNT OF ALL CURRENT CHILD SUPPORT ORDERS EXCEEDS THE MAXIMUM ALLOWABLE WITHHOLDING OF 50% OF THE EMPLOYEE'S DISPOSABLE INCOME. The Department of Economic Security developed this worksheet to enable you to easily calculate the allocation. If you need any assistance in completing the worksheet, please contact us through our Employer Hotline STEP 1: LIST THE CURRENT CHILD SUPPORT AMOUNTS FOR EACH ORDER A) $_____________ B) $_____________ C) $_____________ STEP 2: TOTAL THE CURRENT CHILD SUPPORT AMOUNTS FOR EACH ORDER A) $____________ + B) $____________ + C) $____________ = D) $______________ STEP 3: COMPUTE THE ALLOCATION RATIOS BY DIVIDING EACH CURRENT CHILD SUPPORT AMOUNT ORDERED BY THE TOTAL CURRENT CHILD SUPPORT AMOUNT A) $_____________ / D) $______________ = E) ____________ (ALLOCATION RATIO) B) $_____________ / D) $______________ = F) ____________ (ALLOCATION RATIO) C) $_____________ / D) $______________ = G) ____________ (ALLOCATION RATIO) STEP 4: DETERMINE THE AMOUNT TO ALLOCATE TO EACH CURRENT CHILD SUPPORT WAGE WITHHOLDING ORDER BY MULTIPLYING THE MAXIMUM WITHHOLDING AMOUNT OF 50% OF THE EMPLOYEE'S DISPOSABLE INCOME BY THE ALLOCATION RATIO FOR EACH ORDER. NET INCOME: $_____________ X 50% = H) $_____________ H) $ ___________ X E) ___________% = I) $____________ (ALLOCATION AMOUNT FOR ORDER A) H) $ ___________ X F) ___________% = J) $____________ (ALLOCATION AMOUNT FOR ORDER B) H) $ ___________ X G) ___________% = K) $___________ (ALLOCATION AMOUNT FOR ORDER C) STEP 5: PAY THE AMOUNT ALLOCATED TO EACH CURRENT CHILD SUPPORT ORDER TO THE ADDRESS AS DIRECTED ON EACH WAGE WITHHOLDING ORDER. PLEASE NOTE THAT WAGE WITHHOLDING ORDERS MAY HAVE BEEN DIRECTED BY DIFFERENT COURTS, AND SHOULD BE SENT TO THE APPROPRIATE ADDRESSES. THE PAYMENTS SHOULD BE MADE ON SEPARATE CHECKS. PLEASE INDICATE ON EACH CHECK THAT AN ALLOCATION HAS BEEN MADE. American LegalNet, Inc. www.FormsWorkflow.com

Related forms

-

Child Support Agreement

Child Support Agreement

Michigan/Local County/Oakland/Family Division/ -

Order For Appointment Of Guardian Ad Litem

Order For Appointment Of Guardian Ad Litem

Michigan/Local County/Oakland/Family Division/ -

Reference Questionaire

Reference Questionaire

Michigan/Local County/Oakland/Family Division/ -

Adoption Services Face Sheet

Adoption Services Face Sheet

Michigan/Local County/Oakland/Family Division/ -

Description Of Person Wanted For Oakland County Friend Of The Court

Description Of Person Wanted For Oakland County Friend Of The Court

Michigan/Local County/Oakland/Family Division/ -

Adoption Questionnaire-Adult

Adoption Questionnaire-Adult

Michigan/Local County/Oakland/Family Division/ -

Birth Family And Child History

Birth Family And Child History

Michigan/Local County/Oakland/Family Division/ -

Application To Establish Delayed Registration Of Foreign Birth

Application To Establish Delayed Registration Of Foreign Birth

Michigan/Local County/Oakland/Family Division/ -

Petition And Order For Authority To Amend Petition For Adoption

Petition And Order For Authority To Amend Petition For Adoption

Michigan/Local County/Oakland/Family Division/ -

Physicians Report For A Child

Physicians Report For A Child

Michigan/Local County/Oakland/Family Division/ -

Physicians Report For An Infant Under The Age Of One Year

Physicians Report For An Infant Under The Age Of One Year

Michigan/Local County/Oakland/Family Division/ -

Physicians Report For Adoptive Applicant

Physicians Report For Adoptive Applicant

Michigan/Local County/Oakland/Family Division/ -

Request And Order For Payment Of Court Appointed Counsel (Paternity)

Request And Order For Payment Of Court Appointed Counsel (Paternity)

Michigan/Local County/Oakland/Family Division/ -

Stipulation Or Certification And Order Excusing Attorney(s) From Attendance At The E.I.C.

Stipulation Or Certification And Order Excusing Attorney(s) From Attendance At The E.I.C.

Michigan/Local County/Oakland/Family Division/ -

Release Of Information Authorization Adult Adoptee

Release Of Information Authorization Adult Adoptee

Michigan/Local County/Oakland/Family Division/ -

Order For Discharge Or Abatement Of Arrears Following Compliance With Payment Plan

Order For Discharge Or Abatement Of Arrears Following Compliance With Payment Plan

Michigan/Local County/Oakland/Family Division/ -

Order For Payment Plan And Order For Surcharge Abatement

Order For Payment Plan And Order For Surcharge Abatement

Michigan/Local County/Oakland/Family Division/ -

Parents Consent Or Denial To Release Information To Adult Adoptee

Parents Consent Or Denial To Release Information To Adult Adoptee

Michigan/Local County/Oakland/Family Division/ -

Request For Support Review

Request For Support Review

Michigan/Local County/Oakland/Family Division/ -

Rescission Of Stepparent Adoption Requirements

Rescission Of Stepparent Adoption Requirements

Michigan/Local County/Oakland/Family Division/ -

Affidavit Of Health Care Expenses

Affidavit Of Health Care Expenses

Michigan/Local County/Oakland/Family Division/ -

Child Support Allocation Worksheet

Child Support Allocation Worksheet

Michigan/Local County/Oakland/Family Division/ -

Income Withholding Information

Income Withholding Information

Michigan/Local County/Oakland/Family Division/ -

Judgment Checklist

Judgment Checklist

Michigan/Local County/Oakland/Family Division/ -

Statement Of Objection - Family Counselor Or Support Specialist Recommendation

Statement Of Objection - Family Counselor Or Support Specialist Recommendation

Michigan/Local County/Oakland/Family Division/ -

Statement Of Objection - Referee Hearing

Statement Of Objection - Referee Hearing

Michigan/Local County/Oakland/Family Division/ -

Stipulation And Order Regarding Custody And Parenting Time

Stipulation And Order Regarding Custody And Parenting Time

Michigan/Local County/Oakland/Family Division/ -

Personal Representative - Notice To The Friend Of The Court

Personal Representative - Notice To The Friend Of The Court

Michigan/Local County/Oakland/Family Division/ -

Stepparent Adoption Requirements

Stepparent Adoption Requirements

Michigan/Local County/Oakland/Family Division/ -

Motion For Discharge Or Abatement Of Arrears Following compliance With Payment Plan

Motion For Discharge Or Abatement Of Arrears Following compliance With Payment Plan

Michigan/Local County/Oakland/Family Division/ -

Request For Child Custody Determination Registration Under The Uniform Child Custody Jurisdiction And Enforcement Act

Request For Child Custody Determination Registration Under The Uniform Child Custody Jurisdiction And Enforcement Act

Michigan/Local County/Oakland/Family Division/ -

Motion For Payment Plan And Motion For Surcharge Abatement

Motion For Payment Plan And Motion For Surcharge Abatement

Michigan/Local County/Oakland/Family Division/ -

Adoption Questionnaire-Relatives

Adoption Questionnaire-Relatives

Michigan/Local County/Oakland/Family Division/ -

Request To Access Friend Of The Court Records

Request To Access Friend Of The Court Records

Michigan/Local County/Oakland/Family Division/ -

Custody And Parenting Time Questionaire

Custody And Parenting Time Questionaire

Michigan/Local County/Oakland/Family Division/ -

Judgment Of Divorce

Judgment Of Divorce

Michigan/Local County/Oakland/Family Division/ -

Order Of Reference To FOC For Custody Parenting Recommendation

Order Of Reference To FOC For Custody Parenting Recommendation

Michigan/Local County/Oakland/Family Division/ -

Support Enforcement Request

Support Enforcement Request

Michigan/2 Local County/Oakland/Family Division/ -

Temporary Payment Coupon

Temporary Payment Coupon

Michigan/2 Local County/Oakland/Family Division/ -

Oakland County Friend Of The Court Parenting Time Complaint Form

Oakland County Friend Of The Court Parenting Time Complaint Form

Michigan/Local County/Oakland/Family Division/ -

Judge On Line Request

Judge On Line Request

Michigan/2 Local County/Oakland/Family Division/ -

Agency Voluntary Release

Agency Voluntary Release

Michigan/Local County/Oakland/Family Division/ -

Family Information For Home Status Offenses

Family Information For Home Status Offenses

Michigan/Local County/Oakland/Family Division/ -

Motion To Change Support Order

Motion To Change Support Order

Michigan/Local County/Oakland/Family Division/ -

Motion To Change Custody Order

Motion To Change Custody Order

Michigan/Local County/Oakland/Family Division/ -

Order Of Reference To Friend Of The Court For Support Investigation

Order Of Reference To Friend Of The Court For Support Investigation

Michigan/Local County/Oakland/Family Division/ -

Order Of Reference For Referee Hearing

Order Of Reference For Referee Hearing

Michigan/Local County/Oakland/Family Division/ -

Request And Notice For Hearing To Contest Registration Of Child Custody Determincation Registration Under UCCJEA

Request And Notice For Hearing To Contest Registration Of Child Custody Determincation Registration Under UCCJEA

Michigan/Local County/Oakland/Family Division/ -

Adoption Questionnaire - Stepparents

Adoption Questionnaire - Stepparents

Michigan/Local County/Oakland/Family Division/ -

Motion To Change Parenting Time Order

Motion To Change Parenting Time Order

Michigan/Local County/Oakland/Family Division/ -

Motion To Opt Out Of Friend Of The Court Services

Motion To Opt Out Of Friend Of The Court Services

Michigan/Local County/Oakland/Family Division/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!